|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-8-to-12-of-november-2021/252432/

|

Energy market:

In the US Senate, a certain woman in power called on not to prohibit men from showing their masculinity. Apparently, something happened. Well, traders from Wall Street and from other streets have no time to think that somewhere someone lacks male attention. On our agenda is OPEC + ‘s refusal to increase production beyond measure, and the dollar, which still cannot beat gold, despite the propaganda deployed on the network.

The countries participating in the agreement on limiting oil production responded to Washington and other importers with a strong refusal to demand to increase the supply of oil in foreign markets. As a result, we see that prices are unwilling to go below $ 80.00 per barrel. A drop to 75.00 may take place, but it will be more technical in nature after which purchases will be resumed, especially since there is at least six months before the real rate hike in the US, which means that expensive money will not interfere with economic growth.

Gas prices in Europe remain at the level of $ 1,000 per cubic meter, since no one knows yet when Nord Stream 2 will start working, whether in December, or in January, or maybe even in March. The colder it gets, the less Brussels will grimace, where, by the way, it is necessary to change all the functionaries leaning towards the green agenda. It will be different as in «Game of Thrones», preparation for winter will be extremely nervous and dramatic every year. Some environmentalists will be cut off their heads right in the squares.

High gas prices will support oil prices for the foreseeable future.

Grain market:

Large purchases of wheat from Saudi Arabia 1.3 million tons and Egypt 360 thousand tons with prices around $ 330 per ton supported the market.

Rising nitrogen fertilizer prices, where natural gas costs 70 percent of production costs, will support corn prices. The use of fertilizers is critical to growing corn. A number of farmers in the United States are considering opting for soybeans next season.

By the way, about soybeans. Due to favorable forecasts for the harvest in Brazil, we see a decline in soybean prices, which may lead to stabilization of prices at current levels in the grain market.

Recall that the harvest of both wheat and corn this season is at a historical maximum. The current rise in grain prices is largely due to the rise in energy prices, as well as panic in the press. If the prices for gas and oil stabilize, we will expect a ten- or fifteen-percent decline in prices on the wheat and corn market by the beginning of December.

USD/RUB:

At the moment, the strengthening of the US dollar against other currencies is only visible, but is unlikely to be long-term, since the curtailment of the quantitative easing program has just been launched and it is not yet known how events will develop. The Fed made a reservation on a possible revision of the policy tightening schedule if the situation in the US economy does not meet the expectations of Mr. Powell and the company.

We do not see a drop in the US stock market after the Fed meeting on November 3, which tells us that no one is seriously thinking about strengthening the dollar’s position. Additional confirmation of the dollar’s weakness is the gold quotes, which have consolidated above $ 1,800 per troy ounce.

The ruble in the current environment may continue to strengthen against the American currency.

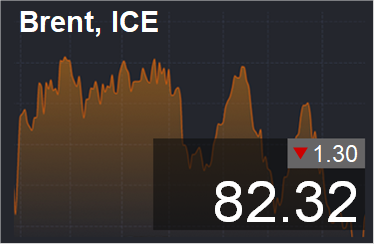

Brent. ICE

We’re looking at the volume of open interest of Brent managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 8.3 thousand contracts. For four weeks in a row, speculators have been reducing the number of long positions, while we do not see a collapse in the market, since no one is in a hurry to sell.

Growth scenario: November futures, expiration date November 30. We will continue to wait for the fall to the area of 76.00. We will buy there.

Falling scenario: the current levels for selling are understated, however, a short is possible with a reasonably placed stop order.

Recommendation:

Purchase: when approaching 76.00. Stop: 71.00. Target: 101.00.

Sale: on touch 87.80. Stop: 92.30. Target: 76.00. Or now. Stop: 84.60. Target: 76.00.

Support — 79.26. Resistance — 85.10.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 6 units and is 450 units.

Commercial oil reserves in the US increased by 3.290 to 434.102 million barrels, against the forecast of +2.225. Gasoline inventories fell -1.488 to 214.258 million barrels. Distillate stocks rose 2.16 to 127.122 million barrels. Stocks at Cushing’s storage dropped by -0.916 to 26.416 million barrels.

Oil production rose 0.2 to 11.5 million barrels per day. Oil imports fell by -0.082 to 6.172 million barrels per day. Oil exports rose by 0.138 to 2.925 million barrels per day. Thus, net oil imports fell by -0.22 to 3.247 million barrels per day. Oil refining increased by 1.2 to 86.3 percent.

Gasoline demand rose 0.181 to 9.504 million barrels per day. Gasoline production rose 0.104 to 10.176 million barrels per day. Gasoline imports rose 0.174 to 0.667 million barrels per day. Gasoline exports fell by -0.053 to 0.76 million barrels per day.

Distillate demand fell by -0.183 to 3.686 million barrels. Distillate production rose 0.252 to 4.833 million barrels. Distillate imports fell by -0.135 to 0.19 million barrels. Distillate exports fell by -0.071 to 1.028 million barrels per day.

