|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-11-to-15-november-2024/332561/

|

Energy market:

There is a Trump rally on the Russian stock market. Would we have had a Harris rally? Maybe next time. On the whole, what is happening resembles a psychosis, a psychosis of the money masses, but who knows, maybe the seven green candles on the RTS index that have appeared will develop into a Christmas rally. Although… although nothing in foreign policy has happened de facto yet. Only rumors, intentions and assumptions. But people believe.

What a situation. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Despite Trump’s election victory, we are not seeing a drop in oil prices. Why, because Iran has once again declared the destruction of Israel and threatened hell for America. Now we are waiting. Well, what else to do. Once you are born, you have to “have fun” to the fullest, don’t you? Make an enemy, make an enemy and burn. That’s so human.

OPEC and its “+” have postponed consideration of a production increase for a month. There is clearly a thread that a price below $70.00 a barrel is not satisfactory to the community. Will Trump be the reason the price of oil drops? Probably, if he does continue to bankrupt Europe through increased military spending and China through duties on goods produced in the Middle Kingdom. Both will walk more and drive electric cars and consume less oil.

Grain market:

Another USDA report has been released. We can see that the forecasts are stable, we note only a decrease in gross soybean yield, by 0.81%, which is normal against the background of record forecasts made earlier.

We can see that corn is inclined to growth on the stock exchange in Chicago. It should be noted that speculators’ bets on growth of this crop this week became more than bets on falling. Nothing like that is happening with wheat. It continues to stand in the corridor.

Everyone realizes that if the SWO ends, tensions in an important food-producing region will ease and prices are bound to respond. Expectations of normalization are holding back crop growth.

In general, we have winter and trade maneuvers ahead of us: who will sell to whom and for how much. It is possible to make forecasts for next year, of course, based on the condition of winter crops, but without spring, these forecasts are more like guessing. The spring months can make significant adjustments.

According to MARS, the rains have somewhat hampered the harvesting of late crops, but nothing dramatic is happening in Europe.

USD/RUB:

“Give the rate 50%,” we wrote six weeks ago. So far this scenario cannot be discounted, but there is a feeling that the industry lobby is beginning to grumble. Further inflation of SWO costs will lead to even higher rates from the Central Bank, which will deprive businesses of room for maneuver. And here we will have to find a balance sooner or later. It should be noted that we will not see a strengthening of the ruble without a qualitative change in the external background.

The Fed cut the rate by 0.25% to 4.75%. Judging by the mood of the chairman, another rate cut this year on December 18th cannot be ruled out. There is one “but”: Trump really likes to spend money. A lot. He has nothing to lose. He’s been bankrupt several times, he’s been shot at, he’s 78 years old. Americans should remember him as a great president under whom they could afford to buy everything and they had everything! “A flood after us,” is a great phrase for all time belonging to the Marquise de Pompadour, a favorite of Louis XV. The king spent so much that he left his successor with a country on the verge of bankruptcy. Trump’s friend Elon will also help him.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 17 thousand contracts. Buyers did practically nothing, sellers reduced their positions. Bulls are controlling the market.

Growth scenario: we consider November futures, expiration date November 29. After the elections in the USA it did not become easier. We continue to stay out of the market.

Downside scenario: nothing is clear. Off-market.

Recommendations for the Brent oil market:

Buy: no.

Sale: no.

Support — 72.90. Resistance — 76.19.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 479.

US commercial oil inventories rose by 2.149 to 427.658 million barrels, with +0.3 million barrels forecast. Gasoline inventories rose 0.412 to 211.28 million barrels. Distillate stocks rose 2.947 to 115.809 million barrels. Cushing storage stocks increased by 0.522 to 25.879 million barrels.

Oil production remained unchanged at 13.5 million barrels per day. Oil imports increased by 0.265 to 6.24 million barrels per day. Oil exports fell by -1.411 to 2.85 million barrels per day. Thus, net oil imports rose by 1.676 to 3.39 million barrels per day. Oil refining rose by 1.4 to 90.5 percent.

Gasoline demand fell -0.331 to 8.828 million barrels per day. Gasoline production rose by 0.013 to 9.708 million barrels per day. Gasoline imports fell -0.266 to 0.229 million barrels per day. Gasoline exports rose 0.098 to 0.884 million barrels per day.

Distillate demand fell by -0.475 to 3.406 million barrels. Distillate production rose by 0.233 to 5.096 million barrels. Distillate imports rose 0.004 to 0.162 million barrels. Distillate exports increased by 0.152 to 1.431 million barrels per day.

Demand for petroleum products fell by -1.899 to 19.739 million barrels. Petroleum products production fell -0.23 to 22.276 million barrels. Imports of refined petroleum products fell -0.028 to 1.328 million barrels. Exports of refined products rose by 1.331 to 7.617 million barrels per day.

Propane demand fell -0.6 to 0.71 million barrels. Propane production fell -0.011 to 2.743 million barrels. Propane imports rose 0.01 to 0.11 million barrels. Propane exports rose 0.711 to 2.289 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 55 thousand contracts. The change is significant. Buyers were actively entering the market. Sellers were leaving. Bulls strengthened their control.

Growth scenario: we consider December futures, expiration date November 20. We continue to refrain from any actions.

