|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-22-february-to-1-march-2024/314096/

|

Energy market:

Washington imposed again, Brussels sat next to it and imposed the same. The mountain of sanctions is growing. It is a European tradition to build up a stable and live in it. And they want to put us in the same place. Hercules will hardly be born there anymore. Well, not Hercules, de Gaulle would at least show up.

They say that oilmen will have a lot of bananas now. They will exchange them for all sorts of things they need: fur coats, furry and warm hats. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

Secondary sanctions on companies and banks of states working with Russia will force the fragmentation of resource supplies and make them irregular. Payment will come in exotic currencies and currencies of developing countries. This will complicate the work of the oil sector, which has already given 60 billion dollars to India, which now has to be taken back somehow. We offer to take slaves to build something from us. They can dig a tunnel to Japan, even if Japan doesn’t really agree. The slaves can be paid in their own rupees.

The hunt for tankers carrying Russian oil is gaining momentum. This has already led to a drop in oil exports from Russia by sea. It is difficult to say whether this is actually true or not, but Bloomberg is analyzing and counting something. But there is another side to the coin: now, to pass through the Red Sea, American and British ship captains will have to hope that their ship will not be hit. The Houthis are running rampant. Shooting firecrackers at anything that moves under the wrong flag.

The U.S. raised production again to 13.3 million bpd, suggesting that at these prices, even the expensive labor of U.S. oil workers is finding a niche in the domestic and global market.

Grain market:

Corn collapsed on the Chicago exchange, which should create a bearish backdrop for wheat as well. The spread between the crops has now widened to 150 cents on May contracts. The main feed crop could fall another 10% as part of the current decline to 370 cents a bushel. Wheat could also move down to the 520 cents/bushel level.

Polish, and with them French farmers, continue to fret, as there is still time before the sowing season. Macron ran away from the tractor drivers, and Ukraine failed to agree with Poland on grain transit. There is a collapse on the border between the countries, and no solution to the problem can be seen yet. This is an extra reason to speculate that there is plenty of agricultural production in the Old World. They can afford to feed millions of migrants from all over the world. You look and see that the main beneficiaries of rising food prices have been processors and chains, not farmers, otherwise there would not have been any riots.

USD/RUB:

The Western community has explained to itself that you cannot confiscate the assets of other states, but you can confiscate Russian assets.

Now the confiscation has taken place de facto, and when it is legalized, and this money goes to Ukraine, Yukos shareholders, Charles III, someone else, then the Central Bank of Russia will have to recognize the loss of these funds and remove them from the ZVR. Our reserves now are yuan and gold, there is nothing else. It’s kind of orphaned. But the more we trade for rubles, the less we will have to think about what to provide the ruble with. The main thing is to have someone to trade with. If statistics are to be believed, the ruble’s share in Russia’s foreign trade has risen to 40%.

As for the sanctions on the Mir payment system, yes, this will make life more difficult for ordinary citizens. After the sanctions on Kiwi, this is the second significant blow to those Russians who have decided to settle abroad or are traveling abroad.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 4.2 th. contracts. Sellers reluctantly entered the market. There were no new buyers. Bulls keep the advantage.

Growth scenario: switched to March futures, expiration date March 28. We need growth above 85.00. Until it has not happened, we do not look up.

Downside scenario: despite a series of failures when trying to enter short, we will continue to sell as the bulls are not convincing.

Recommendations for the Brent oil market:

Purchase: no.

Sell: now (83.40). Stop: 84.20. Target: 68.00.

Support — 80.16. Resistance — 82.95.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 6 to 503.

U.S. commercial oil inventories rose by 3.514 to 442.964 million barrels, against a forecast of +3.879 million barrels. Gasoline inventories fell -0.293 to 247.037 million barrels. Distillate stocks fell by -4.008 to 121.651 million barrels. Cushing storage stocks rose by 0.741 to 29.512 million barrels.

Oil production remained unchanged at 13.3 million barrels per day. Oil imports increased by 0.184 to 6.654 mln barrels per day. Oil exports rose by 0.618 to 4.965 million barrels per day. Thus, net oil imports fell by -0.434 to 1.689 million barrels per day. Oil refining remained unchanged at 80.6 percent.

Gasoline demand rose by 0.032 to 8.2 million barrels per day. Gasoline production fell -0.146 to 9.029 million barrels per day. Gasoline imports rose 0.298 to 0.734 million barrels per day. Gasoline exports fell -0.06 to 0.908 million barrels per day.

Distillate demand increased by 0.426 to 3.94 mln barrels. Distillate production increased by 0.095 to 4.171 mln barrels. Distillate imports rose 0.11 to 0.245 million barrels. Distillate exports rose 0.078 to 1.049 million barrels per day.

