|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-31-october-to-4-of-november-2022/279437/

|

Energy market:

Do you know that 80% of foreign manufacturers of fish smoking ovens left Russia due to sanctions? Rather, they did not leave, but went to their own, which became profitable markets: to Germany, the Czech Republic and Poland. There are now all stoves in use: for fish, for meat, for anything, as long as the heat comes from them.

Hello!

In Germany, the Minister of Finance proposed to extract gas by hydraulic fracturing. This method is now banned in their country. So, after all, there is fear, if not about the winter of the 23rd year, then about the winter of the 24th year. Otherwise, why voice such thoughts. Or, after all, the storage facilities in Germany are not 100% full, while politicians are lying to ordinary citizens. Many questions. A lot of questions.

In the United States, they began to gradually move away from the idea of setting the price of oil for Russia. In any case, it is unlikely to return to it in the coming days, since the Democrats need to focus on the congressional elections, which will be held on November 8th. Early voting has already begun.

Brent oil prices are likely to remain above $90.00 a barrel in the coming weeks, as the coherence of OPEC + does not give sellers hope that they can capitalize on the fall. As soon as oil tries to break below the 90.00 level, an Arab prince or other influential person will immediately appear on the screens, who will say that we are closely monitoring the balance of supply and demand, and add that Washington has been misbehaving lately.

By reading our predictions, you could make money in the coffee market by taking a move down from 220.00 to 193.00 cents per pound.

Grain market:

It is very likely that after the attack on the ships of the Black Sea Fleet, Russia will withdraw from the “grain deal”. At the moment, 9.3 million tons of grain, mainly corn, have been exported from Ukraine by sea. At the same time, the export of Russian grain is extremely difficult for the West under the same agreement. In fact, it does not give Russia anything, but rather harms it.

It should be noted that over the past five years, excluding 2022, Ukraine has exported an average of 18 million tons of wheat and 27 million tons of corn per year. According to the USDA this year, due to the confrontation with Russia, the country’s export potential has almost halved. It is possible that 80% of the total volume that could be exported this year has already gone to buyers.

Grain markets may react to Russia’s exit from the grain deal with growth immediately from the opening of trading on Monday, since grain exports from Ukraine will now be possible only by land, but its volumes will be clearly insignificant.

USD/RUB:

The central event of the week is the Fed meeting on November 2nd. The market is waiting for the rate increase by 0.75%, which should strengthen the position of the US currency against the candy wrappers of other countries. If the increase takes place, we will get a US rate of 4%, which will make the dollar incredibly attractive in the eyes of not only professional financiers, but also ordinary people.

The commodity group, including gold and other metals, will be under pressure due to the growth of the dollar. Note that not only the fact of the rate hike will be important, but also the Fed’s comment on what they will do in the future. It is clear that Powell will not say anything directly, perhaps because he himself does not know what will happen to inflation and the labor market in the future. However, everyone would like to understand whether there is a mood to push the rate to 5 percent in 2023 or there is no such mood.

The Central Bank of Russia left the rate at 7.5% amid slowing inflation. Most likely, the rate cut cycle is over for us. By the end of the year, we can see, according to the official estimate, a price increase of 12%, which is lower than the optimistic forecast of 14%, which was circulating in the minds earlier.

It is likely that the dollar/ruble pair will hover above the 60.00 level until we have clarity on hydrocarbon export revenues in 2023, which will happen closer to January.

