|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-4-to-8-of-september-2023/301289/

|

Energy market:

The G20 is losing its lustre. The leaders of Russia and China will not come to the summit in India on September 9th, which suggests that neither one nor the other is in a hurry to deal with adherents of their own exceptionalism. Western heads of state, of those who still think something, will be unpleasant to feel that they have been honored with their respect and attention of a person on a level below.

I feel sorry for Sergei Viktorovich. Now dancing at one airport, now dancing again at another. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The oil market did not wait for the numbers, it was enough for him to hear from the lips of Novak the message that Russia and Saudi Arabia agreed on a new voluntary reduction in oil production as early as October. The bulls have taken control of the market and now there is a risk of further growth in quotes. Not only numbers are important here, but also the commitment of the two countries to continue cooperation in regulating the market. With the rise in energy prices, the rise in inflation in the West is beyond doubt.

In August, Russian Urals oil was sold at $74, which is the same as last year. The West cannot put pressure on Russia now. This will only lead to an even greater rise in oil prices. I had to shut up and watch the ever-increasing demand. This may continue until the end of this year, after which a decline in demand for oil will follow against the backdrop of, for example, not very encouraging data on GDP growth from the US and China.

Grain market:

A senior tomato, aka Recep Erdogan, will come to us. Yeah. 4th. They will give him 1 million tons of grain, let him thresh for very poor countries without any grain deal. Maybe they will give something else, but I would like to see some kind of consistency in the actions of the Turkish leader. The choice of one chair out of two was clearly delayed.

Harvesting continues in Russia. 105 million tons of grain have been harvested. The yield of wheat is 40 centners per hectare, against 44 last year. Already threshed 61 million tons of wheat, while there is a drop in quality in the Central regions: the 5th grade is harvested from 20 to 30% of the total, depending on the region. In the south, the quality is all right. 3rd and 4th grade dominate. 5th grade is only 10%.

We see that the new crop beats prices. This is likely the last week the market will make, or try to make, new lows in wheat and corn, followed by a limited rally of around 15% over the next two months as volumes are collected. There will be no shortage of grain.

USD/RUB:

The Central Bank of the Russian Federation will again raise the rate in September. The only question is how much. Nabiullina continues to quarrel with Siluanov, which does not add optimism. The ruble has fallen in price by 50% over the year, which dooms the economy to import inflation, and it will affect almost all sectors within the country. It is worth mentioning separately the rise in gasoline prices, AI-95 on the basis of Surgut went up by 50% in four months to 75,000 rubles per ton. This growth will also lead to inflation in all commodity groups.

The ruble weakened slightly for two weeks after a rapid appreciation in August. The current picture does not deny the possibility of further strengthening of the national currency. Note that oil continues to rise in price, which should help the ruble. On this day and hour, the pair’s decline to 87.00 remains possible.

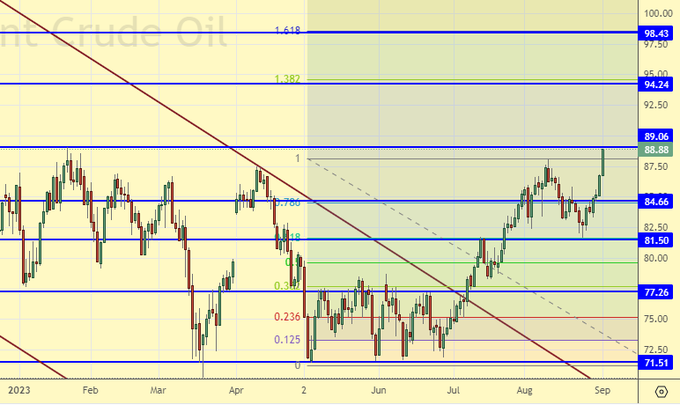

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers decreased by 20.8 thousand contracts. Sellers entered the market, buyers left in small volumes. The spread between long and short positions has narrowed, the bulls continue to control the situation.

Growth scenario: we are considering the September futures, the expiration date is September 29th. There are no interesting levels for purchases. Out of the market.

