|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-7-to-11-of-november-2022/279901/

|

Energy market:

The German chancellor flew to China. Offered to be friends against Russia. Wise Xi knew in advance why Scholz granted, and did not shake hands with him. So they were at a distance, expecting that one would pounce on the other. They had such tense negotiations.

And then the Frenchman Macron refused to fly with Scholz on the same plane to the G20 summit. The Germans were unlucky last week. But the temperature in Berlin is +16. So far it’s a hit here. But some European countries have already begun to withdraw gas from storage facilities. The game has begun.

Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms.

The British Hindu, who is also the new Prime Minister, has forbidden something to explore on the island and to extract oil and gas from the bowels. The pound is no longer so strong, but it can still be bought for something in the world. Britain is waiting for an unprecedented shortage of resources and tax increases. It is very similar to the fact that London blew up the Nord Streams. If evidence of a crime is obtained, then questions will already arise among those who still hoped to get gas through these pipes. And then we remember the city of Berlin and the fact that the Germans have been unlucky lately. Wise men in Washington have invented a formula, no, not a formula of love, but a formula according to which they will calculate the price of oil for Russia. The EU and Australia supported the project. That is, the price will be set for Russia by the great hegemon. It’s good that we can refuse to be robbed so impudently. Oil is likely to stay above $90.00 a barrel as the lifting of strict covid restrictions in China will boost demand for hydrocarbons.

Grain market:

Russia withdrew from the grain deal, but then re-entered it. The futures market did not remain in debt. He was initially thrown up, then lowered down. It was difficult to make money on the rapid development of events.

Since Friday, the Russian press, cautiously, but with some hope, began to speculate that the conflict in Ukraine will end in the next few months. These are still fantasies and rumors, but they can develop into some kind of forecasts for specific dates in the next few weeks.

If the prospect of a settlement looms on the horizon, the grain market will fall by at least 10%. Russia agreed to donate 500,000 tons of food to the poorest countries. This is a timely move that will improve the image of our country in the eyes of the international community. But still, I would like to get something in return. At least beads, or here medicinal plants, the Afghans recently offered by barter, though for oil, but let them supply us with dried black roots and all kinds of powders for grain. And what. Come in handy.

USD/RUB:

The US Federal Reserve on November 2 raised the rate by 0.75% to 4%. After the announcement of the decision, the stock and commodity markets declined, but later the decline stopped, and the gold market turned up on Friday. It should be noted that the physical gold market is 15-20% higher than the quotes on the stock market.

The ruble reacted to news from across the ocean about a rate increase with a slight weakening, but nothing significant has happened so far. The pair rose to the level of 62.00, but could not go higher. Most likely, the market will continue to remain above the 60.00 level, but there will be no strong changes in the ruble against the dollar. Above 65.00 the market is not visible yet.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 17.2 thousand contracts. The change is significant. The bulls came in, the sellers were reluctant to leave the market. The spread between longs and shorts has widened and the bulls are in control.

Growth scenario: we are considering the November futures, the expiration date is November 30th. Friday for the bulls. After rising above the level of 100.00, a strong increase may begin. We hold longs.

Fall scenario: against the backdrop of reports that there is a physical shortage of oil, we will not talk about sales.

Recommendations for the Brent oil market: Purchase: no. Those in positions between 92.00 and 94.00 move the stop to 90.20. Target: 110.00 (150.00) dollars per barrel.

Sale: no.

Support — 93.96. Resistance is 106.84.

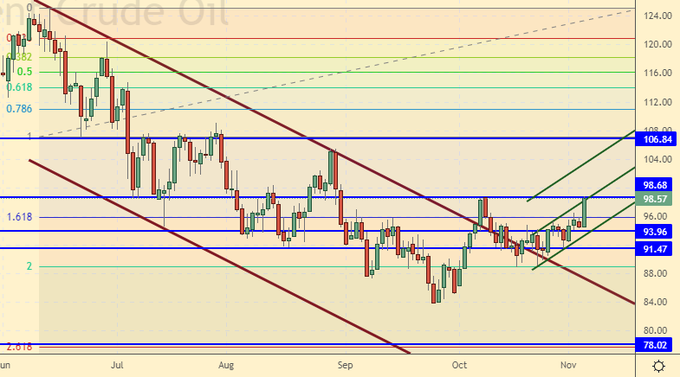

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 3 units and now stands at 613 units.

Commercial oil reserves in the US fell by -3.115 to 436.83 million barrels, while the forecast was +0.367 million barrels. Inventories of gasoline fell -1.257 to 206.633 million barrels. Distillate inventories rose by 0.427 to 106.784 million barrels. Inventories at Cushing rose by 1.267 to 28.164 million barrels.

