|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-11-to-15-december-2023/308613/

|

Energy market:

Venezuela has looked into its neighboring state. With weapons, of course. It seems like there aren’t many people there yet, in the jungle. What to do, the people voted, the lands must be annexed. Maduro cannot ignore the results of the referendum. Yes, there are very large oil deposits there in distant Guyana. Venezuela is number one in terms of reserves, and there will be even more. But it seems like negotiations are still possible…

Now you don’t know whether to dig in the garden or not. Suddenly there is also oil. So this is not good these days.

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

So, the Kremlin paid attention to the Arabian Peninsula and did not forget about Tehran. Everyone is rocking. They pump a lot. We give a long look, for three whole months, and even a little further: white war camels will remain chewing thorns until mid-spring. And after… and after that the topic of market share will come up. But for now, oil will continue to fall heavily. Although the 65.00 mark for Brent is starting to sparkle somewhat badly.

Why can we end up at 65.00? But because in China everyone is again reinfecting each other with the old and new infection, and will go into quarantine right from January 1st. And what?! They liked it from last time. The main thing is not to stop breweries. If nothing like this happens, then we can creep up from current levels.

The consistently high production in the United States is noteworthy. They don’t even drill up to 800 installations; 500 are enough for them. Apparently, the story of sanctions against Russia forced them to become more active. Now we see real US production opportunities. It is possible that they can add another 1 million barrels per day, provided that the price is around 80.00.

Russia will have to think something about tankers, and quickly. Unfortunately, there are no guarantees that new ships will be allowed through. What if the boat is not the right color? On Tuesdays we only allow yellow ones to pass through Danish waters, and this can happen. Or you’ll have to paint everything rainbow…

Grain market:

The USDA report is out. We see that an increase in the gross harvest was recorded for both wheat (+0.13%) and corn (+0.1%). The remains from the fields have been collected. And all the ears of corn are counted.

Comrade Xi didn’t just go to the US, he quite shows his full disposition: China’s wheat imports in 2023/24 (July/June) are forecast in December at 0.5 million tons to 12.5 million, driven by recent large purchasing in the USA. Although imports are still slightly lower than the previous year, China strengthened its position as the world’s largest importer for the second year in a row. And sources of supply are diversifying. This means whether they will pray for us in Beijing. China’s buying pushed the Chicago stock up 100 cents a bushel to 650 cents a bushel in a short period of time.

But Egypt took it well from us: 420 thousand tons at a price of $265 per ton, excluding freight, with delivery in January. And a week ago, Cairo took another 120 thousand tons at 255, which makes our export background very workable.

Argentine wheat prices have fallen significantly from $300/t since harvest began as volumes were better than expected and are now below $250/t FOB. Russian quotations, on the contrary, recovered to 265, after falling to 230 dollars per ton in October.

USD/RUB:

Over the course of a week, the ruble lost all its courage. We are almost at 94.00, completing a bullish spurt from 88.00 in 13 trading days.

In the middle of the week, on the 13th, we have the US Federal Reserve, where they will most likely leave the rate at 5.5%, and on Friday we have the Central Bank of the Russian Federation. Elvira Sakhipzadovna, in the heat of the fight against inflation, can drive the rate to 17%. Whether it will be or not, we’ll see. Screams of a similar nature were heard online. A move to 96.50 cannot be ruled out, but a stronger growth of the dollar against the ruble is possible only if oil prices continue to slide down.

