|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-24-to-28-june-2024/322577/

|

Energy market:

In search of a currency that could not be taken away from you, mankind invented the blockchain on which bitcoin was invented. It turned out that just in bitcoin everything is clearly recorded who owned the money, thanks to the blockchain. It’s called going crazy. Bury the gold in the garden of ineptitude! Just like your grandparents did. It’s the only way to keep what you’ve got. Bitcoin, you know! Wasting electricity, fooling around.

Eh, I wish I could go through the Rublevskiy sites with a metal detector… And the nearest forests would have to be walked through. That’s where there’s something (someone) hidden there. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

Brent continued to grow last week. All local technical targets have been met, and it is possible to correct by a couple of dollars. However, talk that Europe will get involved in the conflict in Ukraine, for example, right after the Olympics in France, can generate nothing but buying. It cannot be ruled out that we will go to 92.00 without a pullback.

The Chinese data at the beginning of the week was not as great as we would have liked. And at the end of the week it turned out that home sales in the U.S. were somewhat subdued. This creates risks of lower GDP growth in these two countries, which could lead to a drop in oil demand in the next 6 months.

Grain market:

The harvesting campaign has started in the southern regions of Europe. This is a serious blow to an already weak market. Suddenly, for someone who is at a computer, it’s harvest time. The planet is waiting for 798 million tons of wheat. The drop of 5 million tons of harvest in Russia due to spring frosts was compensated by other regions of the world.

Domestic wheat prices jerked upwards, by 15% minimum. Rather, it was due to sanctions against MICEX. People simply removed grain from the market, wanting to understand what will happen next with the ruble. The «next» has come. There is no clarity yet, but there is an understanding that it will not be easier. If the status quo is maintained (dollar/ruble, wheat harvest volume of 83 million tons), EXW prices are unlikely to continue to grow, rather they will return to the values of two weeks ago, as the world market sees a drop in wheat prices from $285 to $240 per ton FOB. There is nowhere to put it inside the country. Only to sell it.

The grain market has very likely set the stage for a strong drop. In Chicago we can see that corn, wheat and soybeans are aggressively down. Unless there is some factor that will attract bulls to the market next week, and it can only be geopolitics, we are in for a 10% move down in all of these crops. A stronger fall is hardly possible.

USD/RUB:

The celebration of the fact that KSA withdrew from the agreement with the Americans to sell oil only for dollars was short-lived. It turns out that if you are not stupid, moreover, smart, it is dollars that you will ask for your job. Why? Because you live in the United States. Why? Because the highest concentration of intelligence is there and you just enjoy being with smart energetic people like yourself. Eh, the death of the dollar is postponed again. Currency exchange rates in today’s world are backed by IQ.

What’s a ruble? What’s a ruble… Have you heard of the electric chair? It moves back and forth. As long as we somehow designate ourselves officially at 90.00, the ruble can still try to strengthen. But we have already urgently reduced the mandatory rate of sale of foreign currency earnings to 60% in order to prevent us from reaching 76.00. And we wanted so much… And what will happen to the remaining 40% of money? Maybe we should sell 40% less resources. Let them lie in the ground rather than changing them for entries in accounts that can go to zero at any time.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 74 thousand contracts. Buyers actively entered the market, sellers ran in the same volumes. Buyers strengthened their control over the market.

Growth scenario: we consider July futures, expiration date July 31. It would be interesting to buy from 80.00. Buying after growth above 86.00 is possible, but it is better to buy on «hours».

Downside scenario: sell now. We should see a correction to 83.00 at least. If it happens, move the stop to the breakeven level.

Recommendations for the Brent oil market:

Buy: at 80.10. Stop: 79.10. Target: 99.00.

Sell: now (84.33). Stop: 85.37. Target: 70.00?!

Support — 82.89. Resistance — 85.33.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 3 units to 485.

U.S. commercial oil inventories fell -2.547 to 457.105 million barrels, with a forecast of -2.8 million barrels. Gasoline inventories fell -2.28 to 231.232 million barrels. Distillate stocks fell -1.726 to 121.64 million barrels. Cushing storage stocks rose by 0.307 to 34.122 million barrels.

