|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-21-to-25-of-august-2023/300193/

|

Energy market:

Apparently, the gas hub will be in Iran, the grain deal will go through Qatar, and the Turkish sultan will get a donut hole. And he will continue to behave badly, he will not see the nuclear power plant. The confrontation between Ankara and Moscow is getting much higher than the tomato level.

Let the degree rise, but we hope that it will not come to a drunken fight, as in some hotel in a Turkish resort. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

US oil production began to grow noticeably after oil settled above $80 per barrel. Production rose to 12.7 from 12.2 million barrels per day for the month. The Americans can increase the supply of oil to their own country not only from their own sources, but also using the reserves of Canada, and in the future, Venezuela. With such a turn, the significance of the KSA and the UAE for them will become less.

OPEC+ countries are still disciplined to reduce production, but Washington has begun to work more closely with Iran. Tehran has long stated that as a result of sanctions for two decades, the country has received less, let’s say, an incalculable amount of income, while the rest were earning. Therefore, they have the moral right to offer oil on the foreign market in the maximum amount available to them. It was not in vain that the Kremlin offered Iran a project with a gas hub, possibly also in order to prevent an additional 1 million barrels of Iranian oil from appearing on the market. In fact, it would be a good idea to link the gas agreement with the oil agreement in order to maintain control over the world oil market in the short term.

Reading our forecasts, you could take a move up the dollar / ruble pair from 86.00 to 98.90.

Grain market:

IGC forecasts total global grain production (wheat and coarse grains) to be the second highest on record, up 1% year-over-year to 2,294 million tonnes, with significant gains in maize and sorghum production of more than compensates for lower yields of wheat, barley, oats and rye.

The drought in Europe did not have a significant impact on the harvest, losses can be estimated at only 3 million tons, decreasing from 138 million tons to 135 million tons. Dryness came late. The plants are fully formed, a small part was lost during harvesting, but in general Europe will provide for itself and France will be ready to ship its standard 15 million tons for export. And this is good, otherwise the aggressive hordes in the West will become even more angry due to underfeeding.

Grain data is optimistic, which should not allow markets to show rapid growth in the near future. At the same time, we note that both wheat and corn retain chances to show even lower levels than those that were indicated last week over the next 10-12 trading days.

USD/RUB:

Remember the cartoon where the Wolf is chasing the Hare. When he is behind the levers on the combine, he pulls them back and forth, and rakes the chickens with a ladle instead of a hare. So… The wolf is the Central Bank, the levers are the interest rate, and the chickens are the enterprises that have kept economic activity.

By raising the rate by 3.5% at an emergency meeting, the Central Bank managed to stop the fall of the national currency. Most likely we will not see a strong rollback in the pair. It is possible in theory to allow touching the level of 80.00, but it is impossible to imagine that we will linger in this area at the moment. A visit to the 87.00 mark looks much more real, and this is where the whole strengthening will end.

If external negative conditions persist and there are no proposals for making money inside the country, the ruble will be prone to fall in the coming months. We can already talk about visiting the 115.00 mark by the end of the year.

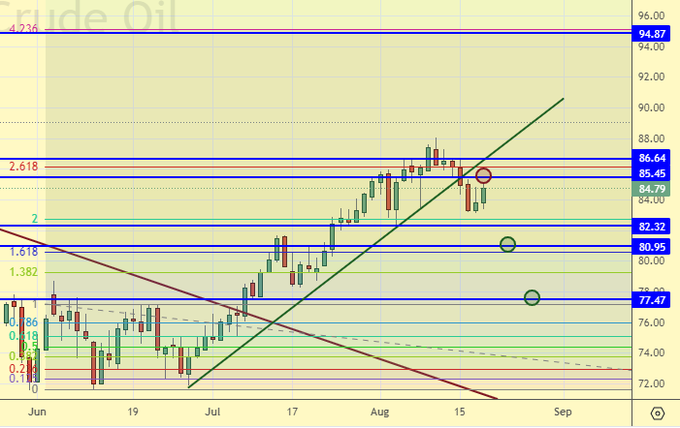

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 19.3 thousand contracts. Buyers entered the market, sellers remained indifferent to what was happening. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: consider the August futures, the expiration date is August 31. We continue to stay out of the market. Buying from 81.00 and 77.50 make sense.

