|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-21-to-25-of-march-2022/262366/

|

Energy market:

The Germans are encouraged to eat as little meat as possible to annoy Russia, and no one but the head of the Ministry of Agriculture of Germany. And yes, everyone go vegan. Now you don’t have to compete with our athletes, but for physical education, you can keep fit on the grass. Moreover, it will soon be possible to smoke again in the West. And everywhere. And you can also drink everywhere.

Hello!

Gas pumping through Nord Stream 1 and through the territory of Ukraine is in full swing. And most importantly, everyone agrees. There are simply no disagreements. Everyone takes a position of principle, that is, an advantageous position for themselves.

After Biden began to beg around the world in search of oil, Boris, who is Johnson, joined him. And then it turned out that England, of course, is great, and all sorts of museums with theaters there, it’s just great, but there is no oil. Neither the Arabs have it, nor the Persians. With the latter, it is also necessary to sign an agreement on a nuclear deal, but still nothing. Everything doesn’t add up.

Most likely, Brent in this situation will stand above the level of $100.00 per barrel. The International Energy Agency predicted a drop in oil production in Russia due to sanctions from 10 to 7 million barrels of oil. In fact, we must count the fall from 11 to 8, because somewhere the respected Agency is losing one million barrels of oil per day. But let’s forgive them.

Note that Halliburton announced the curtailment of its activities in Russia, Schlumberger and Baker Hughes — the suspension of new investments. The lack of advanced oil production technologies and maintenance services will really complicate the life of the oil sector and we will see some kind of drop in production in the coming months.

Grain market:

According to unconfirmed reports, the Turks are ready to buy wheat at $420-430 per ton, and genetically modified wheat will be admitted to tenders. Recall that 6 months ago the price of $300 per ton seemed unreasonably high.

Now this is a new reality. As the armed confrontation between Moscow and Kiev drags on, there is growing uncertainty about how the sowing season will go and what will grow in the fields.

The fact that the West will not buy Russian grain even after the lifting of the export ban by Russia itself is still a big question, since no one knows how the season will turn out. They pump gas, they pump oil, they will also buy grain. Of course, if they sell. Demand from grain importers this year will be at a high level, there is no doubt about it. Logistic costs for a number of transactions may increase due to the beginning of the transformation of the unipolar world into a multipolar one. They will drag barges across the ocean, nothing can be done. Politics.

USD/RUB:

France has frozen the assets of the Central Bank of the Russian Federation for 22 billion euros. What can I say… The Russians left Paris in 1814 in vain.

Now all this chaos would not exist. The US Federal Reserve raised the rate by 0.25%, which was a kind of compensation for those who believe only in the dollar. Strong or weak doesn’t matter. The main thing is just to believe. It is possible that the rate will be raised six more times this year. Whether this will help the US economy is a big question.

Elvira Nabiullina will remain the head of the Central Bank for another five years. The President expressed his full confidence in her. The Central Bank of the Russian Federation left the rate at the level of 20% per annum.

The rate will remain at this level as long as hostilities are ongoing in Ukraine. In the future, we can count on a gradual reduction in the rate, but it is unlikely to drop below 10% before the end of this year.

The black market for cash currency is clearly warmed up now, and it will survive the second wave closer to summer, since not every potential tourist raises his hand to buy a cash dollar for 150 rubles. However, for some, working with cash is also a business. Let’s celebrate them during this difficult time.

Note that closer to the summer, Turkey, Egypt and possibly a number of Asian countries will begin to accept rubles, which should, in fact, lead to the strengthening of the national currency and the expansion of the sales market for Russian goods, since the rubles accepted from Russian tourists will have to go somewhere . It is most profitable to buy in Russia with the proceeds the goods that the state-resorts need.

As long as the ruble rate remains at 100.0 against the dollar, a short-term nod towards the 95.00 mark is possible.