Oil production was unchanged at 13.2 million barrels per day. Oil imports fell by -1.25 to 7.054 million barrels per day. Oil exports rose by 1.23 to 4.418 million barrels per day. Thus, net oil imports fell -2.48 to 2.636 million barrels per day. Oil refining fell by -1.5 to 93.5 percent.

Gasoline demand increased by 0.346 to 9.386 million barrels per day. Gasoline production increased by 0.084 to 10.17 million barrels per day. Gasoline imports rose 0.088 to 1 million barrels per day. Gasoline exports increased by 0.152 to 1.01 million barrels per day.

Distillate demand rose by 0.328 to 3.977 million barrels. Distillate production fell by -0.272 to 4.76 million barrels. Distillate imports rose 0.059 to 0.15 million barrels. Distillate exports fell -0.168 to 1.18 million barrels per day.

Demand for refined products increased by 1.862 million barrels to 21.081 million barrels. Production of petroleum products increased by 0.842 to 22.601 million barrels. Imports of refined petroleum products rose 0.378 to 2.198 million barrels. Exports of petroleum products fell -0.941 to 6.561 million barrels per day.

Propane demand fell -0.153 to 0.712 million barrels. Propane production fell -0.107 to 2.66 million barrels. Propane imports fell -0.019 to 0.077 million barrels. Propane exports fell -0.067 to 1.791 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 41.4 th. contracts. Buyers were sluggishly entering the market. Sellers were fleeing. Bulls strengthened their control.

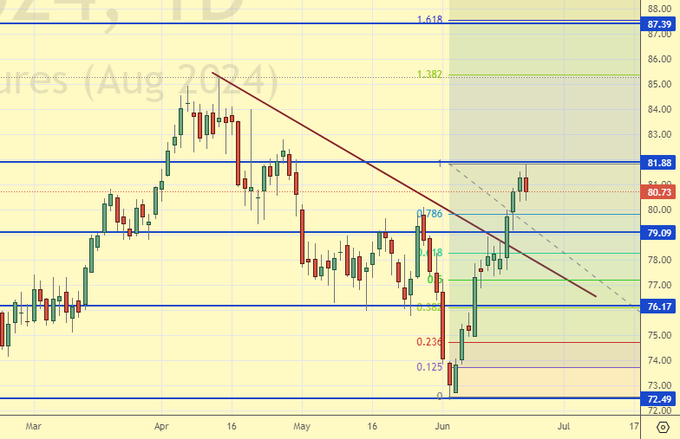

Growth scenario: moved to August futures, expiration date July 22. It is interesting to buy from 76.00 area. If there will be growth above 83.00, it is worth to look for opportunities on «watch».

Downside scenario: selling from the current area is interesting. The risk is small. If we fall to 79.00, move the stop to the breakeven level.

Recommendations for WTI crude oil:

Buy: when approaching 76.20. Stop: 75.20. Target: 96.50.

Sell: now (80.73). Stop: 82.00. Target: 65.00?!

Support — 79.09. Resistance — 81.88.

Gas-Oil. ICE

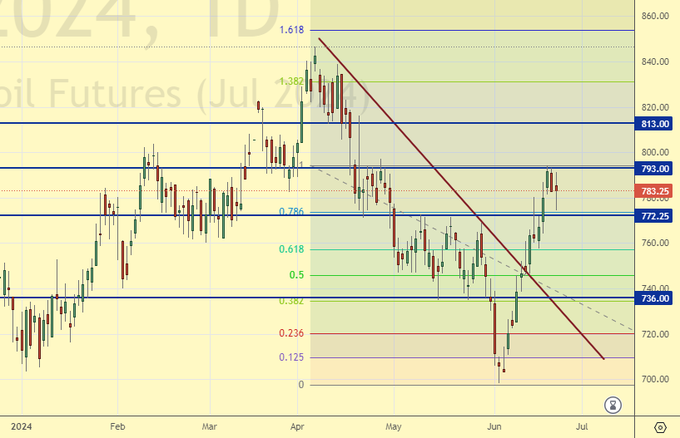

Growth scenario: we consider July futures, expiration date July 11. In case of a pullback to 740.00 it is possible to buy.