Fall scenario: you can hold short from 84.96. One more price branch suggests itself down.

Recommendations for the Brent oil market:

Purchase: when approaching 81.00. Stop: 79.40. Target: 94.80.

Sale: no. Who is in position from 84.96, move the stop to 86.90. Target: 77.70.

Support — 82.32. Resistance is 85.45.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 5 units and now stands at 520 units.

Commercial oil reserves in the US fell by -5.96 to 439.662 million barrels, while the forecast was -2.32 million barrels. Inventories of gasoline fell by -0.262 to 216.158 million barrels. Distillate inventories rose by 0.296 to 115.743 million barrels. Inventories at Cushing fell -0.837 to 33.802 million barrels.

Oil production increased by 0.1 to 12.7 million barrels per day. Oil imports rose by 0.476 to 7.158 million barrels per day. Oil exports rose by 2.239 to 4.599 million barrels per day. Thus, net oil imports fell by -1.763 to 2.559 million barrels per day. Oil refining increased by 0.9 to 94.7 percent.

Gasoline demand fell by -0.451 to 8.851 million barrels per day. Gasoline production fell by -0.336 to 9.585 million barrels per day. Gasoline imports fell by -0.098 to 0.586 million barrels per day. Gasoline exports fell by -0.06 to 0.881 million bpd.

Demand for distillates fell by -0.114 to 3.648 million barrels. Distillate production fell -0.182 to 4.729 million barrels. Distillate imports rose by 0.064 to 0.129 million barrels. Distillate exports fell -0.019 to 0.177 million barrels per day.

Demand for oil products rose by 0.936 to 21.663 million barrels. Production of petroleum products increased by 0.401 to 23.179 million barrels. Imports of petroleum products fell by -0.268 to 1.533 million barrels. Exports of petroleum products fell by -0.555 to 5.856 million barrels per day.

Demand for propane rose by 0.441 to 1.244 million barrels. Propane production fell -0.033 to 2.654 million barrels. Propane imports fell -0.021 to 0.083 million barrels. Propane exports rose by 0.036 to 0.106 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers decreased by 31.5 thousand contracts. Buyers fled, sellers entered the market in approximately the same volumes. The advantage in the market remains with the bulls.

Growth scenario: we are considering the October futures, the expiration date is September 20. There is no point in buying at current levels. We remain out of the market.

Fall scenario: The position is not good for holding a short. Let’s close the market with almost no loss and take a break. In case of growth to 86.00 — sell.

Recommendations for WTI oil:

Purchase: not yet.

Sale: in case of growth to 86.00. Stop: 87.30. Target: 75.20.

Support — 78.51. Resistance — 85.89.

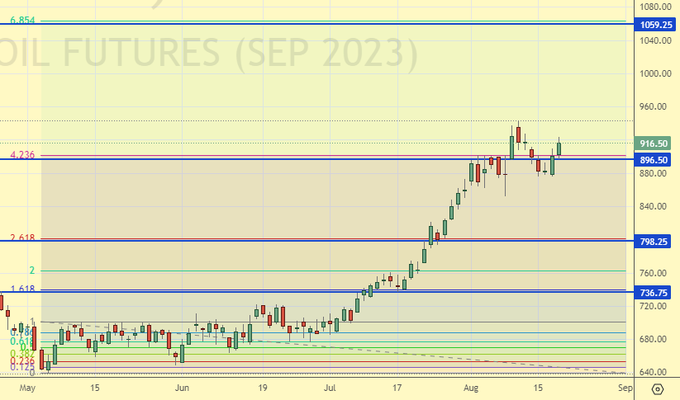

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. There is no point in shopping. Out of the market.

