|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-8-to-12-of-august-2022-2/273398/

|

Energy market:

The Americans are flying to Taiwan again. After looking at the sluggish reaction of China, Washington decided to raise the degree. Now a whole military plane full of politicians is heading for the island. If there is no active opposition from the Celestial Empire, then in a couple of months we are waiting for the ban on communist ideology and the American police on the streets of Beijing.

Hello!

American analysts admit that if gas supplies from Russia to Europe are not resumed, they will have to burn wood, and possibly old magazines. There will be enough gas until November, and then everything. Cold and damp. But you can’t imagine how antipyretics will be dismantled in pharmacies. A gram of aspirin will cost the same as a gram of cocaine. The people will get sick. Not everyone will survive.

In this situation, there will be popular riots in Europe in the fall. Already about 100 thousand English families have declared openly that they will not pay bills for an apartment from October. Their motive: «Why would we give our money to those who do not think about their people.»

Expensive gas will support the oil market. But, for the time being, we are unlikely to expect a surge upwards to the level of 120.00 dollars per barrel for Brent oil. Rather, we will decline slightly, to begin with, to the level of $90.00 per barrel.

Grain market:

The impact of drought on the gross harvest of major crops was minimal, almost none. There will be no food problems either in 2022 or 2023. A report from the US Department of Agriculture has been released. The forecast for the gross harvest of wheat is increased by 1% to 779 million tons. The forecast for the gross harvest of corn is reduced by 0.5% to 1180 million tons. The forecast for the gross harvest of soybeans is increased by 0.36% to 393 million tons. Against such a positive background, journalists simply have nothing to scare the people with. But still found: ketchup has risen in price in the USA. Yes, now this is a new national problem. Turkish President Recep Tayyip Erdogan immediately felt how the tomato plantations he owns, yielding a crop two or three times a year, began to rise in price.

Tomato paste is now a new investment idea.

It will be extremely difficult for the grain market to rise up. There is a high probability that we will see another attempt to go down in both wheat and corn before the end of August.

USD/RUB:

On Monday, foreigners from friendly countries should come to the Russian bond market. They were allowed. The basic scenario is simple: a sell-off of Russian debt securities will begin. The national currency should weaken somewhat against the dollar, as foreign investors will sell the rubles received from the sale of bonds and buy the US currency.

There is a possibility that the Central Bank will not interfere in the situation and will calmly watch how the ruble weakens.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 20.4 thousand contracts. The buyers retreated, while the sellers tentatively increased their positions.

Growth scenario: consider the August futures, the expiration date is August 31. We see a small rise, but we will not think about buying until we are below $100.00 per barrel.

Fall scenario: sellers here can escalate their aggression. From a technical point of view, the market is capable of falling to the 80.00 level.

Recommendations for the Brent oil market: Purchase: no.

Sale: no. Who are in positions from 120.00, 117.00 and 105.00 keep the stop at 105.60. Brent target: $80.00 per barrel.

Support — 92.76. Resistance is 100.44.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 3 units to 601 units.

Commercial oil reserves in the US increased by 5.457 to 432.01 million barrels, while the forecast was +0.073 million barrels. Inventories of gasoline fell -4.978 to 220.316 million barrels. Distillate inventories rose by 2.166 to 111.49 million barrels. Inventories at Cushing rose by 0.723 to 25.189 million barrels.

Oil production increased by 0.1 to 12.2 million barrels per day. Oil imports fell by -1.171 to 6.171 million barrels per day. Oil exports fell by -1.402 to 2.11 million barrels per day. Thus, net oil imports increased by 0.231 to 4.061 million barrels per day. Oil refining increased by 3.3 to 94.3 percent.

Gasoline demand rose by 0.582 to 9.123 million barrels per day. Gasoline production increased by 0.858 to 10.15 million barrels per day. Gasoline imports fell -0.014 to 0.595 million bpd. Gasoline exports rose by 0.286 to 1.126 million barrels per day.

Demand for distillates fell by -0.153 to 3.724 million barrels. Distillate production increased by 0.189 to 5.122 million barrels. Distillate imports fell -0.03 to 0.204 million barrels. Distillate exports fell -0.341 to 1.293 million barrels per day.

Demand for petroleum products fell by -0.474 to 19.474 million barrels. Production of petroleum products increased by 0.249 to 21.881 million barrels. Imports of refined products fell by -0.068 to 2.002 million barrels. Exports of petroleum products fell by -0.007 to 6.439 million barrels per day.

