|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-26-to-30-of-june-2023/296014/

|

Energy market:

It’s good that Russia is a big country. While you are going to visit from one end to the other, you have time to think. At the same time, the receiving side also has time to set the table, especially if it turned out that the visit would be largely sudden. In the meantime, you can change your mind and cancel your appearance on the doorstep.

How good and useful are kilometer posts in Russia. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Major players continue to push in the corridor 70.00 — 80.00. Neither side is able to win. Powell (Fed chief) is threatening to raise rates twice more this year. This could knock down the bulls in the entire commodities sector. It is possible that prices will drop to the level of 65.00 for oil. But there, the respected prince of the KSA will again take the stage and say that the futures market is a phantom divorced from reality, after which the people will climb the mountain with a mark of 75.00 in fright. This is how we will live for a while.

There are very serious suspicions that the high rate in the US, which is being increased as part of the fight against inflation, will reduce economic activity in the West by the end of the year. This will be followed by a natural slowdown in China, which will lead to a drop in demand for oil, and we may be at 55.00, which is not very good for the Russian Federation. But nothing can be done here. However, Novak could have announced a more significant reduction in production for a couple with the prince. The main thing is that Iran and the UAE should not let go of free bread against this background. And then there will again begin the struggle for market share.

By reading our forecasts, you could make money in the wheat market by taking a move up from 640.0 to 746.0 cents per bushel. You could also make money on the dollar/ruble pair by taking a move up from 81.00 to 83.90.

Grain market:

The current rise in cereals does not look mandatory. But if it has already happened, then it is still worth carefully looking for opportunities to enter shorts. We note that at the moment the market may still be scared by the cancellation of the grain deal and extraordinary events on Saturday in Russia, but in general, the high rate in the US should crush prices. The scheme is old: in order to service the more expensive debts that have to be entered now, agricultural countries will be more accommodating in the pricing process. The market may begin to take this moment into account, since the rate in the US will most likely not decrease until the end of the year, and this is a trap for states with a high level of external debt: they need to constantly re-borrow.

There were reports that prices inside Russia for wheat began to rise. The growth is still small and ranges from 500 to 700 rubles per ton, depending on the class (more for higher classes). It may continue provided that prices continue to accelerate in Chicago, for example, amid fears of a severe drought in Europe. Bulls they are, they can come up with a reason out of nothing.

We note once again that the rise in food prices looks disgusting against the backdrop of falling living standards in almost all countries. Capitalism, and with signs of collusion.

USD/RUB:

On a nervous Saturday, there were reports that a number of banks were selling the dollar at 200 rubles. It is unlikely that anyone took it, since it was possible to grab green pieces of paper at 115. By the evening, the tension was gone and on Sunday people were swarming around the 100 mark.

There is no doubt that on Monday we will see a gap up at the open of the market, but it will not develop strongly. Most likely we will rest our foreheads at 90.00 and we will not go higher until we go.

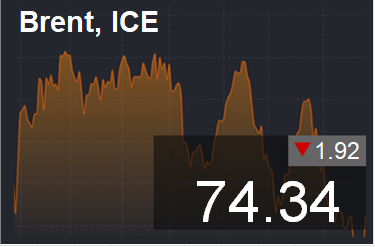

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 16.6 thousand contracts. Buyers entered the market, while sellers left it to a small extent. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: we consider the June futures, the expiration date is June 30. The chances for growth remain, but they look illusory.

Fall scenario: further fall is in question. For now, we are refusing to enter shorts, in particular, due to the modest prospects for the market to fall.

Recommendations for the Brent oil market:

Purchase: now. Stop: 72.20. Target: 95.00.

Sale: no.

Support — 72.27. Resistance — 77.13.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 6 units to 546 units.

Commercial oil reserves in the US fell by -3.831 to 463.293 million barrels, while the forecast was +1.873 million barrels. Inventories of gasoline rose by 0.479 to 221.402 million barrels. Distillate inventories rose by 0.434 to 114.288 million barrels. Inventories at Cushing fell -0.098 to 42.035 million barrels.

