|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-28-february-to-4-of-march-2022/260802/

|

Energy market and grain market:

Today we are analyzing the situation globally, according to the scale of the events taking place.

Like in counting-out game «We shared an orange, there are many of us, and he is alone».

What are we talking about?

On the gold and foreign exchange reserves of the Russian Federation in the amount of 640 billion dollars. But it’s not just about money.

Hello!

Almost half, about 48% of all assets of the Central Bank of the Russian Federation are placed in such countries as France, Japan, the USA, Great Britain. Thus, on Sunday, at the suggestion of Washington, half of the paper money was taken away from Russia, one quarter of the reserves in currencies and one quarter, which is in gold, remain. And in order to force Russia, just like 100 years ago, just like 80 years ago, to give up the washed gold for some goods or for debts, there will be a further game.

A good decision on the part of Moscow would be not to open trading on the stock exchange on Monday and not to conduct them until March 9th. Otherwise, Black Monday and Black Thursday that passed last week will take on a light gray color, since everything is known in comparison.

India, China, Brazil, Argentina, the United Arab Emirates are in no hurry to accuse Russia of all sins. Turkey breathes heavily, but is silent. Yes, in fact, there is a confrontation between Moscow and Kiev, but, in fact, what is happening is the beginning of a revolt of the colonies against the Anglo-Saxon empire. Russia is at the forefront, but it is not alone.

The slave rebellion must be put down. Otherwise, the empire and the satellites, hastily closing their skies and refusing to play football with Russia, will cease to exist in their current form.

We are not alone these days.

Argentina and Brazil unanimously declared that what is happening in Ukraine has nothing to do with South America, and therefore there is nothing to discuss.

China is limited to political trolling so far, they have something to lose, 3.2 trillion dollars in gold reserves is … that’s a lot. They need to be somehow slowly moved or cashed out so that they are not taken away.

India has already announced the possibility of making settlements with Russia in rupees.

There are many who can present something to the Anglo-Saxons. All of Asia, the Middle East, all of North Africa, South and Central America. There are a lot of dissatisfied people on the planet, in fact: seven billion out of eight.

Brent is not seen below 84.00 in the current situation. The move to 110.0 remains possible.

The grain market is unlikely to be able to break the uptrend. Only a correction of 10-15% from the current levels is possible, after which the growth is likely to continue.

By reading our forecasts, you could make money in the corn market by taking a move up from 625.0 to 685.0 cents per bushel. You could also make money on the dollar/ruble pair by taking a move up from 77.30 to 84.70. And also you could earn on the futures on the RTS index by taking a move down from 145000 to 82200.

USD/RUB:

Separately, a few words about the ruble. Not all of the Central Bank’s reserves have been seized, but now we have become more vulnerable. It is possible that by the end of March, as soon as possible, due to the attack of biased speculators, we will receive a rate of 120 rubles per dollar. This can be avoided by acting tough.

Whether the Kremlin will raise rates is not yet clear. You can refuse to pay dividends abroad. You can nationalize a number of enterprises, you can declare a refusal to pay their debts. There are still tools to influence inflamed minds. Biden says that the next step after freezing the assets of the Russian Central Bank is a nuclear war. Grandpa is wrong. Even with a moderate imagination, you can come up with a lot of things.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 9.4 thousand contracts. In the current tense situation, the market is unlikely to be inclined to decline. Growth scenario: March futures, the expiration date is March 31. Here you can buy cautiously with the target at 110.0.

Falling scenario: sell when approaching 110.0. Sales from current levels do not look optimal. We do not deny the possibility of a move to 84.00. Global GDP is very likely to fall this year. Oil consumption will decrease.

Recommendation:

Purchase: now. Stop: 93.30. Target: 110.0. Who is in position from 96.60, move the stop to 93.30. Target: 110.00.

Sale: now and when approaching 110.0. Stop: 117.0. Target: 84.00.

Support — 94.22. Resistance is 105.72.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 2 units and now stands at 522 units.

Commercial oil reserves in the US increased by 4.514 to 416.022 million barrels, while the forecast was +0.442 million barrels. Inventories of gasoline fell -0.582 to 246.479 million barrels. Distillate inventories fell -0.584 to 119.678 million barrels. Inventories at Cushing fell -2.049 to 23.778 million barrels.