Propane demand fell by -0.14 to 0.606 million barrels. Propane production fell by -0.039 to 2.344 million barrels. Propane imports rose by 0.016 to 0.121 million barrels. Propane exports rose by 0.083 to 1.565 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 28.6 thousand contracts. Sellers actively entered the market, bulls massively closed their positions. One more such week and the power in the market will pass to the sellers.

Growth scenario: consider the September futures, the expiration date is August 22. We will continue to refrain from shopping. It is possible that the market settled in a falling channel for a long time.

Fall scenario: continue to hold shorts. Those who wish can increase their positions here. We may fall to the level of $70 per barrel.

Recommendations for WTI oil:

Purchase: no.

Sale: no. Who is in positions from 114.00, 108.00 and 106.00, keep the stop at 101.30. Target: $70.00 per barrel.

Support — 86.02. Resistance — 94.28.

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. Refrain from shopping. Only after the growth above 1115.00 will we try to go long.

Fall scenario: it is worth keeping the shorts open earlier. Those who wish can sell from current levels.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 1060.0, keep the stop at 1070.0. Target: $777.0 per ton.

Support — 926.25. Resistance is 1114.25.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. We continue to hold longs. There will be an apocalypse in Europe this winter.

Fall scenario: we continue to refuse to enter the short. No one can replace Russia, and Russia has not yet been agreed.

Recommendations for natural gas:

Purchase: no. Who is in position between 6.000 and 5.500, move the stop to 7.400. Target: $15,000 for 1 million BTUs.

Sale: no.

Support — 7.527. Resistance is 9.613.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 5.2 thousand contracts. There is some pressure from sellers, but it has no effect on quotes yet.

Growth scenario: consider the September futures, the expiration date is September 14th. We continue to think that it makes no sense to think about buying while the market is below the level of 850.0 cents per bushel. Out of the market.

Fall scenario: we will sell from current levels. Market growth is not convincing. Good fundamental data on the gross harvest of wheat should put pressure on prices.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 860.0 cents per bushel.

Sale: now. Stop: 823.0. Target: 650.0 cents per bushel.

Support — 783.2. Resistance — 820.6.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers increased by 16.7 thousand contracts. Approximately how many sellers left the market, so many buyers entered. It is possible that these were the same people who changed their view of the development of events.

Growth scenario: consider the September futures, the expiration date is September 14th. We will keep previously open longs from the level of 625.0 cents per bushel. The position is not the best, so we will tighten the stop order.

Fall scenario: in this area it is necessary to sell. We are waiting for the appearance of a red daily candle and enter the short.

Recommendations for the corn market:

Purchase: no. Who is in position from 625.0, move the stop to 612.0. Target: 700.0 cents per bushel. Sale: after the appearance of a daily red candle. Stop: above its maximum. Target: 450.0 cents per bushel.

Support — 614.2. Resistance — 641.2.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. The current rise looks optional. Out of the market.

Fall scenario: holding shorts. Those interested can sell here. The story of the growing soybeans is distrustful against the backdrop of USDA data. Recommendations for the soybean market: Purchase: no.

Sale: now. Stop: 1575.0. Target: 1360.0 cents per bushel. Those in positions between 1520 and 1510 keep the stop at 1575. Target: 1360.0 cents per bushel.

Support — 1484.2. Resistance — 1606.0.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. And we took it, and suddenly grew. While out of the market.

Fall scenario: continue to hold shorts. We believe that the market may leave at 15.20. You can sell from current levels.

Recommendations for the sugar market:

Purchase: not yet.

Sale: now. Stop: 18.70. Target: 15.20. Who is in position from 19.40 and 19.00, keep the stop at 18.70. Target: 15.20 cents a pound.

Support — 18.02. Resistance — 18.84.

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. Market growth looks optional. We don’t buy.

Fall scenario: we will continue to sell. I do not want to miss the moment of turning down.

Recommendations for the coffee market:

Purchase: when approaching 140.00. Stop: 120.00. Target: 180.00 cents per pound.

Sale: now. Stop: 233.00. Target: 140.00 cents per pound.

Support — 222.25. Resistance is 241.50.