Oil production fell by -0.2 to 12.2 million barrels per day. Oil imports fell by -0.22 to 6.161 million barrels per day. Oil exports rose by 1.273 to 4.543 million barrels per day. Thus, net oil imports fell by -1.493 to 1.618 million barrels per day. Oil refining fell by -0.6 to 93.1 percent.

Gasoline demand rose by 0.182 to 9.375 million barrels per day. Gasoline production fell by -0.352 to 9.819 million barrels per day. Gasoline imports fell by -0.129 to 0.925 million barrels per day. Gasoline exports fell -0.098 to 0.859 million bpd.

Demand for distillates rose by 0.404 to 3.978 million barrels. Distillate production increased by 0.089 to 5.077 million barrels. Distillate imports rose 0.008 to 0.144 million barrels. Distillate exports fell -0.017 to 0.199 million barrels per day.

Demand for oil products rose by 0.517 to 20.925 million barrels. Production of petroleum products fell by -1.233 to 22.126 million barrels. Imports of petroleum products increased by 0.395 to 2.457 million barrels. Exports of petroleum products fell by -0.345 to 6.046 million barrels per day.

Propane demand rose by 0.466 to 1.036 million barrels. Propane production fell by -0.043 to 2.545 million barrels. Propane imports rose by 0.02 to 0.096 million barrels. Propane exports rose by 0.064 to 0.242 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 20.7 thousand contracts. Sellers actively left the market, buyers practically remained in place. The spread between long and short positions widened. The advantage in the market remains with the bulls.

Growth scenario: we are considering the August futures, the expiration date is July 20. We will keep the purchase, although it does not cause great expectations.

Fall scenario: stay in shorts. We still have to wait and see who wins. As long as the price remains in the range.

Recommendations for WTI oil:

Purchase: no. Who is in position from 70.50. Stop: 69.80. Target: 90.00.

Sale: no. Who is in position from 72.00, keep the stop at 74.40. Target: 62.00?!

Support — 66.96. Resistance is 75.70.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, the expiration date is July 12. Those who wish can buy at current levels. Stop below 667.0.

Fall scenario: we continue to refrain from sales. The season is coming.

Gasoil recommendations:

Purchase: now. Stop: 664.0. Target: 800.0. Who is in position from 744.0, move the stop to 678.0. Target: 800.0.

Sale: not yet.

Support — 667.90. Resistance is 711.75.

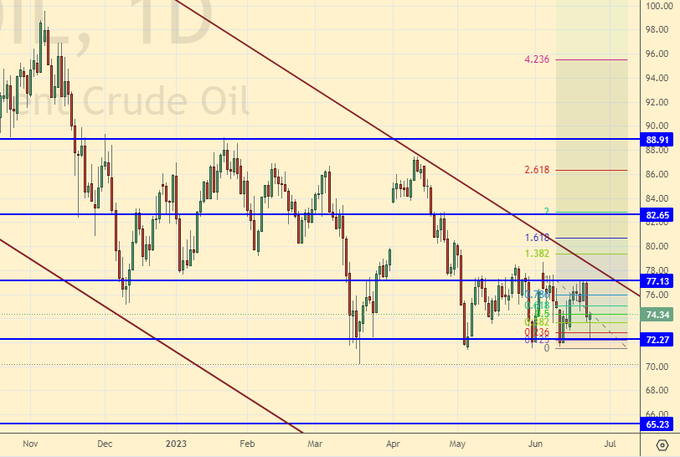

Natural Gas. CME Group

Growth scenario: we are considering the August futures, the expiration date is July 27. We continue to count on the growth of the market. We keep logs.

Fall scenario: we will not sell. However, when approaching 3.700, you can think about entering the short.

Recommendations for natural gas:

Purchase: no. Who is in position between 2.137 and 2.223, move the stop to 2.300. Target: 3.700.

Sale: not yet.

Support — 2.242. Resistance is 2.887.