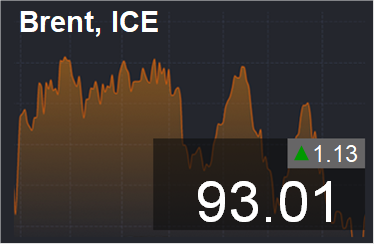

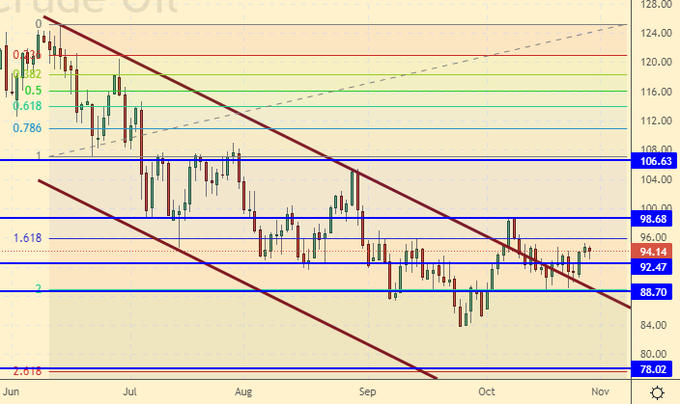

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 30.9 thousand contracts. The change is significant. The bulls entered the market aggressively. At the same time, sellers became slightly less. The spread between longs and shorts has widened and the bulls are in control.

Growth scenario: we are considering the November futures, the expiration date is November 30th. We continue to recommend purchases. After rising above the level of 100.00, a strong increase may begin.

Fall scenario: the market failed to go below the 88.00 level, which we consider to be a key one for sellers. We do not sell.

Recommendations for the Brent oil market:

Purchase: now. Stop: 87.00. Target: 110.00. Who is in position from 92.00 and 94.00, keep the stop at 87.00. Target: 110.00 (150.00) dollars per barrel.

Sale: no.

Support — 92.47. Resistance is 98.68.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and now stands at 610 units.

Commercial oil reserves in the US increased by 2.588 to 439.945 million barrels, with the forecast of +1.029 million barrels. Inventories of gasoline fell -1.478 to 207.89 million barrels. Distillate inventories rose by 0.17 to 106.357 million barrels. Inventories at Cushing rose 0.667 to 26.897 million barrels.

Oil production has not changed and is 12 million barrels per day. Oil imports rose by 0.272 to 6.18 million barrels per day. Oil exports rose by 0.991 to 5.129 million barrels per day. Thus, net oil imports fell by -0.719 to 1.051 million barrels per day. Oil refining fell by -0.6 to 88.9 percent.

Gasoline demand rose by 0.252 to 8.93 million barrels per day. Gasoline production increased by 0.056 to 9.437 million barrels per day. Gasoline imports rose by 0.18 to 0.655 million barrels per day. Gasoline exports rose by 0.095 to 0.876 million barrels per day.

Demand for distillates fell by -0.194 to 3.878 million barrels. Distillate production fell -0.045 to 4.978 million barrels. Distillate imports rose by 0.028 to 0.139 million barrels. Distillate exports rose by 0.171 to 1.215 million barrels per day.

Demand for petroleum products fell by -0.174 to 20.587 million barrels. The production of petroleum products increased by 0.401 to 22.41 million barrels. Imports of petroleum products rose by 0.408 to 2.239 million barrels. Exports of petroleum products increased by 0.967 to 6.297 million barrels per day.

Propane demand fell by -0.766 to 0.72 million barrels. Propane production increased by 0.012 to 2.572 million barrels. Propane imports rose by 0.016 to 0.096 million barrels. Propane exports rose by 0.741 to 1.827 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week, the difference between long and short positions of managers increased by 5.7 thousand contracts. Few bulls came, few bears left. The market is in balance. The spread between long and short positions widened slightly, the bulls continue to control the situation.

Growth scenario: we consider the December futures, the expiration date is November 21. We continue to recommend purchases. Demand for fuel in the US economy remains high.

Fall scenario: a small short is possible from current levels, the chances of taking profit are small, but the risk is justified.

Recommendations for WTI oil:

Purchase: now. Stop: 80.30. Target: 120.00. Who is in positions from 82.10, 84.00 and 85.00, keep the stop at 80.30. Target: 120.00.

Sale: now. Stop: 91.30. Target: $60.00 per barrel.

Support — 81.37. Resistance — 93.73.

Gas-Oil. ICE

Growth scenario: we are considering the November futures, the expiration date is November 10. We will keep open earlier longs. We are threatened with a flight to the 1330 area.

Fall scenario: we are not thinking about shorts yet. Bulls climb up with tripled energy.

Gasoil recommendations:

Purchase: no. Who is in positions from 1055.00, 1070.00 and 1090.00, move the stop to 1040.00. Target: 1325.00.

Sale: no.