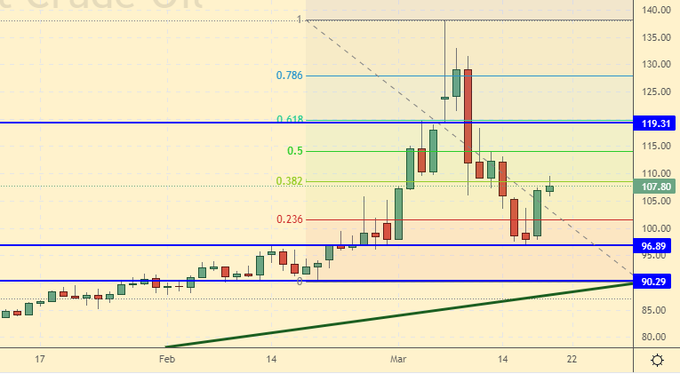

Brent. ICE

We are looking at the volumes of open interest in Brent. You should keep in mind that this data is three days old (for Tuesday of the last week), it is also the most recent one published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 12,000 contracts. In conditions of uncertainty, sellers left the market, buyers continued to hold long positions.

Growth scenario: we consider the March futures, the expiration date is March 31. It is worth showing some stubbornness and not giving up purchases at this stage. A move to 120.00 is possible.

Falling scenario: we will not sell. The kingdoms of the Arabian Peninsula are in no hurry to share oil with Biden.

Recommendation:

Purchase: now. Stop: 94.00. Target: 120.00 (155.00?!). Count the risks.

Sale: no.

Support — 96.89. Resistance is 119.31.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 3 units to 524 units.

Commercial oil reserves in the US increased by 4.345 to 415.907 million barrels, while the forecast was -1.375 million barrels. Inventories of gasoline fell -3.615 to 240.991 million barrels. Distillate inventories rose by 0.332 to 114.206 million barrels. Inventories at Cushing rose by 1.786 to 24.007 million barrels.

Oil production has not changed and is 11.6 million barrels per day. Oil imports rose by 0.076 to 6.395 million barrels per day. Oil exports rose by 0.514 to 2.936 million barrels per day. Thus, net oil imports fell by -0.438 to 3.459 million barrels per day. Oil refining increased by 1.1 to 90.4 percent.

Gasoline demand fell by -0.018 to 8.944 million barrels per day. Gasoline production fell by -0.197 to 9.38 million barrels per day. Gasoline imports fell -0.229 to 0.531 million barrels per day. Gasoline exports rose by 0.113 to 0.78 million barrels per day.

Demand for distillates fell by -0.883 to 3.704 million barrels. Distillate production increased by 0.305 to 4.945 million barrels. Distillate imports fell -0.052 to 0.222 million barrels. Distillate exports rose by 0.341 to 1.415 million barrels per day.

Demand for oil products fell by -0.558 to 20.652 million barrels. Production of petroleum products fell by -0.083 to 21.548 million barrels. Imports of petroleum products fell by -0.413 to 2.109 million barrels. The export of oil products increased by 0.625 to 6.369 million barrels per day.

Demand for propane rose by 0.344 to 1.532 million barrels. Propane production increased by 0.06 to 2.366 million barrels. Propane imports fell -0.015 to 0.138 million barrels. Propane exports fell by -0.213 to 1.29 mb/d.

We are looking at the volumes of open interest on WTI. You should keep in mind that this data is three days old (for Tuesday of the last week), it is also the most recent one published by the ICE exchange.

Last week the difference between long and short positions of managers decreased by 11.2 thousand contracts. A number of bulls exited the market, taking profits. It is impossible to exclude the influx of new money into the purchase.

Growth scenario: we are considering the May futures, the expiration date is April 20. You can buy from the current levels. We keep open longs. Falling scenario: do not sell. Speculators smelled blood. Where five dollars for a gallon of gasoline, there are seven and ten. And they will buy, but not all of them.

Recommendation:

Purchase: now. Stop: 92.00. Target: 150.00?! Who is in position from 107.00, keep the stop at 92.00. Target: 150.00?!

Sale: no.

Support — 92.09. Resistance is 110.43.

