|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-28-november-to-2-of-december-2022/281359/

|

Energy market:

In Russia, the Ministry of Finance is ready to agree to settlements on foreign trade transactions in cash. It is very interesting how this will happen. Imagine, a wagon is coming towards us, no, a barge of money is floating. Security platoon, armored cars, helicopters in the air.

For example, Afghanistan will pay for the supply of gasoline in US currency, it is possible that it is of its own production, or Libya will ship half a ton of money on board for the supply of wheat. The cashier in such a transaction will be a very respected person.

Hello to us all!

The Europeans have begun to patrol their pipelines that supply resources. It turns out that it is scary to be left without oil and gas in the middle of winter. It is even possible that they will walk along the bottom with flashlights.

So far, the EU cannot come to a common denominator on the issue of determining the price ceiling for Russian oil. But they cannot simply because instead of the current deficit, they will receive a catastrophe in their localities. Russia has explicitly stated that deliveries will not be made to any country that supports the price cap initiative. Scary, everyone is scared.

The oil market is currently inclined to continue to fall. The bearish mood could easily be stopped by a verbal intervention by Saudi Arabia or the United Arab Emirates. Fearing this interference, sellers are unlikely to bet too much on the line. Brent below the level of 80.00 is not yet visible.

It should be noted that fears of a new round of the pandemic in China and fears of a recession in the United States in 2023 will put pressure on the market, and exporting countries will reduce supply in order to prevent falling prices. The next OPEC+ meeting is on December 4th.

Reading our forecasts, you could make money on the euro/dollar pair by taking a move up from 0.9930 to 1.0290. Also, you could earn on the futures on the RTS index by taking a move up from 105,400 to 111,000 points.

Grain market:

Livestock breeders in Russia can significantly increase the number of pork and poultry. There is a lot of grain in the country, and it is cheap. Taking into account the current export rates, 5.8 million tons of grain in October and currently 4 million tons of grain in November, we can say that it will not be possible to export all 65 million tons of grain before the new harvest.

Trying to limit the export of energy resources from Russia, the Europeans are digging a hole for themselves. In the spring of next year, some of the European farmers may not have enough fuel, or it will cost so much that it is better to just live on this money and do nothing. And food will be bought in North and South America. Of course, the European bureaucrats will take care of their farmers, but since they don’t have much brains, a situation may arise when in the fall all sanctions against Russia will be lifted in exchange for food, and all simply because the poor majority will want to eat.

In fairness, we note that this year Europe closed all its problems with grain due to massive supplies from outside.

USD/RUB:

The dollar index fell slightly last week, but this did not affect the ruble in any way, as we continue to live in our own reality isolated from big money.

It is worth recognizing that the fall in prices for raw materials and the embargo on the supply of oil and petroleum products to Europe, over time, can have a strong negative impact on the Russian economy, however, we will not see a strong change in the exchange rate against the US dollar until some “X” hour, when it becomes obvious to everyone that a country with a ratio of 65 rubles per dollar cannot exist.

There is no doubt that next year budget expenditures will increase, and there will be problems with revenues, especially with regard to corporate income tax.

If the pair falls to the level of 55.00, and possibly 50.00, buy.

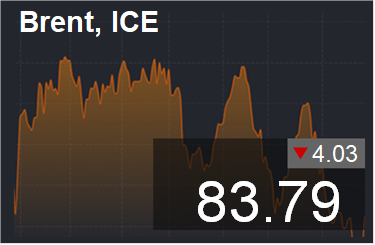

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers decreased by 68.3 thousand contracts. The change is significant. The bulls left the market en masse, the sellers actively entered. The spread between long and short positions has narrowed significantly, the bulls may lose control of the market.

Growth scenario: consider the December futures, the expiration date is December 30th. We won’t be buying yet. Only when approaching 67.00 is it worth going long.

Fall scenario: with a very high probability we will reach the level of 80.00. If something negative happens, we can go to the level of 67.00 dollars per barrel. A sharp drop in prices should be considered as one of the possible scenarios.

Recommendations for the Brent oil market:

Purchase: on touch 67.00. Stop: 63.20. Target: 90.00.

Sale: no. Who is in position from 90.00, move the stop to 91.30. Target: $67.00 per barrel. Upon reaching the level of 80.00, close 25% of the position.

Support — 79.26. Resistance is 91.60.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 4 units and now stands at 627 units.

