|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-19-to-23-july-2021/243288/

|

Energy market:

The guys from OPEC + could not sleep and did not rest on the weekend. The conspirators decided all the questions on Sunday. Traders are saying «sincere» thanks to you. On Monday night, we will most likely have a gap down, well, come on, we will survive somehow.

So, there will be an increase in oil production. They will increase 400 thousand barrels per day every month until the current restrictions of 5.8 million barrels per day are completely removed. The next formal meeting will be held in September, and in December they’ll make sure they are on the same page.

From May next year, the base levels from which production quotas are calculated will be revised. Russia will receive an additional 0.5 million barrels per day, as a result of which it will be possible to produce 11.5 million barrels per day. The rest of the participants will not be offended either. By the way, the UAE will receive an increase in the base level from 3.2 to 3.5 million barrels per day, and initially they wanted to raise it to 3.8, because of them there was a delay in making a decision.

From the point of view of common sense, the decision is not bad, especially since the growth in oil demand is now beyond doubt. This time, the intellect is felt.

In Germany and Austria, downpours caused floods, which led to the collapse in several areas of these countries. The oil market will remain indifferent to these events, provided that the floods are not biblical.

Grain market:

It is not yet clear what the showers will do in Europe, will help to transfer the heat to wheat, or to a greater extent will cause irreparable harm. Mostly mountainous regions suffer, but there are only grapes, fruits and various exotics, there are no main crops on the slopes of the hills. Nevertheless, the picture from Germany and Austria is unpleasant, so on Monday and Tuesday the wheat market may react with moderate growth.

In the US, increased corn stocks and reduced competition from Brazil are improving export prospects for the current marketing year. US corn exports are forecast to be 63 million tonnes. US export forecasts remain at an all-time high, bringing the US share of world corn trade to nearly 40 percent, the highest since 17/18, when the other three major corn exporters — Brazil, Argentina and Ukraine — were in trouble with harvest due to unfavorable weather.

USD/RUB:

The market is calmly awaiting a rate hike from the RF Central Bank on Friday. We do not see a strong desire of speculators to weaken the ruble or strengthen it.

OPEC + will increase oil production from August. This event can force prices to correct, but we will not see a strong fall, for example, to the area of $ 60, at this stage, which will allow the ruble to feel tolerable against the dollar in the coming month.

But as far as the dollar is concerned, everything is not so simple. Powell’s reluctance to notice inflation could lead to a fall in the American currency in the fall. Our references to the fact that the labor market in America is weak, since three homeless people under the Brooklyn Bridge do not want to work, do not stand up to scrutiny.

In addition, various programs of assistance and subsidies, for example, for children in the amount of $ 300 a month, will force almost 2 trillion to be printed. dollars. They write about 1.9 trillion. But who notices such trifles: 100 billion there, 100 billion here. We have only one question: did your system go haywire, gentlemen from the State Department.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 5.1 thousand contracts. Sellers-speculators more actively left the market, which led to the fact that there were a few more bulls on the market. However, it is unlikely that after today’s OPEC + decision to increase production, buyers will become the main force in the market.

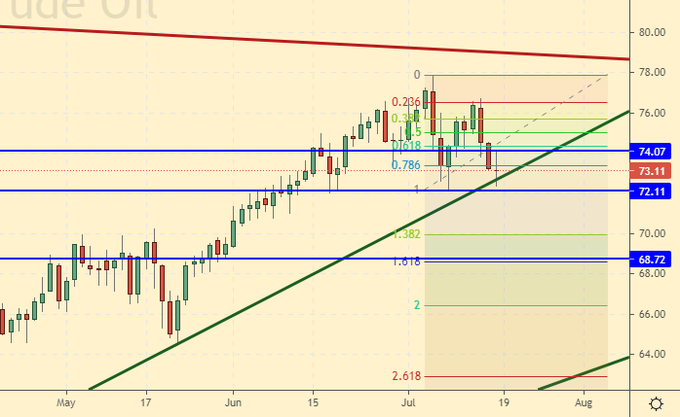

Growth scenario: July futures, expiration date July 30. We continue to assume that you can buy from 69.00. But it will be necessary to look at the nature of the fall on Monday and Tuesday. If it is fast, then you should refrain from entering the long.

Falling scenario: after falling below 72.00, you can add to the previously opened shorts. If there is a rebound to 76.00, sell. Since such market behavior against the background of production growth will be considered a bluff.

Recommendation:

Purchase: think when approaching 69.00.

Sale: when approaching 76.00. Stop: 76.90. Target: 69.00. Whoever is in the position between 74.70 and 76.00, keep the stop at 76.90. Target: 69.00.

Support — 72.11. Resistance — 74.07.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 2 units and is 380 units.

Commercial oil reserves in the United States fell by -7.896 to 437.580 million barrels, while the forecast was -4.359 million barrels. Gasoline inventories rose by 1.038 to 236.535 million barrels. Distillate stocks rose by 3.657 to 142.349 million barrels. Cushing’s stocks fell -1.589 to 38.058 million barrels.