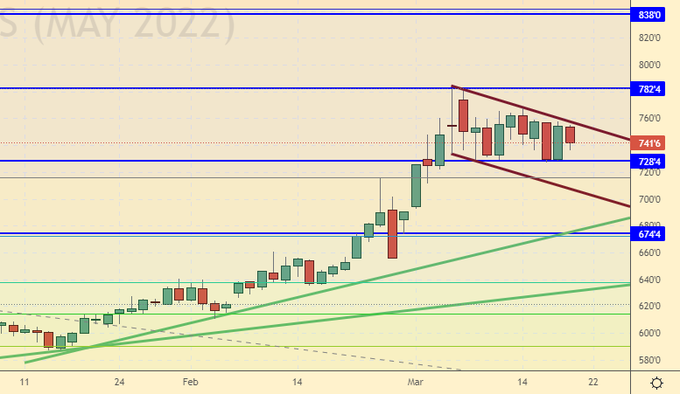

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. The rise in retail fuel prices continues. And sometimes it is panicky. We must buy.

Falling scenario: we will not sell. It is not yet clear at what levels the growth will end. Recommendation:

Purchase: now. Stop: 904.0. Target: 1800.0?! Count the risks.

Sale: no.

Support — 867.75. Resistance is 1186.25.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 27. We continue to hold longs. Everyone is scared. If Europe starts to ban the export of medicines, seeds and other sensitive items to Russia, Miller will solemnly turn off the tap.

Fall scenario: we will not sell. Looks like the Americans have been dominating. There will be a severe energy crisis in the US.

Recommendation:

Purchase: no. Who is in position from 3.875, move the stop to 4.030. Target: 8.777.

Sale: no.

Support — 4.590. Resistance is 5.409.

Wheat No. 2 Soft Red. CME Group

We are looking at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, 09.03.22 – 15.03.22, the difference between long and short positions of managers increased by 3.2 thousand contracts. Speculators are somewhat confused. The bulls maintain control of the market, but the huge volatility interferes with normal trading.

Growth scenario: we are considering the May futures, the expiration date is May 13. Current levels are interesting for i shopping. Yes, we can go to 900.0, but we are unlikely to go even lower. Falling scenario: we will not sell, The world is restless. Everyone yells, they want to eat. Recommendation:

Purchase: now. Stop: 1010.0. Target: 1500.0. Count the risks.

Sale: no.

Support — 1029.6. Resistance is 1224.0.

We are looking at the volumes of open interest of managers in corn. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 5.4 thousand contracts. Speculators did not take active actions in the market. Bulls are in complete control of the situation. Another wave of growth cannot be ruled out.

Growth scenario: we are considering the May futures, the expiration date is May 13. Let’s continue to hold longs. Our target is at 838.0. Fear of a disastrous season in Ukraine will push prices up.

Falling scenario: do not sell. It is absolutely not clear how high the price can go. Recommendation:

Purchase: no. Who is in position from 685.0, keep the stop at 718.0. Target: 838.0.

Sale: no.

Support — 728.4. Resistance — 782.4.

Soybeans No. 1. CME Group

Growth scenario: we are considering the May futures, the expiration date is May 13. We continue to expect some correction. The current levels for entering a long position are too high, but you can also buy on them.

Falling scenario: a serious fall is in question, as the world may not see Ukrainian sunflower this season, which means that prices for all oilseeds will be at a high level. We do not sell. Recommendation:

Purchase: think when approaching 1570.0. Stop: 1540.0. Target: 2000.0. Or now. Stop: 1634.0. Target: 2000.0.

Sale: no.

Support — 1574.6. Resistance — 1801.2.

Sugar 11 white, ICE

Growth scenario: we are considering the May futures, the expiration date is April 29. Let’s keep the bullish position. Obviously there will be problems with the harvest of sugar beets in Ukraine.

Falling scenario: we will not sell, the situation is far from normalization.

Recommendation:

Purchase: now. Stop: 18.30. Target: 23.20. Who is in position from 17.80, keep the stop at 18.30. Target: 23.20.

Sale: no.

Support — 18.34. Resistance — 19.00.

Сoffee С, ICE

Growth scenario: we are considering the May futures, the expiration date is May 18. Came out of the growing channel down. We take a break. If it falls to 175.00, it is a must buy.