The demand for petroleum products increased by 0.165 to 19.997 million barrels. Production of petroleum products fell by -0.155 to 20.946 million barrels. Imports of petroleum products rose by 0.02 to 2.044 million barrels. Exports of petroleum products rose by 0.226 to 5.336 million barrels per day.

Propane demand rose 0.302 to 1.282 million barrels. Propane production rose 0.03 to 2.302 million barrels. Propane imports rose 0.026 to 0.125 million barrels. Propane exports fell by -0.015 to 1.083 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 13.8 thousand contracts. Sellers are hesitant to enter the market. We cannot deny the continuation of the upward movement.

Growth scenario: December futures, expiration date November 19. A break above 85.00 will not come as a surprise. The market can safely move towards 96.00 in the current environment.

Falling scenario: like the previous week, we recommend selling based on the technical picture. The market is able to go to 71.00.

Recommendation:

Purchase: after rising above 86.00. Stop: 82.00. Target: 98.00.

Sale: now. Stop: 86.30. Target: 76.00 (71.00). Anyone in the position from 84.00, keep the stop at 86.30. Target: 76.00 (71.00).

Support — 75.74. Resistance — 85.01.

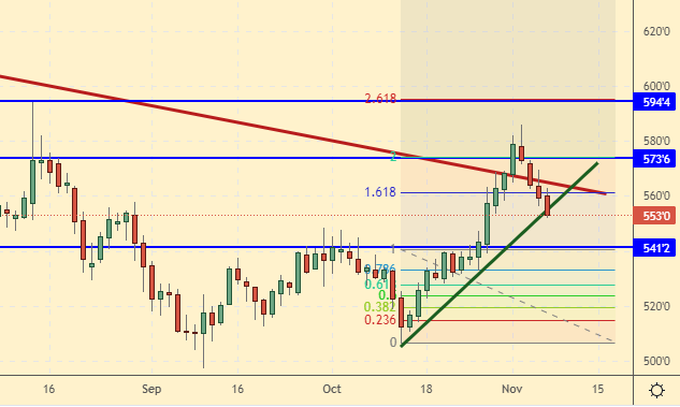

Gas-Oil. ICE

Growth scenario: considering the December futures, the expiration date is December 10. If we rise above 750.00, we will buy. The second option is to buy after falling to 620.00.

Falling scenario: sales levels remain acceptable. You can enter the short.

Recommendation:

Purchase: after rising above 754.00. Stop: 714.00. Target: 850.00.

Sale: now. Stop: 754.0. Target: 670.0. Whoever is in the position between 750.00 and 720.00, keep the stop at 754.00. Target: 670.00.

Support — 688.75. Resistance — 740.00.

Natural Gas. CME Group

Growth scenario: December futures, expiration date November 26. We continue to recommend purchases. Gas prices in Europe remain high.

Falling scenario: do not sell. Gas demand is still alive.

Recommendation:

Purchase: now. Stop: 5.330. Target: 8.777.

Sale: no.

Support — 5.429. Resistance — 6.191.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 16.2 thousand contracts. The bulls raised their heads. There are significantly fewer sellers on the market. We do not consider the current fall as a signal for a downward reversal of the market.

Growth scenario: December futures, expiration date December 14. The current levels are interesting to buy. Growth to 815.0 remains the main idea. Forced to raise stop orders. A fall in prices below 740.0 is undesirable for bulls.

Falling scenario: the maximum was at 807.0. We talked about the sales opportunity when we were approaching 815.0. If you are short, hold it; if not, wait for another rise in prices.

Recommendation:

Purchase: no. Those who are in positions between 717.0 and 720.0, move the stop to 738.0. Target: 816.0.

Sale: when approaching 815.0. Those who are in the position from 805.0, move the stop to 807.0. Target: 700.0.

Support — 763.0 (741.4). Resistance — 815.4.

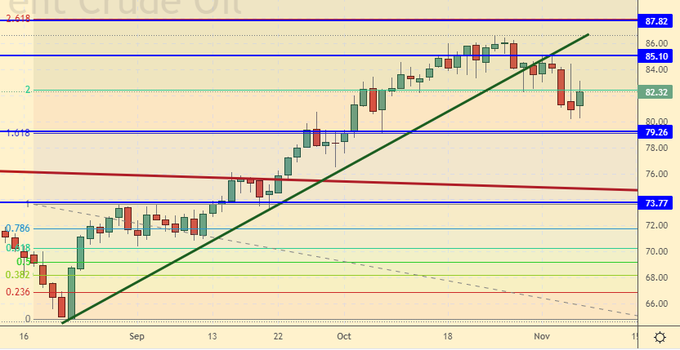

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 83.6 thousand contracts. A large buyer entered the market, but this did not lead to an increase in prices. It is possible that he later turned into a seller. We still perceive the current drop in quotations as a temporary phenomenon.

Growth scenario: December futures, expiration date December 14. We will keep longs, continuing to count on the move to 600.0. If prices fall to 540.0, we will increase purchases.

Falling scenario: we see a unidirectional downward movement for four days. If prices fall below 520.0, this could lead to a strong break down to the 500.0 area.