Downside scenario: nothing new. Off-market.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 66.56. Resistance — 72.87.

Gas-Oil. ICE

Growth scenario: we switched to December futures, expiration date December 12. There is no growth, as well as falling. We will continue to hold longs. There are no big prospects in what is happening.

Downside scenario: as long as oil doesn’t fall. Outside the market.

Gasoil Recommendations:

Buy: no. Who is in position from 645.00 (taking into account the transition to a new contract), move the stop to 643.00. Target: 830.00?!!!!

Sale: no.

Support — 657.75. Resistance — 698.50.

Natural Gas. CME Group

Growth scenario: we consider December futures, expiration date November 26. Buying does not make sense yet. The bulls are weak. Out of the market.

Downside scenario: given the aggressive fall, we can try to adjust to it on the rebound. We will sell at around 3,000.

Natural Gas Recommendations:

Buy: no.

Sell: when approaching 3,000. Stop: 3.100. Target: 1.550.

Support — 2.473. Resistance — 3.021.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 1.6 th. contracts. Buyers and sellers entered the market in insignificant volumes. Bears keep control.

Growth scenario: we consider December futures, expiration date December 13. Nothing new. We do nothing at the current price levels. We need deviations up or down.

Downside scenario: nothing interesting. Off-market.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 557.6. Resistance — 580.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 38.5 th. contracts. Buyers were entering the market. Sellers were slightly reducing positions. Bears lost control!

Growth scenario: we consider December futures, expiration date December 13. It has started to grow. It is necessary to take 435.0 in order to have a prospect of a move to 465.0.

Downside scenario: need higher levels to sell. For example: 465.0. Out of the market for now.

Recommendations for the corn market:

Buy: no. Who is in position from 415.6, 410.0 and 400.0, move stop to 408.0. Target: 465.0.

Sell: thinking when approaching 465.0.

Support — 409.2. Resistance — 434.4.

Soybeans No. 1. CME Group

Growth scenario: we switched to January futures, expiration date is January 14. We are not thinking about buying yet. There are a lot of soybeans.

Downside scenario: we will continue to keep open shorts. The target is shifted to 835.0. In the current area those who wish can join the shorts.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Who is in the position from 1049.0 (taking into account the transition to the January contract), keep the stop at 1053.0. Target: 835.0.

Support — 971.4. Resistance — 1047.6.

Growth scenario: we consider December futures, expiration date December 27. We continue to demand a pullback for purchases.

Downside scenario: at the top we have 2838, from this level we can sell. The current fall can be worked off.

Gold Market Recommendations:

Buy: when approaching 2550. Stop: 2450. Target: 2840.

Sell: on approach to 2838. Stop: 2858. Target: 2550. Or now (2694). Stop: 2720. Target: 2550.

Support — 2648. Resistance — 2733.

EUR/USD

Growth scenario: we have consolidated under 1.0950. We will remember about purchases in case of a move to 1.0200 (1.0000).

Downside scenario: it is possible to continue to keep shorting. Sellers, judging by the red long candles, have seized the market.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Those in position from 1.0935, move your stop to 1.0910. Target: 1.0000.

Support — 1.0595. Resistance — 1.0950.

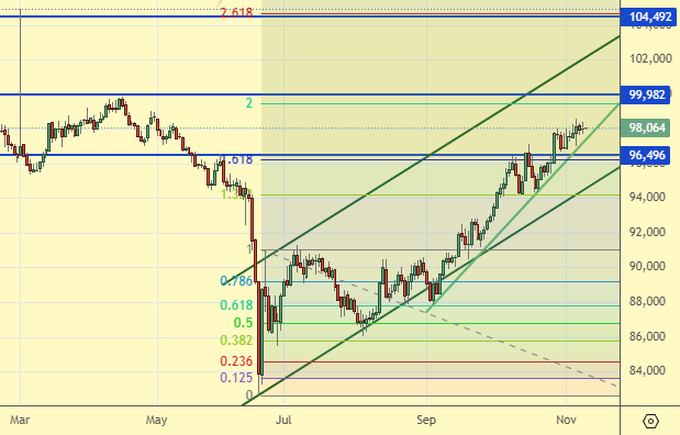

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. With a pullback to 91000 it makes sense to buy again. Pullback to 96000 can also be considered for long entry, but from this level it is better to trade on hours.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: when approaching 90000. Stop: 88800. Target: 104000. Who is in position from 96234, keep stop at 95900. Target: 150000, 200000?! (these are the benchmarks so far)

Sale: no.

Support — 96496. Resistance — 99982.

RTSI. MOEX

Growth scenario: we consider the December futures, expiration date December 19. We must buy in this area, although it is not ideal. It is desirable for us to get a pullback at least to 88000.

Downside scenario: we see an emotional recovery after the US election. It is somewhat incomprehensible, because no one appointed Russia as favorite wife. This is a consequence of long-term stress rather than a competent long entry. From 93000 it makes sense to sell, however, take into account the news background. Recommendations on the RTS index:

Buy: on a pullback to 88000 and 86000. Stop: 84000. Calculate the risks!

Sell: on approach to 93000. Stop: 94800. Target: 70000 (further 0.0000 (zero) absolute, well, who is afraid, let it be 20000).

Support — 88790. Resistance — 93260.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.