|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-27-june-to-1-july-2022/269575/

|

Energy market:

Drilling activity continues to grow in the US. Soon Biden will be given a tower instead of a bicycle. It will be possible to drill right in Michelle Obama’s garden. Suddenly he finds something. Then you don’t have to meet Arabs in July either.

Hello!

Oil prices have eased slightly, but are yet to settle below $110.00 per barrel, as data on increased purchases from India and China raise doubts that oil demand has begun to decline. Moreover, Europe continues to pump into itself everything it can reach.

Looking at what is happening, one wonders, and the Russian economy was definitely only one and a half percent of the world’s. You thought everything was right there, Nobel laureates.

The latest trick is to ban the purchase of Russian gold. Well, okay, if you don’t want gold, buy sawdust fuel briquettes. They will be very relevant west of the Greenwich meridian this winter.

By reading our forecasts, you could make money in the soybean market by taking a move down from 1750 to 1530 cents per bushel.

Grain market:

The Vice-Chancellor of Germany began to wash less. He did it voluntarily. France calls for saving gas and electricity. All according to plan. They will re-introduce balls in palaces to divert attention from problems, lower prices for already cheap wine and pour perfume on themselves, trying to hide a slight stench. Imagine how famously the shares of perfume houses will grow.

So far, forecasts for the future harvest continue to be optimistic. According to the International Grain Council, we are waiting for a record grain harvest in the amount of 2,290 million tons. This is not surprising, since in the spring, all countries that had at least some kind of government became concerned about food security. Only Russia increased the area of cultivated land by 1 million ha to 81.3 million ha.

It is already clear that there will be no food shortage either this year or next year. The question remains only with the supply of grain from Russia and Ukraine, but it is unlikely that there will be strong obstacles based on humanitarian considerations. It cannot be denied that there may be elements of a redistribution of the market between participants in international trade, but they can be seen as part of the process of economic demarcation between Europe and Russia.

USD/RUB:

The Russian Government is looking for options for conducting international settlements with other countries for the supply of resources. Ideas are given up to the introduction of certain crypto-currencies. Based on the current trend, we can already assume, rather than fantasize about stopping trading on the stock exchange with a pair of dollar / ruble and euro / ruble as unnecessary. Note that this has already happened with the Swiss franc/ruble pair. Yes. This couple is no longer needed.

It is possible that some cross-rates will be withdrawn through gold, provided that the ruble is tied to it directly. However, if all trade with the West is curtailed, then there will be no need to convert anything into rubles.

The current situation for the ruble is quite comfortable, it can continue its strengthening, for example, to the level of 46.00. How useful this will be for exporters and the budget is another question.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers has decreased by 25.9 thousand contracts. The bulls trembled. Sellers can build on success.

Growth scenario: we are considering the July futures, the expiration date is July 29. We will continue to refrain from shopping. The market may go below the 100.00 level.

Fall scenario: here you can cling to the shorts. In case of falling below 100.00, you can add. No one is now saying that world GDP will grow significantly. Expected growth of 1 — 1.5 percent, and this is nothing compared to expectations for the beginning of the year in the amount of 4.2%. Such forecasts can reduce oil prices.

Recommendation:

Purchase: no.

Sale: now and on the rise to 120.00. Stop: 122.00. Target: 72.00.

Support — 106.42. Resistance is 116.19.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 10 units and now stands at 594 units.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 33.5 thousand contracts. As with Brent, we see the flight of the bulls. Moreover, for WTI, we are seeing not just the closing of positions, but also the build-up of shorts.

Growth scenario: we are considering the August futures, the expiration date is July 20. We will continue to refrain from going long. The support line is under the threat of a breakdown in the area of 100.00.

Fall scenario: from the current levels and in case the market returns to the 115.00 area, you can sell. In case of falling below 100.00, you can increase the short.

Recommendation:

Purchase: no.

Sale: now and when approaching 115.00. Stop: 118.00. Target: 70.00.

Support — 100.79. Resistance is 110.68.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, the expiration date is July 12. We will not buy. Oil prices may fall.

Fall scenario: we continue to recommend sales. We can go downhill.

Recommendation:

Purchase: no.

Sale: now. Stop: 1370.0. Target: 1000.0. Who is in position from 1320.0, move the stop to 1370.0. Target: 1000.0.

Support — 1247.50. Resistance is 1350.25.

Natural Gas. CME Group

Growth scenario: we are considering the August futures, the expiration date is July 27. Prices returned to comfortable buying levels. You can buy.

Fall scenario: we are unlikely to see a further fall. There will be constant demand for gas from Europe and Asia. We do not sell.

Recommendation:

Purchase: now and when approaching 5.000. Stop: 4.000. Target: 15.000! Count the risks.

Sale: no.

Support — 5.879. Resistance is 7.014.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers has decreased by 3.7 thousand contracts. We observe an unremarkable slight reduction in bullish positions.

Growth scenario: consider the September futures, the expiration date is September 14th. The bulls are preparing money. When approaching 860.0, you must buy.

Fall scenario: keep your shorts open. We are quite capable of reaching the 860.0 level. Recommendation:

Purchase: when approaching 860.0, then 800.0. Stop: 780.0. Target: 1400.0. Count the risks.

Sale: no. Who is in position from 1100.0, move the stop to 1060.0. Target: 860.0. You can close 20% of the position.

Support — 860.6. Resistance — 1036.6.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers decreased by 11.5 thousand contracts. Buyers slightly reduced their positions. It is too early to talk about sellers coming to power in the market.

