|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-7-to-11-of-august-2023/299082/

|

Energy market:

Do you know that there is a direct correlation between the price of cocoa in US dollars and the exchange rate of the Russian ruble against the US currency? Yes, chocolate will be expensive now. It is because of the fact that prices for orange juice are rising, which directly affects the mood of the bulls in the dollar against the currencies of developing countries. All traders are excited and pounding chocolate in the workplace, bringing themselves closer to type 2 diabetes. As you can see, rising prices for imported goods affect the national currency. The analyst finished the report.

We will continue to write clearly and understandably so that you can draw unambiguous conclusions.

Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Brent reached 86.00, which makes us say that we are growing too fast. Against the background of reduced deliveries to the foreign market from the Russian Federation and the KSA, the price increase is justified, but I would not like to see it so unidirectional. We are waiting for a rollback to 78.00. If the market fixes above 86.00, then 92.00 awaits us.

We are forced to state a fact: Russia was forced to change the route of oil supply by tankers through the Black Sea. Because of the threat of undermining, we have to move away from Ukrainian territory and go along the Turkish coast. This is not so much directly affecting supplies as it is unnerving, which also keeps oil prices high.

Quiet sniffling is heard from Washington about the fact that Russia has started selling oil at a minimum discount and no one refuses it. Sales levels are already above the sanctioned $60 per barrel and continue to rise. Having shown stubbornness in the conflict with Ukraine, Russia is forcing it to be reckoned with in trade matters as well.

Grain market:

The grain market is at low levels. Setting a new low for wheat before September 10 cannot be ruled out. If this happens, it is unlikely that prices will return above 750.0 for wheat and 600.0 for corn in the next 6 months. But, if a new low is not set, then the bulls have every chance to make grain expensive in the fall, as it was last season.

A strong dollar is sure to break economic growth. The yield inversion of 2-year and 10-year bonds appeared a year ago, after 4 months (16 months since the inversion) we can see a slowdown in GDP growth in the world, which will lead to a drop in consumer sentiment. The positive effect of the New Year sales will be minimal. Will it affect the grain? Yes. After the growth in the fall (if it takes place at all), we will roll back down in the winter. And if it doesn’t exist (look carefully at the previous paragraph), then we will walk in the corridor 550.0 — 650.0 for wheat and 400.0 — 550.0 for corn.

USD/RUB:

From the Russian classics, you can’t pick up quotes for what is happening … You need to look for something in the cartoon about the Simpsons. They seem to have all sorts of predictions. Ah, no. Remember in «The Diamond Arm»: «Chief, it’s all gone.» Here is something that is asking.

We are all being made poorer. I wanted to write “a little poorer”, but “a little” does not fit here, is not applied, and does not stick.

As long as the authorities allow companies to leave the currency abroad (I wonder where exactly), and not sell it on the stock exchange (and perhaps there is no longer a mechanism that could allow this, only through the yuan, apparently), the ruble has no chance against the dollar in situations where the demand for imported goods does not fall. And it will not fall even at a rate of 200 rubles per dollar. Here, at 1000 rubles per dollar, it will decrease somewhat. This is true. And the era of “Japanese two-cassette tape recorders” will come, who remembers, that is, the era of the Great Unsatisfied Consumer Demand.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 26.2 thousand contracts. Sellers leave the market. Buyers enter it in small volumes. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: consider the August futures, the expiration date is August 31. We remain out of the market. There are no good levels for shopping.

Fall scenario: it is necessary to sell. Yes, we can go to 92.00, but this mark still needs to be worked out for shorts.

Recommendations for the Brent oil market:

Purchase: no.

Sale: now. Stop: 86.90. Target: 78.30.

Support — 81.71. Resistance — 86.38.

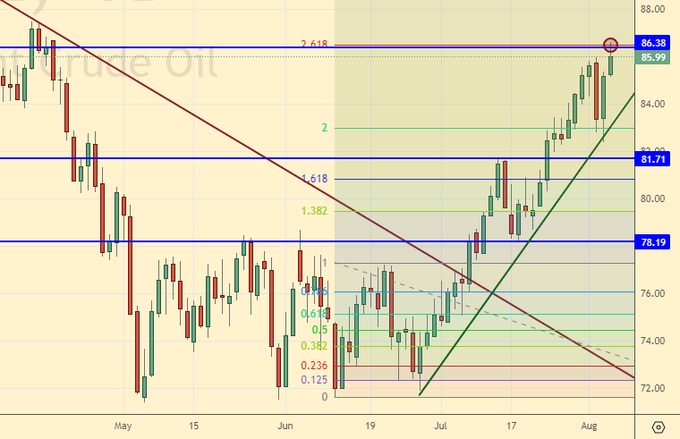

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 4 units to 525 units.

Commercial oil reserves in the US fell by -17.049 to 439.771 million barrels, while the forecast was -1.367 million barrels. Inventories of gasoline rose by 1.481 to 219.081 million barrels. Distillate inventories fell -0.796 to 117.153 million barrels. Inventories at Cushing fell -1.259 to 34.48 million barrels.