Falling scenario: shorts will continue to hold. When approaching 200.0. you can take profit.

Recommendation:

Purchase: When falling to 175.0. Stop: 163.00. Target: 300.00?! Also think when approaching 200.00.

Sale: no. Who is in position from 250.00, move the stop to 237.00. Target: 200.00.

Support – 200.90. Resistance is 220.45.

Gold. CME Group

Growth scenario: we will resume purchases either after rising above 1960.0 or falling to 1830.0. Note that the dollar may strengthen against the background of the beginning of the cycle of rate hikes.

Falling scenario: do not sell. If the international situation were calm, we could talk about shorts. Recommendations:

Purchase: if up above 1960. Stop: 1920. Target: 2300. Or down to 1830. Stop: 1780. Target: 2300.

Sale: no.

Support — 1878. Resistance — 1957.

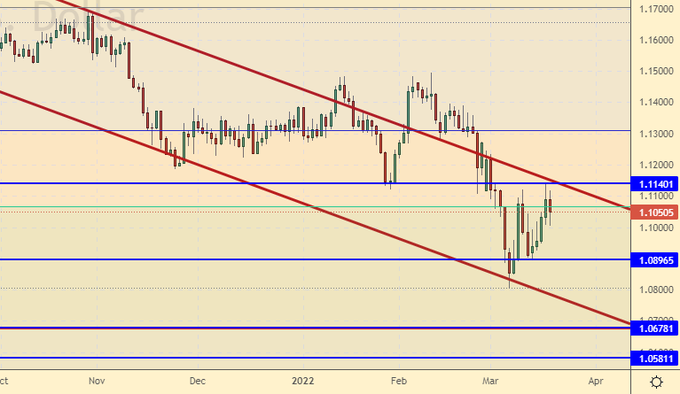

EUR/USD

Growth scenario: the euro will suffocate under the onslaught of rising energy prices. If so much depends on such a small Russia with its 1.5% share in world GDP, maybe you, gentlemen, think wrong and give yourself prizes for this, for example, Nobel Prizes.

Falling scenario: earlier increased the short from 1.1100. You can also sell here. We are waiting for the continuation of the fall to 1.0600.

Recommendations:

Purchase: when approaching 1.0600. Stop: 1.0400. Target: 1.2100 (1.5000?!)

Sale: now. Stop: 1.1210. Target: 1.0600. Who is in position between 1.1370 and 1.1100, keep a stop at 1.1210. Target: 1.0600.

Support — 1.0896. Resistance is 1.1140.

USD/RUB

Growth scenario: Central Bank keeps the rate at 20%. Exporters are required to sell 80% of the proceeds. The ruble is getting strong support. Now every day the market will be in favor of the Central Bank, as traders are aware of the new reality. Sober calculation comes to replace panic. OFZ trading will start on the MICEX on Monday. We can roll back to the area of 90.00 — 95.00, but not for long.

Falling scenario: in the event of growing problems in the West, and there are prerequisites for this, Russia will be forgotten. Then it will be possible to talk about the possible strengthening of the ruble, but, alas, not now.

Recommendations:

Purchase: on a rollback to 90.00. Stop: 84.00. Target: 120.00 (150.00?!). Who remained in the position from 90.00, keep the stop at 98.00. Target: 150.00?!.

Sale: no.

Support — 101.75. Resistance is 114.18.

RTSI

Growth scenario: The Central Bank will not open trading on the stock market in the near future. Quotes will obviously be at low levels, and this is a blow to the psyche of ordinary investors. Professionals have already digested all the gloomy stories in their heads. We hope to see auctions in April.

Falling scenario: almost everything has already happened. They have already taken away all the yachts from the oligarchs, Paris has already frozen our money, and not only from the Central Bank, but also from citizens. Soon they will take away houses, then clothes. Nothing. Come home naked. And there is enough space for all of us. Recommendations:

Purchase: think after the resumption of trading. Count risks.

Sale: no.

Support — 12720. Resistance — 101550.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.