Oil production fell by -0.1 to 11.9 million barrels per day. Oil imports rose by 0.025 to 6.205 million barrels per day. Oil exports fell by -1.204 to 3.925 million barrels per day. Thus, net oil imports rose by 1.229 to 2.28 million barrels per day. Oil refining increased by 1.7 to 90.6 percent.

Gasoline demand fell by -0.27 to 8.66 million barrels per day. Gasoline production increased by 0.043 to 9.48 million barrels per day. Gasoline imports fell -0.369 to 0.286 million bpd. Gasoline exports fell -0.039 to 0.837 million bpd.

Demand for distillates rose by 0.379 to 4.257 million barrels. Distillate production increased by 0.139 to 5.117 million barrels. Distillate imports fell -0.018 to 0.121 million barrels. Distillate exports fell -0.294 to 0.921 million barrels per day.

Demand for petroleum products fell by -0.106 to 20.481 million barrels. Oil products production fell by -0.124 to 22.286 million barrels. Imports of petroleum products fell by -0.356 to 1.883 million barrels. Exports of petroleum products fell by -0.76 to 5.537 million barrels per day.

Demand for propane rose by 0.314 to 1.034 million barrels. Propane production fell by -0.033 to 2.539 million barrels. Propane imports rose by 0.027 to 0.123 million barrels. Propane exports fell -0.376 to 1.451 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 15.7 thousand contracts. The bulls actively entered the market, the positions of the sellers slightly decreased. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: we consider the December futures, the expiration date is November 21. We hold longs. There is a good prospect of a move to the level of 100.00. Further movement to 120.00 is possible.

Fall scenario: we postpone attempts to enter shorts until more convenient situations arise. Out of the market.

Recommendations for WTI oil:

Purchase: no. Those in positions from 82.10, 84.00, 85.00 and 88.00, move the stop to 83.30. Target: $120.00 per barrel.

Sale: no.

Support — 81.37. Resistance — 93.79.

Gas-Oil. ICE

Growth scenario: switched to December futures, expiry date 12 December. We do not invent anything, we buy. In case of growth above 1110.0, positions can be increased.

Fall scenario: do not sell. The market has not been able to break down during the summer, and now he will not succeed.

Gasoil recommendations:

Purchase: now. Stop: 1020.00. Target: 1300.00.

Sale: no.

Support — 981.50. Resistance is 1102.25.

Natural Gas. CME Group

Growth scenario: switched to December futures, expiry date 28 November. We continue to recommend purchases. According to rumors, LNG tankers are standing off the coast of Europe and are not being unloaded. Either they cannot be accepted, or they themselves are waiting for price increases.

Fall scenario: do not sell. The EU has already begun withdrawing gas from storage facilities. The Americans, of course, will bring gas, but how much is still a question.

Recommendations for natural gas:

Purchase: now. Stop: 4.800. Target: 15.000!!! Who is in position between 5.320 and 5.800, move the stop to 5.300. Target: 15.000.

Sale: no.

Support — 5.324. Resistance is 6.642.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers decreased by 0.1 thousand contracts. Buyers and sellers entered the market. The spread between short and long positions remained practically unchanged, sellers retain their advantage.

Growth scenario: consider the December futures, the expiration date is December 14th. Buying here is a little scary, but the risk-reward ratio is attractive. Let’s go long.

Falling scenario: while we are above 820.0, we will not sell. It is worth recognizing that there are some prerequisites for price reductions. Do not forget, there is a lot of wheat this year.

Recommendations for the wheat market:

Purchase: now. Stop: 817.0. Target: 1070.0. Who is in position from 825.0 and 840.0, keep the stop at 817.0. Target: 1070.0.

Sale: think after falling below 820.0 cents per bushel.

Support — 822.2 (792.6). Resistance — 863.6 (906.2).

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 12.6 thousand contracts. Buyers entered the market, sellers were reluctant to close their shorts. The spread between longs and shorts has widened and the bulls’ lead has increased.

Growth scenario: consider the December futures, the expiration date is December 14th. While the level of 670.0 stands, we will only talk about growth. Those interested can buy here.

Fall scenario: nothing has changed since last week. A sharp downward blow continues to suggest itself. In case of a pass below 670.0, the advantage will go to the sellers.

Recommendations for the corn market:

Purchase: now. Stop: 670.0. Target: 750.0. Who is in position between 680.0 and 690.0, keep the stop at 670.0. Target: 750.0.

Sale: after falling below 670.0. Stop: 687.0. Target: 550.0 cents per bushel.

Support — 674.4. Resistance — 700.0.

Soybeans No. 1. CME Group

Growth scenario: switched to January futures, expiry date 13 January. We will keep shopping despite the fact that there is a lot of soybeans. We do not open new positions.

Fall scenario: the current area is interesting for sales. If the grain falls, then the soybeans will go down.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1420, move the stop to 1410.0. Target: 1600.0.

Sale: now. Stop: 1487.0. Target: 1000.0 cents per bushel.

