|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-20-to-24-of-march-2023/288902/

|

Energy market:

Europe paints a beautiful picture: we have moved away from dependence on Russian gas and Russian oil. Scholz from Germany is especially trying. It may be so, of course, but what are your real fuel reserves, that is, what is the real state of affairs, we will find out during the car season this summer. But even before the summer it is clear that now you will be addicted to Russian cucumbers and tomatoes. Growing your own vegetables in greenhouses in an economy independent of Russia suddenly became unprofitable due to high gas prices.

Sauerkraut with sunflower oil strengthens the immune system in spring. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Oil prices dropped $10 or 12% over the week. Banking scandals in the US and Europe are unlikely to be over. This means that investor sentiment will continue to remain gloomy, which may lead to a decrease in economic activity. This probability is now being factored into the price of oil by the market. That is, there can be no question of any consumption records that OPEC dreams of. The G7 countries plan to keep the price ceiling for Russian oil at $60 per barrel. A number of analysts predicted a lowering of the ceiling to $50, but the predictions did not come true. Comrade Xi, one of the main buyers of Russian resources, is coming to Russia next week. Much in the Russian economy will now depend on the mood of China. I do not want to write the word «everything» yet.

By reading our forecasts, you could take a down move on WTI oil futures from $74.00 to $66.00 per barrel.

Grain market:

Grain deal will come true. This agreement gives hope that Russia will not encounter obstacles in the supply of its own food. Hope, she is, she is the last to die.

Given that the tension between East and West is not subsiding, but rather growing, it is not necessary to say that some state in this situation will take its food security lightly. This means that the demand for grain, mainly for wheat, will remain at a high level.

Rosstat estimates the stocks of wheat in agricultural organizations as of February 1 at 19.8 million tons, which is 78% higher than the long-term average. This situation pushes grain traders to carry out active sales. March can be exported 4.2. million tons of wheat, which is twice as high as in March last year. Now we have reached the rate of shipment of 1 million tons per week.

USD/RUB:

The Central Bank of the Russian Federation left the rate unchanged at 7.5% on Friday, while it was indicated that in case of inflation growth, the rate would be raised.

The ECB raised the rate by 0.5%, but this did nothing to reduce market fears. Financiers go into government debt securities against the backdrop of a flaring banking crisis.

We’ll see what the Fed decides next week. Apparently, the structure began to collapse under the influence of the rapid growth of the rate. There is a chance that there will not be even a 0.25% increase.

Problems with the budget of the Russian Federation are pushing the dollar up. The ruble behaves somewhat limply, obeying the situation. We are waiting for the marks 80.00, 84.00 and 88.00.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers decreased by 66.3 thousand contracts. The change is huge. Buyers fled the market, sellers entered it. The spread between long and short positions has narrowed significantly. However, the majority of bulls are still on the market.

Growth scenario: we consider the March futures, the expiration date is March 31. We came out of the consolidation down. Achieving the level of 70.00 is very likely, further fall is still questionable.

Fall scenario: went down below 80.00. According to our recommendations, you should have sold. Note that a further fall will be hampered by the fear of shortages.

Recommendations for the Brent oil market:

Purchase: when approaching 70.00. Stop: 68.40. Target: 110.0.

Sale: no. Who is in position from 80.00, move the stop to 81.00. Target: 70.10 (66.60).

Support — 69.90. Resistance — 75.92.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 1 unit and now stands at 589 units.

Commercial oil reserves in the US increased by 1.55 to 480.063 million barrels, with the forecast of +1.188 million barrels. Inventories of gasoline fell -2.061 to 235.997 million barrels. Distillate inventories fell -2.537 to 119.715 million barrels. Inventories at Cushing fell -1.916 to 37.912 million barrels.

Oil production has not changed and is 12.2 million barrels per day. Oil imports fell by -0.055 to 6.216 million barrels per day. Oil exports rose by 1.665 to 5.027 million barrels per day. Thus, net oil imports fell by -1.72 to 1.189 million barrels per day. Oil refining increased by 2.2 to 88.2 percent.

Gasoline demand rose by 0.032 to 8.594 million barrels per day. Gasoline production fell by -0.446 to 9.111 million barrels per day. Gasoline imports rose by 0.004 to 0.45 million barrels per day. Gasoline exports rose by 0.06 to 0.891 million barrels per day.

Demand for distillates rose by 0.222 to 3.736 million barrels. Distillate production fell -0.097 to 4.428 million barrels. Distillate imports rose by 0.014 to 0.155 million barrels. Distillate exports rose by 0.077 to 1.209 million barrels per day.

Demand for petroleum products increased by 0.064 to 19.113 million barrels. Production of petroleum products fell by -0.199 to 20.505 million barrels. Imports of petroleum products fell by -0.637 to 1.469 million barrels. The export of oil products increased by 0.193 to 6.203 million barrels per day.

Propane demand fell -0.521 to 0.713 million barrels. Propane production increased by 0.019 to 2.433 million barrels. Propane imports rose by 0.046 to 0.167 million barrels. Propane exports rose by 0.379 to 1.756 million barrels per day.

