|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-25-to-29-march-2024/316362/

|

Energy market:

No jokes today. It’s just about getting point across.

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The OPEC countries are gradually losing influence amid high oil prices and the importers’ desire to reduce their dependence on external supplies. One careless word about the elected state (people) and the right to an exclusive opinion on who and how much to produce, the cartel will immediately cease to exist, as the coalition will disintegrate due to the desire of each individual country to preserve its commodity business, its clientele. The collapse will be driven by the very buyers who sleep and see themselves reacquiring valuable commodities for beads, or for the word of a Westerner who cannot really be trusted.

Russia is facing a drop in oil production to 9.5 million bpd in the next couple years (this is a vision, a projection of the situation, not an estimate) from the current 11 due to rig maintenance issues, due to Western service companies leaving, and depletion of current fields.

Also, the production slowdown will be caused by the fact that China will not make any efforts and will not invest in Russia’s oil and gas sector. This is already evident from Beijing’s behavior, which is not granting a loan to the Kremlin, while Moscow asked for it in early March, if not earlier. The country’s domestic resources will be extremely limited due to the SWO, and company profits will not be used for capital investments, as they will simply be withdrawn due to the constant growth of taxes.

Grain market:

Russian agriculture will be put to the test this season. If fuel from still operating refineries reaches the agrarians, the work will be done. At the same time, it is difficult to predict what the price policy will be at the end of the season. The country will need foreign currency, and it can be obtained for grain. At the same time, the cheaper you buy grain for rubles from a farmer on the spot and the more expensive you sell it at FOB for foreign currency, the greater the yield. It is possible that instead of a grain exchange we will get a monopoly and state regulation of wheat prices inside the country.

Apparently, Europe is determined to cut humanitarian ties that ensure the supply of medicines and components for food synthesis (sausages, for example. Sweeteners, thickeners, guts and the like). This list includes seeds. We will not have enough seeds of our own, which will inevitably lead to a drop in crop yields, if not this year, then next year. However, we can try to leave the cocks and senors without fertilizers, but Europe has already been left without gas, and now they have fallen in love with Qatar. If we try to leave them without fertilizers, they will fall in love with Canada even more, but they will not give seeds.

This year somehow we’ll drop out, next year there are big questions.

USD/RUB:

Elvira Nabiullina left the rate at 16%. This is a neutral scenario for the ruble at the moment. For the economy, when loan rates have already gone above 30%, it is tantamount to freezing business activity. Business will tolerate another year, and the situation will deteriorate further.

It is worth writing here that trying to keep the ruble around 90.00 to the dollar makes sense only if it does not reduce foreign exchange reserves (the number of yuan), otherwise a sharp devaluation will await us in the future. Banks always lose to the market. However, if imports drop significantly, it may help the CB this year.

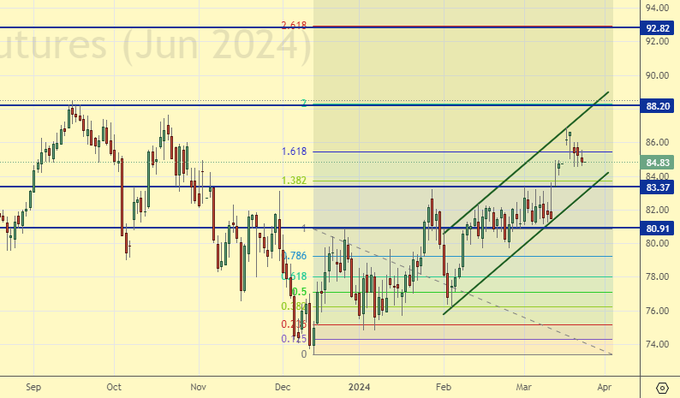

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 58.2 thousand contracts. Bulls sharply increased the volume of positions. Sellers fled. The change is significant. The bulls have increased their advantage.

Growth scenario: we consider April futures, expiration date is April 30. It makes sense to keep buying. A move to the 93.00 area is possible.

Downside scenario: selling looks unjustified for now. We need to go higher, probably much higher, to be able to enter shorts.

Recommendations for the Brent oil market:

Buy: no. Who is in the position from 82.68 (taking into account the transition to the new futures), move the stop to 81.90. Target: 92.82.

Sale: no.

Support — 83.37. Resistance — 88.20.

