|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-22-to-26-january-2024/311284/

|

Energy market:

While Russian farmers are looking for a way to increase the number of eggs, and indeed how this should be done, India has resumed purchasing pork from Russia. Some people don’t eat pork, others don’t eat beef…

Still others don’t eat swan meat, no, not because they don’t want to, but they simply don’t have it. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Yemeni comrades are firing at all tankers, including those carrying Russian oil, which cannot be considered normal behavior. Some great powers there, recently there are more and more of them, these powers, have launched some kind of operation, but the Houthis themselves have no idea about it. But manufacturers of goods are aware of the loss of profit, and logistics companies and insurers are rubbing their hands once again. Now everything will be transported through Africa. Plus ten days to the delivery time from Asia to Europe.

Denmark hinted at closing its territorial waters to the export of Russian oil and this happened almost immediately after reports emerged that an agreement on fishing in Russian waters by British vessels was terminated. Britain will be without cod, and we will not be able to export our oil. If this happens, prices will go up, and overstocking will occur in Russia, which will be comparable to a catastrophe. Oil production cannot be stopped so easily, and it will be impossible to resume somewhere. We are following Denmark. In general, we keep an eye on everyone.

Russia continues to move away from dollars and euros. We get paid for oil like hell, soon they will be beads, but in this situation beads are also a theme. You can declare it a cultural heritage, put any price tag on it, put it in a warehouse and issue rubles against it, since there is no other security. Yes, and we are waiting for cryptocurrencies as a means of payment for energy supplies. We can also take Argentine pesos and greyhound puppies.

By reading our forecasts, you could take an upward move on RTS index futures from 105000 to 114400.

Grain market:

Symbolic, but still, the growth of carryover stocks reduces tension in the grain market. Favorable forecasts for the 23/24 season do not allow prices to rise. The blocking of the Red Sea did not cause panic. After the horrors of the pandemic, when ports simply closed, current events for logistics do not seem out of the ordinary. The situation as a whole can be considered good, precisely because of the high level of supply. At the same time, we continue to note that the fabric of trade routes continues to be torn due to political squabbles.

Egypt purchased 300 thousand tons of Russian wheat at $265 per ton plus $20 freight. In addition, the pyramid builders took 60 thousand tons from the French for $262. Please note that the price level of the agreement for this tender is slightly higher than the market.

Chicago wheat has yet to gain a foothold above 600.0 cents per bushel, but as the spring growing season approaches, we are more likely to see gains in February simply due to the uncertainty.

Good weather conditions in Argentina have suppressed the corn market, but as the market plunges, more and more buyers from the real sector are active. Soon the pressure of speculators in this market will be compensated by corn consumers. It is unlikely that we will fall below 400 cents per bushel.

USD/RUB:

At the end of the 23rd year, Russia’s trade balance turned out to be plus 118 billion dollars, which is lower than the excellent year 22 (197 billion dollars), but quite enough to cover all expenses. Such indicators, together with a rate of 16%, will help maintain the stability of the ruble. Yes, we can assume some weakening or strengthening of the national currency, but it will not be multiple, but rather limited to the range of plus or minus 10 — 15% from current levels in 2024.

There can be talk that the ruble will depreciate to 150 or even 200 rubles per dollar, but these levels are unlikely to be reached this year. Only blocking oil supplies by sea can cause such a strong blow to the national currency. In all other cases, including when supplies of a number of goods and components are blocked, the impact on the ruble will be limited.

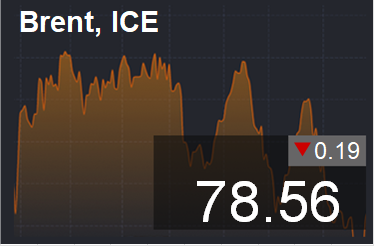

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 15.7 thousand contracts. Buyers entered the market, sellers fled. The bulls strengthened their lead.

Growth scenario: we are considering January futures, expiration date is January 31. For purchases without changes: we will buy if there is a rise above 81.60. There are still doubts about the ability of the bulls to reverse the trend upward.

Fall scenario: shorts from current levels is interesting from a technical point of view. A fall to 65.00 remains the main idea.

Recommendations for the Brent oil market:

Purchasing: think about it arriving by 65.00. In case of growth above 81.60. Stop: 77.70. Goal: 120.00. Consider the risks!