Demand for petroleum products fell by -0.337 to 18.918 million barrels. Petroleum products production fell by -0.386 to 20.207 million barrels. Imports of refined petroleum products rose 0.728 to 2.255 million barrels. Exports of refined products rose by 0.696 to 6.962 million barrels per day.

Propane demand fell -0.303 to 1.03 million barrels. Propane production fell -0.015 to 2.468 million barrels. Propane imports rose 0.025 to 0.147 million barrels. Propane exports rose 0.049 to 0.16 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 23.2 thousand contracts. Buyers increased the volume, sellers were leaving the market. Bulls keep control.

Growth scenario: we switched to April futures, expiration date March 20. We will not buy. To buy we need to go above 79.20.

Downside scenario: we will continue to insist on selling. Friday’s red candle is favorable for shorts.

Recommendations for WTI crude oil:

Purchase: no.

Sell: now (76.49). Stop: 79.40. Target: 65.00. Count the risks!

Support — 75.50. Resistance — 79.13.

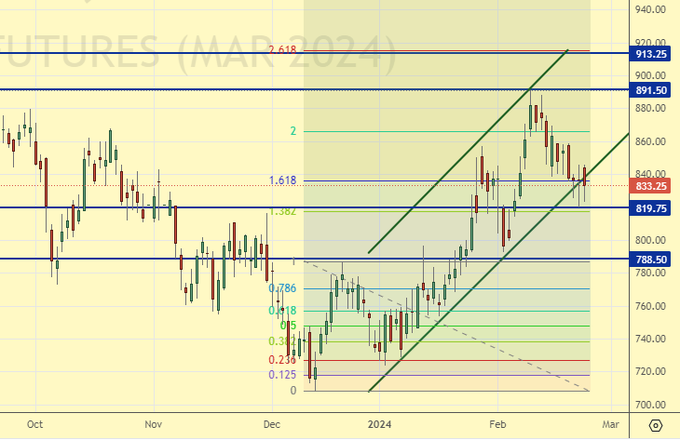

Gas-Oil. ICE

Growth scenario: we consider the March futures, expiration date is March 12. We will continue to buy, as a move to 913.00 cannot be ruled out.

Downside scenario: we are not selling yet. Out of the market.

Gasoil Recommendations:

Purchase: Now (833.25). Stop: 814.00. Target: 913.00.

Sale: no.

Support — 819.75. Resistance — 891.50.

Natural Gas. CME Group

Growth scenario: switched to April futures, expiration date March 26. The market is still falling. We are not making any attempts to buy yet.

Downside scenario: a close trend stop order on the previous contract worked. We will not sell more for now.

Natural Gas Recommendations:

Purchase: no.

Sale: no.

Support — 0.356. Resistance — 2.088.

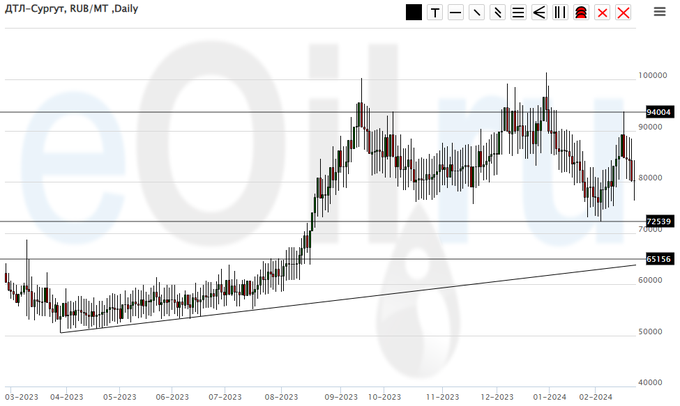

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Downside scenario: refrain from shorts. Clearly domestic fuel demand is now at a high level. On the other hand, supply disruptions by sea may lead to future overstocking.

Diesel Market Recommendations:

Purchase: no.

Sale: no.

Support — 72539. Resistance — 94004.

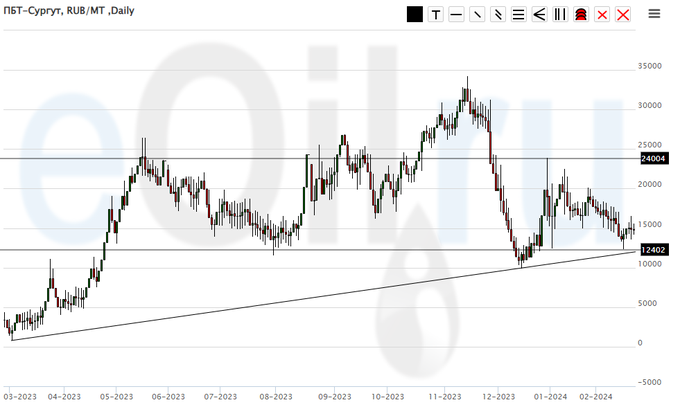

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to hold longing. It is not excluded that the market is at local lows. Those who wish can buy at current levels.