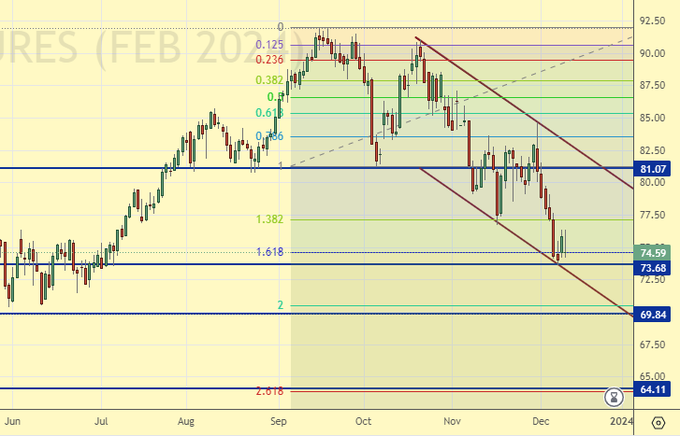

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers has decreased by 26 thousand contracts. The number of sellers increased significantly, buyers fled in small quantities. The bulls continue to control the situation.

Growth scenario: we are considering December futures, expiration date is December 29. Not bad levels to enter long. In case of failure by 65.00 also buy.

Fall scenario: we won’t short. A further drop would be a surprise given the OPEC cuts.

Recommendations for the Brent oil market:

Purchase: Now. Stop: 73.00. Goal: 150.00.

Sale: no.

Support – 73.68. Resistance – 81.07.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and amounts to 503 units.

Commercial oil reserves in the United States fell by -4.633 to 445.031 million barrels, with the forecast of -1.354 million barrels. Gasoline inventories increased by 5.42 to 223.604 million barrels. Distillate inventories increased by 1.267 to 112.045 million barrels. Inventories at the Cushing storage facility rose by 1.829 to 29.551 million barrels.

Oil production fell by -0.1 to 13.1 million barrels per day. Oil imports increased by 1.675 to 7.508 million barrels per day. Oil exports fell by -0.416 to 4.339 million barrels per day. Thus, net oil imports increased by 2.091 to 3.169 million barrels per day. Oil refining increased by 0.7 to 90.5 percent.

Demand for gasoline increased by 0.26 to 8.466 million barrels per day. Gasoline production increased by 0.18 to 9.517 million barrels per day. Gasoline imports increased by 0.226 to 0.689 million barrels per day. Gasoline exports fell by -0.227 to 0.948 million barrels per day.

Demand for distillates increased by 0.742 to 3.756 million barrels. Distillate production increased by 0.072 to 5.07 million barrels. Imports of distillates fell by -0.013 to 0.082 million barrels. Exports of distillates fell by -0.119 to 1.215 million barrels per day.

Demand for petroleum products increased by 0.694 to 19.611 million barrels. Production of petroleum products increased by 0.555 to 22.185 million barrels. Imports of petroleum products increased by 0.708 to 1.89 million barrels. Exports of petroleum products fell by -0.107 to 6.603 million barrels per day.

Propane demand fell by -0.217 to 0.998 million barrels. Propane production fell by -0.012 to 2.633 million barrels. Propane imports increased by 0.03 to 0.118 million barrels. Propane exports fell -0.083 to 0.057 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 15.5 thousand contracts. Sellers are advancing, buyers are retreating in small quantities. The bulls continue to control the situation; control may be lost in the coming weeks.

Growth scenario: we are considering January futures, expiration date is December 19. Let’s return to the discussion about longs after the rise above 75.00. From 61.50 a must buy.

Fall scenario: there is nothing interesting below. Off the market.

Recommendations for WTI oil:

Purchase: when approaching 61.50. Stop: 58.50. Goal: 120.00. Think after rising above 75.00.

Sale: no.

Support – 68.83. Resistance – 72.46.

Gas-Oil. ICE

Growth scenario: we are considering January futures, expiration date is January 11. The idea is the same: we’ll take it when we approach 700.00, if the market gives such an opportunity. We do nothing at current prices.

Fall scenario: a 700.0 impact cannot be ruled out. We are counting on him.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: no. Those who sold from 850.00, move the stop to 780.00. Goal: 700.00.

Support – 692.75. Resistance – 763.50.

Natural Gas. CME Group

Growth scenario: we are considering January futures, expiration date is December 27. The market is absolutely not interesting for speculation. Off the market.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 2.101. Resistance – 3.464.