Sale: now (78.56). Stop: 80.90. Goal: 65.00. For those in positions between 78.75 and 76.10, keep your stop at 80.90. Goal: 65.00.

Support – 76.53. Resistance – 80.68.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and amounts to 497 units.

Commercial oil reserves in the United States fell by -2.492 to 429.911 million barrels, with the forecast of -0.313 million barrels. Gasoline inventories increased by 3.083 to 248.065 million barrels. Distillate inventories increased by 2.37 to 134.753 million barrels. Inventories at the Cushing storage facility fell by -2.099 to 32.074 million barrels.

Oil production increased by 0.1 to 13.3 million barrels per day. Oil imports increased by 1.179 to 7.42 million barrels per day. Oil exports increased by 1,707 to 5,029 million barrels per day. Thus, net oil imports fell by -0.528 to 2.391 million barrels per day. Oil refining fell by -0.3 to 92.6 percent.

Gasoline demand fell by -0.056 to 8.269 million barrels per day. Gasoline production fell by -0.291 to 9.365 million barrels per day. Gasoline imports increased by 0.049 to 0.549 million barrels per day. Gasoline exports increased by 0.274 to 1.097 million barrels per day.

Demand for distillates increased by 0.213 to 3.645 million barrels. Distillate production fell by -0.265 to 4.902 million barrels. Imports of distillates fell by -0.159 to 0.115 million barrels. Exports of distillates fell by -0.043 to 1.033 million barrels per day.

Demand for petroleum products increased by 0.264 to 19.869 million barrels. Production of petroleum products fell by -0.087 to 22.259 million barrels. Imports of petroleum products increased by 0.054 to 1.97 million barrels. Exports of petroleum products increased by 0.145 to 6.383 million barrels per day.

Propane demand fell by -0.194 to 1.397 million barrels. Propane production fell by -0.033 to 2.604 million barrels. Propane imports increased by 0.035 to 0.146 million barrels. Propane exports increased by 0.039 to 0.141 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 18.5 thousand contracts. Buyers entered the market, sellers fled in small quantities. The bulls are in control.

Growth scenario: we are considering March futures, expiration date is February 28. Nothing new for buyers. If there is a rise above 76.30, you can think about buying.

Fall scenario: exited the falling upward channel, but growth is in doubt. For now we will look down.

Recommendations for WTI oil:

Purchase: when approaching 61.50. Stop: 58.50. Goal: 120.00. After rising above 76.60. Stop: 72.70. Goal: 110.00.

Sale: now (73.25). Stop: 75.80. Target: 61.50. If you are in a position from 73.90, keep your stop at 75.80. Target: 61.50.

Support – 70.53. Resistance – 75.37.

Gas-Oil. ICE

Growth scenario: we are considering the February futures, expiration date is February 12. So far the bulls want to, but they can’t. We wait.

Fall scenario: we will continue to hold shorts in anticipation of a dive to 600.00.

Recommendations for Gasoil:

Purchase: think when approaching 600.00. After rising above 830.00. Stop: 770.00. Goal: 1200.00.

Sale: now (796.25). Stop: 830.00. Goal: 600.00. Anyone in position from 782.0, keep a stop at 830.0. Goal: 600.0.

Support – 731.75. Resistance – 815.75.

Natural Gas. CME Group

Growth scenario: we are considering March futures, expiration date is February 27. If it weren’t for Friday’s long red candle, I could have bought. Not on the market yet.

Fall scenario: we will continue to hold shorts, a new low is possible.

Natural gas recommendations:

Purchase: no.

Sale: no. Who is in position from now (2.570), move the stop to 2.700. Goal: 2,000.

Support – 2.181. Resistance – 2.794.

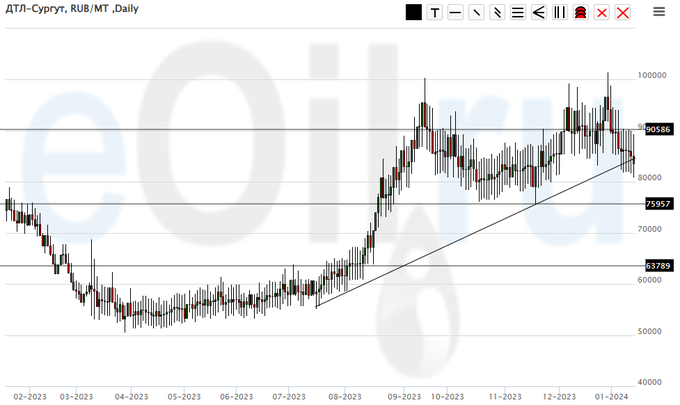

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to remain outside the market. Prices are too high for interesting purchases.