Oil production increased by 0.1 to 11.4 million barrels per day. Oil imports rose 0.346 to 6.221 million barrels per day. Oil exports rose by 1.397 to 4.025 million barrels per day. Thus, net oil imports fell by -1.051 to 2.196 million barrels per day. Refining fell by -0.4 to 91.8 percent.

Gasoline demand fell by -0.76 to 9.283 million barrels per day. Gasoline production fell by -0.696 to 9.858 million barrels per day. Gasoline imports rose 0.028 to 1.044 million barrels per day. Gasoline exports fell by -0.101 to 0.747 million barrels per day.

Distillate demand fell by -0.676 to 3.164 million barrels. Distillate production fell by -0.041 to 4.926 million barrels. Distillate imports fell by -0.054 to 0.077 million barrels. Distillate exports rose 0.289 to 1.316 million barrels per day.

The demand for petroleum products fell by -2.244 to 19.303 million barrels. Production of petroleum products fell by -1.778 to 21.265 million barrels. Imports of petroleum products fell by -0.215 to 2.437 million barrels. Exports of petroleum products rose by 0.395 to 5.595 million barrels per day.

Propane demand fell by -0.012 to 1.116 million barrels. Propane production rose 0.067 to 2.333 million barrels. Propane imports rose 0.011 to 0.081 million barrels. Propane exports fell by -0.068 to 1.071 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 3.1 thousand contracts. Bulls came to the market a little more actively than bears. However, this situation will soon be reversed due to the OPEC + deal to increase production.

Growth scenario: September futures, the expiration date is August 20. We continue to remain out of the market. In case of a fall to 66.50, one can buy, provided that the fall is not quick. Falling scenario: our mantras about falling are still working. If there is a bounce up to 74.00 amid the OPEC + decision, then sell is mandatory. Recommendation:

Purchase: think when approaching 67.50.

Sale: when approaching 74.00. Stop: 75.20. Target: 66.60. Those who are in positions between 72.80 and 74.00, move the stop to 75.20. Target: 66.60.

Support — 69.97. Resistance — 74.99.

Gas-Oil. ICE

Growth scenario: August futures, the expiration date is August 12th. Growth is not visible. Yes, we have not broken through the support yet, but the market is extremely tired of moving up.

Falling scenario: nothing has changed. We continue to wait for the support breakout. The position in terms of technique for short is not bad, as the market has been growing for a long time in a relatively narrow price channel.

Recommendation:

Purchase: no.

Sale: on touch 578.00. Stop: 607.00. Target: 520.00.

Support — 582.25. Resistance — 618.50.

Natural Gas. CME Group

Growth scenario: August futures, expiration date July 28. The bulls are stubbornly holding the market above 3.500, which creates preconditions for further price growth to 4.150.

Falling scenario: think about shorts from 4.150. The prospect of completing Nord Stream 2 should cool the market somewhat.

Recommendation:

Purchase: on a rollback to 3.400. Stop: 3.200. Target: 4.120. Now. Stop: 3.480. Target: 4.150. Sale: thinking when approaching 4.150.

Support — 3.524. Resistance — 4.154.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 9.9 thousand contracts. Moreover, the difference itself is negative. Thus, the number of sellers in the market increases, while the number of buyers decreases. Therefore, we perceive the current rise in prices as an opportunity for sales.

Growth scenario: September futures, expiration date September 14. It will be extremely difficult to get above the 700.0 area. We do not enter long. August is coming soon. We should see at least a slight correction.

Falling scenario: when a daily candle appears with an average or long red body, we will sell. The current surge is a bluff.

Recommendation:

Purchase: on touch 571.0. Stop: 557.0. Target: 700.0. Sell: when a daily candle appears with a medium or long red body. The stop is 20 cents above the high of the candlestick. Target: 571.0.

Support — 646.0. Resistance — 709.0.

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers decreased by 12.5 thousand contracts. The difference itself is still positive, but the bulls are quickly leaving the market. We perceive any growth as a sales opportunity.

Growth scenario: September futures, expiration date September 14. We will continue to refrain from buying, as the long-term support line is under the threat of breaking.

Falling scenario: when trying to close the gap at 587.0, shorts are required. Crop prospects remain good, there is no reason for price increases. Recommendation:

Purchase: on touch 506.0. Stop: 492.0. Target: 700.0.

Sale: now and at touch 584.0. Stop: 620.0. Target: 507.0.

Support — 546.4. Resistance — 571.2.

Soybeans No. 1. CME Group

Growth scenario: the position is of no interest for entering a long. Out of the market.

Falling scenario: we will continue to sell. You can sell now, you can wait for a confirmation in the form of a red candle and only then go short.