Growth scenario: we are considering the May futures, the expiration date is April 20. We didn’t expect growth. Moreover, prices have started to decline. If we fall to 60.00 you can buy.

Fall scenario: fell below 74.00. We’re going fast. Arrival at 60.00 cannot be ruled out. Note that our first mark at 66.00 was reached by the market.

Recommendations for WTI oil:

Purchase: when approaching 60.00. Stop: 58.40. Target: 100.00.

Sale: no. Who remained in the position from 74.00, move the stop to 72.70. Target: $60.00 per barrel.

Support — 65.24. Resistance is 71.21.

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. Fuel fell after oil, but it will be hard to fall further. While out of the market.

Fall scenario: we will continue to keep short with the target at 670.0. Stop orders can be pulled closer to the scene.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 900.0, move the stop to 810.0. Target: 670.0.

Support — 721.50. Resistance is 857.50.

Natural Gas. CME Group

Growth scenario: we are considering the April futures, the expiration date is March 29. Given the fall in the oil market, we cannot rule out a further decline in quotations for gas. We keep old longs, we do not open new positions.

Fall scenario: selling levels are extremely low, out of the market.

Recommendations for natural gas:

Purchase: no. Those who are in positions between 2.200 and 2.600 keep the stop at 2.330. Target: 4,000 (8,000?!).

Sale: no.

Support — 2.108. Resistance is 3.052.

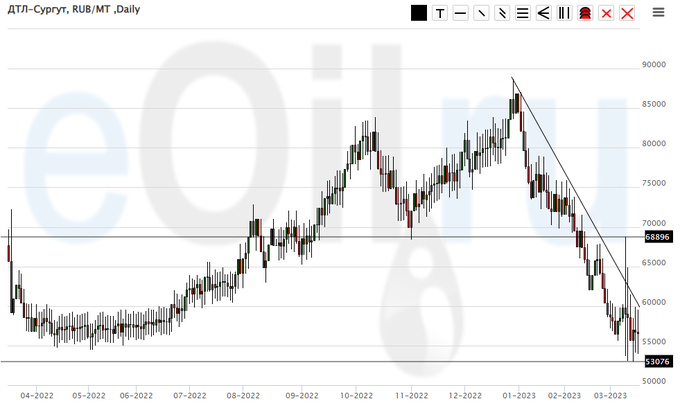

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: we see that there are buyers from 55,000. Must buy with them in the current area. In case of a fall below 53,000, you will have to leave the long position until the situation clears up.

Fall scenario: further sales with speculative purposes are not interesting. Out of the market.

Diesel market recommendations:

Purchase: now. Stop: 53000. Target: 72000.

Sale: no.

Support — 53076. Resistance — 68895.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to recommend buying in the expectation that current levels will become a long-term support area.

Fall scenario: we will continue to refuse sales. Prices are low.

Recommendations for the PBT market:

Purchase: now. Stop: 1100. Target: 7500 rubles per ton. Whoever is in a position from 2600, keep a stop at 1100. Target: 7500 rubles per ton.

Sale: no.

Support — 2119. Resistance — 4805.

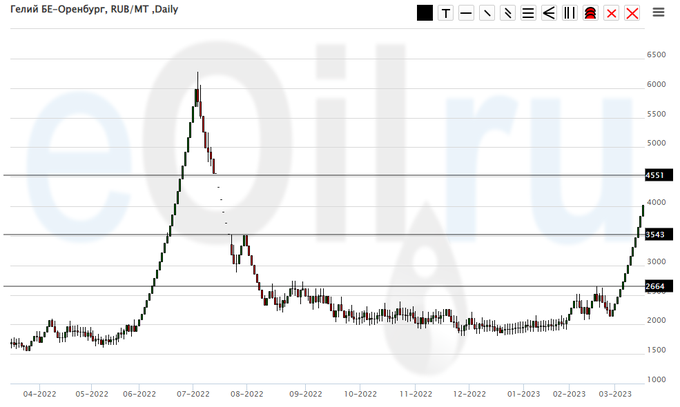

Helium (Orenburg), ETP eOil.ru

Growth scenario: The market continues to rally. There are no interesting levels to buy. Out of the market. We are looking for other opportunities on other instruments.

Fall scenario: When approaching 4500, you can look for opportunities to sell after the red daily candle appears.

Recommendations for the helium market:

Purchase: no.

Sale: around 4500 on a red daily candle. Stop above its maximum. Target: 2700 (2300) rubles per cubic meter.

Support — 3543. Resistance — 4551.

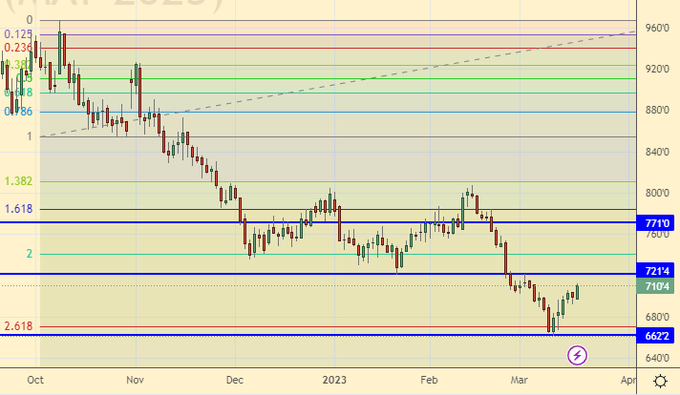

Wheat No. 2 Soft Red. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We continue to reluctantly recover from the fall in February. The market is able to move to 770.0 before the May USDA meeting. We hold longs.