Fall scenario: short is possible after the close of the day below 900.0.

Gasoil recommendations:

Purchase: no.

Sell: if the day closes below 900.0. Stop: 923.0. Target: 742.0.

Support — 896.50. Resistance is 1059.25.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. Unpleasant rollback, but it must be sat out. We keep long.

Fall scenario: do not sell. It is clear that in Europe the storage facilities are almost full, but no one knows what the winter will be like.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep the stop at 2.320. Target: 3.900.

Sale: no.

Support — 2.476. Resistance is 2.759.

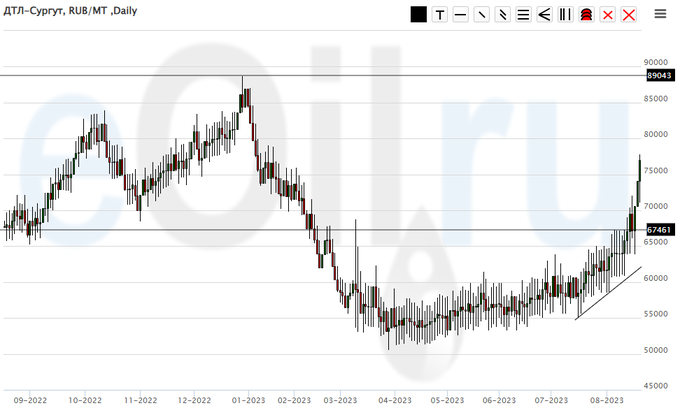

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we see an acceleration in price growth. We continue to hold long.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, move the stop to 59000. Target: 100000 (revised). You can close 10% of the position at current prices.

Sale: no.

Support — 67461. Resistance — 89043.

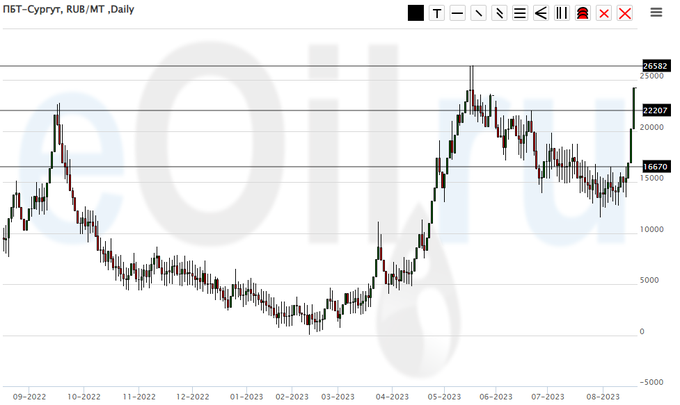

Propane butane (Surgut), ETP eOil.ru

Growth scenario: You should be buying from 16500. You should keep long. The energy market in Russia exploded… unfortunately really.

Fall scenario: we do not make sales.

Recommendations for the PBT market:

Purchase: no. Who is in position from 16500, move the stop to 16400. Target: 30000!

Sale: no.

Support — 22207. Resistance — 26582.

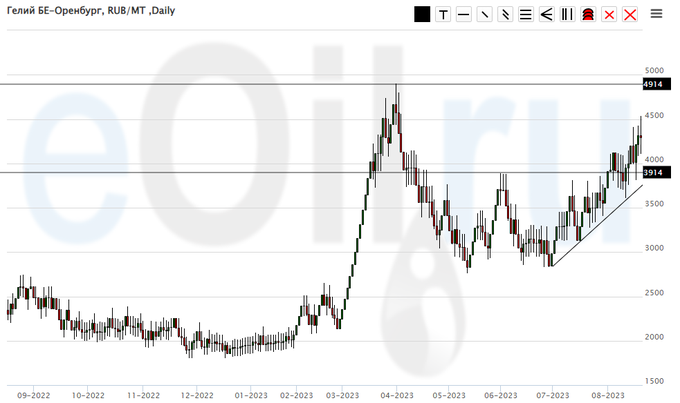

Helium (Orenburg), ETP eOil.ru

Growth scenario: New High. Market in a growing channel. We keep long.