Fall scenario: we will continue to hold shorts. There may be some reduction in case of a move below 80,000.

Recommendations for the diesel market:

Purchase: no.

Sale: no. If you are in a position from 90300, move your stop to 93000. Target: 65000.

Support – 75957. Resistance – 90586.

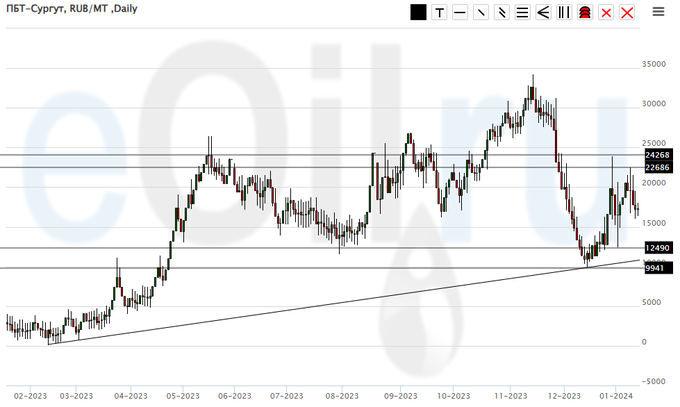

Propane butane (Surgut), ETP eOil.ru

Growth scenario: buying from current levels is not interesting. Off the market.

The fall scenario: shorts from 23,000 is interesting. Those who have already entered, hold on.

Recommendations for the PBT market:

Purchase: no.

Sale: when approaching 23000. Stop: 26000. Target: 15000. Anyone in a position from 22500, keep the stop at 26000. Target: 15000, you can close 50% of the position.

Support – 12490. Resistance – 22686.

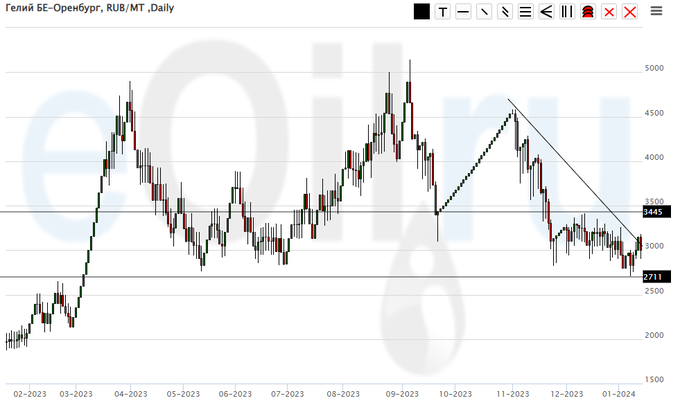

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. We continue to hope that the market will not go below 2700.

Fall scenario: we remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2711. Resistance – 3445.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that these are data from three days ago (for Tuesday of last week), they are also the most the latest ones published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 15.1 thousand contracts. Sellers entered the market, buyers retreated in small volumes. The bears have tightened their control.

Growth scenario: we are considering March futures, expiration date is March 14. We touched 580.0 and entered a buy position. We will remain long in anticipation of a market recovery.

Fall scenario: tried to go below 570.0. If they couldn’t, there is a possibility that the sellers were exhausted. Off the market.

Recommendations for the wheat market:

Purchase: no. For those in position from 580.0, keep your stop at 560.0. Goal: 700.0.

Sale: no.

Support – 579.5. Resistance – 602.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 34.4 thousand contracts. The sharp influx of sellers and the retreat of buyers continues. The Bears strengthened their advantage.

Growth scenario: we are considering March futures, expiration date is March 14. We are waiting for prices to arrive in the area of 420.0. We’ll buy there.

Fall scenario: the probability of a move to 420.0 remains high. We keep short.

Recommendations for the corn market:

Purchase: when approaching 420.0. Stop: 407.0. Goal: 600.0.

Sale: no. Anyone in position from 470.0, move the stop to 463.0. Target: 422.0.