Recommendation:

Purchase: when approaching 540.0. Stop: 530.0. Target: 593.0. Those who are in the position from 538.0, move the stop to 530.0. Target: 593.0.

Sale: when approaching 595.0. Stop: 607.0. Target: 550.0.

Support — 541.2. Resistance — 573.6.

Soybeans No. 1. CME Group

Growth scenario: January futures, expiration date January 14. We continue to refuse purchases. We are waiting for the arrival of prices to 1111.0.

Falling scenario: hold the shorts. You must have a fairly aggressive stance. We are counting on the move to 1111.0.

Recommendation:

Purchase: on touch 1111.0. Stop: 1002.0. Target: 1175.0.

Sale: no. Those who are in positions between 1400.0 and 1350.0, move the stop to 1270.0. Target: 1111.0.

Support — 1102.2. Resistance — 1268.6.

Sugar 11 white, ICE

Growth scenario: considering the March futures, the expiration date is February 28. We do not take the current growth seriously. We remain out of the market for now. Buy after rising above 20.70.

Falling scenario: here you can enter short. Movement to 18.15 is possible.

Recommendation:

Purchase: when approaching 18.15. Stop: 17.40. Target: 23.20. Or after rising above 20.70. Stop: 20.20. Target: 23.20.

Sale: now. Stop: 20.40. Target: 18.20. Those who are in positions between 19.50 and 20.00, move the stop to 20.40. Target: 18.20.

Support — 19.40. Resistance — 20.10.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 20. There is a danger of falling to 190.00 and below. We pull up stop orders. We do not open new positions.

Falling scenario: after the rise to 244.00, we will definitely sell. It is also possible to enter short from the current levels.

Recommendation:

Purchase: no. Whoever is in the position from 192.00, move the stop to 194.00. Target: 244.00. Sale: now. Stop: 212.00. Target: 150.00. Or after rising to 244.00. Stop: 266.0. Target: 166.00 ?!

Support — 190.65. Resistance — 215.05.

Gold. CME Group

Growth scenario: on Wednesday after the Fed meeting, everyone was a little nervous, but as we can see, the sentiment remained bullish. We buy. The outlook for gold remains good.

Falling scenario: we are not thinking about sales yet. Gold has clearly lagged behind the entire commodity market and should rise.

Recommendations:

Purchase: now. Stop: 1773. Target: 2060.

Sale: no.

Support — 1748. Resistance — 1832.

EUR/USD

Growth scenario: euro on the defensive. Let’s make a risky assumption that we will not go below 1.1500 for now. Let’s buy here.

Falling scenario: keep the shorts open two weeks ago. Moves to 1.1310 and 1.1060 are possible, although the prospect of reaching these levels has dimmed after a nondescript Fed meeting. Recommendations:

Purchase: now. Stop: 1.1480. Target: 1.2800?!

Sale: no. Those who are in positions between 1.1900 and 1.1650, move the stop to 1.1710. Target: 1.1310 (1.1060).

Support — 1.1312. Resistance — 1.1704.

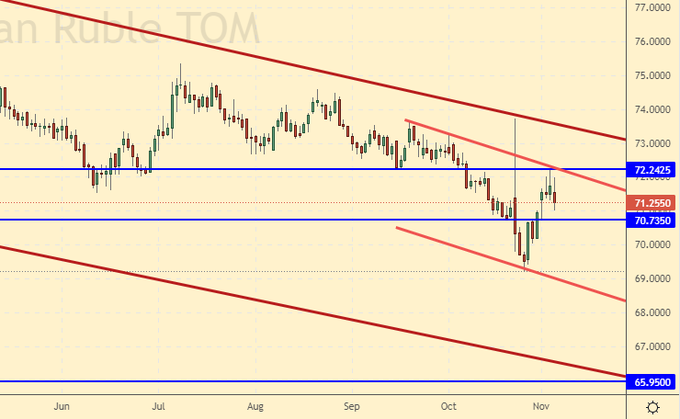

USD/RUB

Growth scenario: even though the Ministry of Finance will buy dollars in November for as much as 518 billion rubles, this may not help the American currency. We will start buying the pair only after it rises above 74.00.

Falling scenario: sell here. If there is no force majeure, then we can go to 65.00. Oil is expensive, gas is too. The budget is surplus. Things are good. Recommendations:

Purchase: when approaching 65.00 or buy after rising above 74.00.

Sale: now. Stop: 73.30. Target: 65.00. Whoever is in the position from 70.70, keep the stop at 73.30. Target: 65.00.

Support — 70.73. Resistance — 72.24.

RTSI

Growth scenario: high interest rate has not yet scared off investors in the stock market. Not everyone ran to put their money on deposits at a fixed interest rate. The external background remains positive. Growth is possible from current levels. Buy carefully.

Falling scenario: we do not open new sell positions, we keep the old ones. A move under 175,000 will open the way to 150,000. But we shouldn’t fall from scratch, we need some reason to move down. Recommendations:

Purchase: now. Stop: 178000. Target: 215000.

Sale: no. Who entered between 192,700 and 190,000, hold the stop at 192,000. Target: 150,000.

Support — 181510 (176040). Resistance — 192790.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.