|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-25-to-29-of-april-2022/265094/

|

Energy market:

The work of the Russian embassy in the United States is blocked. There is no access to the account, but you have to live somehow. It is strange that Russian diplomats have some business left in the USA. Everyone needs to return to Moscow, put a fax on the table and send everyone.

What times, what customs! Hello!

In Europe, they decided to abandon Russian gas by the year 27, that is, in five years. In the current realities, when everything changes every day, these five years can be compared to five centuries in a calm period. What will happen there, what kind of life will be there, no one knows.

For now, OPEC remains firm on Western demands to increase production. There will be an increase in supply in May, but only by the previously agreed 400,000 barrels per day. Saudi Arabia will hold out for another couple of months, and then it is not clear, since entering the European market without giving anything in return to Russia, for example, its Asian contracts, is a great temptation. European countries have not yet been able to agree on a ban on oil imports from Russia at the moment, but the issue will obviously be worked out further. The West, in fact, has already lowered the iron curtain, leaving indulgences only for food products and medicines, while at home it still wants to see only hydrocarbons.

Reading our forecasts, you could make money in the oil market by taking a move down from 114.00 to 108.00 dollars per barrel. You could also make money in the natural gas market by taking a move up from $3,875 to $7,800 per 1 million BTUs.

Grain market:

In French and Greek ports, pilots play checkers with arrested Russian ships. Ships interfere with loading and unloading, so they have to be constantly rearranged. We wish dockers and customs brokers not to get confused when answering the questions “this is what”, “this is where” and “this is to whom”.

Traders are already preparing for the May USDA report. Bulls slowed down somewhat, but grain prices continue to be at high levels. The weather, in general, does not fail. Most likely, we will see an optimistic forecast for the gross wheat harvest, but traders will make their adjustments to the situation in the Black Sea region.

It will be interesting to follow the changes in the forecast for the 22/23 season, as the increased price of fertilizers could have done a disservice to farmers. Surely many went to violate technology. The end result will be affected by the reduction in costs during sowing in early August.

As an illustration of the protection of its own market, let’s take the example of Indonesia, which will close the export of palm oil from April 28 for an indefinite period. In cookies, butter and ice cream, you will have to change the recipe. It looks like we’ll soon find out what could be cheaper than palm oil.

USD/RUB:

On the 29th, on Friday, the Central Bank may go for a new reduction in interest rates despite inflation, which, according to official data, slightly fell short of 17%.

This will help smooth out the pressure on the construction market and the car market. I would like life to return to these sectors, but it is unlikely that households will now practice a model of unrestrained consumption. Note that any double-digit rates on long-term loans are prohibitive. On the market, the dollar may strengthen from the current 75 to 80 rubles.

While for foreigners it is closed to participate in the auction of a strong upward movement in the dollar / ruble pair, we do not expect.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 26.6 thousand contracts. Bulls actively entered the market. The prospect of an embargo on Russian energy carriers by the EU unnerved traders.

Growth scenario: we are considering the May futures, the expiration date is May 31. We will continue to keep long from 103.00. In terms of technology, the market could rise higher.

Falling scenario: there is a slight chance of a fall towards 82.00, possibly 72.00. Can be sold. Recommendation:

Purchase: no. Who is in position from 103.00, move the stop to 98.00. Target: 150.00.

Sale: now. Stop: 110.60. Target: 72.00.

Support — 97.00. Resistance is 109.72.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 1 unit and now stands at 549 units.

Commercial oil reserves in the US fell by -8.02 to 413.733 million barrels, while the forecast was +2.471 million barrels. Inventories of gasoline fell by -0.761 to 232.378 million barrels. Distillate inventories fell -2.664 to 108.735 million barrels. Inventories at Cushing fell -0.185 to 26.152 million barrels.

Oil production increased by 0.1 to 11.9 million barrels per day. Oil imports fell by -0.158 to 5.837 million bpd. Oil exports rose on 2.09 to 4.27 million barrels per day. Thus, net oil imports fell by -2.248 to 1.567 million barrels per day. Oil refining increased by 1 to 91 percent.

Gasoline demand rose by 0.132 to 8.868 million barrels per day. Gasoline production increased by 0.335 to 9.836 million barrels per day. Gasoline imports rose by 0.158 to 0.597 million barrels per day. Gasoline exports rose by 0.032 to 0.918 million barrels per day.