Downside scenario: no interesting ideas for sales. Out of the market.

PBT Market Recommendations:

Purchase: No. Who is in position from now 13000, keep stop at 11000. Target: 25000.

Sale: no.

Support — 12402. Resistance — 24004.

Helium (Orenburg), ETP eOil.ru

Growth scenario: like a week ago, we believe that when approaching 2100 we should definitely buy. In principle, this area is already interesting for buying. Therefore, it makes sense to open a position now and add after the move to 2100.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: no. Who is in position from 2200 and 2100, keep stop at 1900. Target: 5000.

Sale: no.

Support — 1984. Resistance is 2844.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 13.4 th. contracts. Sellers actively entered the market. Buyers increased their volumes much more modestly. Bears keep control.

Growth scenario: switched to May futures, expiration date May 14. The bulls are having a hard time so far. Corn has collapsed, and wheat by itself will not be able to grow now.

Downside scenario: high volatility did not allow our short to survive. Nevertheless, on the market we are looking down.

Recommendations for the wheat market:

Purchase: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sale: no.

Support — 553.6. Resistance — 603.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 23.6 th. contracts. Sellers entered the market, buyers left it. Bears strengthened their advantage.

Growth scenario: moved to May futures, expiration date May 14. Buying from 350.0 would be very successful, the level of 370.0 is also interesting. We note with surprise that the market did not stop at 420.0.

Downside scenario: we continue to fall further. It’s a pity, but we are out of position. The current movement is already a drama for the bulls.

Recommendations for the corn market:

Purchase: when approaching 370.0, add at 350.0 aggressively. Stop: 320.0. Target: 500.0. Consider the risks!!!

Sale: no.

Support — 365.1. Resistance — 421.7.

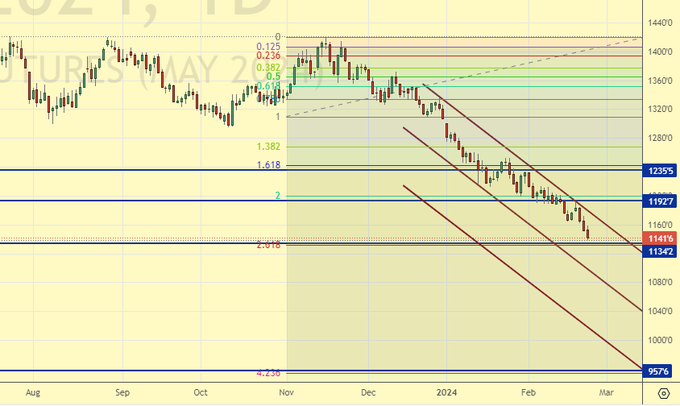

Soybeans No. 1. CME Group

Growth scenario: moved to May futures, expiration date May 14. It makes sense to buy here. If nothing comes out, we will open new longs only from 955.0.

Downside scenario: fly to the area we want. Make a profit.

Recommendations for the soybean market:

Purchase: now (1141.6). Stop: 1110.0. Target: 1230.0.

Sale: no.

Support — 1134.2. Resistance — 1192.7.

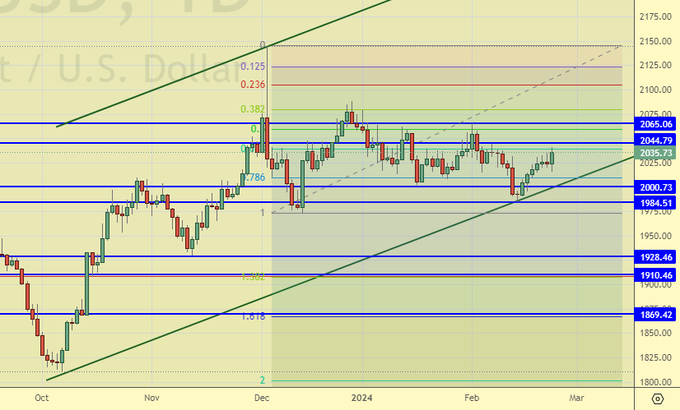

Growth scenario: Friday’s candlestick is not so much bullish as it is «brazen». As long as we are below 2050, we are not talking about buying.

Downside scenario: shorts have not been successful so far. Let’s take a break for a week and watch the development of events.

