|

Отчеты

|

https://www.oilexp.ru/oilstat/report/price-forecast-from-22-to-26-of-march-2021/233166/

|

Energy market:

The admission of the beginning of the third wave of the pandemic by the European authorities shook the bulls’ nerves, and they moved to take profits last week. On Thursday alone, prices fell $ 5. Drilling activity begins to grow in the US, which implies an increase in production in the 4-6 month horizon by about 1 million barrels per day.

Most likely, the calling and stumbling grandfather, who is also the President of the United States, will be dismissed, and the topic of «green» energy will be shelved for an indefinite period. It is clear that the Americans will never repay their debt, but with the growth of their own oil production, at least it will be possible to talk about smoothing out the situation with a constantly negative trade balance. Look, the debt situation will drag on until 2029, and then, like a hundred years ago, a global economic catastrophe will break out.

We are waiting for the continuation of the decline in oil prices. Brent could go to $ 58.00 a barrel. If the situation in Europe worsens, then it will be possible to talk about the fall below $ 50. We are unlikely to get a copy of last year on the charts, but a certain downward movement is possible.

Grain market:

China continues to buy American corn, trying to prevent the army of pigs that the Celestial Empire is rebuilding after the plague from feeling hungry. Hence the very vigorous state of the corn market versus wheat.

Let’s not forget that almost all of the wheat from the 20/21 harvest will be consumed, which means a shortage will arise closer to winter, provided that the 21/22 harvest is worse than the previous one. This will support the wheat market and are unlikely to see a correction below 550 cents a bushel.

If the USDA’s May 21//22 forecast is bad, the long is the only thing that can be recommended in the grain market this year.

USD/RUB:

The Fed left the rate unchanged, indicating the prospects for an increase in the 23rd year. It cannot be ruled out that the situation will develop at a faster pace, which is what part of traders who are already buying up 10-year US government bonds are betting on.

Nabiullina raised the rate by 0.25%, thereby responding to the rise in inflation in the food sector in January-February. If prices do not stabilize, then it is worth counting on further tightening of monetary policy by the Bank of Russia in the near future.

The ruble reacted very briskly to the rate hike. The threat of passage above 75.00 remains. The RGBI index continues to fall, which indicates a decrease in the interest of foreign investors in the Russian government debt.

We see no reasons for the strengthening of the ruble against the US dollar next week, amid falling oil and the RGBI index.