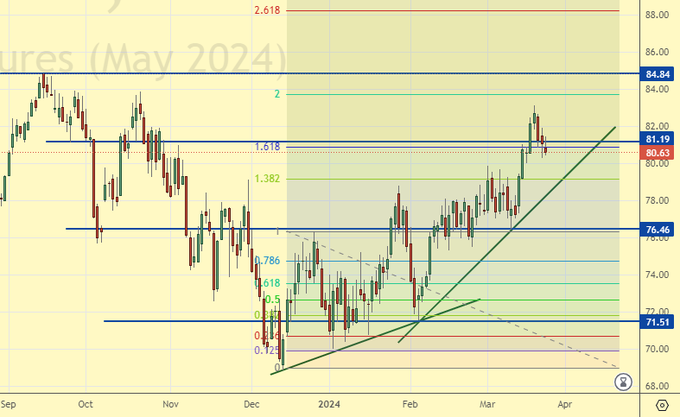

WTI. CME Group

US fundamental data: the number of active rigs decreased by 1 unit to 509.

U.S. commercial oil inventories fell -1.952 to 445.042 million barrels, with a forecast of -0.9 million barrels. Gasoline inventories fell by -3.31 to 230.773 million barrels. Distillate stocks rose 0.624 to 118.522 million barrels. Cushing storage stocks fell by -0.018 to 31.433 mln barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports increased by 0.787 to 6.278 mln barrels per day. Oil exports rose by 1.734 to 4.881 million barrels per day. Thus, net oil imports fell by -0.947 to 1.397 million barrels per day. Oil refining rose by 1 to 87.8 percent.

Gasoline demand fell -0.235 to 8.809 million barrels per day. Gasoline production fell -0.263 to 9.648 million barrels per day. Gasoline imports fell -0.138 to 0.496 million barrels per day. Gasoline exports rose 0.034 to 1.033 million barrels per day.

Distillate demand increased by 0.411 to 3.786 mln barrels. Distillate production rose by 0.128 to 4.69 million barrels. Distillate imports fell -0.001 to 0.17 million barrels. Distillate exports fell -0.246 to 0.985 million barrels per day.

Demand for petroleum products fell by -1.061 to 19.742 million barrels. Petroleum products production fell -0.455 to 22.075 million barrels. Imports of refined petroleum products fell -0.622 to 1.443 million barrels. Exports of refined products rose by 0.766 to 6.894 million barrels per day.

Propane demand fell by -0.327 to 0.909 million barrels. Propane production rose 0.042 to 2.625 million barrels. Propane imports rose 0.015 to 0.129 million barrels. Propane exports rose 0.43 to 1.794 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 45.1 thousand contracts. The inflow of volumes of bulls was significant. Sellers were leaving the market. Bulls strengthened their control.

Growth scenario: we consider May futures, expiration date April 22. We keep buying. A move to 88.00 looks natural. But it is possible that in the beginning we will pullback to 76.50.

Downside scenario: we refuse to sell for the time being. It is possible that we will see an acceleration of price growth.

Recommendations for WTI crude oil:

Buy: on a pullback to 76.50. Stop: 75.40. Target: 88.00. Those who are in the position from 79.97, move the stop to 79.80. Target: 88.00.

Sale: no.

Support — 76.46. Resistance — 81.19 (84.84).

Gas-Oil. ICE

Growth scenario: we switched to April futures, expiration date April 11. We will continue to hold the long. So far the situation is favorable.

Downside scenario: this is not what we expected a week ago. Out of the market.

Gasoil Recommendations:

Buy: No. Those in position at 804.25, move your stop to 814.00. Target: 1000.00?!

Sale: no.

Support — 789.00. Resistance — 842.00.

Natural Gas. CME Group

Growth scenario: we switched to May futures, expiration date April 26. We continue to be in the falling channel. Out of the market.

Downside scenario: refrain from selling.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.730. Resistance — 2.152.

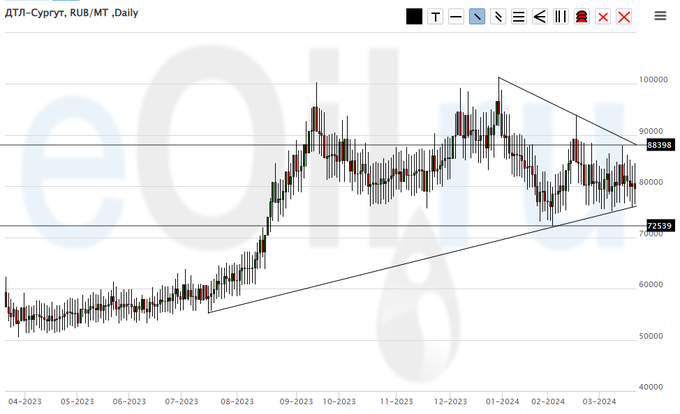

Diesel arctic fuel, ETP eOil.ru

Growth scenario: nothing new. As long as we don’t go above 90000, we don’t think about buying. Out of the market.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 72539. Resistance — 88398.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to keep longing. If the market goes below 10000, it may lead us to 5000. And there we will definitely need to buy.