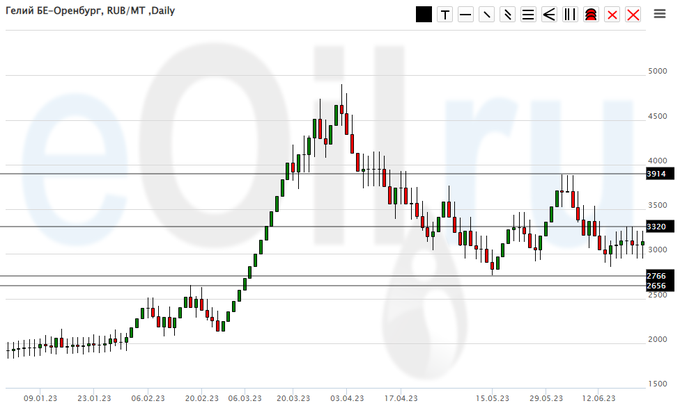

Diesel arctic fuel, ETP eOil.ru

Growth scenario: There are slight signs of the start of price growth acceleration. But the bulls still need to make significant efforts in order for the quotes to really start to grow.

Fall scenario: It is unlikely that a downtrend can form in the current conditions. We do not sell.

Diesel market recommendations:

Purchase: no. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 52813. Resistance — 61602.

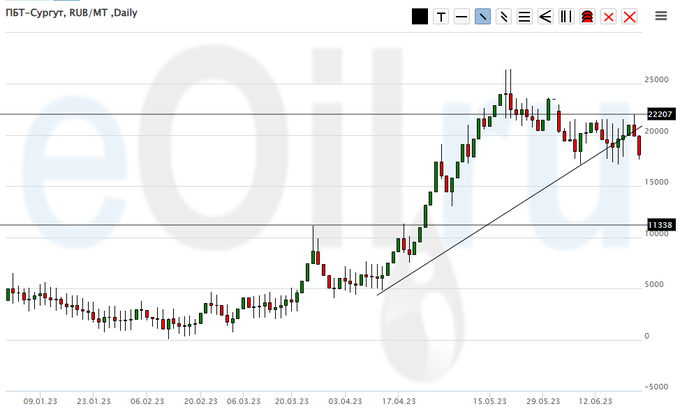

Propane butane (Surgut), ETP eOil.ru

Growth scenario: close all purchases at current prices. While we are out of the market. From 11500 it is obligatory to buy.

Fall scenario: it is necessary to hold the previously opened shorts with the target at 15000, we do not open new positions.

Recommendations for the PBT market:

Purchase: when approaching 11500. Stop: 10800. Target: 15000.

Sale: no. Who is in position from 21000, move the stop to 22300. Target: 15000.

Support — 11338. Resistance — 22207.

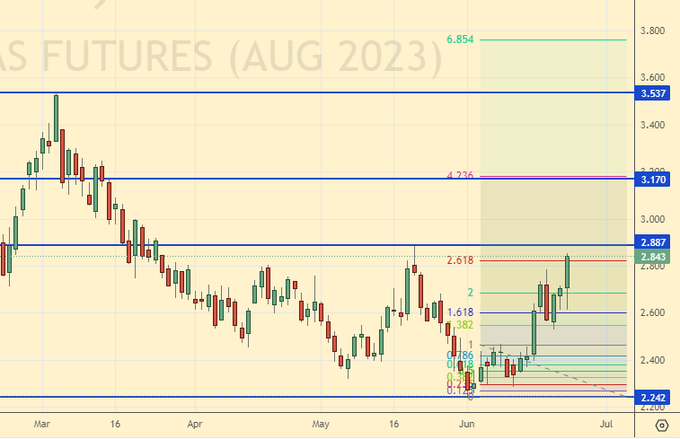

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market found support at 2800. Buy.

Fall scenario: we do not open new positions, we keep the old ones. It is unlikely that we will see a strong fall, but the move to 2600 is not prohibited.

Recommendations for the helium market:

Purchase: now. Stop: 2700. Target: 5000.

Sale: no. Who is in position from 3700, move the stop to 3400. Target: 2600 (revised).

Support — 2766. Resistance — 3320.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers decreased by 26.1 thousand contracts. Sellers left the market in significant numbers. Buyers, oddly enough, followed them, but in many times smaller volume. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: switched to September futures, expiration date 14 September. The purchase was correct. We fix profit at current levels. There will be a rollback, prices rose too quickly.

