|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-20-to-24-may-2024/320173/

|

Energy market:

The prestige of working in the Foreign Ministry will soon increase dramatically. If you have a «crust», you will be able to visit duty-free stores that will be organized in Moscow and St. Petersburg. With real sausage there, and other things.

For the chosen few, the future will be even brighter. And the rest of us will be lucky. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

We couldn’t sell Brent 80.00 downwards. Yes, and we shouldn’t be able to do it amid the ongoing mess. When buyers are searching all over the world for the grade they need and sending ships to the other hemisphere. It’s uncomfortable, really. We got another hit on our refinery, our refinery. Not good. A trader sees this on the terminal and presses «Buy».

The government flew to China. The results of the visit are that for the time being the status quo will remain, i.e. it was not stated that China will stop buying oil, but it was stated that there are problems with payments and how to solve this issue is not clear. Money is not getting through. For the oil market, the lack of surprise in this direction is a somewhat smoothing story, but prices are unlikely to fall for the time being. Moreover, OPEC continues to insist that consumption will increase this year and next.

Let’s pay attention to Kazakhstan’s demand to increase the production limit for next year under the OPEC+ agreement, as well as the fact that Iraq does not want to cut anything else, there is a sense of irritation there. At the same time, Russia reduced production according to OPEC data from 9.4 million bpd in March to 9.3 million bpd in April.

Grain market:

Our delegation during its visit to Beijing clearly tried to persuade the Chinese to buy more agricultural products. But agriculture is an area of strategic stability of the state, no less important than the defense sector, so it will not be easy to expand sales. And this is how all importing countries behave: several suppliers are a guarantee of stability. But export growth is possible: it is enough for 1.4 billion people to put a spoon to their mouth for once more. And we are just here with our wheat and other products.

Bulls are trying to rock the market of wheat and corn. At the same time, they somehow manage to do it for wheat, while for corn we see volatility growth without any noticeable success. It should be noted that we have not heard of any weather problems in May (except for frosts in Russia), which gives us reason to say that June forecasts for the new crop will most likely not differ much from May forecasts.

Yes, there is a risk that Russia and Europe will not have enough wheat compared to last year, and due to this there will be some pressure from the bulls on the stock exchange, but there is nothing terrible to talk about. The EU is expecting 132 in Russia for 88 million tons. Seeing 750 cents a bushel in Chicago is the limit of dreams for the bulls right now.

USD/RUB:

The official figures are that our imports are falling, while exports remain at high levels. These data are consistent with the current behavior of the ruble. The pair claims to test the 90.00 level. At the same time, it should be noted that according to the Central Bank’s «minutes» the possibility of raising the rate to 17% was discussed, which creates support for the ruble at the moment.

Bonds continue their peak. Demand for Russian debt remains weak. Bankers clearly want to see more interesting offers from the Ministry of Finance against the backdrop of increased inflation expectations of the population and against the backdrop of official inflation rising from 7.72% to 7.84% per annum.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 46.5 thousand contracts. The change is significant. Bulls continued to run in significant volumes, bears silently watched the situation. Buyers continue to control the situation.

Growth scenario: we consider May futures, expiration date is May 31. It was possible to take the market on the approach to 81.00. Now, who entered, just keeps longing. It will be possible to add in case of growth above 85.50.

Downside scenario: 81.00 was touched, we did not close, but this is a reason to keep shorting further. A move to 77.00 cannot be ruled out.

Recommendations for the Brent oil market:

Buy: no. Those in position from 81.10, move your stop to 81.40. Target: 120.00!

Sell: no. Those in position from 89.50, keep stop at 87.70. Target: 77.00 (revised).

Support — 80.92. Resistance — 85.01.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 1 unit to 497.

U.S. commercial oil inventories fell -2.508 to 457.02 million barrels, with a forecast of -0.4 million barrels. Gasoline inventories fell -0.235 to 227.767 million barrels. Distillate stocks fell -0.045 to 116.365 million barrels. Cushing storage stocks fell by -0.341 to 34.995 million barrels.

Oil production is unchanged at 13.1 million barrels per day. Oil imports fell by -0.225 to 6.744 million barrels per day. Oil exports fell by -0.333 to 4.135 million barrels per day. Thus, net oil imports rose by 0.108 to 2.609 million barrels per day. Oil refining rose by 1.9 to 90.4 percent.