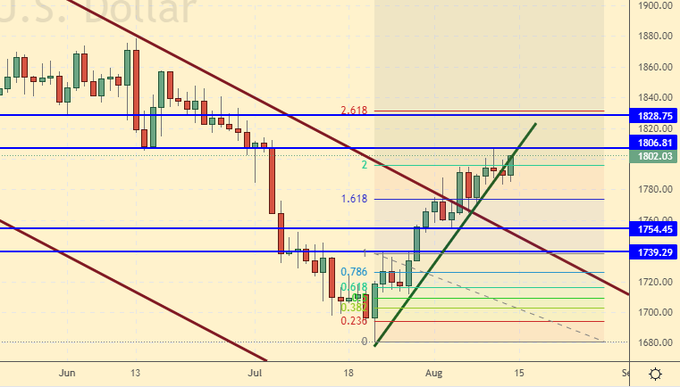

Gold. CME Group

Growth scenario: we can hit in 1830. If this happens, then the bulls may come into the market. If the 1800 area holds out and we move down, then the risk of collapse by 1620 will increase significantly.

Fall scenario: here you can sell, and aggressively. The stop order will be close.

Recommendations for the gold market:

Purchase: no. Those in positions between 1695 and 1700 move the stop to 1780. Target: $2300 a troy ounce.

Sale: now. Stop: 1811. Target: 1612.

Support — 1754. Resistance — 1828.

EUR/USD

Growth scenario: amid high energy prices, we do not believe in the strength of the euro. We don’t buy.

Fall scenario: it is necessary to sell. We continue to assume that the pair is able to go to 0.9700.

Recommendations for the EUR/USD pair: Purchase: no.

Sale: now. Stop: 1.0430. Target: 0.9700. Who is in position from 1.0350, keep a stop at 1.0430. Target: 0.9700.

Support — 1.0116. Resistance is 1.0365.

USD/RUB

Growth scenario: from the point of view of technology, the ruble remains in a growing price channel. However, he can easily get out of it in one day, so the situation is extremely delicate. Having stood in the range all week, the ruble only increased the state of uncertainty. See how the market opens on Monday, if we start to grow, we can try to go long. If there is a downward movement, then it would be reasonable to wait for the fall to 56.00 and think about buying there.

Fall scenario: if quotes fall below 58.80 on Monday, you can sell. Otherwise, we remain out of the market. We hold the previously opened positions.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth on Monday above 62.70. Stop: 61.10. Target: 74.00 rubles per dollar. Who is in position from 54.00 and 57.80, keep the stop at 59.20. Target: 74.00 rubles per dollar.

Sale: in case of falling below 58.80. Stop: 60.30. Target: 56.00 (46.00?!) rubles per dollar. Who is in position from 61.20, keep the stop at 62.70. Target: 56.60 (46.00?!) rubles per dollar.

Support — 58.92. Resistance — 62.76.

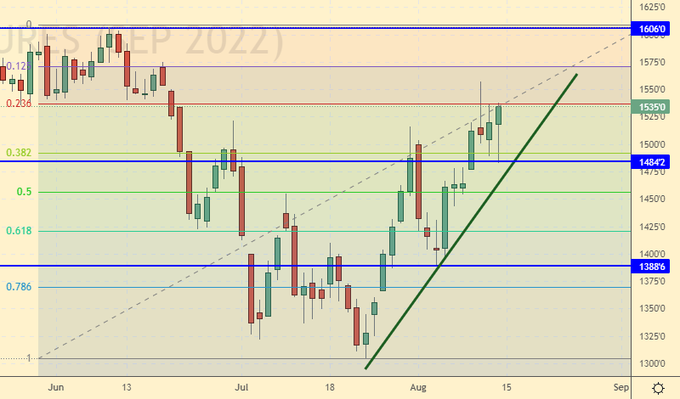

RTSI

Growth scenario: the Russian stock market can grow only on the money that domestic investors are willing to invest in it. And this money is clearly not much. It is possible to go long in the current situation, but it must be done with an understanding of the risks.

Fall scenario: we will continue to hold short positions. A move to 96,000 and 88,000 points is possible. While we manage to sell raw materials. But it is possible that in the future it will become more and more difficult.

Recommendations for the RTS index:

Purchase: now. Stop: 103,000. Target: 150,000 pips.

Sale: no. Who is in position from 129000, keep the stop at 114000. Target: 89000 points.

Support — 100200. Resistance — 112690.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.