Oil production has not changed and is 12.2 million barrels per day. Oil imports rose by 0.301 to 6.668 million barrels per day. Oil exports rose by 0.692 to 5.283 million barrels per day. Thus, net oil imports fell by -0.391 to 1.385 million barrels per day. Oil refining fell by -0.7 to 92.7 percent.

Gasoline demand fell by -0.101 to 8.838 million barrels per day. Gasoline production increased by 0.341 to 9.829 million barrels per day. Gasoline imports rose by 0.191 to 0.945 million barrels per day. Gasoline exports fell -0.177 to 0.818 million bpd.

Demand for distillates rose by 0.108 to 3.826 million barrels. Distillate production increased by 0.08 to 4.861 million barrels. Distillate imports fell -0.047 to 0.113 million barrels. Distillate exports fell -0.035 to 0.154 million barrels per day.

Demand for petroleum products fell by -1.253 to 20.023 million barrels. Production of petroleum products fell by -0.617 to 22.031 million barrels. Imports of refined products fell by -0.183 to 1.969 million barrels. The export of oil products increased by 0.156 to 6.496 million barrels per day.

Propane demand rose 0.051 to 0.885 million barrels. Propane production fell -0.054 to 2.5 million barrels. Propane imports rose by 0.013 to 0.079 million barrels. Propane exports fell -0.041 to 0.189 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 16.1 thousand contracts. Buyers keep coming. The sellers leave. The advantage in the market remains with the bulls.

Growth scenario: consider the September futures, the expiration date is August 22. There is no point in buying at current levels. Out of the market.

Fall scenario: you can sell now, be sure to sell when you rise to 86.00. Market in a wide range. Exit above 90.00 will be a challenge for the West.

Recommendations for WTI oil:

Purchase: no.

Sale: now. Stop: 84.30. Target: 75.20. Or when approaching 86.00. Stop: 86.60. Target: 75.20. Count the risks!!!

Support — 75.04. Resistance — 86.06.

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. There is no point in shopping. Out of the market.

Fall scenario: sell at current levels. It can be aggressive. We expect a rollback to 805.0, a more distant target is 757.0.

Gasoil recommendations:

Purchase: no.

Sale: now. Stop: 923.0. Target: 805.0 (757.0).

Support — 805.25. Resistance is 904.75.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. Nothing has changed in a week. Let’s continue to stand in the longs. By autumn, everyone will already start thinking about winter. What will she be…

Fall scenario: nothing has changed for sellers. Only when approaching 4,000, you can think about entering the short.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep a stop at 2.400. Target: 3.900.

Sale: no.

Support — 2.476. Resistance is 2.759.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we see new highs. We keep long. Russia will follow the path of Turkey. Fans of skiing will pay.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, move the stop to 56000. Target: 70000 (80000).

Sale: no.

Support — 58574. Resistance — 68887.

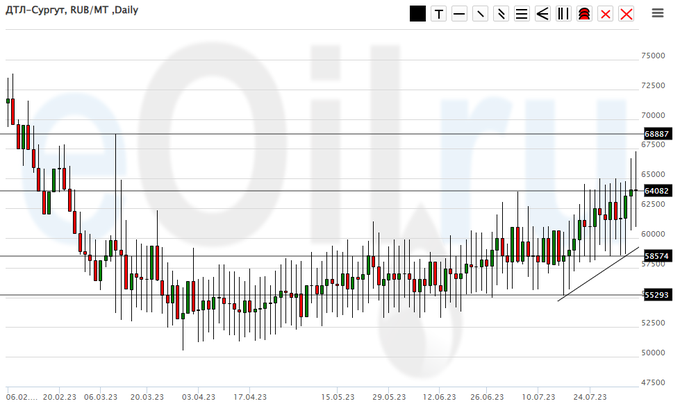

Propane butane (Surgut), ETP eOil.ru

Growth scenario: continue to pause. We understand that we are on the verge of a breakthrough upwards.

Fall scenario: we do not make sales. The fall in energy prices in the current situation looks extremely unlikely.

Recommendations for the PBT market:

Purchase: think after rising above 18000.

Sale: no.

Support — 11680. Resistance — 16670.

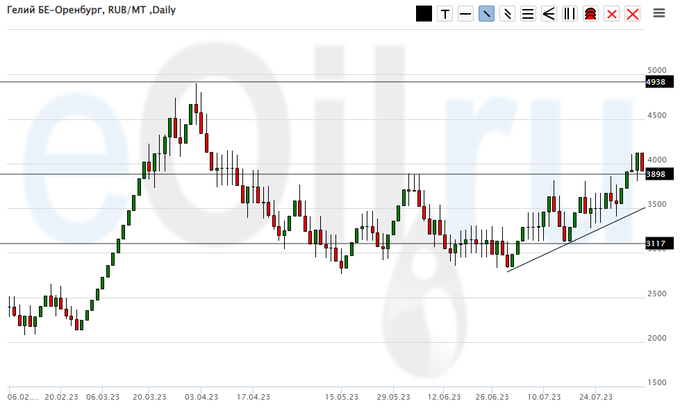

Helium (Orenburg), ETP eOil.ru

Growth scenario: keep longs. We see a new high. Most likely this is not the end of the upward movement.