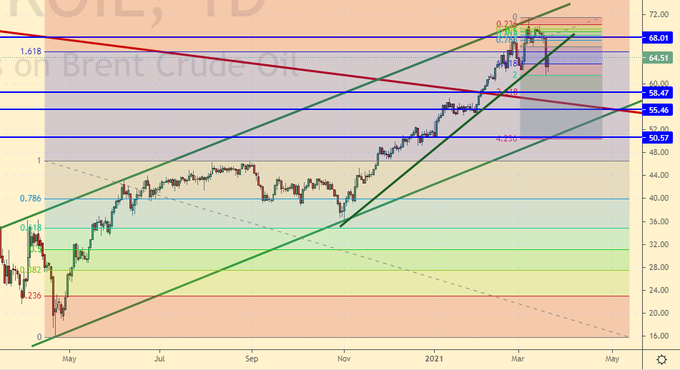

Brent. ICE

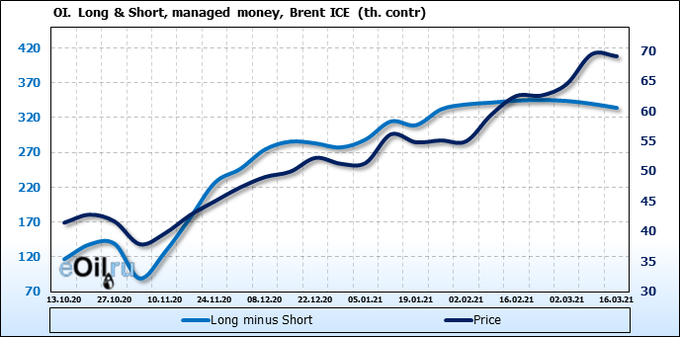

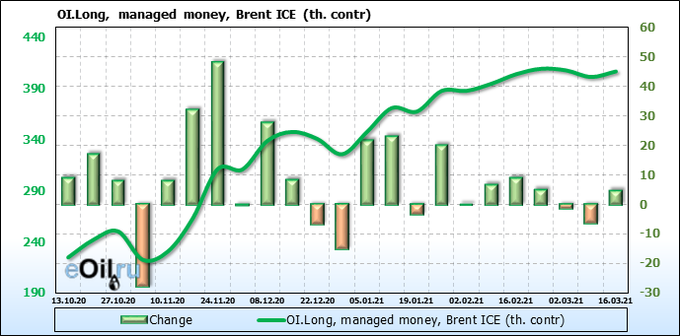

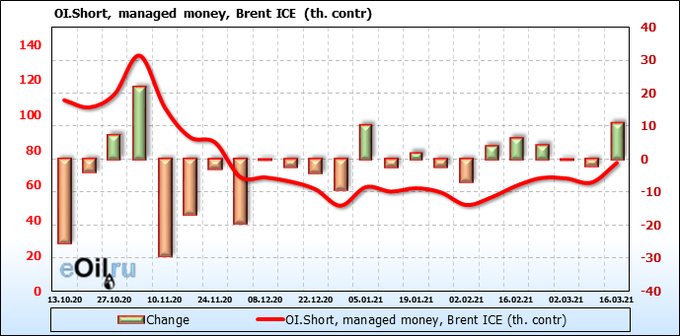

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Sellers have increased activity, however bulls continue to remain in the market. Most likely, sellers will be able to seize the initiative for the next couple of months.

Growth scenario: March futures, the expiration date is March 31. All is well. We are waiting for a rollback to 55.00, a small long is possible there. Falling scenario: we have broken through the support line and test it from the reverse side. Possible short from the current levels. Recommendation:

Purchase: think when approaching 55.00.

Sale: now and until 68.00. Stop: 69.00. Target: 56.00 (51.00).

Support — 58.47. Resistance — 68.01.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 9 units to 318 units.

US commercial oil reserves rose by 2.396 to 500.799 million barrels. Gasoline inventories rose by 0.472 to 232.075 million barrels. Distillate stocks rose 0.255 to 137.747 million barrels. Stocks at Cushing’s storage fell -0.624 to 48.21 million barrels.

Oil production has not changed at 10.9 million barrels per day. Oil imports fell by -0.332 to 5.323 million barrels per day. Oil exports fell by -0.113 to 2.52 million barrels per day. Thus, net oil imports fell by -0.219 to 2.803 million barrels per day. Oil refining increased by 7.1 to 76.1 percent.

Gasoline demand fell by -0.284 to 8.442 million barrels per day. Gasoline production fell by -0.128 to 8.877 million barrels per day. Gasoline imports rose 0.333 to 0.91 million barrels per day. Gasoline exports fell by -0.097 to 0.58 million barrels per day.

Distillate demand fell by -0.459 to 4.028 million barrels. Distillate production rose 0.524 to 4.228 million barrels. Distillate imports rose 0.052 to 0.524 million barrels. Distillate exports rose 0.213 to 0.688 million barrels per day.

The demand for petroleum products increased by 0.261 to 18.933 million barrels. Production of petroleum products increased by 0.842 to 20.173 million barrels. Imports of petroleum products rose by 1.076 to 2.892 million barrels. Exports of petroleum products rose 0.09 to 4.327 million barrels per day.

Propane demand rose 0.288 to 1.426 million barrels. Propane production rose 0.139 to 2.236 million barrels. Propane imports rose 0.033 to 0.19 million barrels. Propane exports fell by -0.098 to 1.025 million barrels per day.

