|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-8-to-12-april-2024/317301/

|

Energy market:

Rosatom has demonstrated an engine for interplanetary flights, and we continue with manic persistence to find out how much oil will cost tomorrow.

And it’s not clear which activity is more interesting. It’s one thing to predict the future, albeit not always successfully, and another to pick at influences and interactions. We don’t need Mars, leave it to Mask. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

The world awaits Iran’s response to the assassination of a general in Syria. And there may not be one. However, the Jewish state does not harbor illusions: mobilization is underway, people are buying foodstuffs to spare. Traders, of course, follow the situation in the Middle East and often press «buy».

OPEC+ will keep the market toned down without considering a possible reduction in the current cuts. Prices have gotten to 90.00, but have not gotten to $100 a barrel. If that happens, it could infuriate Washington, which will launch a diplomatic crusade on Riyadh to push for more reasonable price levels. The West can’t afford to feed Saudi Arabia and other OPEC+ members.

According to official reports, in March, Russia made good money on the sale of resources, including oil: 1.308 trillion rubles. If only we could reduce expenditures… but there is no way and it will not happen in the near future. The main conclusion is that the Western sanctions can be circumvented at the moment, at least those aimed at blocking or complicating the sale of resources.

Grain market:

Market participants will give their assessment of the events between Israel and Iran. In case of escalation, grain prices may slightly increase: 5 — 10%, but we will not see total growth, as both countries are not key players in the global agricultural market, but logistical obstacles due to mutual firing may arise.

Domestic prices are at low levels: 3rd grade can be taken at 11500, fourth grade at 10000 rubles per ton, which does not please farmers. However, the situation may change if exports continue to remain at the current record levels for the next 3 months: around 6 million tons. Seeing that residuals are decreasing, producers will be able to raise prices. In case of decrease in shipments, the domestic grain market is not expecting anything good. It is possible that livestock breeders will be able to increase grain consumption by 10 — 15%, but this will not change the situation radically.

We will see a number of articles on weather conditions in key regions of the world in the coming month, but it is not worth reacting to each one individually. Let’s be patient and wait for the May USDA report with the first forecast for the 24/25 season.

USD/RUB:

The good news for the ruble is that Russia is still managing to sell resources. That is, some inflow of some currencies into the country continues. These inflows are critically needed in the conditions of the transition period. The country will have to learn to produce as many products as possible inside, spending currency will go only on critical imports, primarily in the military-industrial complex.

The government will continue to borrow 1 trillion rubles per quarter on the domestic market, at a significant rate, which will create a strain, but not a problem, with debt servicing in the future. We note the continuation of the bearish trend in the RGBI index, which indicates a decline in interest in Russian government debt securities.

Note that the hint of the completion of the SWO (negotiations) can sharply strengthen the ruble exchange rate in the moment, possibly to the area of 75.00.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 11.8 th. contracts. Bulls continued to increase their positions on the market. Sellers kept the «status-quo». Bulls strengthened their advantage.

Growth scenario: we consider April futures, expiration date is April 30. It makes sense to keep buying. We are almost at our target.

Downside scenario: tactical shorts from 92.70 are possible, but no big plans should be made.

Recommendations for the Brent oil market:

Buy: no. Those in position from 82.68, move stop to 89.30. Target: 92.70. It is possible to close 30% of the position at current prices.

Sell: at touching 92.70. Stop: 92.96. Target: 88.60.

Support — 88.68. Resistance — 92.70.

WTI. CME Group

US fundamental data: the number of active drilling rigs rose by 2 units to 508.

U.S. commercial oil inventories rose 3.21 to 451.417 million barrels, against a forecast of -0.3 million barrels. Gasoline inventories fell by -4.256 to 227.816 million barrels. Distillate stocks fell -1.268 to 116.069 million barrels. Cushing storage stocks fell by -0.377 to 33.163 million barrels.

Oil production is unchanged at 13.1 million barrels per day. Oil imports fell by -0.084 to 6.618 million barrels per day. Oil exports fell by -0.159 to 4.022 million barrels per day. Thus, net oil imports rose by 0.075 to 2.596 million barrels per day. Oil refining fell by -0.1 to 88.6 percent.

Gasoline demand increased by 0.521 mb/d to 9.236 mb/d. Gasoline production rose 0.767 to 9.98 million barrels per day. Gasoline imports fell -0.034 to 0.488 million barrels per day. Gasoline exports rose 0.077 to 0.863 million barrels per day.

Distillate demand fell -0.533 to 3.495 million barrels. Distillate production fell by -0.208 to 4.606 million barrels. Distillate imports fell -0.061 to 0.104 million barrels. Distillate exports rose -0.276 to 1.396 million barrels per day.

Demand for petroleum products increased by 1.761 mln barrels to 21.292 mln barrels. Production of petroleum products increased by 1.392 mln barrels to 22.592 mln barrels. Petroleum product imports rose 0.005 to 1.666 million barrels. Exports of refined products fell by -0.711 to 5.938 million barrels per day.