Fall scenario: do not sell. The market is forming a bullish trend.

Recommendations for the helium market:

Purchase: no. Those in positions between 2900 and 3200, move the stop to 3200. Target: 6000.

Sale: not yet.

Support — 3898. Resistance — 4938.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 14.9 thousand contracts. Vendors enter the market. There are no new volumes from buyers. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: consider the September futures, the expiration date is September 14th. So far, we cannot catch on to purchases. In case of touching 610.0 – buy. In case of growth above 660.0 – think.

Fall scenario: yes, we are below 650.0 as expected, but we will not sell in a situation where a grain tanker could be torpedoed any day.

Recommendations for the wheat market:

Purchase: on touch 611.0. Stop: 603.0. Target: 880.0. Think, read the news, in case of growth above 660.0.

Sale: no.

Support — 610.0. Resistance — 776.5.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open long positions than short ones. Last week the difference between long and short positions of managers decreased by 12.4 thousand contracts. Both buyers and sellers entered the market. Sellers did it more actively. Buyers still hold the advantage.

Growth scenario: consider the September futures, the expiration date is September 14th. Rollback. The situation is tense. If there is a new low, then you will have to forget about buying for a couple of weeks.

Fall scenario: we will not sell. The market can instantly react with growth to negative news from the Black Sea region.

Recommendations for the corn market:

Purchase: now. Stop: 477.0. Target: 708.0!!! Who is in position between 490.0 and 500.0, move the stop to 477.0. Target: 708.0!!!

Sale: no.

Support — 473.2. Resistance is 494.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: if there is a rollback to 1390, you can sell. We consider the opening at 1333 not optimal. The market gives us the opportunity to correct the situation. Let’s hit the stop order sharply.

Recommendations for the soybean market:

Purchase: no.

Sale: up to 1390. Stop: 1430. Target: 1000?! Who is in position from 1333, move the stop to 1353. Target: 1000.0?!

Support — 1256.4. Resistance — 1391.3 (1435.2).

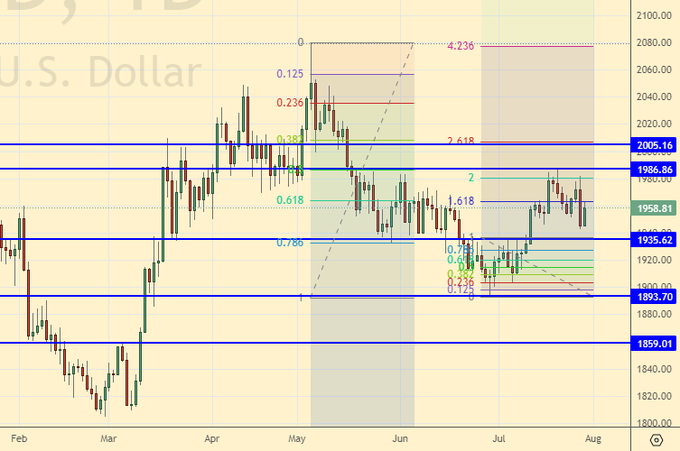

Growth scenario: a seductive picture for a long entry. Everything was set according to the classical wave theory. Let’s buy. It is possible that it will be necessary to buy from 1930, but we will not explicitly recommend this purchase for now.

Fall scenario: For this week, we will postpone the reasoning about sales. Let’s see how events will develop.

Recommendations for the gold market:

Purchase: now. Stop: 1942. Target: 2070.

Sale: no.

Support — 1935. Resistance — 1986.

EUR/USD

Growth scenario: You should have bought from 1.0930. Now we stand and wait what will happen. The dollar will sooner or later begin to lose ground, but it is not certain that this will happen next week. To confirm the growth, we need to go above 1.1200.

Fall scenario: technically the current levels are not bad for short entries, but I would like to see slightly higher levels, for example, 1.1100.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.0930, move the stop to 1.0920. Target: 1.2000?!

Sale: touching 1.1110. Stop: 1.1220. Target: 1.0000?!

Support — 1.0900. Resistance is 1.1034.

USD/RUB

Growth scenario: and here we have a question… Should we take profit at 100.00. Judging by what we see (and hear, for example, from Siluanov), we can go to 115.00 and further, and further, and further … What a horror.

Fall scenario: we will not sell, now most likely for a very long time. Out of the market.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 86.00, move the stop to 90.40. Target: 115.00?!

Sale: no.

Support — 91.17. Resistance is 99.87.

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. We continue to refuse purchases. There are suspicions that the market will turn down next week.

Fall scenario: knocks us out of the shorts, but the situation is so interesting that we will continue to bet on the fall. A good option would be to short from 105500. If the market falls below 102000 on Monday morning, you will have to sell at current prices.

Recommendations for the RTS index:

Purchase: no.

Sale: up to 105500. Stop: 107000. Target: 90000 (50000; 20000?!!!). Also when falling below 102000. Stop: 106000. Target: 90000 (50000; 20000?!!!). Count the risks!!!

Support — 98070. Resistance — 107860.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.