Demand for distillates rose by 0.338 to 3.822 million barrels. Distillate production increased by 0.162 to 4.816 million barrels. Distillate imports fell -0.05 to 0.104 million barrels. Distillate exports fell -0.261 to 1.478 mb/d.

Demand for petroleum products increased by 0.262 to 19.033 million barrels. Production of petroleum products increased by 0.165 to 20.566 million barrels. Oil product imports fell by -0.096 to 1.86 million barrels. Exports of petroleum products fell by -0.477 to 6.33 million barrels per day.

Demand for propane rose by 0.254 to 1.083 million barrels. Propane production increased by 0.005 to 2.428 million barrels. Propane imports fell -0.023 to 0.093 million barrels. Propane exports fell by -0.365 to 1.205 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 0.5 thousand contracts. Speculators practically remained on their previous positions. Market uncertainty is growing.

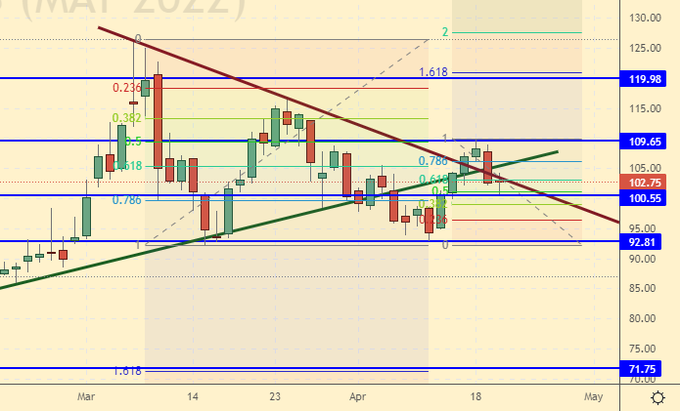

Growth scenario: we are considering the June futures, the expiration date is May 20. In case of falling to 100.00, you can buy. You can also go long from current levels.

Falling scenario: if the market falls below 99.00, we will go short again. We can not rule out a fall to 72.00.

Recommendation:

Purchase: now and on a pullback to 100.00. Stop: 95.00. Target: 150.00.

Sale: after falling below 99.00. Stop: 107.00. Target: 72.00. Count the risks.

Support — 100.55. Resistance is 109.65.

Gas-Oil. ICE

Growth scenario: consider the May futures, the expiration date is May 12. We hold longs. There will be problems with fuel this year.

Falling scenario: in this situation, short is interesting. Let’s go on sale.

Recommendation:

Purchase: no. Who is in position from 980.0, move the stop to 1040.0. Target: 1500.0!

Sale: now. Stop: 1210.0. Target: 750.0.

Support — 1078.00. Resistance is 1189.50.

Natural Gas. CME Group

Growth scenario: we are considering the June futures, the expiration date is May 26. All with a profit. Again we will enter the log from 5.200. There is no excess gas left in America. Everything is contracted.

Falling scenario: we will not sell. The market is nervous, the levels are too low.

Recommendation:

Purchase: when approaching 5.200. Stop: 4.700. Target: 12.000.

Sale: no.

Support — 6.113. Resistance — 7.233.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers has decreased by 2.3 thousand contracts. There are slightly more bulls than bears in the market. We can say that we see an equilibrium picture.

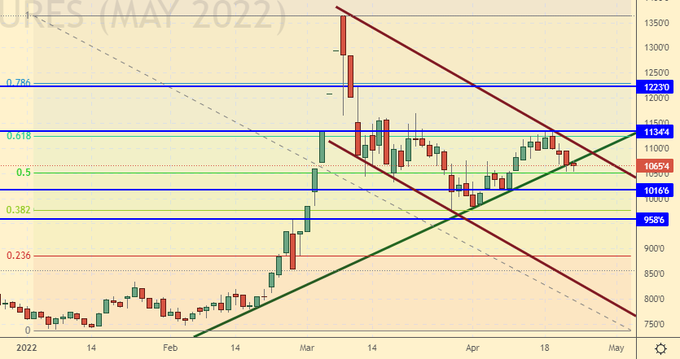

Growth scenario: we are considering the May futures, the expiration date is May 13. The situation is delicate. We keep long, but we understand that the stop loss can work.

