|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-16-to-20-august-2021/245600/

|

Energy market:

In connection with the latest events in Afghanistan, where, in fact, there was a change of power, one has to look at the map. Iran is located west of Afghanistan and has a long border with it. So far, there are no prerequisites for dragging Iran into a civil war in Afghanistan, but if this happens, then any hints of an increase in confrontation on the border can support oil prices. We also note that the logistics risks for natural gas will increase sharply if a threat looms over Tajikistan and Turkmenistan.

There are prerequisites in the United States for increasing production capacities. This is logical, since the oil era will end at an accelerated pace by 2030, maybe 2040, since natural disasters raging in Western countries (this must be emphasized) forced Washington to talk in a completely different way with Europeans, who began to think a little earlier on reducing emissions. The prospect of losing the fertile south to climate change clearly does not suit the United States. Oil, and even more coal, may be under attack.

It is possible that in the next few months, as part of the fight against planetary overheating, we will face strong political decisions that will negatively affect the oil exporting countries, including Russia.

By reading our predictions, you could have made money in the sugar market by moving up from 17.00 to 19.50 cents per pound.

Grain market:

The Americans in their report sharply lowered the forecast for the gross harvest of wheat in the world, immediately by 1.95% to 776.9 million tons. The market was expecting something like this, as problems with the harvest in the USA, Brazil and Russia were announced earlier, but the decline in the forecast by 15 million tons at once was unexpected. In this regard, ending stocks had to be revised downward by 4.33%, which caused some traders and analysts to panic. Quotes quickly went above 750.0 cents per bushel.

Let us remind that the total amount of wheat reserves on the planet for 4 months is 279 million tons, and this is a good indicator by modern standards. If we imagine that there will be no next harvest … no, it’s better not to imagine. Note that the nervousness of market participants is justified. The outlook for corn was calmer. The fall in comparison with the July report was only 0.73%, so we did not see a sharp upward surge.

We will not be surprised at the drop in quotations next week on the grain market, as, in general, negative forecasts were already in the price. Wheat growth above 780 cents a bushel seems unreasonable at the moment.

USD/RUB:

The dollar is falling. Consumer sentiment in the United States fell to a 10-year low, plus rumors appeared that if Powell resigns, his term expires in February 2022, he will be replaced by his deputy, Mrs. Leil Brainard, who has even more soft views on monetary policy. Then, for sure, no one will see an increase in rates, and this is with consumer inflation of 5.4% per annum.

If oil prices remain in the region of 70.00, the ruble is able to continue its strengthening to the level of 70.00. The demand for Russian debt securities is growing, as some market participants are betting on the slowdown in inflation in the Russian Federation and the growth of net yields on debt securities, which also supports the ruble.

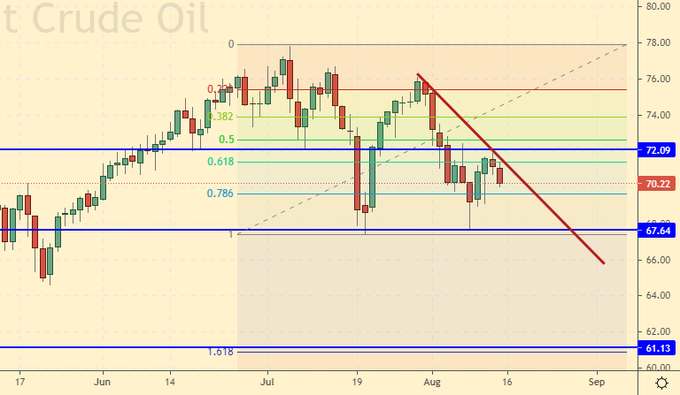

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 26.6 thousand contracts. The price dropped by $ 4.67. The bulls are leaving the market. In the second half of the week, buyers were unable to impose their will. Friday candle is red. The chances of further falling are good.

Growth scenario: August futures, the expiration date is August 31. We continue to be on the sidelines. We look forward to lower prices.

Falling scenario: we will continue to hold the previously opened short. You can add here. The target at 61.60 looks reachable.

Recommendation:

Purchase: no.

Sale: no. Those who are in positions between 74.50 and 75.80, move the stop to 72.30. Target: 61.60.

Support — 67.64. Resistance — 72.09.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 10 units and is 397 units.

Commercial oil reserves in the United States fell by -0.448 to 438.777 million barrels, while the forecast was -1.271 million barrels. Gasoline inventories fell -1.401 to 227.469 million barrels. Distillate stocks rose 1.767 to 140.511 million barrels. Stocks at Cushing’s storage fell -0.325 to 34.575 million barrels.