Fall scenario: I want to sell, but we will endure another week.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support — 731.6. Resistance — 761.0.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more asset managers open long positions than short ones. Last week the difference between long and short positions of managers increased by 64.2 thousand contracts. The change is gigantic. Vendors are fleeing the market in large numbers. The initiative goes to the buyers.

Growth scenario: switched to September futures, expiration date 14 September. We continue to refrain from any action in this market. Too high volatility.

Fall scenario: no interesting entry points. We refrain from transactions.

Recommendations for the corn market:

Purchase: no.

Sale: think when approaching 700.0.

Support — 555.4. Resistance — 624.4.

Soybeans No. 1. CME Group

Growth scenario: switched to the November futures, the expiration date is November 14th. As with the corn market, we will not make any decisions now. The uncertainty is great.

Fall scenario: when approaching 1395, you can sell. The growth of the market with good forecasts of the gross harvest raises questions.

Recommendations for the soybean market:

Purchase: no.

Sale: when approaching 1395. Stop: 1430. Target: 1000.0.

Support — 1235.6. Resistance — 1395.4.

Growth scenario: Sellers take over the market. We don’t buy. Only when approaching 1870 can you go long.

Fall scenario: holding shorts. We expect the market to fall 1870 (target revised).

Recommendations for the gold market:

Purchase: when approaching 1870. Stop: 1840. Target: 3000?!!!

Sale: no. Who is in position from 2020, move the stop to 1960. Target: 1870 (1740).

Support — 1909. Resistance — 1956.

EUR/USD

Growth scenario: keep longs. Yes, the dollar is strong, but the euro will not yield to it, at least until the ECB indicates that it is concerned about the fall of the economy and will not raise the rate further.

Fall scenario: we see the pair’s fall potential as limited. We do not sell.

Recommendations for the EUR/USD pair:

Purchase: when approaching 1.0800. Stop: 1.0770. Target: 1.1900. Who is in position from 1.0720, move the stop to 1.0770. Target: 1.1900.

Sale: no.

Support — 1.0780. Resistance is 1.1013.

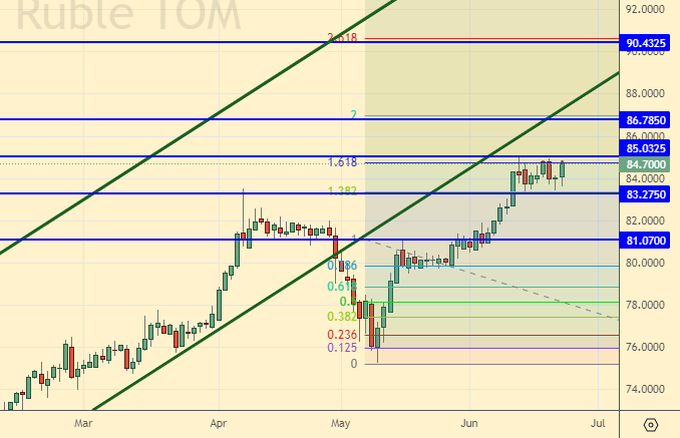

USD/RUB

Growth scenario: we were waiting for a rollback to 81.00 … but it will not happen. We are not waiting for a fall, but a test of the level of 90.00. A move to 100.00 is not excluded.

Fall scenario: for now, the fall of the pair is not a topic for discussion.

Recommendations for the dollar/ruble pair:

Purchase: If the market allows you to buy from 86.0, buy. Stop: 83.00. Target: 90.00 (95.00;100.00).

Sale: no.

Support — 83.27. Resistance — 85.03.

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. It is difficult to talk about growth after the destabilization of the political situation on Saturday. Despite the normalization, people will be inclined to sell. We don’t buy. Close all positions.

Fall scenario: sorry, but we were knocked out of the short at 106700, which creates tactical problems. We sell at any price, in case of growth to 106000 we add to sales. Count the risks.

Recommendations for the RTS index:

Purchase: no. Close everything.

Sale: now and as it rises to 106000. Stop: 107700. Target: 90000 (50000; 20000?!!!).

Support — 100940. Resistance — 105070.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.