US commercial oil inventories fell by -3.69 to 431.665 million barrels, while the forecast was -1.055 million barrels. Inventories of gasoline rose by 3.058 to 210.998 million barrels. Distillate inventories rose by 1.718 to 109.101 million barrels. Inventories at Cushing fell -0.887 to 24.73 million barrels.

Oil production has not changed and is 12.1 million barrels per day. Oil imports rose by 1.504 to 7.063 million barrels per day. Oil exports rose by 0.38 to 4.242 million barrels per day. Thus, net oil imports rose by 1.124 to 2.821 million barrels per day. Oil refining increased by 1 to 93.9 percent.

Gasoline demand fell by -0.415 to 8.327 million bpd. Gasoline production fell by -0.625 to 9.164 million barrels per day. Gasoline imports rose by 0.013 to 0.585 million barrels per day. Gasoline exports fell -0.029 to 0.898 million bpd.

Demand for distillates fell by -0.017 to 3.846 million barrels. Distillate production increased by 0.014 to 5.111 million barrels. Distillate imports rose by 0.012 to 0.122 million barrels. Distillate exports fell -0.041 to 1.142 million barrels per day.

Demand for petroleum products fell by -1.209 to 19.878 million barrels. Production of petroleum products fell by -0.947 to 22.139 million barrels. Imports of refined products fell by -0.687 to 1.607 million barrels. Exports of petroleum products fell by -0.34 to 5.685 million barrels per day.

Propane demand fell by -0.069 to 0.874 million barrels. Propane production fell by -0.027 to 2.456 million barrels. Propane imports fell -0.004 to 0.098 million barrels. Propane exports fell by -0.124 to 1.507 million barrels per day.

Growth scenario: consider the January futures, the expiration date is December 20. The bulls gave up. There is a prospect of falling to 67.00. Up to this level we do not buy.

Fall scenario: sellers behave aggressively. Those who are already in shorts can increase their selling positions.

Recommendations for WTI oil:

Purchase: when approaching 67.00. Stop: 64.00. Target: 80.00.

Sale: no. Who is in position from 86.80, move the stop to 85.80. Target: $67.00 per barrel.

Support — 66.21. Resistance — 82.59.

Gas-Oil. ICE

Growth scenario: consider the December futures, the expiration date is December 12. We have sunk very deep. Regardless, buy here.

Fall scenario: we continue to believe that we should not sell until we fix below 900.0. We monitor the situation, if we trade, then with a small risk to the capital.

Gasoil recommendations:

Purchase: no.

Sale: think after falling below 900.0.

Support — 849.50. Resistance is 969.25.

Natural Gas. CME Group

Growth scenario: consider the January futures, the expiration date is December 28. We stand in longs. Suddenly it will be very cold in the USA.

Fall scenario: we continue to refuse sales. The market will stand or go higher. Falling prices in the current situation is not a scenario.

Recommendations for natural gas:

Purchase: no. Who is in position between 5.320 and 5.800, move the stop to 5.800. Target: 15.000 per 1 million BTUs.

Sale: no.

Support — 6.565. Resistance — 8.197.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. We will continue to recommend buying from current levels in the expectation that on Monday, immediately after the American holidays, the bulls will try to attack.

Fall scenario: hold short from 840.0 for a fall to 700.0 cents per bushel. The situation is comfortable, but it could get even better if the 790.0 level on Monday fails and we go lower.

Recommendations for the wheat market:

Purchase: now. Stop: 773.0. Target: 1070.0. Who is in position from 810.0, move the stop to 773.0. Target: 1070.0.

Sale: no. Who is in position from 840.0, move the stop to 832.0. Target: 700.0 cents per bushel.

Support — 787.2. Resistance — 820.4.

Growth scenario: we consider the March futures, the expiration date is March 14. The market is in equilibrium, sellers have a slight advantage. We will buy either after the growth above 700.0, or after the fall to 625.0.

Fall scenario: sellers failed to achieve any gains last week. We hold old positions, we do not open new ones.

Recommendations for the corn market:

Purchase: ideal when approaching 625.0. Stop: 605.0 Target: Target: 670.0. Also think about buying in case of growth above 700.0.

Sale: no. Who is in position from 670.0, keep the stop at 683.0. Target: 600.0 (550.0) cents per bushel.

Support — 624.0. Resistance — 673.6 (704.4).

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, the expiration date is January 13th. You can hold longs from 1425.0. We are not opening new positions.

Fall scenario: downward prospects remain. Keep shorts. Those who wish can increase sales.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, move the stop to 1416.0. Target: 1600.0.