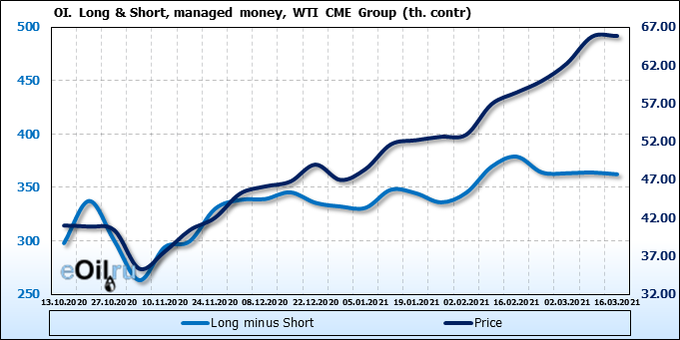

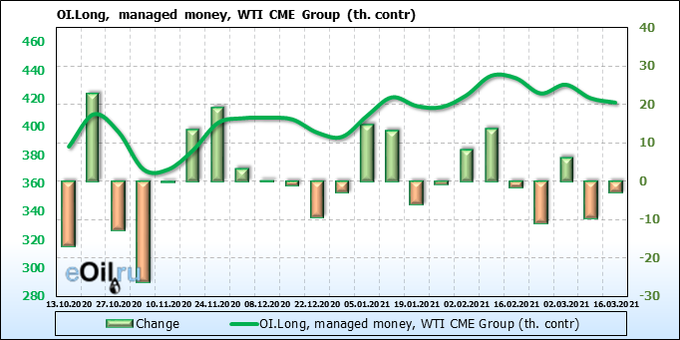

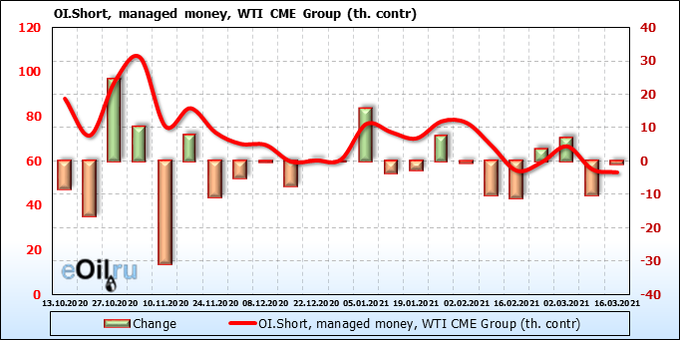

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Relative inertia in the market should be replaced by active actions, mainly due to the arrival of sellers. The coronavirus has an extremely negative impact on the European economy.

Growth scenario: May futures, the expiration date is April 20. We went down. Most likely there will be at least one more wave of decline to 56.00. We are not in a hurry to buy.

Falling scenario: when approaching 63.00, you can sell. If everything is bad, then by 46.00 we will come.

Recommendation:

Purchase: not yet.

Sale: when approaching 63.00. Stop: 67.00. Target: 46.00.

Support — 55.89. Resistance — 63.23.

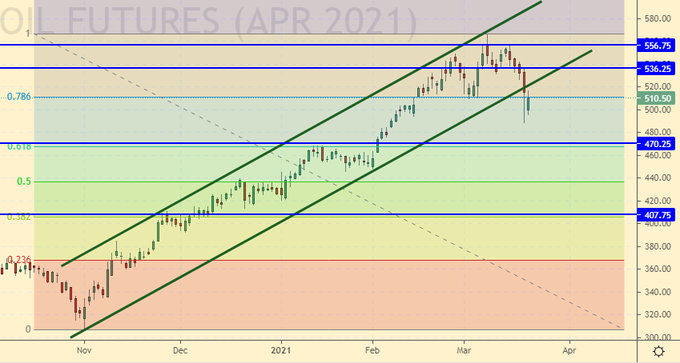

Gas-Oil. ICE

Growth scenario: April futures, the expiration date is April 12th. In the current situation, the market has chances to fall to the area of 400.0. We do not buy.

Falling scenario: we broke through the channel, we test it from the reverse side. You can sell. Recommendation:

Purchase: no.

Sale: now and up to 536.0. Stop: 553.0. Target: 410.0. Consider the risks!

Support — 470.25. Resistance — 536.25.

Natural Gas. CME Group

Growth scenario: April futures, expiration date March 29. Despite the downward breakdown of the Fibo level at 2.48, we continue to recommend buying.

Falling scenario: do not sell. It doesn’t make any sense.

Recommendation:

Purchase: now. Stop: 2.380. Target: 3.615.

Sale: no.

Support — 2.420. Resistance — 2.581.