Gasoline demand increased by 0.078 to 8.875 million barrels per day. Gasoline production increased by 0.203 to 9.698 million barrels per day. Gasoline imports rose 0.007 to 0.726 million barrels per day. Gasoline exports increased by 0.09 to 0.897 million barrels per day.

Distillate demand increased by 0.342 to 3.831 million barrels. Distillate production rose by 0.021 to 4.804 million barrels. Distillate imports fell -0.022 to 0.089 million barrels. Distillate exports fell -0.257 to 1.069 million barrels per day.

Demand for petroleum products fell by -0.234 to 20.056 million barrels. Petroleum products production fell by -0.181 to 22.198 million barrels. Imports of refined petroleum products fell -0.294 to 1.864 million barrels. Exports of petroleum products fell -0.676 to 6.152 million barrels per day.

Propane demand fell -0.273 to 0.548 million barrels. Propane production fell -0.036 to 2.785 million barrels. Propane imports fell -0.002 to 0.073 million barrels. Propane exports rose 0.135 to 1.9 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 14.7 thousand contracts. Both buyers and sellers ran, but sellers ran in higher volumes. Bulls keep control.

Growth scenario: we switched to July futures, expiration date June 20. We couldn’t get a hold on the long at the levels mentioned earlier, but we still have to take into account the prospect of oil growth to 97.00.

Downside scenario: close the short on the June contract at 80.06. Do not open new positions down.

Recommendations for WTI crude oil:

Buy: in case of growth above 81.50. Stop: 78.70. Target: 97.00. Consider the risks!

Sale: no.

Support — 76.24. Resistance — 86.51.

Gas-Oil. ICE

Growth scenario: we consider June May futures, expiration date is June 12. We entered from 740.00 into long. We will hold the long.

Downside scenario: there are no interesting levels for selling.

Gasoil Recommendations:

Buy: no. Those who are in positions from 740.0 and 758.0, move the stop to 740.00. Target: 880.00.

Sale: no.

Support — 734.50. Resistance — 773.75.

Natural Gas. CME Group

Growth scenario: we consider June futures, expiration date May 29. We see acceleration of price growth. We hold long.

Downside scenario: we refrain from selling for now, the market is low. However, given the market saturation with various gas projects, we do not expect a significant price increase. From the area of 3,000 you can already think about sales.

Natural Gas Recommendations:

Buy: no. Those in position from 1.988, move your stop to 2.090. Target: 3.000?!

Sale: not yet.

Support — 2.389. Resistance — 2.894.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 80000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 61709. Resistance — 75352.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will buy, but only after growth above 11500. We will stop hitting the lows sooner or later. Although there should be plenty of gas domestically due to sanctions. That’s worth taking.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: in case of growth above 11500. Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 6914. Resistance — 11084.

Helium (Orenburg), ETP eOil.ru

Growth scenario: fenita la comedia. Helium is of no use to anyone. Sanctions.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 998. Resistance — the area of 1633.

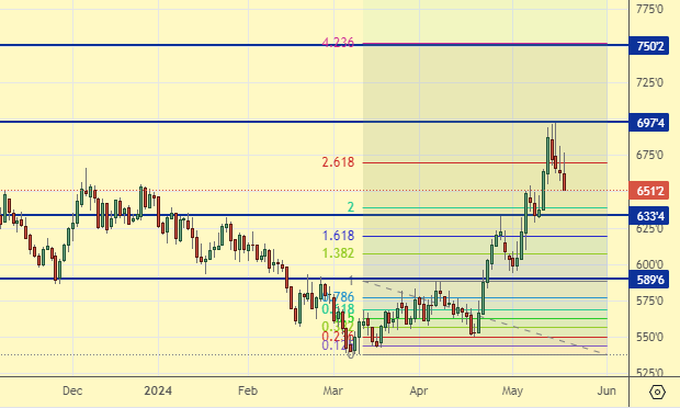

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 14.6 th. contracts. Bulls entered the market, sellers fled. Bears risked losing control.

Growth scenario: we consider July futures, expiration date July 12. Nothing new for us. Despite the attractive growth story, we will refrain from buying until the pullback to 600.0.