Oil production has not changed and is 11.6 million barrels per day. Oil imports rose by 1.038 to 6.828 million barrels per day. Oil exports rose by 0.415 to 2.686 million barrels per day. Thus, net oil imports increased by 0.623 to 4.142 million barrels per day. Oil refining increased by 2.1% to 87.4%.

Gasoline demand rose by 0.087 to 8.657 million barrels per day. Gasoline production increased by 0.44 to 9.27 million barrels per day. Gasoline imports fell -0.139 to 0.416 million bpd. Gasoline exports rose by 0.246 to 0.685 million barrels per day. Demand for distillates fell by -0.088 to 4.233 million barrels.

Distillate production increased by 0.238 to 4.693 million barrels. Distillate imports fell -0.021 to 0.416 million barrels. Distillate exports rose by 0.166 to 0.96 million barrels per day. Demand for petroleum products fell by -1.258 to 21.483 million barrels.

Production of petroleum products increased by 0.048 to 21.585 million barrels. Imports of petroleum products fell by -0.504 to 1.956 million barrels. The export of oil products increased by 0.466 to 4.774 million barrels per day. Propane demand fell by -0.187 to 1.88 million barrels. Propane production increased by 0.137 to 2.448 million barrels. Propane imports fell -0.005 to 0.147 million barrels. Propane exports rose by 0.029 to 1.273 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 20.2 thousand contracts. Sellers appeared on the market. Growth prospects for the global economy have become much more modest.

Growth scenario: April futures, the expiration date is March 22. Here you can buy with the target at 106.00. Above this mark, the market is not visible. Falling scenario: selling when approaching 106.00 is mandatory. You can also go short from current levels.

Recommendation:

Purchase: now. Stop: 88.20. Target: 106.00. Who is in position from 93.00, move the stop to 88.20. Target: 106.00.

Sale: now and when approaching 106.00. Stop: 111.70. Target: 85.00 (65.00).

Support — 87.54. Resistance is 100.47.

Gas-Oil. ICE

Growth scenario: March futures, the expiration date is March 10. It makes sense to close longs at current levels. We don’t buy anymore.

Falling scenario: you can sell here. In connection with the hostilities in Ukraine, there is a risk of a fall in world GDP and a reduction in fuel consumption.

Recommendation:

Purchase: no. Close all positions.

Sale: now. Stop: 887.00. Target: 660.00.

Support — 790.00. Resistance is 929.00.

Natural Gas. CME Group

Growth scenario: April futures, the expiration date is March 29. Europe will refuse cheap Russian gas and will buy expensive American. The US has almost a monopoly. And since there is a monopoly, there will be no cheap prices. We hold longs.

Falling scenario: we will not sell. The redistribution of the world has just begun. Its final configuration is questionable.

Recommendation:

Purchase: no. Who is in position from 3.875, keep the stop at 3.730. Target: 8.777.

Sale: no.

Support — 4.152. Resistance is 5.005.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 17.1 thousand contracts. There are more bulls, although they have not yet been able to surpass sellers in the number of contracts. An autumn bun in London this year can be very expensive.

Growth scenario: May futures, the expiration date is May 13. We continue to hold longs. Target at 1170.0 beckons us.

Falling scenario: it is still dangerous to sell. Too many uncertainties.

Recommendation:

Purchase: no. Who is in position from 777.0, keep the stop at 767.0. Target: 1170.0.

Sale: no.

Support — 882.0. Resistance — 1173.2.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers increased by 21.6 thousand contracts. Buyers continue to control the market. Growth scenario: May futures, the expiration date is May 13. Reached the target at 685.0. Now you can buy again.

Falling scenario: unlikely yet meaning to talk about shorts. The situation remains uncertain. We do not sell.

Recommendation:

Purchase: now. Stop: 580.0. Target: 1000.0.

Soybeans No. 1. CME Group

Growth scenario: May futures, the expiration date is May 13. The market looks aggressive. I would like to see a pullback to the 1400.0 area for a new round of buying.

Falling scenario: under conditions of uncertainty, a downfall is unlikely to take place. We do not enter shorts.

Recommendation:

Purchase: think when approaching 1400.0.

Sale: no.

Support — 1210.0. Resistance — 2196.6.

Sugar 11 white, ICE

Growth scenario: May futures, the expiration date is April 29. Until the market can go up. We hold longs, we do not open new positions.

