|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-22-to-26-july-2024/324494/

|

Energy market:

We should look for the positive. Because of sanctions, we buy 41.8% of imports in rubles. And soon we will buy everything for rubles. And we’ll be able to, because we’ll sell raw materials for the same rubles. As much as we sold raw materials, we bought all sorts of things for the house. Or some pills. Panadol, for example.

For a ruble! To the interest rate! To low inflation! Hooray! Hooray! Hooray! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Even the EIA has admitted that there will be a fuel shortage in Q3. Which means the market will be fine, in the sense that it will hardly be able to go below 80.00. But the Prince of KSA needs prices above 100 for a deficit-free budget. Appetites are growing, two years ago it was only 80.00, so they will try to regulate the market so that they can realize all their desires. Oh, and the prince should regularly forgive consumer loans to citizens. What a vicious practice! They are corrupting their own population at the expense of the West.

Slovakia and Hungary have stopped receiving oil from the pipeline that ran through Ukraine. For these countries, until they find alternative sources of supply, the coming weeks will be difficult. The search for resources by individual, albeit small, market participants could stoke demand. The fabric of the previously created economic space continues to unravel.

US oil inventories have fallen for three weeks in a row. So far the situation does not look dramatic, but we are heading there, towards that drama. If inventories fall below 400 million barrels, currently 440, it will drive prices higher.

Grain market:

IGC has published a new forecast for July gross harvest. For wheat, we are expected to harvest 801 million tons, while consumption will be 802 million tons. For corn we should harvest 1225 million tons, and consumption will be at the level of 1230 million tons. That is, we are all ready to eat, and every time we make a mess, we raise prices upwards. However, they are still down, as the new crop is coming to the market, and we are likely to be looking for new lows for a few more weeks. The down cycle will end on September 10. Possibly somewhat earlier. Soybeans and rice will also be harvested more than last year, leaving no chance for wheat and corn to replace those crops in any niches.

There can be only one case of price growth on the grain market: logistical problems. For example, some port will be closed. Political obstacles. The fall of the U.S. dollar! The emergence of a new religion, according to which it is necessary to eat twice as much as usual. If none of this happens, the price increase in the fall will be a modest 15 — 20% of the lows that we probably don’t see yet.

At the moment 450 cents a bushel for wheat, and 330 for corn we can’t deny.

USD/RUB:

So, this week we have a meeting of the Central Bank, which has been covered by all the media. Will they give us 18%? They will. In fact, Elvira Sakhipzadovna initially chose an aggressive style of fighting inflation. And she can be understood. Br5 trillion a month is injected into the economy and after they are used to produce goods and services for the Central Bank, something must be done with them: either to offer some consumer goods or to attract deposits. The Central Bank does not produce goods, it can only raise the rate and take away liquidity. However, maybe they will start selling indulgences, since they are sluggish in taking bonds.

Inflation data for this day and hour are contradictory, something is rising, something is falling, but we are beyond 9% per annum. 4% in the current realities for next year is a dream, which is unlikely to come true until the completion of the SWO.

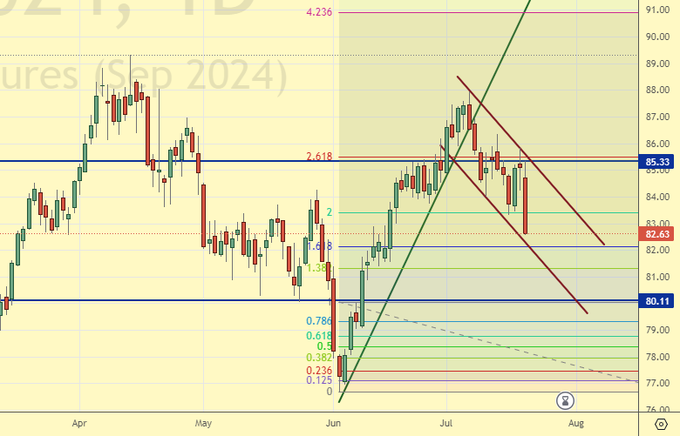

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 18.1 th. contracts. There were no buyers. Sellers were entering the market. Buyers are maintaining control.

Growth scenario: we consider July futures, expiration date July 31. Yes, we wait for 80.20 and buy.

Downside scenario: we will continue to hold our shorts. There were suspicions that we would not be able to fall, but no, we did.

Recommendations for the Brent oil market:

Buy: when approaching 80.20. Stop: 79.20. Target: 99.90.

Sell: no. Those who are in position from 86.54, move your stop to 85.30. Target: 80.20.

Support — 80.11. Resistance — 85.33.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 1 unit to 477.

U.S. commercial oil inventories fell by -4.87 to 440.226 million barrels, with a forecast of -0.9 million barrels. Gasoline inventories rose by 3.328 to 232.994 million barrels. Distillate stocks rose 3.454 to 128.066 million barrels. Cushing storage stocks fell by -0.875 to 32.664 million barrels.

Oil production remained unchanged at 13.3 million barrels per day. Oil imports increased by 0.277 to 7.037 million barrels per day. Oil exports fell by -0.035 to 3.964 million barrels per day. Thus, net oil imports rose by 0.312 to 3.073 million barrels per day. Oil refining fell -1.7 to 93.7 percent.

Gasoline demand fell -0.615 to 8.783 million barrels per day. Gasoline production fell -0.751 to 9.549 million barrels per day. Gasoline imports fell -0.04 to 0.728 million barrels per day. Gasoline exports fell -0.068 to 0.851 million barrels per day.