Downside scenario: it was possible to hook at the approach to 700.0, namely from 695.0. Here it is even possible to close a part of the position, taking into account the speed of the fall and the imminent rise to the top. But we will hold.

Recommendations for the wheat market:

Buy: when approaching 600.0. Stop: 570.0. Target: 700.0.

Sell: those in position from 695.0, move stop to 694.0. Target: 600.0.

Support — 633.4. Resistance — 697.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week, the difference between long and short positions of asset managers decreased by 32.5 thousand contracts. Buyers came in, sellers continued to disappear. Bears risk losing control.

Growth scenario: we consider July futures, expiration date July 12. We encountered a sharp pullback. We will continue to hold the long.

Downside scenario: it is worth selling from 550.0. It is necessary only for the market to give this level. It cannot be ruled out that we went to 360.0.

Recommendations for the corn market:

Buy: no. Those in position from 442.0, keep stop at 446.0. Target: 550.0.

Sell: on approach to 550.0. Stop: 570.0. Target: 360.0?!

Support — 443.6. Resistance — 475.4.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. We hold the long, but if nothing comes out we will accept it, as they threaten to harvest a lot of soybeans: as much as 420 million tons.

Downside scenario: from 1310 we will definitely go short. While out of the market.

Recommendations for the soybean market:

Buy: No. Who is in position from 1215, move stop to 1190. Target: 1310 (revised).

Sell: when approaching 1310.0. Stop: 1330.0. Target: 960.0.

Support — 1191.0. Resistance — 1255.6.

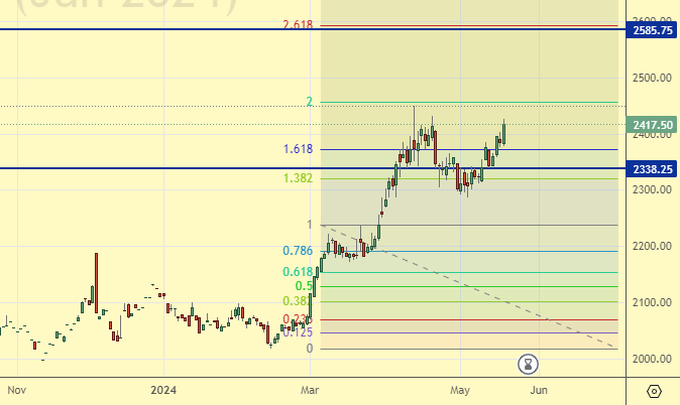

Growth scenario: we consider May futures, expiration date May 29. To buy, we continue to want a correction. Good to 2100, ideal to 2020. We do not deny the possibility of a move to 2600 without any pullbacks.

Downside scenario: the story with shorts ended sadly. The market did not go down and we do not see any signs for it. Nevertheless, he who does not risk does not drink champagne. Back to shorts!

Gold Market Recommendations:

Buy: from 2100 would be interesting, from 2000 would be perfect.

Sale: now. Stop: 2430. Target: 2020. Count the risks!

Support — 2338. Resistance — 2585.

EUR/USD

Growth scenario: you should not buy for now. The euro will be under pressure amid continued high interest rates in the US.

Downside scenario: we will re-short while we fight for the idea of the pair falling to 1.0000.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0867). Stop: 1.0930. Target: 1.0000.

Support — 1.0812. Resistance — 1.0919.

USD/RUB

Growth scenario: there is no reason to talk about longs again yet. Outside the market.

Downside scenario: it is possible to hold shorts. Until the Central Bank raises the rate to 20%, the ruble will be looked at as a quite healthy creature. A move to 89.00 looks natural.

Recommendations on dollar/ruble pair:

Buy: no.

Sell: no. Those in position from 92.10, move your stop to 92.40. Target: 86.00?!

Support — 89.30. Resistance — 91.22.

RTSI

Growth scenario: we consider June futures, expiration date June 20. It took off and grew. It’s not an obvious story. The trend was missed by us. Only a pullback to 115000 will allow us to enter it.

Downside scenario: and we’re growing. Wow. Short from 126000 will be interesting in the future, but we need to reach this level.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 119190. Resistance — 121910.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.