Recommendation:

Purchase: on touch 1111.0. Stop: 1083.0. Target: 1300.0.

Sale: now and as it grows to 1460. Stop: 1480. Target: 1111.0.

Support — 1353.2. Resistance — 1438.2.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. The stop at 16.70 survived. We keep long. Target: 19.50.

Falling scenario: from 19.50 we will definitely sell. Short from the current levels is possible, but I would like to see a red candle as an additional signal.

Recommendation:

Purchase: no. Those who are in positions between 17.50 and 17.00, move the stop to 16.90. Target: 19.50.

Sale: on touch 19.50. Stop: 20.50. Target: 16.50. Those who are in the position from 17.00, move the stop to 18.20. Target: 16.50.

Support — 16.32. Resistance — 18.51.

Сoffee С, ICE

Growth scenario: September futures, expiration date September 20. In case of growth above 168.00, it can be added to the current longs. The bulls are keeping the situation under control for now.

Falling scenario: the levels are not bad for entering the sale. There will be a fight here, but if a red candle appears, you can go short.

Recommendation:

Purchase: no. Those who are in the position from 153.0, move the stop to 154.00. Target: 194.00.

Sale: when a red candle appears with a close below 156.00. Stop: 166.00. Target: 140.00. Those who are in the position from 158.00, move the stop to 168.0. Target: 140.00.

Support — 147.75. Resistance — 164.15.

Gold. CME Group

Growth scenario: we continue to consider the current levels to be interesting for purchases. If, against the background of money printing, gold falls somewhere in the future by 1700 or 1600, then it will be necessary to buy there.

Falling scenario: after rising to the level of 1850 and a rollback from it downward, you can sell. There are no other interesting ideas for a short on the market at the moment.

Recommendations:

Purchase: now. Stop: 1760. Target: 2060. Whoever is in the position between 1760 and 1770, keep the stop at 1760. Target: 2060.

Sale: after rising to 1850 and then returning below 1830. Stop: 1856. Target: 1600?!

Support — 1794. Resistance — 1854.

EUR/USD

Growth scenario: floods in Europe are likely to undermine the euro on Monday. The damage will be tens of billions. As before, we will think about growth only after the market rises above 1.2100.

Falling scenario: keep short. Americans are flooding problems with money, but things are no better in Europe either. We will fall to 1.1500, possibly we will go to 1.1000.

Recommendations:

Purchase: think after a rise above 1.2100.

Sale: whoever is in position from 1.1950, keep the stop at 1.1980. Target: 1.1050?!!!

Support — 1.1701. Resistance — 1.1969.

USD/RUB

Growth scenario: as in the previous week, we believe that ruble strengthening to 73.40 is possible. Stronger strengthening is unlikely to be possible. It is unlikely that oil prices will continue to rise. The Central Bank of the Russian Federation will raise the rate, but these expectations are already in the price. While we look up the pair.

Falling scenario: if we rise to 76.20, we will sell, as there, most likely, the phase of strengthening of the dollar index will end. Short from current levels can only be tactical on 1H intervals. Recommendations:

Purchase: on touch 73.43. Stop: 72.80. Target: 80.00. Anyone in the position from 72.07, keep the stop at 72.80. Target: 80.00.

Sale: when approaching 76.20. Stop: 76.60. Target: 73.40.

Support — 73.35. Resistance — 75.36.

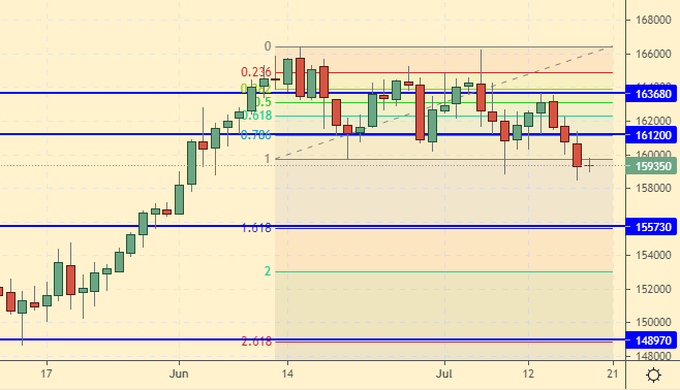

RTSI

Growth scenario: the global stock market, and without the help of Powell, who does not want to raise rates amid inflation, began to decline under its own weight. In addition, the Russian stock market is under pressure due to the expectation of an increase in the rate of the Central Bank of the Russian Federation. For now, we will postpone shopping.

Fall scenario: to the shorts opened last week, it will be possible to add in case of a fall below 158000. A move to 149000 is possible. This will be our working version. At the rise to 162,000, those who wish can enter the short.

Recommendations:

Purchase: no.

Sale: when going up to 162000. Stop: 164600. Target: 149000 (135000). Anyone in the position from 162000, move the stop to 164600. Target: 149000 (135000).

Support — 155730. Resistance — 161200.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.