Support – 421.0. Resistance – 452.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering March futures, expiration date is March 14. We continue to refrain from shopping. There will be a lot of soy again.

Fall scenario: we will continue to hold shorts. Lower levels are also possible. If it falls below 1190, you can increase your position.

Recommendations for the soybean market:

Purchase: not yet.

Sale: when approaching 1280. Stop: 1284. Target: 1000.0?! If you are in a position from 1295.0, move your stop to 1284.0. Goal: 1000.0?!

Support – 1201.7. Resistance – 1234.1.

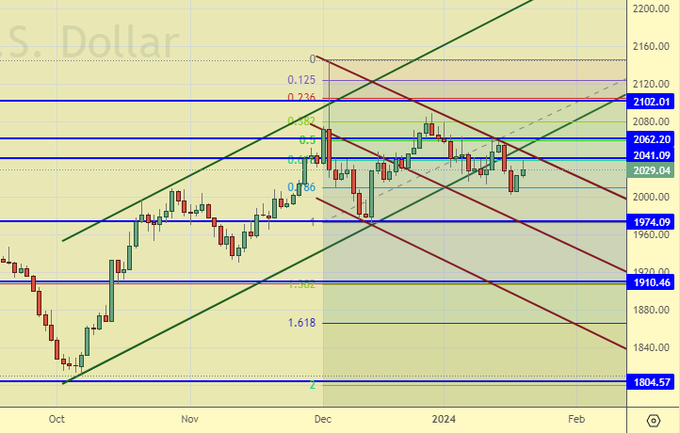

Gold. CME Group

Growth scenario: we continue to refrain from purchases. A move to 1910 remains highly probable.

Fall scenario: a high rate in the US, and most importantly, a high probability of maintaining it on January 31, supports the dollar.

Recommendations for the gold market:

Purchase: no.

Sale: no. Those who are selling from 2090, move the stop to 2067. Target: 1910 (1810).

Support – 1974. Resistance – 2041.

EUR/USD

Growth scenario: still uncomfortable to buy. But from 1.0720 would be just right.

Fall scenario: keep short. There is a prospect of a move to 1.0720.

Recommendations for the euro/dollar pair:

Purchase: when approaching 1.0720. Stop: 1.0620. Target: 1.2000.

Sale: no. If you are in a position from 1.1050, move your stop to 1.1060. Target: 1.0720 (1.0000?!).

Support – 1.0821. Resistance – 1.0955.

USD/RUB

Growth scenario: the bulls tried to move up, but failed. Off the market.

Fall scenario: a long shadow knocked us out of short. Let’s try to go short again.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: when approaching 91.00. Stop: 92.00. Goal: 75.00?!!! Or in case of a fall below 86.90. Stop: 88.60. Goal: 75.00?!!! Consider the risks!

Support – 87.41. Resistance – 92.78.

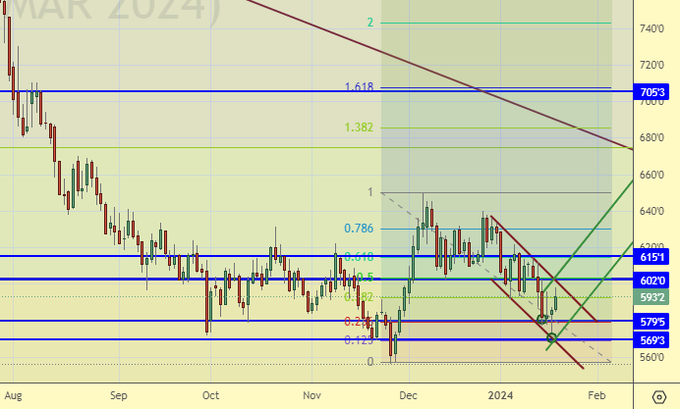

RTSI

Growth scenario: we are considering March futures, expiration date is March 21. The growth has stopped, but we continue to remain in a growing channel. Growth to 125,000 is possible. This is where you need to look for shopping opportunities. Good dividends from Russian companies support the market.

Fall scenario: we will reach 117,000. From this level it will be possible to sell.

Recommendations for the RTS Index:

Purchase: when approaching 112000. Stop: 111000. Target: 124750.

Sale: when approaching 117000. Stop: 118600. Target: 107000?!

Support – 111230. Resistance – 116890.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.