Oil production increased by 0.1 to 11.3 million barrels per day. Oil imports fell by -0.036 to 6.396 million barrels per day. Oil exports rose 0.759 to 2.663 million barrels per day. Thus, net oil imports fell by -0.796 to 3.732 million barrels per day. Oil refining increased by 0.5 to 91.8 percent. Gasoline demand fell by -0.345 to 9.43 million barrels per day. Gasoline production fell by -0.19 to 9.961 million barrels per day. Gasoline imports rose 0.08 to 0.925 million barrels per day. Gasoline exports rose 0.121 to 0.746 million barrels per day.

Distillate demand rose 0.116 to 3.734 million barrels. Distillate production rose 0.008 to 4.885 million barrels. Distillate imports rose 0.023 to 0.185 million barrels. Distillate exports fell by -0.218 to 1.084 million barrels per day.

The demand for petroleum products fell by -1.654 to 19.514 million barrels. Production of petroleum products fell -1.443 to 21.009 million barrels. Imports of petroleum products fell by -0.237 to 1.947 million barrels. Exports of petroleum products rose by 1.007 to 6.432 million barrels per day.

Propane demand rose by 0.158 to 1.114 million barrels. Propane production rose 0.056 to 2.378 million barrels. Propane imports rose 0.009 to 0.083 million barrels. Propane exports rose 0.206 to 1.438 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 12.7 thousand contracts. The price dropped by $ 5.53. Customers leave. It is somewhat embarrassing that the number of short positions is not growing, but this situation may change in the near future. Growth scenario: October futures, expiration date September 21. We will continue to stay out of the market expecting lower price levels in the near future.

Falling scenario: I would like to see the 58.00 mark. We will stand in the previously opened shorts. At the current levels, it is possible to build up short positions somewhat.

Recommendation:

Purchase: no.

Sale: no. Those who are in positions between 72.40 and 74.10, move the stop to 70.60. Target: 59.10.

Support — 64.93. Resistance — 69.89.

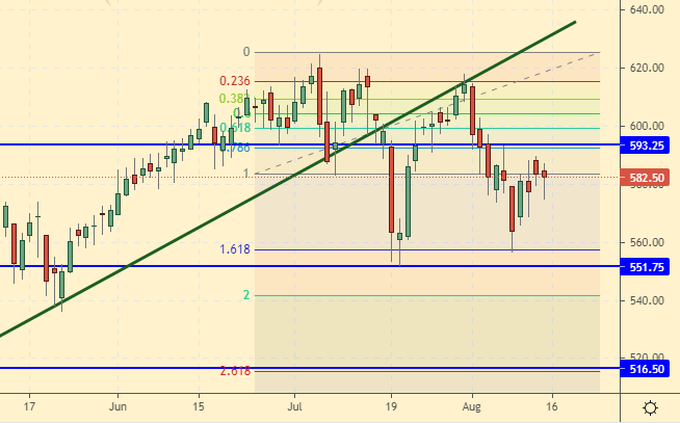

Gas-Oil. ICE

Growth scenario: September futures, the expiration date is September 10th. We do not enter the long. Despite the fact that we can see the chances of growth, we will count on a decline in prices.

Falling scenario: here you can add to the previously opened shorts. The prospect of a move to 520.0 is visible.

Recommendation:

Purchase: no.

Sale: no. Whoever is in positions between 578.00 and 612.0, keep the stop at 610.00. Target: 521.00. Support — 551.75.

Resistance — 593.25.

Natural Gas. CME Group

Growth scenario: September futures, expiration date August 27. The American market did not share the panic European sentiment. But the chances for growth remain. We stand in longs. Falling scenario: we can admit a decline to 3.360, a lower fall against the background of increased demand for gas is not visible.

Recommendation:

Purchase: no. Anyone in the position from 3.650, keep the stop at 3.700. Target: 4.540 (6.000?). Sale: no.

Support — 3.794. Resistance — 4.540.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 4.5 thousand contracts. The bulls entered the market expecting a bad forecast from the USDA and were right.

Growth scenario: September futures, expiration date September 14. The buying levels are too high. We do not open new positions, we keep the old ones.

Falling scenario: while there are no downward reversal signals, we will remain out of the market. Recommendation:

Purchase: no. Those who are in the position from 723.0, move the stop to 719.0. Target: 890.0 ?! Sale: no.