Support — 1423.2. Resistance is 1520.0.

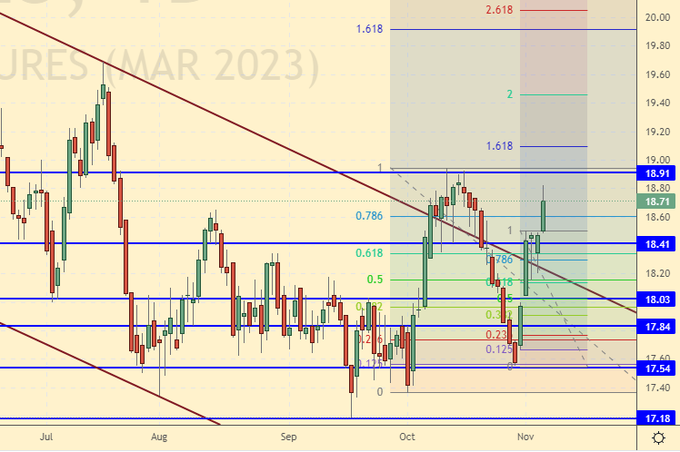

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. The risk we took last week paid off. If you have earned a lot, then you can close part of the position, but in general you need to continue to keep the long.

Fall scenario: we will not sell yet, despite the fact that the market may return by 18.20.

Recommendations for the sugar market:

Purchase: no. Who is in position from 17.65, move the stop to 17.80. Target: 19.90.

Sale: no.

Support — 18.41. Resistance — 18.91.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. Nothing new. When approaching 160.00, we will buy. After touching 160.00, prices may return to the level of 190.00, possibly 210.00.

Fall scenario: the market is oversold. We refrain from selling.

Recommendations for the coffee market:

Purchase: now and when approaching 160.00. Stop: 140.00. Target: 210.00. Count the risks.

Sale: no.

Support — 159.90. Resistance is 183.35.

Gold. CME Group

Growth scenario: Seeing a very bullish close on Friday. You will have to buy at current levels and add when you roll back down.

Fall scenario: This is a sharp reversal up. Until we sell.

Recommendations for the gold market:

Purchase: now and on pullback to 1650. Stop: 1637. Target: 2300.

Sale: no.

Support — 1641. Resistance — 1728.

EUR/USD

Growth scenario: The dollar suffered on Friday after the release of unemployment data. It rose to 3.7% in October. In September it was 3.5%. Can buy.

Fall scenario: we will not sell yet. Dollar fails statistics.

Recommendations for the EUR/USD pair:

Purchase: now and when approaching 0.9850. Stop: 0.9820. Target: 1.2000. Count the risks.

Sale: no.

Support is 0.9728. Resistance is 1.0096.

USD/RUB

Growth scenario: On Thursday, the dollar rose slightly on the back of higher US rates. However, judging by the way the US currency weakened on Friday while we were celebrating the Holiday, on Monday we will see a slight strengthening of the ruble. It is possible that by the end of the week we will go to the level of 60.00.

Fall scenario: we do not place bets on the fall yet. We take a break.

Recommendations for the dollar/ruble pair:

Purchase: when falling to 60.00 and 59.00. Stop: 57.40. Target: 74.00. Who is in position from 61.60, keep the stop at 57.40. Target: 74.00.

Sale: no.

Support — 60.68. Resistance — 64.87.

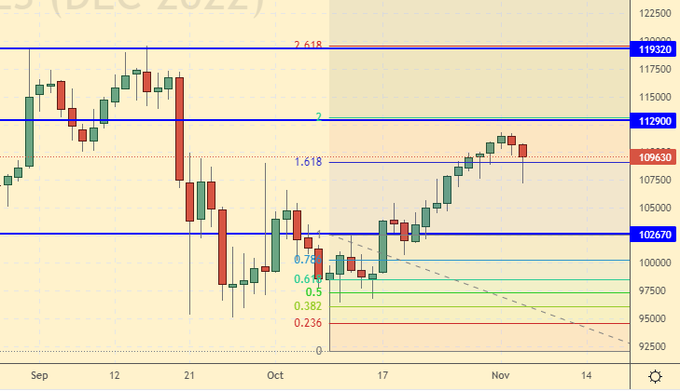

RTSI

Growth scenario: consider the December futures, the expiration date is December 15th. In the current situation, we can continue to keep open longs with the expectation that the market will move towards 120,000. Note that it will not be easy to grow without positive international information.

Fall scenario: when you touch the level of 113000, you need to sell. Who has already entered the sale, you can keep the shorts.

Recommendations for the RTS index:

Purchase: no. Who is in position from 105400, keep stop at 105000. Target: 120000.

Sale: when approaching 113000. Stop: 114600. Target: 80000 (50000) points. Who is in position from 112000, move the stop to 112200. Target: 80000 (50000) points.

Support — 102670. Resistance — 112900.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.