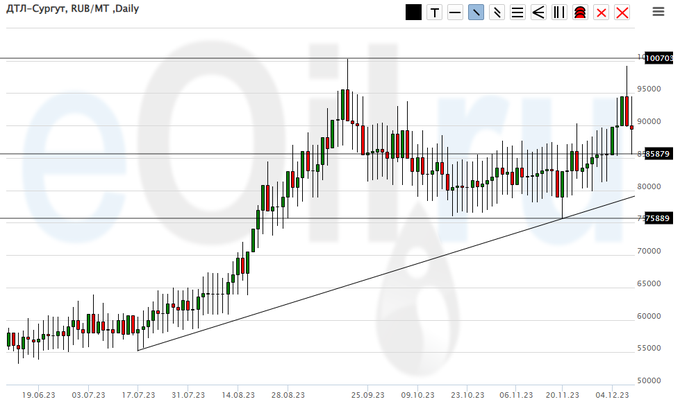

Diesel arctic fuel, ETP eOil.ru

Growth scenario: 100,000 outlier was a surprise. Off the market.

Fall scenario: a nasty upward blow knocked us out of position. Now we are taking a break for a week.

Recommendations for the diesel market:

Purchase: no.

Sale: no.

Support – 85879. Resistance – 100705.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: this is a very strong unidirectional decline. While there are no signs of an upward reversal, we remain outside the market.

Fall scenario: during the fall we didn’t take as much as we could, oh, this is the market, it’s always like that here. Either he entered in the wrong place… Then he entered there, but did not stand for long…

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support – 1436. Resistance – 16270

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. It is unlikely that the market will go below 2700 in the near future.

Fall scenario: we continue to remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2828. Resistance – 3373.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 15.5 thousand contracts. The sellers fled. Buyers were reluctant to enter the market. The bears continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. We need a rollback to at least 580.0 (at least 600.0) in order to enter a long position. Current levels are too high.

Fall scenario: the harvest has already influenced the fall in prices. Now it’s more convenient to look only up.

Recommendations for the wheat market:

Purchase: on a rollback to 580.0. Stop: 566.0. Goal: 700.0.

Sale: no.

Support – 611.3. Resistance – 649.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 55.2 thousand contracts. The sellers fled. Buyers entered the market in the same volumes. The bears continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. Under the current circumstances, it will be interesting to buy from 479.0.

Fall scenario: the market gave us nothing. We no longer go short during the day.

Recommendations for the corn market:

Purchase: when touching 479.0. Stop: 468.0. Goal: 600.0.

Sale: no.

Support – 482.3. Resistance – 492.1.

Soybeans No. 1. CME Group

Growth scenario: we are considering January futures, expiration date is January 12. We don’t buy. A drop in gross receipts of 0.38% is nothing. Lots of soy.

Fall scenario: keep short from 1320. It is not yet clear how the bulls will regain control of the market.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Anyone in position from 1320, move the stop to 1333. Target: 1212.

Support – 1285.0. Resistance – 1330.6.

Gold. CME Group

Growth scenario: the outlier of last week with the breakdown of stop orders of the “short traders” can lead to dire consequences. We could fall to 1920 on a spike pattern. We hold long.

Fall scenario: You can short here, but it is better to try to get yourself a higher quote, for example 2030.

Recommendations for the gold market:

Purchase: no. For those in position from 1840, move the stop to 1976. Target: 2400.

Sale: when approaching 2030. Stop: 2042. Goal: 1800?!

Support – 1984. Resistance – 2009.

