|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-25-to-29-december-2023/309703/

|

Energy market:

China has virtually banned the export of rare earth metals. No one else will receive precious raw materials: germanium, lithium, samarium, cobalt and further on the list. If you want to produce something, give us technology and the Celestial Empire will do it for you from its raw materials and in its factories. The problem for the West is that there are no alternative deposits of rare earth metals on the ball.

And in the West it’s Christmas, but here we have New Year soon, and then Christmas. Even holidays are celebrated incorrectly. And China imposed an embargo on the export of rare earth metals for this, and did everything right. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Tensions continue to rise in the Red Sea. The parties are pulling up to the Yemeni coast, whoever has what. Some are ships from the sea side, some are anti-ship systems from the land side, and some are just big firecrackers, so as to create an effect. The oil market, which was generally ready to collapse earlier, now has a new horror story in the form of logistical problems. Note that if Brent consolidates above 80.00 for several days, this may lead to an attempt to break through to 90.00.

On the other hand, on the part of the bears, we have a mutiny on the ship: Angola decided to leave OPEC being dissatisfied with the quotas that were determined for it by its “senior comrades”. If a chain reaction follows, a number of small and medium-sized players may begin to assert their rights. Then KSA, the UAE and Russia will have to cut their spoils, and simply persuade the rest. As if the ardent southerners would not have a new round of confrontation with each other. Moscow absolutely does not need a new round of sharp increases in production in order to damage its competitor. Then we will see both 40 dollars and 20.

Let us note that, unwittingly, the United States is now in the same boat with Russia. Firstly, their production is the highest, and secondly, it increased to 13.3 million barrels per day precisely due to the good oil price of around $80.00 per barrel. This is the price that suits everyone.

By reading our forecasts, you could take a move down the Gasoil tool from $850.00 to $780.00 per ton.

Grain market:

My soul somehow became calmer from the fact that eggs were coming to us from Azerbaijan and Turkey. That is, only the Ottoman Empire has eggs. So be it, maybe we will restore our potential in a few months.

The gross corn harvest in the EU in the 23/24 season will be 61.4 million tons, which is 15.6% higher than last year’s harvest, which was affected by drought. Soft wheat production will amount to 125.7 million tons. Soft wheat export forecast: 31.0 million tons. We see that Europeans can create competition for Russia in the foreign market. They added the same volume: 31 million tons last year.

Grain exports from Russia in December will amount to 3.9 million tons due to bad weather in the Black Sea. However, on average, exports will remain at the level of 4.5 million tons, since we only have 65 million tons of wheat ready for export at the end of the 23rd year. And it must be sold.

USD/RUB:

The pair is still above 90.00, which indicates a mild scenario for the development of events if we look at the month of March. It is impossible to deny attempts to reach 80.00 in the spring, but this requires expensive oil and the absence of strong negativity. If we can get above 93.52 before the New Year, then already in the first days of trading in ’24 we will be aiming for a move to 97.00. Otherwise, sellers will try to break below 90.00.

Note that the resumption of currency purchases in accordance with the budget rule, after the start of the CBO, this practice was stopped, can provide support to the dollar, which will not allow the ruble to go below 80.00.

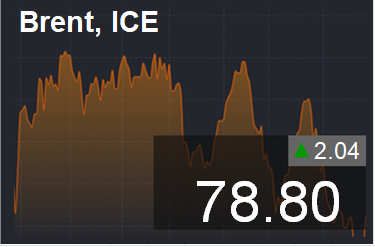

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 67.1 thousand contracts. The difference is significant. Long rates rose sharply. The bulls strengthened their advantage.

Growth scenario: we are considering January futures, expiration date is January 31. The current shopping area is inconvenient. Off the market.

Fall scenario: shorts from current levels and from 81.00 are possible. A fall to 65.00 remains the main idea.

Recommendations for the Brent oil market:

Purchase: think when approaching 65.00.

Sale: now. Stop: 80.80. Goal: 65.00.

Support – 72.53. Resistance – 80.54.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 3 units and amounts to 498 units.

Commercial oil reserves in the United States increased by 2.909 to 443.682 million barrels, with a forecast of -2.283 million barrels. Gasoline inventories increased by 2.71 to 226.723 million barrels. Distillate inventories increased by 1.485 to 115.024 million barrels. Inventories at the Cushing storage facility rose by 1.686 to 32.465 million barrels.

Oil production increased by 0.2 to 13.3 million barrels per day. Oil imports increased by 0.233 to 6.75 million barrels per day. Oil exports increased by 0.35 to 4.121 million barrels per day. Thus, net oil imports fell by -0.117 to 2.629 million barrels per day. Oil refining increased by 2.2 to 92.4 percent.

Gasoline demand fell by -0.105 to 8.754 million barrels per day. Gasoline production increased by 0.496 to 10.038 million barrels per day. Gasoline imports fell by -0.178 to 0.537 million barrels per day. Gasoline exports increased by 0.062 to 1.193 million barrels per day.