Fall scenario: while the market does not allow us to take profit on the fall. Out of the market.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no.

Support — 84.66. Resistance is 89.06 (94.24).

WTI. CME Group

Fundamental US data: the number of active drilling rigs has not changed and is 512 units.

US commercial oil inventories fell by -10.584 to 422.944 million barrels, while the forecast was -3.267 million barrels. Inventories of gasoline fell by -0.214 to 217.412 million barrels. Distillate inventories rose by 1.235 to 117.923 million barrels. Inventories at Cushing fell -1.504 to 29.165 million barrels.

Oil production has not changed and is 12.8 million barrels per day. Oil imports fell by -0.316 to 6.617 million barrels per day. Oil exports rose by 0.27 to 4.528 million barrels per day. Thus, net oil imports fell by -0.586 to 2.089 million barrels per day. Oil refining fell by -1.2 to 93.3 percent.

Gasoline demand rose by 0.158 to 9.068 million barrels per day. Gasoline production increased by 0.29 to 10.005 million barrels per day. Gasoline imports fell by -0.045 to 0.848 million barrels per day. Gasoline exports rose by 0.024 to 0.854 million barrels per day.

Demand for distillates fell by -0.134 to 3.702 million barrels. Distillate production fell -0.043 to 5.023 million barrels. Distillate imports rose by 0.075 to 0.163 million barrels. Exports of distillates rose by 0.017 to 0.136 million barrels per day.

Demand for petroleum products increased by 0.264 to 21.429 million barrels. Production of petroleum products increased by 0.885 to 23.974 million barrels. The import of oil products has not changed and is 0 remained at the level of 2.108 million barrels. Exports of petroleum products fell by -0.405 to 5.881 million barrels per day.

Propane demand fell by -0.335 to 0.639 million barrels. Propane production fell -0.069 to 2.539 million barrels. Propane imports rose by 0.037 to 0.101 million barrels. Propane exports fell -0.077 to 0.099 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 27.6 thousand contracts. Sellers left the market, buyers entered it in insignificant volumes. The advantage in the market remains with the bulls.

Growth scenario: we are considering the October futures, the expiration date is September 20. Buying at current levels does not make sense. Need a rollback. Out of the market.

Fall scenario: we will keep short from 85.50. The next level where you can try to take on the fall is 98.70.

Recommendations for WTI oil:

Purchase: no.

Sale: no. Who is in position from 85.50, move the stop to 86.40. Target: 73.00.

Support — 77.57. Resistance — 86.09.

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. There is no point in shopping. Out of the market.

Falling scenario: we will keep short from 890.0. We do not give too much space to the market. Stop order close.

Gasoil recommendations:

Purchase: no.

Sale: when approaching 1070.0. Stop: 1130.0. Target: 930.0. Who is in position from 890.0, move the stop to 945.0. Target: 760.0.

Support — 884.00. Resistance is 1073.75.

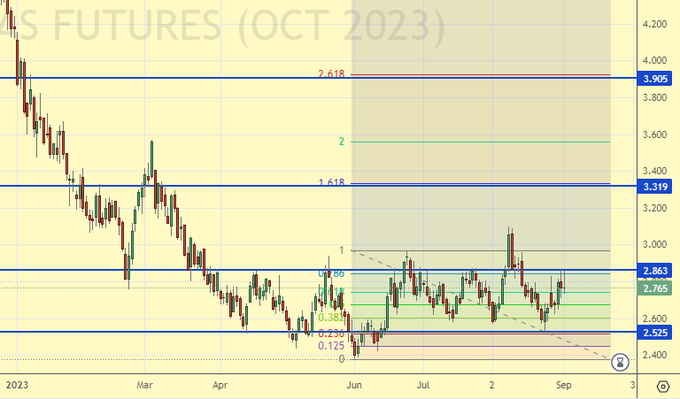

Natural Gas. CME Group

Growth scenario: consider the October futures, the expiration date is September 27th. We continue to hold long. Looking forward to growth. Despite the gas storages in Europe being 90% full, there is a sense of nervousness.