Support — 1033.25. Resistance is 1168.50.

Natural Gas. CME Group

Growth scenario: switched to December futures, expiry date 28 November. We continue to recommend longs based on a rebound upwards. Winter ahead. Sooner or later it will be scary.

Fall scenario: do not sell. Gas reserves in Europe are such a dark matter that we will get to the bottom of the truth only in the spring, or in February, when the pipes begin to freeze and burst.

Recommendations for natural gas:

Purchase: now. Stop: 4.800. Target: 15.000!!! Who is in position from 5.320, keep the stop at 4.800. Target: 15.000.

Sale: no.

Support — 5.324. Resistance is 6.642.

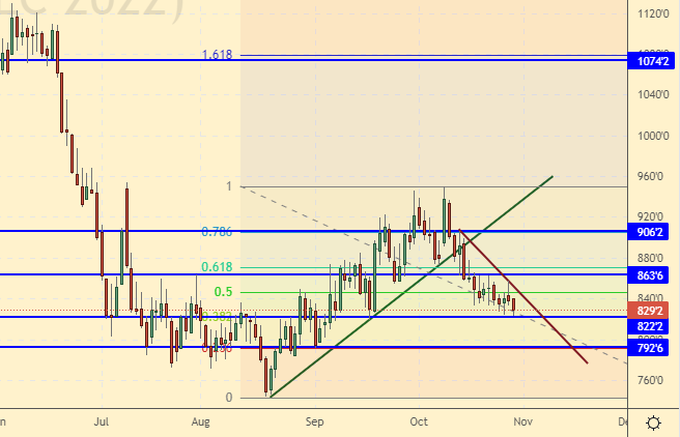

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 13.8 thousand contracts. Sellers actively entered the market, while buyers remained inert. The spread between short and long positions widened, sellers strengthened their advantage.

Growth scenario: consider the December futures, the expiration date is December 14th. Considering the very likely exit of Russia from the grain deal, it is necessary to buy here and now. In addition, the levels are extremely convenient for technical analysis purchases.

Fall scenario: let’s move the stop orders closer to the current quotes in order to take at least a part of what the market has already given us. Most likely on Monday we will grow, not fall.

Recommendations for the wheat market:

Purchase: now. Stop: 817.0. Target: 1070.0. Also when approaching 820.0. Stop: 817.0. Target: 1070.0. Who is in position from 825.0 and 840.0, move the stop to 817.0. Target: 1070.0.

Sale: no. Who is in position from 853.0, move the stop to 843.0. Target: 820.0 (750.0) cents per bushel.

Support — 822.2 (792.6). Resistance — 863.6.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 9.5 thousand contracts. Both buyers and sellers entered the market, but more buyers came. The spread between longs and shorts has widened and the bulls’ lead has increased.

Growth scenario: consider the December futures, the expiration date is December 14th. Level 670.0 stands, which allows us to count on price growth. Here you can buy.

Fall scenario: a sharp downward blow continues to suggest itself. From the point of view of technical analysis, in case of a pass below 670.0, the advantage will go to the sellers. If this breakdown actually happens, then you can enter short.

Recommendations for the corn market:

Purchase: now. Stop: 670.0. Target: 750.0. Who is in position from 680.0, keep the stop at 670.0. Target: 750.0 cents per bushel.

Sale: after falling below 670.0. Stop: 687.0. Target: 550.0. Who is in position from 688.0, move the stop to 693.0. Target: 550.0 cents per bushel.

Support — 674.4. Resistance — 700.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. Can buy. The chances of growth are small, but it is possible that the grain market will go up next week and pull soybeans with it.

Fall scenario: we can rise to 1440.0. If this happens, we will sell there. Keep open shorts.

Recommendations for the soybean market:

Purchase: now. Stop: 1370.0. Target: 1600.0.

Sale: when approaching 1440.0 Stop: 1447.0. Target: 1000.0. Those in positions from 1420.0, 1400.0 and 1390.0 move the stop to 1402.0. Target: 1000.0 cents per bushel.

Support — 1356.4. Resistance — 1398.4.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. We will buy at current levels. There is a risk, but it is justified due to the high profit/loss ratio.