Falling scenario: if the market closes any day below 1050.0 next week, sell. In case of downward movement, the move to 900.0 is quite probable.

Recommendation:

Purchase: no. Who is in position from 1060.0, keep the stop at 1010.0. Target: 1500.0.

Sale: if the day closes below 1050.0. Stop: 1100.0. Target: 900.0.

Support — 1016.6. Resistance — 1134.4.

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Last week, the difference between long and short positions of managers increased by 6,000 contracts. Bulls do not let the situation out of control. There are no hints of a break in the upward trend.

Growth scenario: we are considering the May futures, the expiration date is May 13. I would like to see the level 840.0. We hold longs. Pressing a stop order.

Falling scenario: the recommendation is the same, when approaching 840.0, you can try to sell, provided that wheat starts to correct. Recommendation:

Purchase: no. Who is in position from 764.0, move the stop to 769.0. Target: 839.0.

Sale: when approaching 840.0, provided that wheat is already falling. Stop: 860.0. Target: 720.0.

Support — 771.0. Resistance is 819.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the May futures, the expiration date is May 13. We continue to refuse purchases, as the current levels have approached a strong resistance zone.

Falling scenario: short from 1800.0 is the main idea in this situation.

Recommendation:

Purchase: no.

Sale: when approaching 1800. Stop: 1870. Target: 1500.0.

Support — 1644.2. Resistance — 1801.2.

Sugar 11 white, ICE

Growth scenario: we are considering the July futures, the expiration date is June 30. Turned down too early. The situation is not clear. Out of the market.

Falling scenario: shorts from 21.60 are possible. Sales from current levels are not interesting. Recommendation:

Purchase: no.

Sale: when approaching 21.60. Stop: 22.27. Target: 19.00.

Support — 17.35. Resistance is 20.50.

Сoffee С, ICE

Growth scenario: we are considering the May futures, the expiration date is May 18. We don’t buy. The bulls have lost the lead.

Falling scenario: short is possible. Here you can sell.

Recommendation:

Purchase: no.

Sale: now. Stop: 235.0. Target: 180.0 (150.0).

Support — 210.10. Resistance is 237.95.

Gold. CME Group

Growth scenario: they could not go above 2000. Out of the market.

Falling scenario: the position is bearish. Here you can sell. Gold falls ahead of the Fed meeting.

Recommendations:

Purchase: no.

Sale: now and on rise to 1960. Stop: 1983. Target: 1840 (1750). Count the risks.

Support — 1900. Resistance — 1958.

EUR/USD

Growth scenario: nothing has changed. We continue to wait for the market at 1.0600. The Fed will raise rates, but the ECB may wait.

Falling scenario: we continue to hold shorts. It is very likely that the target at 1.0600 will be reached.

Recommendations:

Purchase: when approaching 1.0600. Stop: 1.0400. Target: 1.2100 (1.5000?!)

Sale: no. Who is in position from 1.1020, move the stop to 1.0960. Target: 1.0600.

Support — 1.0678. Resistance is 1.0933.

USD/RUB

Growth scenario: It is possible that we will see a slight increase in the pair next week. Without the weakening of currency regulation, there will be no strong strengthening of the dollar.

Falling scenario: we will not sell. The Government does not need a strong ruble, as it will worsen the situation with budget revenues.

Recommendations:

Purchase: now. Stop: 74.00. Target: 85.00 (120.00?!).

Sale: think when approaching 100.0.

Support — 71.02. Resistance — 77.75.

RTSI

Growth scenario: we see no reason for growth. Only long-term investors can now enter the market. Companies with state participation are at risk due to sanctions. We are not talking about the normal development of the economy now. Only faith in a bright future strengthens rare bulls. We continue to consider the level of 80,000 comfortable for buying futures on the RTS index.

Falling scenario: levels are slightly lower for selling, however, short entry is possible. Recommendations:

Purchase: when approaching 80000. Stop: 70000. Target: 130000. Calculate risks. Meditate. Read news.

Sale: now. Stop: 102000. Target: 80000 (50000). Who is in position from 108000, move the stop to 102000. Target: 80000 (50000).

Support — 87810. Resistance — 97190.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.