Downside scenario: current levels are interesting for selling. If we fall to 760.0. Move the stop to the breakeven level.

Gasoil Recommendations:

Buy: on a pullback to 740.00. Stop: 730.00. Target: 950.00.

Sale: now (783.25). Stop: 796.00. Target: 650.00.

Support — 772.25. Resistance — 793.00.

Natural Gas. CME Group

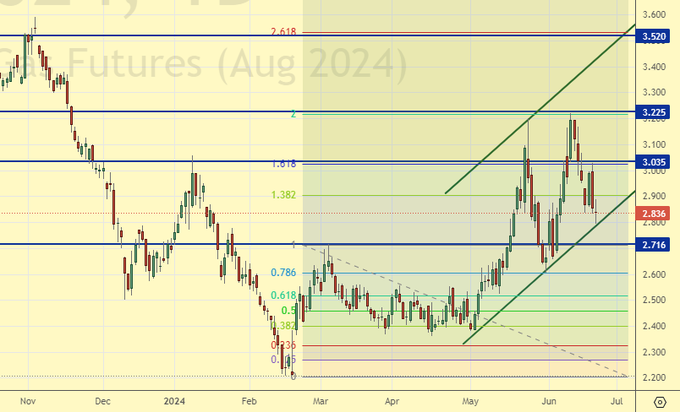

Growth scenario: we consider August futures, expiration date July 29. We hold long. The level of 3.500 is realistic.

Downside scenario: when approaching 3.500 we will think about selling. Out of the market for now.

Natural Gas Recommendations:

Buy: no. Who is in the position from 2.450 (taking into account the transition to a new contract), move the stop to 2.670. Target: 3.500.

Sale: not yet.

Support — 2.716. Resistance — 3.035.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: let’s try to enter longing. Those who caught on when approaching 62000 — good.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: Now (65000). Stop: 60000. Target: 100000!

Sale: no.

Support — 63965. Resistance — 69658.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will keep longing. The first impulse was long, which may lead us to high levels.

Downside scenario: if there will be a hiccup with growth around 30000 we can think about selling. Out of the market for now.

PBT Market Recommendations:

Buy: no. Those in position from 11000, move stop to 13000. Target: 35000.

Sale: no.

Support — 13516. Resistance — 21094.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see growth from 1000. Nevertheless, still out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1037. Resistance — the area of 1516.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 14.2 th. contracts. Buyers are fleeing from this market. Sellers are not increasing volumes yet. Bears have strengthened their control.

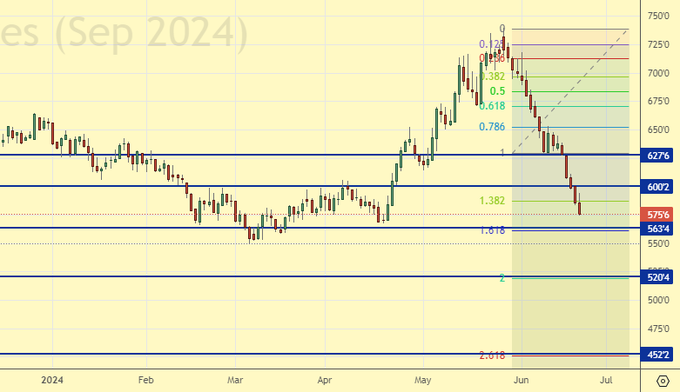

Growth scenario: moved to September futures, expiration date September 13. Sellers destroyed everything. The market is heavily oversold, but it is not certain that everything will stop at current levels. We may not end up at 450.0.

Downside scenario: without upward correction, medium-term sales are not safe. Outside the market.

Recommendations for the wheat market:

Buy: when touching 455.0. Stop: 440.0. Target: 600.0.

Sale: no.

Support — 563.4. Resistance — 600.2.