Gold Market Recommendations:

Purchase: no.

Sale: no.

Support — 2000. Resistance is 2044.

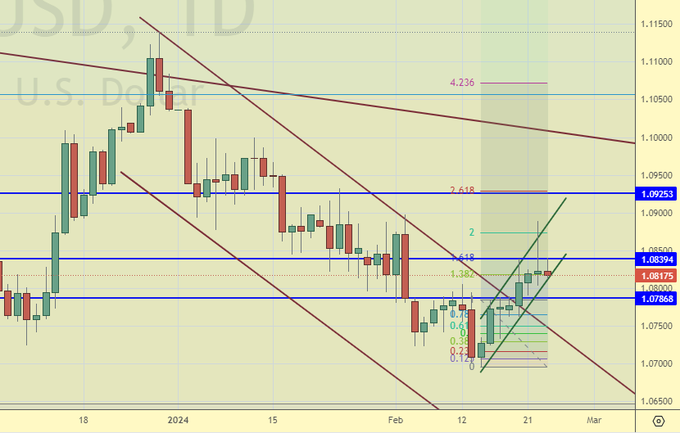

EUR/USD

Growth scenario: we will continue to keep buying. There are doubts in continuation of growth, but they are not so strong to close the current long.

Downside scenario: they have not given us the 1.0460 mark yet. We see a strong surge upward, which knocked out the long-term short with some profit. Don’t sell yet.

Recommendations on euro/dollar pair:

Purchase: no. Those who are in position from 1.0722, move the stop to 1.0730. Target: 1.2000.

Sale: no.

Support — 1.0786. Resistance — 1.0839.

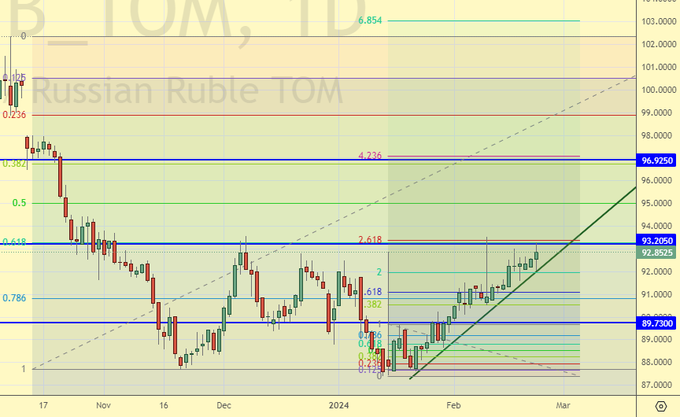

USD/RUB

Growth scenario: not a single red day. This is a classic long with a gradual rise of quotations inside the growing price channel. Let’s keep buying.

Downside scenario: we continue to refuse from shorts. We are facing a «double bottom», the final formation of which may lead to a quick move to 97.00.

Recommendations on dollar/ruble pair:

Purchase: no. Who is in position from 91.60, move your stop to 90.80. Target: 97.00 (120.00?!).

Sale: no.

Support — 89.73. Resistance — 93.20.

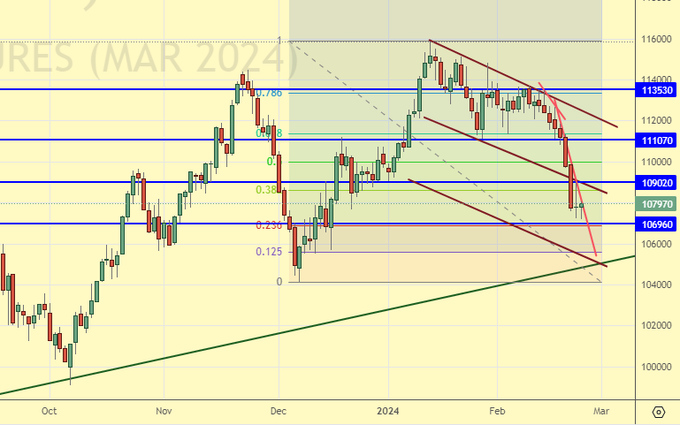

RTSI

Growth scenario: we consider the March futures, expiration date March 21. It is an interesting area for buying from a technical point of view. We cannot ignore it and have to work it out despite the gloomy background from new sanctions.

Downside scenario: keep shorts. There is a threat of a move below 105000, which will quickly take us to 103000.

Recommendations on the RTS index:

Purchase: if the market rises and is above 107500 before Monday’s afternoon clearing. Stop: 106300. Target: 111000.

Sell: no. Those who are in position from 113010 and 110000, move the stop to 111750. Target: 100000 (80000).

Support — 106960. Resistance — 109020.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.