Fall scenario: do not sell, the levels are too low.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep the stop at 2.320. Target: 3.900.

Sale: no.

Support — 2.525. Resistance is 2.863.

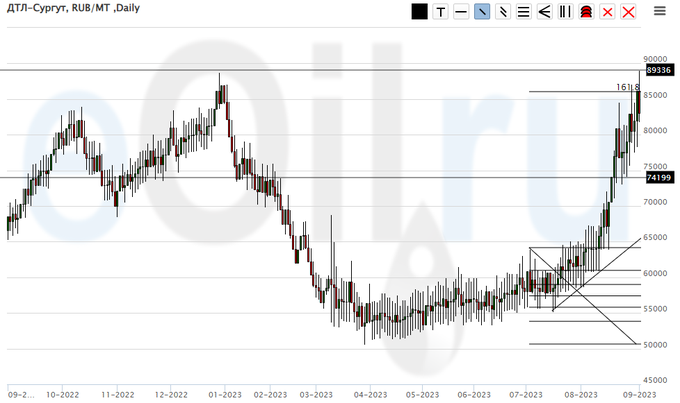

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we see a new maximum. We continue to keep long, gradually fixing profits as we grow.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, move the stop to 73000. Target: 100000 (revised). You can close another 20% of the position at current prices. Thus, 40% of the position should have already been closed.

Sale: no.

Support — 74199. Resistance — 89336.

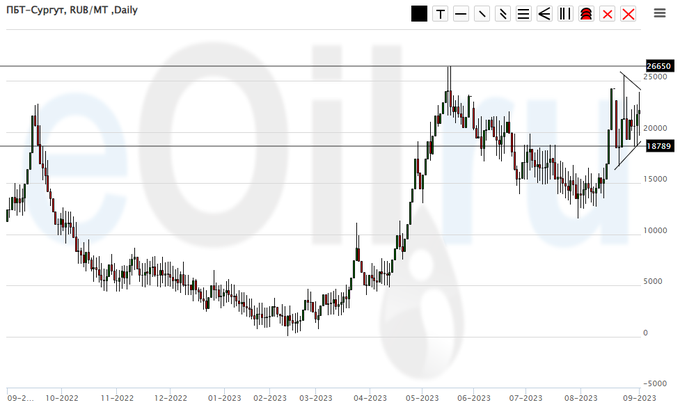

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we see consolidation. An upward exit is not ruled out. Let’s buy.

Fall scenario: we do not make sales, the mood in the energy market is bullish.

Recommendations for the PBT market:

Purchase: now. Stop: 18300. Target: 30000.

Sale: no.

Support — 18789. Resistance — 26650.

Helium (Orenburg), ETP eOil.ru

Growth scenario: the stop did not work. We keep long. We are counting on 6000.

Fall scenario: do not sell. Prices may continue to rise.

Recommendations for the helium market:

Purchase: no. Who is in position between 2900 and 3200, keep a stop at 3900. Target: 6000.

Sale: no.

Support — 4008. Resistance — 5023.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 3.8 thousand contracts. Sellers in small volumes continue to arrive. There are no new buyers yet. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: consider the December futures, the expiration date is December 14th. Just like last week, we are waiting. When approaching 570.0, it is a must to buy. You have to be mentally prepared to fight for longs in the near future.

Fall scenario: sales are not interesting. There is no speculative potential here.

Recommendations for the wheat market:

Purchase: when approaching 570.0. Stop: 560.0. Target: 700.0.

Sale: no.

Support — 571.2. Resistance is 615.0.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Last week the difference between long and short positions of managers decreased by 30.5 thousand contracts. Buyers have arrived. Sellers began to reduce pressure and leave the market. However, sellers continue to control the market.

Growth scenario: consider the December futures, the expiration date is December 14th. We don’t buy. We wait. However, when approaching 455.0, going long is mandatory.

Fall scenario: there is no point in selling. Out of the market.