Demand for distillates increased by 0.053 to 3.823 million barrels. Distillate production fell by -0.114 to 4.873 million barrels. Imports of distillates increased by 0.02 to 0.225 million barrels. Exports of distillates fell by -0.145 to 1.063 million barrels per day.

Demand for petroleum products fell by -0.294 to 20.785 million barrels. Production of petroleum products increased by 0.446 to 23.009 million barrels. Imports of petroleum products fell by -0.129 to 1.847 million barrels. Exports of petroleum products fell by -0.273 to 6.28 million barrels per day.

Propane demand increased by 0.031 to 1.231 million barrels. Propane production fell by -0.024 to 2.608 million barrels. Propane imports fell -0.009 to 0.121 million barrels. Propane exports fell -0.029 to 0.071 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 41.4 thousand contracts. The number of sellers has dropped sharply. Buyers still retain control over the market.

Growth scenario: we are considering the February futures, expiration date is January 22. Shopping levels are inconvenient. We are not going long yet. From 61.50 a must buy.

Fall scenario: we will sell at current prices. The bulls are unconvinced even amid tensions in the Red Sea.

Recommendations for WTI oil:

Purchase: when approaching 61.50. Stop: 58.50. Goal: 120.00. Think after rising above 76.00.

Sale: now. Stop: 75.70. Target: 61.50.

Support – 67.87. Resistance – 75.46.

Gas-Oil. ICE

Growth scenario: switched to February futures, expiration date February 12. We refrain from entering long. A new “war” for market share may break out in OPEC.

Fall scenario: good levels to enter shorts. Let’s sell.

Recommendations for Gasoil:

Purchase: think when approaching 650.00.

Sale: now. Stop: 810.0. Goal: 650.0.

Support – 753.50. Resistance – 795.75.

Natural Gas. CME Group

Growth scenario: we are considering the February futures, expiration date is January 29. From 1.600 it makes sense to buy. The current upward rebound is interesting for smaller intervals.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: when approaching 1.600. Stop: 1.400. Goal: 3,000.

Sale: no.

Support – 2.189. Resistance – 3.038.

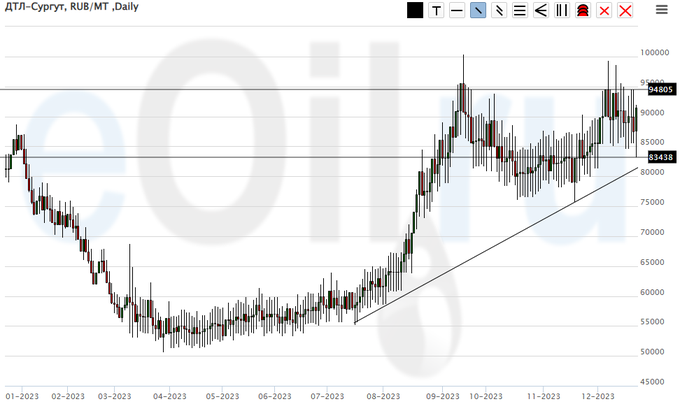

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to remain outside the market. Prices are too high for interesting purchases.

Fall scenario: can be sold. If we assume that one year is similar to another, then prices are at their maximum.

Recommendations for the diesel market:

Purchase: no.

Sale: now. Stop: 97000. Target: 65000.

Support – 83438. Resistance – 94805.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: difficult situation, we will continue to stay on the sidelines. Off the market.

Fall scenario: if we return to 25,000, then we can sell.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support – 10117. Resistance – 16357.

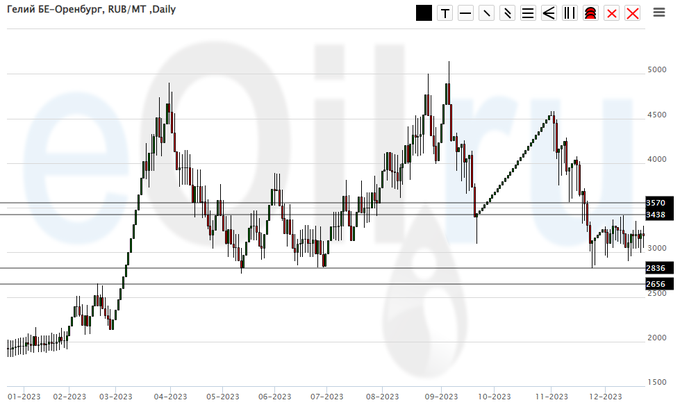

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. It is unlikely that the market will go below 2700 in the near future. We draw your attention to the stabilization of prices around 3000.

Fall scenario: we continue to remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2836. Resistance – 3438.