Support — 739.0. Resistance — 781.6.

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 3.8 thousand contracts. In the ranks of buyers, panic may begin next week, as the forecast for corn from the USDA, although it decreased, turned out to be better than expected.

Growth scenario: September futures, expiration date September 14. We will keep purchases from 580.0, but we will not do anything else. The market is able to turn down.

Falling scenario: we did not close the gap down by the candlestick body. Only a shadow. We will keep sales from 584.0. We hope that the new harvest will push down prices.

Recommendation:

Purchase: no. Those who are in the position from 580.0, move the stop to 558.0. Target: 700.0 ?! Sale: no. Whoever is in positions between 570.0, 560.0 and 584.0, keep the stop at 620.0. Target: 425.0? !!!

Support — 548.4. Resistance — 589.2.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, expiration date September 14. The US Department of Agriculture has cut the forecast for soybean production by only 0.41%, which cannot support the market in any way. We see growth on Friday, but it raises strong doubts. Let’s move the stop order.

Falling scenario: we have already opened positions down. Now we do nothing. Recommendation:

Purchase: no. Those who are in the position from 1335.0, move the stop to 1326.0. Target: 1600.0 ?! Sale: no. Whoever is in the position between 1400.0 and 1350.0, keep the stop at 1417.0. Target: 1111.0.

Support — 1311.0. Resistance — 1392.6.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. The market moved above 19.50, which opens the 21.66 level. If there is a return by 19.00 — we will buy.

Falling scenario: we will keep sales from 19.50, expecting that the food market will cool down somewhat in the second half of August. Recommendation:

Purchase: on touch 19.00. Stop: 18.40. Target: 21.66.

Sale: no. Anyone in the position from 19.50, keep the stop at 20.50. Target: 16.50.

Support — 19.28. Resistance — 20.11.

Сoffee С, ICE

Growth scenario: September futures, expiration date September 20. As expected, the market bounced off the 170.00 area. Since further growth is a big question, we will move the stop order higher.

Falling scenario: sales from current levels are possible.

Recommendation:

Purchase: no. Those who are in positions between 190.0, 180.0 and 170.0, move the stop to 172.00. Target: 245.00.

Sale: now. Stop: 192.0. Target: 140.0.

Support — 169.00. Resistance — 201.65.

Gold. CME Group

Growth scenario: a weakening dollar at the end of the week allowed gold to recover. If we can go above 1840, we can talk about a trend reversal. Falling scenario: we will continue to refrain from selling, although the current levels from a technical point of view are of interest to enter the short.

Recommendations:

Purchase: not yet.

Sale: not yet.

Support — 1675. Resistance — 1835.

EUR/USD

Growth scenario: dollar weakened on Friday. But the euro is not doing much better. At least Americans have economic growth comparable to China’s — 7%. In the Eurozone, it is twice as bad. It’s scary to buy here, but you can. Let’s go long, counting on the fact that the negative on the dollar will grow.

Falling scenario: the market wants to believe that the US interest rate will rise. Nobody knows when this will happen, but while the market is in illusion, one can count on the pair to fall to 1.1050.

Recommendation:

Purchase: now. Stop: 1.1710. Target: 1.2800.

Sale: no. Those who are in the position from 1.1950, move the stop to 1.1930. Target: 1.1050? !!!

Support — 1.1751 (1.1701). Resistance — 1.1950.

USD/RUB

Growth scenario: the outlook for the dollar’s growth has become dimmer, but the ruble has every chance of strengthening due to the inflow of money from abroad into government bonds. We do not open new positions on the long pair. We keep the old ones.

Falling scenario: there is a chance for the strengthening of the national currency. Let’s open the short.

Recommendations:

Purchase: no. Those who are in positions from 72.07 and 73.10, keep the stop at 72.48. Target: 80.00.

Sale: now. Stop: 74.10. Target: 68.00.

Support — 72.62. Resistance — 74.15.

RTSI

Growth scenario: sentiment in the world’s stock markets remains positive due to the continuation of the era of cheap money. The RTS index futures have a chance to rise to 175,000.

Falling scenario: do not sell. It is possible that we started writing the last song of Pinocchio. The growth of stocks will now be fast and unidirectional. And everyone will come to the market, even those who have left, and even those who have left forever. To lose it all again The crowd must believe in a miracle. Recommendations:

Purchase: no. Anyone in the position from 165000, move the stop to 162800. Target: 175000.

Sale: no.

Support — 161320. Resistance — 175400.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.