Fall scenario: in theory, the market is able to try to move from here to 600.0, but so far there are no technical prerequisites for this. We do not sell.

Recommendations for the wheat market:

Purchase: no. Who is in position from 680.0 move the stop to 677.0. Target: 770.0.

Sale: no.

Support — 662.2. Resistance — 721.4.

Growth scenario: consider the May futures, the expiration date is May 12. We will continue to refuse to enter the long position in corn. For a good entry, we need levels around 550.0 cents per bushel.

Fall scenario: continue to hold shorts. We expectedly came to 640.0. From this area you can sell. Growth above 650.0 looks extremely unreasonable.

Recommendations for the corn market:

Purchase: no.

Sale: now and when approaching 660.0. Stop: 663.0. Target: 550.0 cents per bushel. Who is in position from 688.0, keep the stop at 663.0. Target: 550.0 cents per bushel.

Support — 619.2. Resistance — 647.4.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We continue to wait for a deeper fall than what we are seeing now. Out of the market.

Fall scenario: Keep holding shorts with 1,000 cents per bushel targets. There is practically no doubt that we will visit the 1400 mark.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Those in positions between 1540.0 and 1530.0 move the stop to 1520.0. Target: 1400.0 (1000.0) cents per bushel.

Support — 1400.0. Resistance — 1505.4.

Gold. CME Group

Growth scenario: the problems in the US banking sector turned out to be much more serious than one could have imagined a week ago. We must buy.

Fall scenario: hopes for a downward corrective move, on which something could be earned, did not come true. We’re going up, maybe around 2500 to start with. We do not sell.

Recommendations for the gold market:

Purchase: Now and on a pullback to 1860. Stop: 1830. Target: $2,500 ($3,000) per troy ounce.

Sale: no.

Support — 1940. Resistance — 2511.

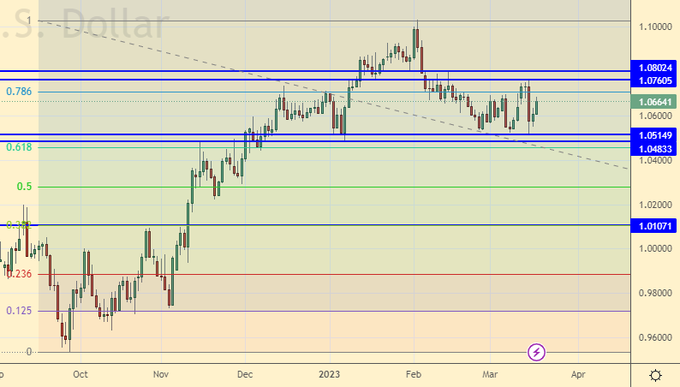

EUR/USD

Growth scenario: the euro may go to 1.2000. Everything is changing very quickly. And we have to too. Due to the banking crisis in the US, the Fed may not raise rates on Wednesday. And even if this happens, the fate of the dollar will still be unenviable. We buy euros.

Fall scenario: given the recent events with banks, we cannot wait for the dollar to strengthen. Since we already have open shorts, we will keep them. We do not open new positions down the pair.

Recommendations for the EUR/USD pair:

Purchase: now. Stop: 1.0470. Target: 1.2000.

Sale: no. Who is in position from 1.0690, keep the stop at 1.0830. Target: 1.0480 (1.0120).

Support — 1.0514. Resistance is 1.0760.

USD/RUB

Growth scenario: “the chances of falling to 72.50 are minimal, but they are,” we wrote last week. Now these chances have become just ghostly. We are going to 88.00 without a rollback.

Fall scenario: no signs of a downside market reversal. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: think when approaching 75.50. Stop: 74.40. Target: 88.00. Who is in position from 76.70, move the stop to 74.40. Target: 88.00.

Sale: no.

Support — 76.00. Resistance — 83.06.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. Sber has pleased shareholders with a message about generous dividends. For some time the market will show signs of life (in rubles). Moreover, inflation will help him. In dollars, Russian securities will continue to fall in price in the long term, despite the positive from Sberbank. Based on the technique, at the moment, we can carefully buy. Stop order close.

Fall scenario: those who wish can sell at current levels. Sberbank pleased us, and then there is nothing interesting. The main thing is there are no prospects for growth. Of course, the military-industrial complex will help us this year, but this is hardly enough to make investors optimistic. And then there’s the banking crisis in the West…

Recommendations for the RTS index:

Purchase: now. Stop: 94700 (93600). Target: 112000. Reduce capital risk for this trade.

Sale: now. Stop: 101000. Target: 80000 (50000, then 20000) points. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101000. Target: 80000 (50000, then 20000) points.

Support — 93650. Resistance — 97180.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.