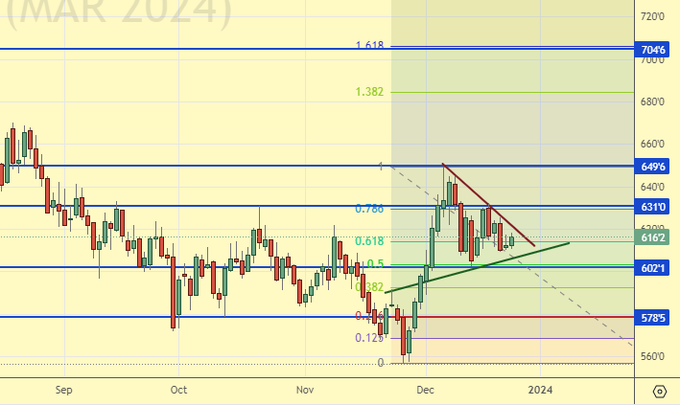

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 4.2 thousand contracts. Sellers continue to flee, but now buyers have also begun to flee. Bears risk losing control of the market.

Growth scenario: we are considering March futures, expiration date is March 14. There were no big changes over the week. We still need a rollback to 580.0. If it is not there, you will have to buy at 645.0, which cannot be called a good idea.

Fall scenario: a move to 580.0 is possible, but it is more convenient to work it out at hourly intervals.

Recommendations for the wheat market:

Purchase: on a rollback to 580.0. Stop: 566.0. Goal: 700.0. Think in case of growth above 645.0.

Sale: no.

Support – 602.1. Resistance – 631.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 32.7 thousand contracts. Sellers actively entered the market. The bears continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. Last week’s purchases did not bring us any profit. Off the market.

Fall scenario: the bulls took it and broke. Can be sold. We haven’t been this deep in a long time. If there is a fall, we will reach 425.0.

Recommendations for the corn market:

Purchase: no.

Sale: now. Stop: 485.0. Target: 425.0. Consider the risks!

Support – 425.0. Resistance – 477.5.

Soybeans No. 1. CME Group

Growth scenario: we are considering March futures, expiration date is March 14. There is no point in buying yet. Off the market.

Fall scenario: went below 1300, accordingly, you should have been sucked into selling. In case of growth to 1335, you can add to shorts.

Recommendations for the soybean market:

Purchase: not yet.

Sale: no. Who is in position from 1300, move the stop to 1314. Target: 1000.0?!

Support – 1281.2. Resistance – 1342.0.

Gold. CME Group

Growth scenario: we do not deny the rise to 2100, but it will be extremely difficult to go higher. We are not buying yet. A rise above 2120 will attract bulls to the market.

Fall scenario: when approaching 2100, you can sell. The current situation is also of interest for entering shorts.

Recommendations for the gold market:

Purchase: not yet.

Sale: now. Stop: 2080. Goal: 1800?! When approaching 2100. Stop: 2130. Goal: 1800?! Consider the risks!

Support – 2009. Resistance – 2075.

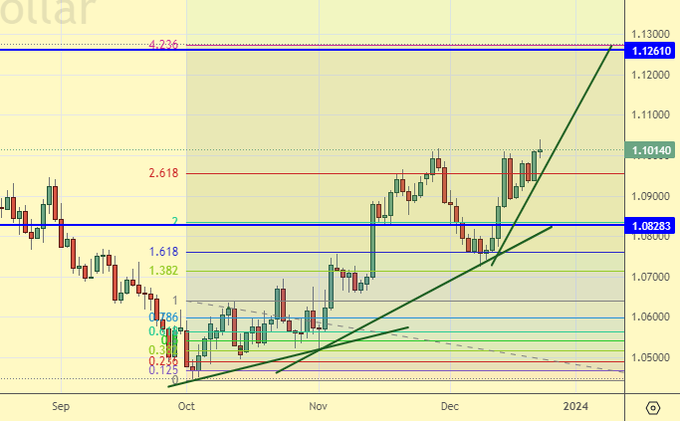

EUR/USD

Growth scenario: the pair did not give us a correction to 1.0820 and went straight up. So be it. We continue to hold long.

Fall scenario: we continue to refuse sales. Off the market.

Recommendations for the euro/dollar pair:

Purchase: no. If you are in a position from 1.0750, move your stop to 1.0790. Target: 1.1250 (1.2000).

Sale: no.

Support – 1.0828. Resistance – 1.1261.

USD/RUB

Growth scenario: we will continue to hold long. Our targets at the top are at 102.70. Note that a possible move above 102.70 will cause a new wave of demand for the dollar.

Fall scenario: nothing has changed for ruble fans. Shorting from 97.00 is not a bad idea, but it must be supported by expensive, or at least rising oil prices. Not on the market yet.

Recommendations for the dollar/ruble pair:

Purchase: no. If you are in a position from 90.50, move your stop to 90.40. Goal: 102.70 (120.00; 200.00; 1000.00).

Sale: no.

Support – 91.57. Resistance – 93.52.

RTSI

Growth scenario: we are considering March futures, expiration date is March 21. We continue to hold the long position from 105,000. At the same time, we understand that the risks for the market to continue to fall are high.

Fall scenario: we are short from 114,000. Yes, the idea of a New Year’s rally this year did not settle in the heads of traders. If we go below 107,000, we can increase our shorts.

Recommendations for the RTS Index:

Purchase: no. Who is in a position from 105000, move the stop to 107000. Target: 125000?!

Sale: no. Who is in a position from 114000, keep a stop at 112000. Target: 50000?! Support – 107600. Resistance – 111070.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.