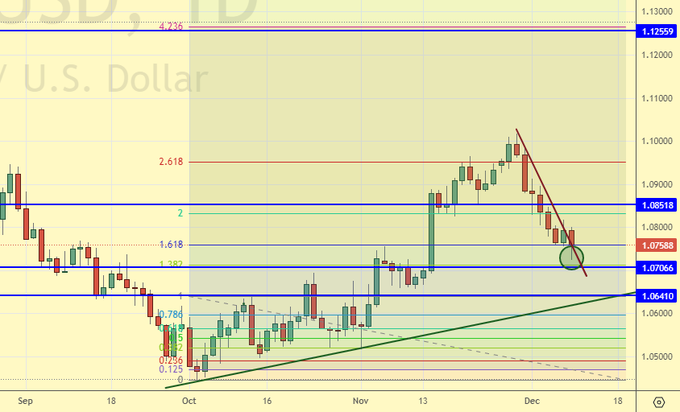

EUR/USD

Growth scenario: in the current area you can buy. Wednesday, the Fed meeting, will be decisive for several days.

Fall scenario: we will not sell. All advances have already been distributed to the dollar.

Recommendations for the euro/dollar pair:

Purchase: Now. Stop: 1.0570. Target: 1.1250 (1.2000).

Sale: no.

Support – 1.0706. Resistance – 1.0851.

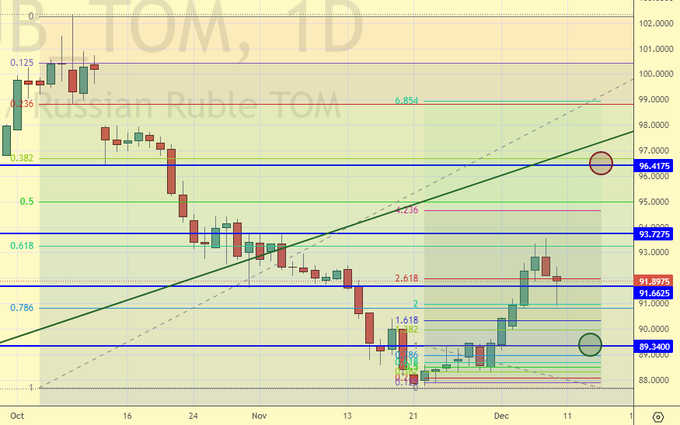

USD/RUB

Growth scenario: we will buy during a pullback to 89.50. In the meantime, we hold the existing long and tighten our stop orders according to the trend.

Fall scenario: we continue to believe that shorting from 96.50 is possible, provided that oil stops falling.

Recommendations for the dollar/ruble pair:

Purchase: no. Anyone in position from 88.00, move the stop to 90.80. Goal: 100.00 (120.00; 200.00; 1000.00).

Sale: when approaching 96.50. Stop: 97.50. Goal: 80.00. Look at the oil!

Support – 89.34. Resistance – 93.72.

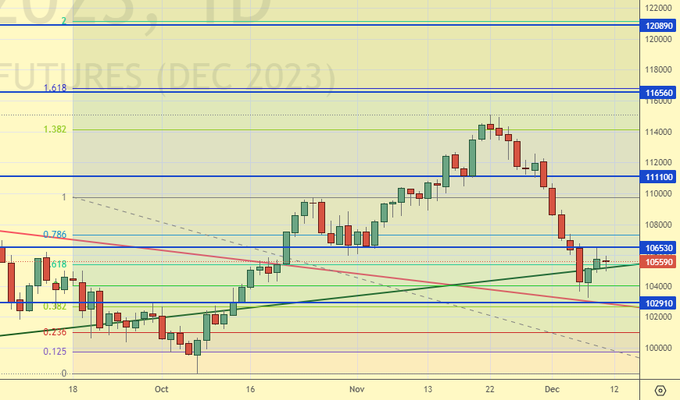

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. Well?! Will we grow for the New Year or not?!!! We visited 103,000, as we wrote earlier. You have to buy the technology.

Fall scenario: we are short at 115,000. Somehow the ruble depreciated against expectations. This means there is the prospect of a deeper dive. A fight at 103,000 is possible, but it may be lost by the bulls.

Recommendations for the RTS Index:

Purchase: now and when you touch 101000. Stop: 99000. Target: 125000. Consider the risks!!!

Sale: no. Who is in a position from 115000, move the stop to 112000. Target: 50000?!

Support – 102910. Resistance – 106530.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.