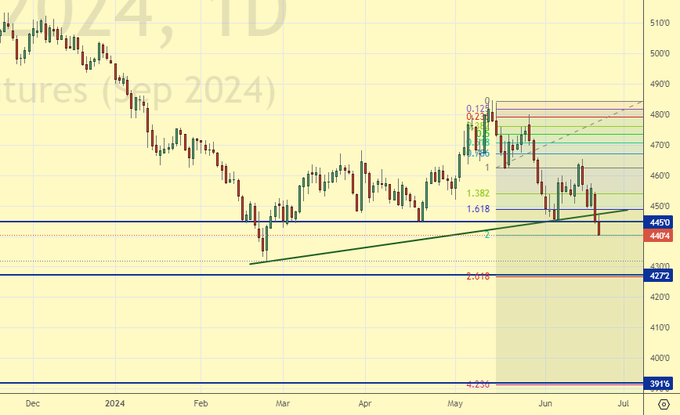

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Last week the difference between long and short positions of asset managers increased by 0.4 thousand contracts. Speculative activity on this market was absent last week. Bears again strengthened their control.

Growth scenario: we switched to September futures, expiration date September 13. Against the background of good expectations for the harvest, we do not buy yet.

Downside scenario: given the good forecasts for the gross harvest, we will hold a short that opened from the 460.0 area.

Recommendations for the corn market:

Buy: when approaching 392.0. Stop: 3380.0. Target: 445.0.

Sell: no. Who is in the position from 463.0 (taking into account the transition to the next contract), move the stop to 458.0. Target: 393.0.

Support — 427.2. Resistance — 445.0.

Soybeans No. 1. CME Group

Growth scenario: moved to September futures, expiration date September 13. Do not buy. Expectations for gross soybean harvest are excellent.

Decline scenario: we will keep the previously opened short. There is a feeling that the market is heavy and ready to fall heavily.

Recommendations for the soybean market:

Buy: no.

Sell: no. Who is in position from 1150.0 (taking into account the transition to the next contract), move the stop to 1152.0. Target: 885.0?!

Support — 1098.2. Resistance — 1129.0.

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting.

Downside scenario: yes, we almost got knocked out of our shorts. We hold our positions. Those who wish can increase volumes.

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Sell: no. Who is in position from 2325, move the stop to 2380. Target: 2120.

Support — 2304. Resistance — 2379.

EUR/USD

Growth scenario: bulls may reverse the situation, but until that happens we remain out of the market.

Downside scenario: 1.0800 has not been given to us. Current sales are undervalued and risky. Unless with a small stop order. Nothing threatens the dollar so far.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0691). Stop: 1.0740. Target: 1.0260.

Support — 1.0668. Resistance — 1.0762.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. The level of 89000 is key. As long as we are below it, we do not buy. However, from 76000 we will definitely buy.

Downside scenario: failed to pass above 89000, which sets the stage for another downside strike.

Recommendations on dollar/ruble pair:

Buy: when approaching 76000. Stop: 73000. Target: 100.00.

Sale: now (86984). Stop: 89070. Target: 76000.

Support — 84200. Resistance — 89021.

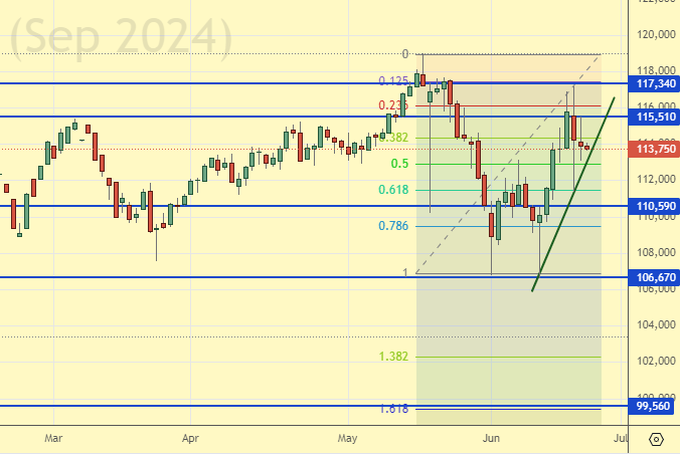

RTSI

Growth scenario: we consider September futures, expiration date September 19. So far, we do not believe in the growth in dollars of the Russian market. Do not buy.

Downside scenario: we will think after the market falls below 109000. If the market gives an opportunity to sell from 116000, we can enter short.

Recommendations on the RTS index:

Buy: no.

Sell: when approaching 116000. Stop: 117600. Target: 99000.

Support — 110590. Resistance — 115510.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.