Fall scenario: there is no point in selling here. The market is oversold. There is a rollback up.

Recommendations for the sugar market:

Purchase: now. Stop: 17.40. Target: 19.37.

Sale: no.

Support — 17.54 (17.18). Resistance — 18.03.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. When approaching 160.00, we will buy. After touching 160.00, prices may return to the level of 190.00, possibly 210.00.

Fall scenario: we will sell only from 210.00, the market is oversold.

Recommendations for the coffee market:

Purchase: when approaching 160.00. Stop: 140.00. Target: 210.00.

Sale: on the rise to 210.0. Stop: 223.0. Target: 160.00.

Support — 159.90. Resistance is 191.95.

Gold. CME Group

Growth scenario: before the Fed meeting, the market is in no hurry to fall or rise. Most likely, we will tend to fall against the backdrop of rising rates. Until we rise above 1700, we remain out of the market.

Fall scenario: holding shorts. In case of falling below 1630, it is possible to increase the number of sell contracts.

Recommendations for the gold market:

Purchase: think after rising above 1680.

Sale: no. If you are in position from 1700, move your stop to 1680. Target: $1480 per troy ounce.

Support — 1618. Resistance — 1674.

EUR/USD

Growth scenario: the market continues to be in the range of 60-62 rubles per dollar. It is unlikely that we will see the dollar fall against the ruble against the background of the Fed rate hike next week. Who has not entered before, you can buy at the current levels.

Fall scenario: the market does not win back the surplus in foreign trade, as successes in the international arena are put in the first place, but there are none yet. We do not sell the dollar against the ruble.

Recommendations for the dollar/ruble pair:

Purchase: when falling to 60.00 and 59.00. Stop: 57.40. Target: 74.00. Who is in position from 61.60, keep the stop at 57.40. Target: 74.00.

Sale: no.

Support — 60.68. Resistance — 64.87.

USD/RUB

Growth scenario: everything is calm. From a technical point of view, the chances for the continued growth of the dollar are not bad. If we make new purchases, then only when we approach the level of 60.00 rubles per dollar. We keep open longs.

Fall scenario: the market does not yet react to a large surplus in foreign trade. The ruble is not strengthening and this raises questions about its strength in the near future. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: When falling to 60.00 and 59.00. Stop: 57.40. Target: 74.00. Who is in position from 61.60, keep the stop at 57.40. Target: 74.00.

Sale: no.

Support — 59.61. Resistance — 64.87.

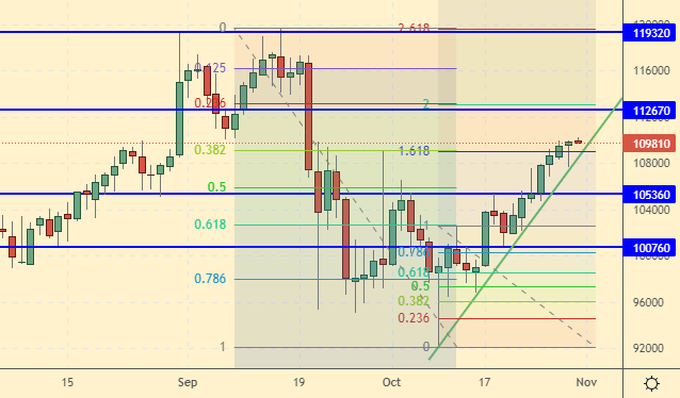

RTSI

Growth scenario: consider the December futures, the expiration date is December 15th. The current growth is very doubtful from a fundamental point of view. If large companies make a profit next year, it can be withdrawn under various pretexts for the needs of the budget. Thus, there is no certainty in dividends. While the market can be pushed up by the free money of private investors who are willing to take risks, but they will quickly run out. We doubt further growth, but we keep open long positions.

Falling scenario: when approaching the level of 113000, it is necessary to sell. Based on technical analysis, there will clearly be a struggle.

Recommendations for the RTS index:

Purchase: no. Who is in position from 105400, move the stop to 105000. Target: 120000.

Sale: when approaching 113000. Stop: 116000. Target: 80000 (50000) points.

Support — 105360. Resistance — 112670.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.