Propane demand increased by 0.675 to 1.429 mln barrels. Propane production increased by 0.013 to 2.673 million barrels. Propane imports rose 0.009 to 0.125 million barrels. Propane exports fell -0.609 to 1.419 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 10 th. contracts. Buyers were coming to the market. Sellers did not change their positions. Bulls keep control.

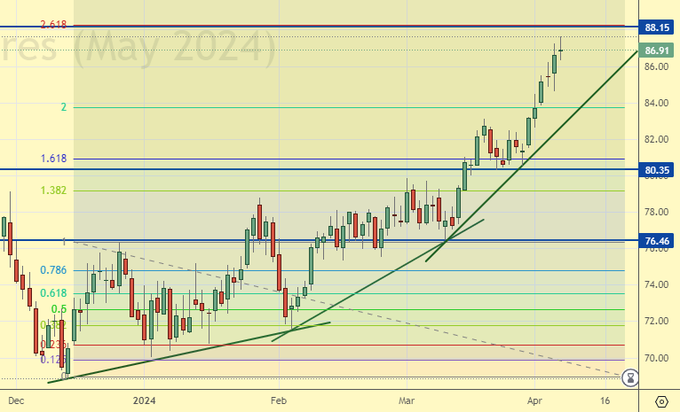

Growth scenario: we consider May futures, expiration date April 22. Keep buying. We are almost there, but still «almost». Waiting for the target.

Downside scenario: shorting from 88.10 area will be reasonable. After sharp growth there may be a sharp pullback.

Recommendations for WTI crude oil:

Buy: no. Those in position from 79.97, move stop to 85.70. Target: 87.90. It is possible to close 30% of the position at current prices.

Sell: when touching 88.10. Stop: 88.40. Target: 81.60.

Support — 80.35. Resistance — 88.15.

Gas-Oil. ICE

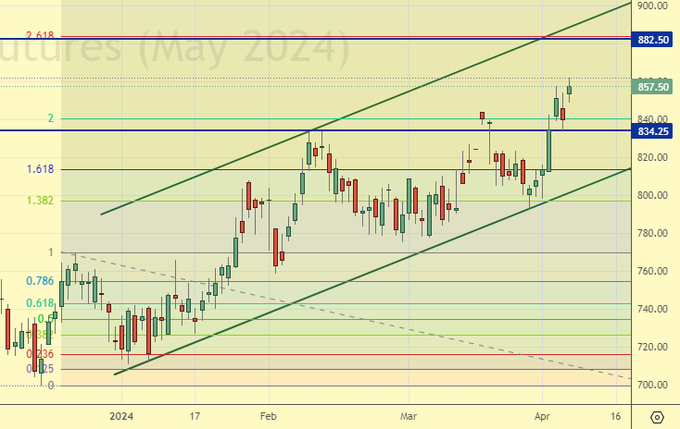

Growth scenario: we consider May futures, expiration date May 10. The market is high. Don’t buy.

Downside scenario: when approaching 882.50 we can sell. We should not expect a strong fall, we are likely to roll back to 840.0, possibly to 820.0.

Gasoil Recommendations:

Buy: no.

Sale: no.

Support — 834.25. Resistance — 882.50.

Natural Gas. CME Group

Growth scenario: we consider May futures, expiration date April 26. We hold longs. We will continue to count on growth, although we do not have big illusions.

Downside scenario: refrain from selling, market is low.

Natural Gas Recommendations:

Buy: no. Who is in position from 1.7630, keep your stop at 1.6900. Target: 2.770?!

Sale: no.

Support — 1.692. Resistance — 1.904.

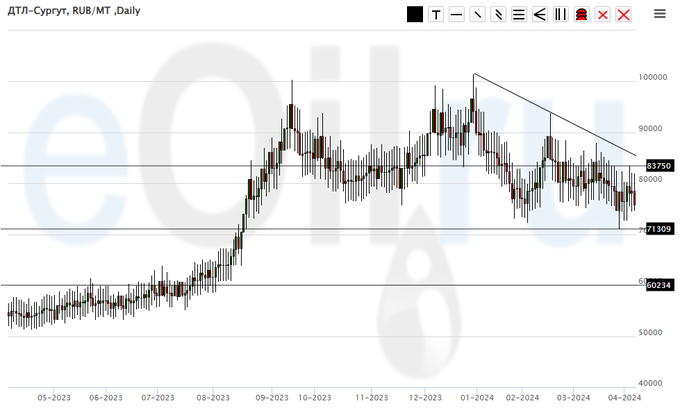

Diesel arctic fuel, ETP eOil.ru

Growth scenario: nothing new. As long as we don’t go above 90000, we don’t think about buying. Out of the market.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 71309. Resistance — 83750.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to keep longing. If the market goes below 10000, it may lead us to 5000. And there we will definitely need to buy.

Downside scenario: we stay out of the market. Movement to 5000 is possible, but selling is risky now.

PBT Market Recommendations:

Buy: no. Those in position from 13000, keep stop at 10700. Target: 25000.