Fall scenario: do not sell. It is difficult to talk now about any fall in prices.

Recommendations for the helium market:

Purchase: no. Those in positions between 2900 and 3200, move the stop to 3600. Target: 6000.

Sale: no.

Support — 3914. Resistance — 4914.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 12.3 thousand contracts. Vendors enter the market. Buyers back off. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: consider the December futures, the expiration date is December 14th. Controversial situation. I would like to continue to insist on purchases, but for now we will refrain from transactions.

Fall scenario: selling doesn’t make sense. Out of the market.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support — 609.0 Resistance — 641.3.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Last week the difference between long and short positions of managers increased by 53.6 thousand contracts. Vendors entered the market en masse. The buyers are running. Vendors have stepped up their dominance.

Growth scenario: consider the December futures, the expiration date is December 14th. Set a new low. Until we buy.

Fall scenario: we will not sell. Prices are low.

Recommendations for the corn market:

Purchase: not yet.

Sale: no.

Support — 484.4. Resistance — 507.4.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: they don’t let us earn anything on sales yet. We take a break for a week.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support — 1337.65. Resistance — 1391.3.

Growth scenario: the market is falling. We do not make purchases.

Fall scenario: we continue to go down. First stop 1859. However, there are no interesting sell levels. Out of the market.

Recommendations for the gold market:

Purchase: no.

Sale: no.

Support — 1859. Resistance — 1903.

EUR/USD

Growth scenario: Buying from 1.0790 would not be the worst attempt to go long. There are no other ideas yet.

Fall scenario: there are no interesting levels for sales. We do not sell.

Recommendations for the EUR/USD pair:

Purchase: when approaching 1.0790. Stop: 1.0700. Target: 1.2000?!!!

Sale: no.

Support — 1.0788. Resistance is 1.0916.

USD/RUB

Growth scenario: if the market allows, then it is mandatory to buy from 87.00. Higher levels, given the aggressive rate growth, are not interesting.

Fall scenario: we will not sell. Out of the market.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 87.00. Stop: 84.80. Target: 114.00.

Sale: no.

Support — 92.54. Resistance is 95.45.

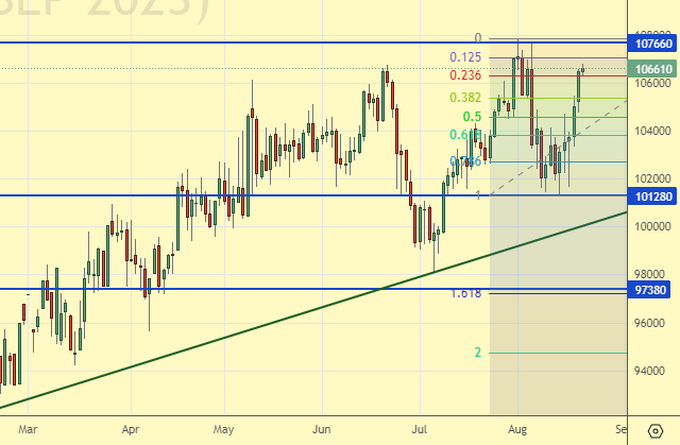

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. We were wrong, after all, the growth was against the background of the strengthening of the ruble. We don’t buy.

Fall scenario: if the day closes below 106000, you can sell.

Recommendations for the RTS index:

Purchase: no.

Sale: close of the day below 106000. Stop: 107000. Target: 90000 (50000; 20000?!!!).

Support — 101280. Resistance — 107660.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.