Sale: no. Who is in position between 1455.0 and 1450.0, move the stop to 1467.0. Target: 1000.0 cents per bushel.

Support — 1407.2. Resistance — 1462.6.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. The rollback continues. We will buy when approaching 19.00 and 18.50. Note that the level of 19.00 is likely to be stitched down.

Fall scenario: for now, let’s refrain from arguing about entering shorts. Out of the market.

Recommendations for the sugar market:

Purchase: when approaching 19.00 and 18.50. Stop: 17.70. Target: 21.45. Count the risks.

Sale: no. Who is in position from 20.00, move the stop to 20.10. Target: 18.00 cents per pound.

Support — 18.97. Resistance — 20.03.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. We see an insignificant bounce up. Let’s move the stop order. We will keep long.

Fall scenario: we remain outside the market and wait for more profitable levels to enter the shorts.

Recommendations for the coffee market:

Purchase: no. Who is in positions from 160.0, 170.00 and 175.00, move the stop to 144.00. Target: 210.0 cents per pound.

Sale: no.

Support — 150.30. Resistance is 167.60.

Gold. CME Group

Growth scenario: 1680 strike suggests itself. If this happens, it will be possible to buy. In case of growth above 1780, we will also buy.

Fall scenario: here you can enter a short or add to a previously opened position. Expect a drop by 1680.

Recommendations for the gold market:

Purchase: on pullback to 1680. Stop: 1640. Target: 2300. Those in position from 1675, keep stop at 1640. Target: 2350. Think in case of growth above 1780.

Sale: now. Stop: 1780. Target: 1680. Those in position from 1740, keep stop at 1780. Target: $1680 a troy ounce.

Support — 1681. Resistance — 1770.

EUR/USD

Growth scenario: from the current situation, the move to 1.0700 is not mandatory. There may be a rollback to 1.0100. If we immediately go to 1.0700, we will not buy.

Fall scenario: Selling when approaching 1.0700 is a normal idea. You can also go short from current levels.

Recommendations for the EUR/USD pair:

Purchase: when approaching 1.0100. Stop: 0.9900. Target: 1.2000.

Sale: now. Stop: 1.0480. Target: 0.8600?!!! When approaching 1.0700. Stop: 1.0770. Target: 0.8600?!!!

Support — 1.0214. Resistance is 1.0491.

USD/RUB

Growth scenario: while the pair is in the range. In case of a decline to 59.50, you can buy. Those who entered earlier should be patient and hold their positions.

Fall scenario: it is worth holding short with a stop order at 61.20. No one expects a move at 50.00, which is why it can happen, will be a gift for Christmas.

Recommendations for the dollar/ruble pair:

Purchase: on the fall to 59.50. Stop: 59.20. Target: 74.00. Who is in positions from 60.00 and 61.60, keep the stop at 59.20. Target: 74.00.

Sale: now. Stop: 61.20. Target: 50.00. Who is in position from 60.80, keep a stop at 61.20. Target: 50.00.

Support — 59.63. Resistance — 61.22.

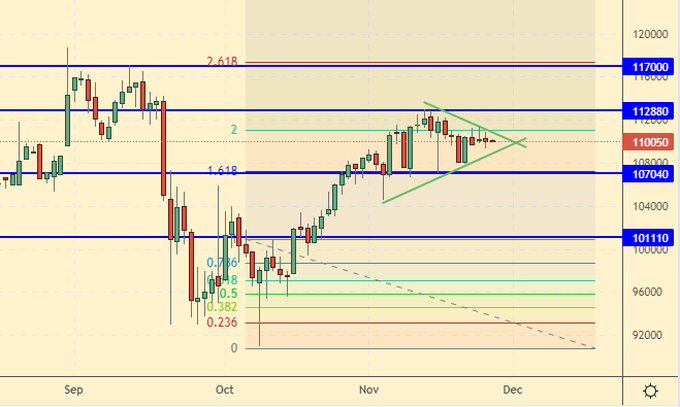

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. Nothing significant happened on the market during the week. One cannot deny the possibility of a corrective move to 101000, and one cannot deny a move to 117000 without a rollback. We will only buy if we roll back to 101000.

Fall scenario: when approaching the level of 117000, we will definitely sell. In case of a fall below 108000, it is also worth going short.

Recommendations for the RTS index:

Purchase: when approaching 101000. Stop: 99000. Target: 117000.

Sale: now. Stop: 111700. Target: 80000 (50000). When approaching 117000. Stop: 118800. Target: 80000 (50000) points.

Support — 107040. Resistance — 112880.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.