Downside scenario: we stay out of the market. Movement to 5000 is possible, but selling is risky now.

PBT Market Recommendations:

Buy: No. Who is in position from now 13000, keep stop at 10700. Target: 25000.

Sale: no.

Support — 10078. Resistance — 16719.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we’ve fallen into a basement somewhere. And suddenly no one needs helium. No balloons.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1510. Resistance — the area of 3000.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 2.6 thousand contracts. Both buyers and sellers entered the market in insignificant volumes. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. Nothing new. We are waiting for the market at 515.0. We can buy there.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place now. It is interesting to sell from 565.0.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sell: on approach to 565.0. Stop: 575.0. Target: 515.0.

Support — 514.7. Resistance — 568.5.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 8.1 th. contracts. Buyers and sellers were leaving the market. Sellers did it somewhat more actively. Bears are keeping control.

Growth scenario: we consider May futures, expiration date May 14. We can hold the long. It is a bit strange, but since it took place, there is no sense to get out of the position now.

Downside scenario: do not sell. There are prerequisites for growth continuation.

Recommendations for the corn market:

Buy: no. Who is in position from 436.6, keep stop at 430.0. Target: 468.0. When approaching 370.0, add at 350.0 aggressively. Stop: 320.0. Target: 500.0.

Sale: no.

Support — 431.6. Resistance — 445.7.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. Growth continues. Judging by the fact that the momentum is in front of us, the growth to 1300.0 may take place.

Downside scenario: out of the market for now.

Recommendations for the soybean market:

Buy: no. Who is in position from 1141.6, move the stop to 1153.0. Target: 1300.0 (revised).

Sale: no.

Support — 1165.7. Resistance — 1235.5.

Growth scenario: like a week ago, we believe that in order to enter the long position nicely, we need to roll back to 2080. If this does not happen, we will have to look for less favorable points for buying.

Downside scenario: shorting is possible. It is more convenient on «hourly» candles, but it can be realized on daily candles as well.

Gold Market Recommendations:

Buy: on a pullback to 2080, 2040. Stop: 2000. Target: 2400. Consider the risks!

Sell: at touching 2188. Stop: 2198. Target: 2080.

Support — 2133. Resistance — 2194.

EUR/USD

Growth scenario: there is no such scenario. Where are the new highs? There aren’t any. Don’t buy.

Downside scenario: how interesting. But, we’re not going to do anything. It’s just interesting.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0757. Resistance — 1.0943.

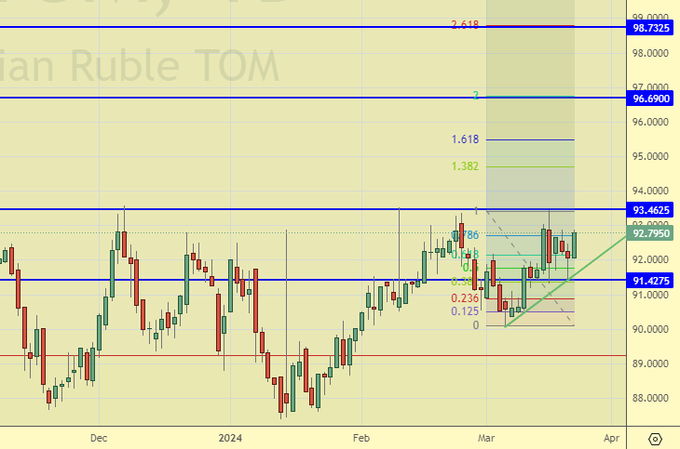

USD/RUB

Growth scenario: those who want to buy here. Those who are already in a position, keep longs. It is possible that we will revise the target after a move above 93.50.

Downside scenario: we will not sell. Nothing good lately.

Recommendations on dollar/ruble pair:

Buy: on a pullback to 91.00. Stop: 90.00. Or now (92.79) Stop: 90.00. Who is in position from 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 91.42. Resistance — 93.46.

RTSI

Growth scenario: we consider the June futures, expiration date June 20. We’re not going anywhere. Out of the market.

Downside scenario: yes, it is possible that the market will fall on Monday, but it is unlikely to last long. We will sell on the upside.

Recommendations on the RTS index:

Buy: no.

Sell: on approach to 110500. Stop: 111900. Target: 100000.

Support — 107560. Resistance — 112070.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.