Distillate demand increased by 0.119 to 3.585 million barrels. Distillate production rose by 0.101 to 5.229 million barrels. Distillate imports fell -0.031 to 0.108 million barrels. Distillate exports rose 0.156 to 1.259 million barrels per day.

Demand for petroleum products fell by -1.319 to 19.43 million barrels. Petroleum products production fell by -0.673 to 22.358 million barrels. Petroleum product imports fell -0.052 to 1.767 million barrels. Exports of refined products fell -0.4 to 6.123 million barrels per day.

Propane demand fell -0.324 to 0.543 million barrels. Propane production fell -0.081 to 2.655 million barrels. Propane imports fell -0.024 to 0.081 million barrels. Propane exports fell -0.135 to 1.532 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 8.5 th. contracts. Buyers were entering the market. Sellers were reducing positions in small volumes. Bulls strengthened their control.

Growth scenario: we moved to September futures, expiration date August 20. We need a pullback to buy. We will buy when approaching 75.40, if the market allows it.

Downside scenario: move to new futures and continue to hold short with downside targets at 75.50.

Recommendations for WTI crude oil:

Buy: when approaching 75.40. Stop: 75.10. Target: 95.00.

Sell: no. Those who are in the position from 82.00 (taking into account the transition to the new futures) move the stop to 81.60. Target: 75.50.

Support — 75.40. Resistance — 82.32.

Gas-Oil. ICE

Growth scenario: we consider the August futures, expiration date August 12. We need correction. In case of a pullback to 735.00 it is possible to buy.

Downside scenario: keep shorting. A move below 700.0 cannot be ruled out.

Gasoil Recommendations:

Buy: on a pullback to 735.00. Stop: 720.00. Target: 950.00.

Sell: No. Those in position from 807.50, move your stop to 790.00. Target: 650.00!

Support — 731.75. Resistance — 816.25.

Natural Gas. CME Group

Growth scenario: moved to September futures, expiration date August 28. You can buy. But don’t feel like it. Colder weather in the US reduces the demand for energy for air conditioners.

Downside scenario: refrain from selling for now.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 2.020. Resistance — 2.202.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 62000. Target: 100000!

Sale: no.

Support — 66543. Resistance — 94043.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: growing. Let’s continue to hold the long. Let’s go to 35000! We can partially close the position.

Downside scenario: 35000 mark may give a reason for shorting.

PBT Market Recommendations:

Buy: no. Those in position from 11000, move stop to 18000. Target: 35000. You can close 25% of the position.

Sale: no.

Support — 21094. Resistance — 34453.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — 1516.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 4.1 thousand contracts. There were no buyers, sellers slightly increased their positions. Bears keep control.

Growth scenario: we consider the September futures, expiration date September 13. We want the mark of 455.0 for purchases.

Downside scenario: without upward correction, medium-term sales are not safe. Outside the market.

Recommendations for the wheat market:

Buy: at 455.0. Stop: 425.0. Target: 650.0!

Sell: thinking when approaching 625.0.

Support — 520.4. Resistance — 555.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 3.6 th. contracts. Sellers and buyers were leaving the market. The bears increased their control again.

Growth scenario: we consider September futures, expiration date September 13. But we are not growing. The market looks heavy. We are waiting for the continuation of the fall.

Downside scenario: looking at the fundamental data it is tempting to go short again.

Recommendations for the corn market:

Buy: when approaching 3350 stop: 315.0. Target: 440.0.

Sell: Now (390.4). Stop: 403.0. Target: 335.0.

Support — 369.4. Resistance — 400.0.

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. It is possible that a deal from 1015 will be interesting. At the same time, we do not exclude the possibility of failure to 880.0.

Downside scenario: we would need a pullback up to 1100.0, for example, for a good short entry. If it does not happen, we will sell after falling below 1000.0.

Recommendations for the soybean market:

Buy: at touching 1015.0. Stop: 985.0. Target: 1090.0. Consider the risks!

Sell: when falling below 1000.0. Stop: 1040.0 Target: 880.0! Count the risks.

Support — 1012.6. Resistance — 1055.2.

Gold. COMEX

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting.

Downside scenario: a difficult and unpleasant picture for shorts. We can go down, but we don’t have to. Fed meeting on July 31, there may not be any long moves down until then.

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Support — 2349. Resistance — 2447.

EUR/USD

Growth scenario: the situation is not interesting for purchases. Outside the market.

Downside scenario: we don’t think about the downside until the Fed meeting on July 31. Everything is not so clear there with the rate drop in September. Suddenly, inflation will rise again, and then the dollar will have a chance to go to 1.0000. Underdog Trump wins the election and we’re at 2.0000. That could happen too.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0844. Resistance — 1.0979.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. A lull, not excluded before the storm. We are out of the market for now. From 74000 we buy it for sure.

Downside scenario: the technician does not deny further strengthening of the ruble. Selling from 91700 will be interesting, and we will recommend it. It is better to short from current levels on “hours”.

Recommendations on dollar/ruble pair:

Buy: when approaching 74000. Stop: 72000. Target: 100.00.

Sell: on approach to 91700. Stop: 92800. Target: 76000.

Support — 87558. Resistance — 89819.

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: not bad levels for opening positions or building up volumes. A pullback is most likely in front of us. We will reach either 111700 or 114000, after which the decline will continue.

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in the position from 115200, move the stop to 114600. Target: 102000.

Support — 108550. Resistance — 112010.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.