Growth scenario: consider the September futures, the expiration date is September 14th. The levels for shopping are not ideal, but interesting. Until the market goes below 650.0, it is worth buying.

Fall scenario: Falls to 600.0 are undeniable, but short entry levels are not optimal. Out of the market. Recommendation:

Purchase: now and as we approach 650.0. Stop: 620.0. Target: 870.0.

Sale: no.

Support — 605.2. Resistance — 694.6.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. The market came to interesting levels for purchases. You can go long. Fall scenario: The market has discharged. We take profit. Further decline is a big question. Recommendation:

Purchase: now. Stop: 1410.0. Target: 1540.0.

Sale: no.

Support — 1423.4. Resistance — 1608.0.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. We do not enter the market. Looking forward to lower levels.

Fall scenario: we will keep open shorts a week earlier with targets at 16.50.

Recommendation:

Purchase: no.

Sale: no. Who is in position from 19.00, move the stop to 18.90. Target: 16.50.

Support — 17.38. Resistance — 18.49.

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. We don’t buy. The market is prone to fall. We hold the previously opened positions.

Fall scenario: good levels for short entry. A move to 175.00 cannot be ruled out.

Recommendation:

Purchase: no. Those in positions between 211.0 and 217.0 move the stop to 219.00. Target: 248.00.

Sale: now. Stop: 238.00. Target: 175.00.

Support — 220.30. Resistance is 237.55.

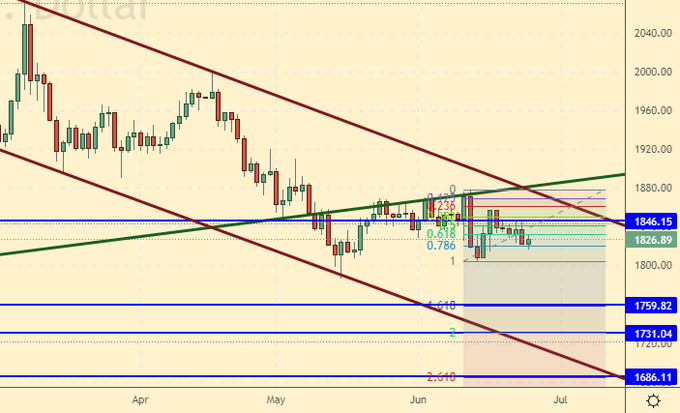

Gold. CME Group

Growth scenario: we continue to refrain from buying. The dollar has a chance to strengthen its position.

Falling scenario: we continue to assume that the current levels are interesting for entering shorts. We may fall by 1690.

Recommendations:

Purchase: when approaching 1690. Stop: 1660. Target: 2300! Think after rising above 1900.

Sale: now. Stop: 1867. Target: 1690. Whoever is in position from 1845, keep the stop at 1867. Target: 1690.

Support — 1759. Resistance — 1846.

EUR/USD

Growth scenario: summer range. For the time being, we refrain from buying.

Fall scenario: we continue to assume that the pair is able to go to 0.9700. You can sell from current levels.

Recommendations:

Purchase: no.

Sale: now. Stop: 1.0750. Target: 0.9700.

Support — 1.0358. Resistance is 1.0603.

USD/RUB

Growth scenario: while maintaining a significant foreign trade surplus, the pair will not be able to show growth. It is impossible to rule out a move to 46.00. We do not buy from current levels.

Fall scenario: it is not comfortable to sell now, as there is a possibility of a sharp change in the policy of the Central Bank or the application of any decrees or acts that can sharply weaken the national currency in just one day. We do not enter shorts in pairs.

Recommendations:

Purchase: think when approaching 46.00.

Sale: no.

Support — 46.44. Resistance — 55.63.

RTSI

Growth scenario: there are no global ideas for restoring sales markets for Russian companies, such as metallurgists, for example. It is possible that infrastructure projects will be launched that will ensure the demand for metal in the domestic market. While we continue to refrain from purchases. The RTS index above 130,000 is not visible in the current situation.

Fall scenario: we entered an interesting area to open a short. After the appearance of a red daily candle with a long body, you can open a sale.

Recommendations:

Purchase: no. Who entered after rising above 122000, move the stop to 121000. Target: 150000?

Sale: when a long red daily candle appears. Stop: 133000. Target: 100000 (80000).

Support — 116740. Resistance — 129090.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Brent, WTI, Gasoil, Natural Gas, Wheat, Corn, Soybean, Sugar, Coffee, Gold, EUR, USD, RUB, RTSI, eOil.ru

Wheat, Corn, Soybean, Sugar, Coffee, Brent, WTI, Gasoil, Natural Gas, Gold, EUR, USD, RUB, RTSI, IDK.ru

#Brent, #WTI, #Gasoil, #NaturalGas, #Wheat, #Corn, #Soybean, #Sugar, #Coffee,

#Gold, #EUR, #USD, #RUB, #RTSI, #eOil

https://www.oilexp.ru/oilstat/report/price-forecast-from-20-to-24-of-june-2022/269101/

Previous forecast

#Wheat, #Corn, #Soybean, #Sugar, #Coffee, #Brent, #WTI, #Gasoil, #NaturalGas,

#Gold, #EUR, #USD, #RUB, #RTSI, #eOil

https://exp.idk.ru/analytics/report/price-forecast-from-20-to-24-of-june-2022/590072/

Previous forecast