Falling scenario: our opinion remains the same: only around 20.00 will we think about shorts. The current levels for entering shorts are not interesting. Recommendation:

Purchase: no. Who is in position from 17.80, keep the stop at 17.30. Target: 23.20.

Sale: think when approaching 20.00.

Support — 17.44. Resistance — 18.30.

Сoffee С, ICE

Growth scenario: March futures, the expiration date is March 21. Let’s buy from the current levels. A move to 280.0 is possible.

Falling scenario: if prices leave the growing channel down, then we will move to the 200.00 area. It makes sense to add to the shorts after falling below 230.0.

Recommendation:

Purchase: now. Stop: 238.0. Target: 280.00.

Sale: no. Who is in position from 250.0, move the stop to 253.00. Target: 200.00.

Support — 220.25. Resistance is 260.40.

Gold. CME Group

Growth scenario: we continue to hold longs, but we tighten stop orders.

Falling scenario: a continuation of the fall is possible, but going short on gold is extremely uncomfortable. Therefore, we sell, but with less capital risk than usual.

Recommendations:

Purchase: no. Those in positions between 1780 and 1790 move the stop to 1840. Target: 2300.

Sale: now. Stop: 1930. Target: 1400?!

Support — 1852. Resistance — 1975.

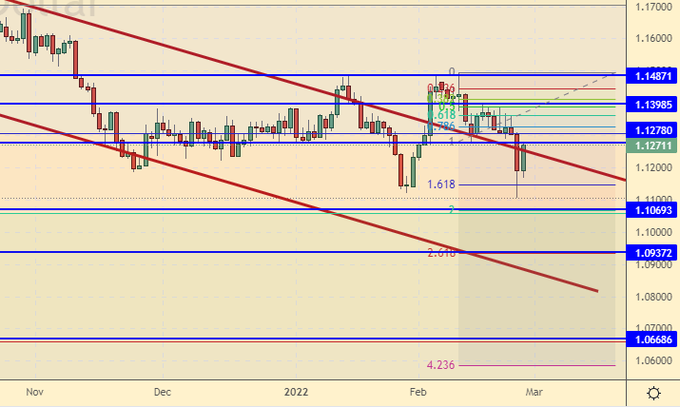

EUR/USD

Growth scenario: it is extremely likely that the pair will continue to fall. Target at 1.0600 remains. We don’t buy.

Falling scenario: the dollar goes to 1.0600. Those interested can sell here.

Recommendations:

Purchase: no.

Sale: now. Stop: 1.1410. Target: 1.0600. Who is in position from 1.1370, move the stop to 1.1410. Target: 1.0600.

Support — 1.1069. Resistance is 1.1271.

USD/RUB

Growth scenario: if the exchange opens tomorrow, we will quickly go to 96.00, provided that the Central Bank does not interfere with the growth of the dollar.

Falling scenario: it will be possible to talk about the strengthening of the ruble only if the situation in Ukraine normalizes and pressure from the West eases somewhat. Don’t sell.

Recommendations:

Purchase: now. Stop: 84.70. Target: 120.00?!

Sale: no.

Support — 80.46. Resistance is 89.60.

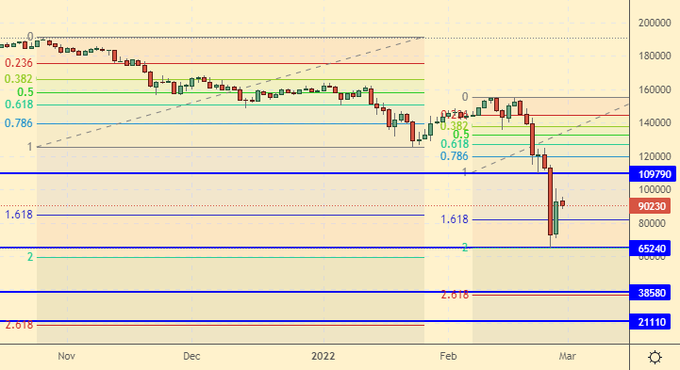

RTSI

Growth scenario: we are not talking about growth yet. The macroeconomic outlook is extremely bleak. We do not enter long.

Falling scenario: unfortunately, last week’s Thursday lows are likely not the end. When rising to 109000, sell again.

Recommendations:

Purchase: no.

Sale: up to 109000. Stop: 120000. Target: 38600.

Support — 65240 (38580). Resistance — 109790.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.