Sale: no.

Support — 10078. Resistance — 16719.

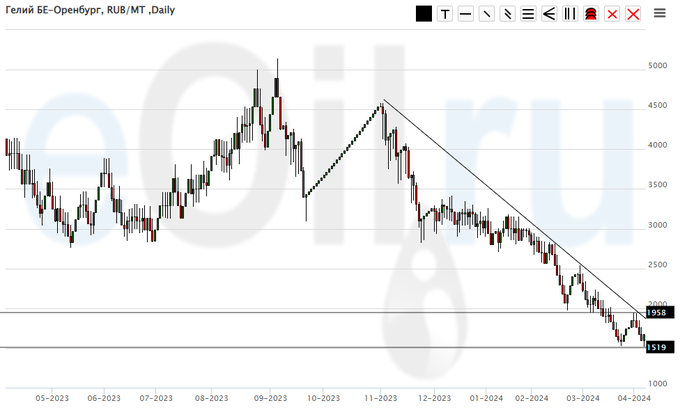

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market gives us a chance to take it at a low price. And we will take that chance.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: Now (1600). Stop: 1400. Target: 3500.

Sale: no.

Support — 1519. Resistance — the area of 1958.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 0.5 thousand contracts. There were slightly more buyers than sellers, while the inflow of new money was minimal. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. We continue to want the market at 515.0, but there are doubts about the probability of such an event. We will not buy from current levels.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place now.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sell: no. Who is in position from 565.0, move stop to hold stop at 577.0. Target: 515.0.

Support — 539.0. Resistance — 575.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 4.6 thousand contracts. Both buyers and sellers were leaving the market, buyers did it a bit more actively. Bears keep control.

Growth scenario: we consider the May futures, expiration date May 14. The week was neutral, and we continue to want growth, even if it has no ground under its feet.

Downside scenario: do not sell. There are doubts in continuation of the fall.

Recommendations for the corn market:

Buy: no. Those who are in position from 432.0, move the stop to 423.0. Target: 500.0.

Sale: no.

Support — 425.1. Resistance — 438.0.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. It makes sense to bet on the growth continuation. Most likely, the market will not stop at 1235, as we supposed earlier, and will go higher. Those who wish can buy at the current levels.

Downside scenario: out of the market for now.

Recommendations for the soybean market:

Buy: think when approaching 1150.0. Those who are in position from 1141.6, move the stop to 1162.0. Target: 1300.0.

Sale: no.

Support — 1165.0. Resistance — 1191.2.

Growth scenario: we flew to 2327. A strong pullback down from this area is possible. Buying from 2100 in the long term would be a good option.

Downside scenario: we can sell. We are unlikely to go above 2333, especially if Iran never starts attacking Israel directly.

Gold Market Recommendations:

Buy: on a pullback to 2100. Stop: 2000. Target: 2430.

Sale: now. Stop: 2338. Target: 2100.

Support — 2224. Resistance — 2327 (2331).

EUR/USD

Growth scenario: we are standing very firmly in a range. No ideas. Out of the market. ECB meeting on Thursday.

Downside scenario: refrain from taking any action.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0724. Resistance — 1.0876.

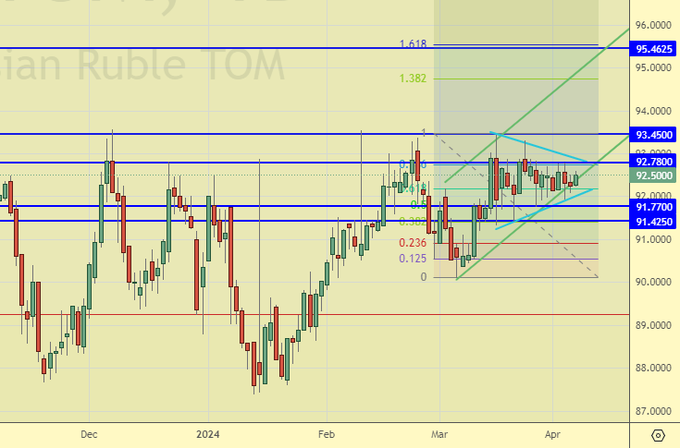

USD/RUB

Growth scenario: nothing new. It is necessary to keep longing. Strengthening to 90.00 on the background of accumulating negativity will be an unexpected revelation.

Downside scenario: we will not sell. None of the experts are seriously talking about the ruble strengthening.

Recommendations on dollar/ruble pair:

Buy: on a pullback to 91.00. Stop: 90.00. Those who are in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 91.77. Resistance — 92.78.

RTSI

Growth scenario: we consider the June futures, expiration date June 20. It is likely that there will be a pullback to 111000. We refrain from buying for now.

Downside scenario: we will enter shorting from current levels. If it is a triangle, it will have a 5th corrective wave to the area of 109500, and only then we will see growth.

Recommendations on the RTS index:

Buy: no.

Sale: now. Stop: 115600. Target: 109500.

Support — 110860. Resistance — 114660.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.