Recommendations for the corn market:

Purchase: when approaching 455.0. Stop: 435.0. Target: 600.0.

Sale: no.

Support — 454.6. Resistance — 485.3.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: we will continue to fight for the shorts. There are many oilseeds. Current levels do not reflect the overall picture.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1406.0. Target: 1000.0?

Support — 1332.2. Resistance — 1390.3.

Growth scenario: An unpleasant candle appeared for the bulls on Friday. We keep long. We pull the stop order.

Fall scenario: sell from current levels. We have not left the falling channel upwards.

Recommendations for the gold market:

Purchase: no. Who is in position from 1910, move the stop to 1907. Target: 2400?!

Sale: now. Stop: 1957. Target: 1600?! Count the risks!

Support — 1925. Resistance — 1948.

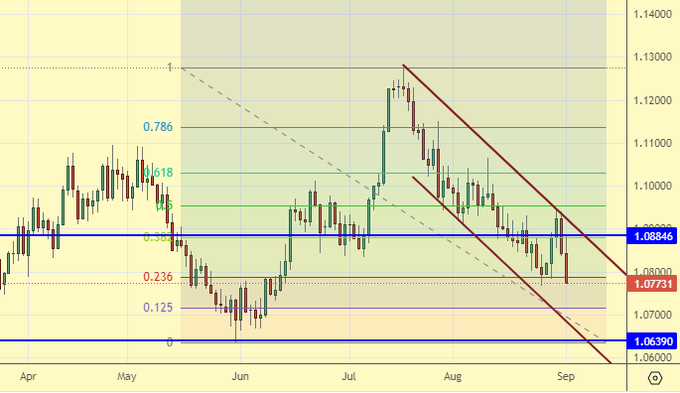

EUR/USD

Growth scenario: keep long from 1.0790. We expect a move to 1.1660. However! The chances of growth resuming are minimal. It just needs to be understood. But the position is not closed. We stand to the end.

Fall scenario: as a week earlier, there are no interesting levels for sales. We do not sell.

Recommendations for the EUR/USD pair:

Purchase: now. Stop: 1.0740. Target: 1.1660. Who is in position from 1.0790, move the stop to 1.0740. Target: 1.1660.

Sale: no.

Support — 1.0639. Resistance is 1.0884.

USD/RUB

Growth scenario: we will not buy at current levels. If the market allows, then from 87.30 it is obligatory to go long.

Fall scenario: shorts from 96.00 are possible.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 87.30. Stop: 84.80. Target: 114.00.

Sale: now. Stop: 97.00. Target: 87.30. Who is in position from 96.00, keep the stop at 97.00. Target: 87.30.

Support — 92.54. Resistance — 96.09.

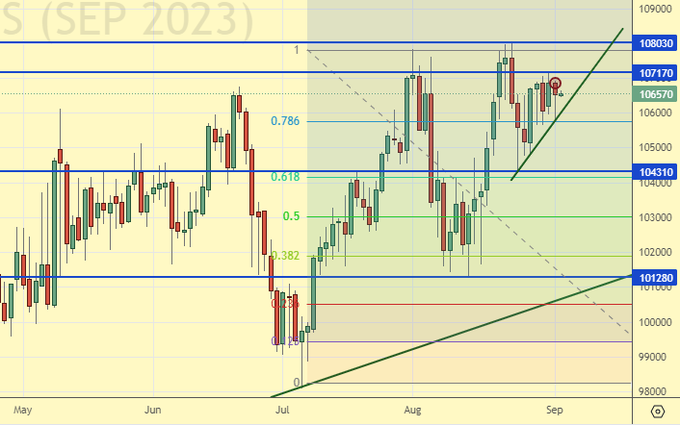

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. Continued growth is possible. We hold a long open last week.

Fall scenario: we will keep the shorts from 105800. The situation is very delicate.

Recommendations for the RTS index:

Purchase: no. Who is in position from 105200, keep stop at 104000. Target: 112000.

Sale: no. Who is in position from 105800, keep stop at 107200. Target: 90000.

Support — 104310. Resistance — 107170.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.