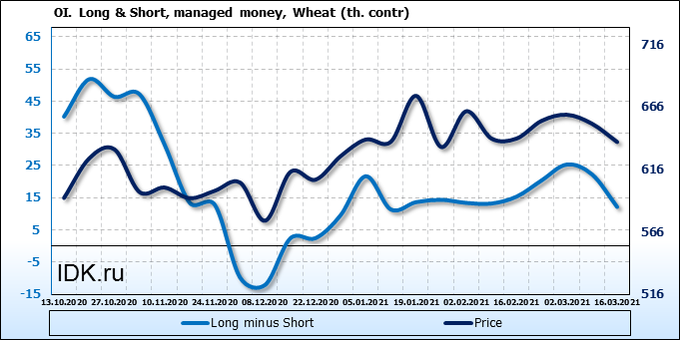

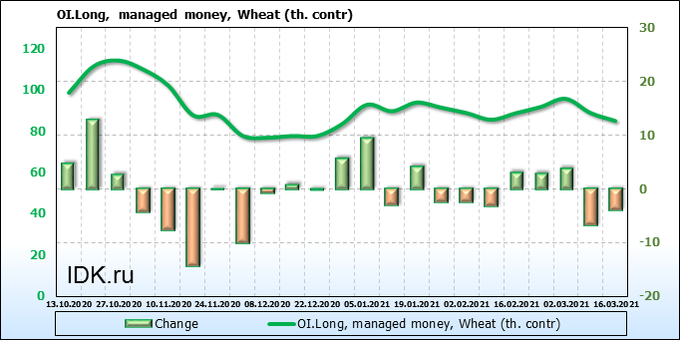

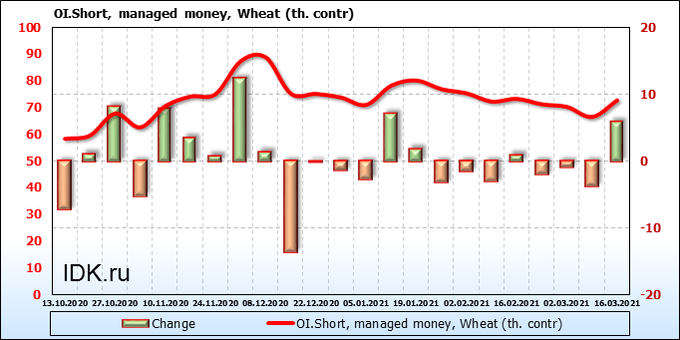

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

On the back of positive news about the state of winter crops in Europe and the success of Australia, sellers came to the market. The bears have three to four weeks to bring prices down.

Growth scenario: May futures, expiration date May 14. Chances of going below 600.0 remain. We will not hurry up with purchases.

Falling scenario: we will count on the fact that we will go to 580.0. We keep the shorts, move the stop order along the trend.

Recommendation:

Purchase: not yet.

Sale: no. Those who are in the position from 660.0, move the stop to 653.0. Target: 580.0.

Support — 619.0. Resistance — 649.6.

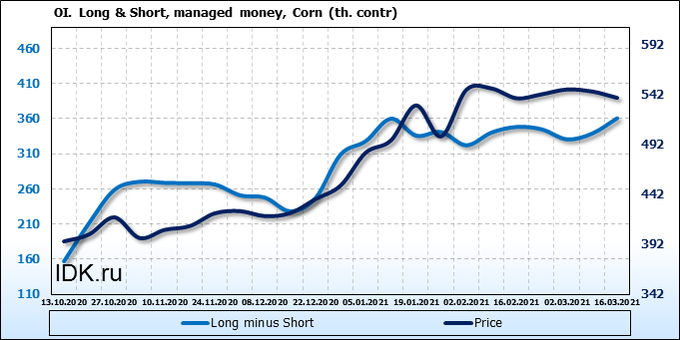

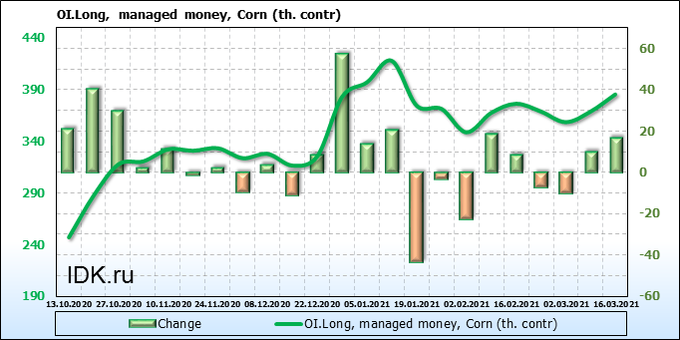

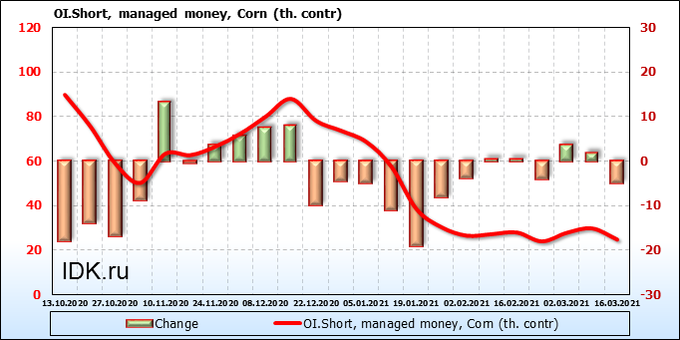

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

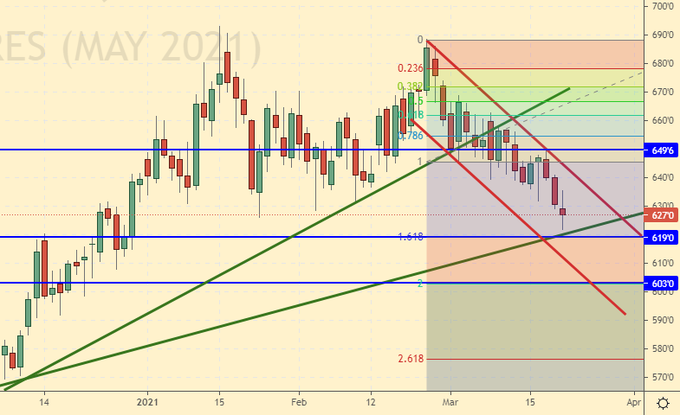

Buyers enter the market as China continues to buy US corn. This story is delicate and can end at any moment. But, we recognize that the planet’s absorption of almost the entire crop creates long-term fundamental support.

Growth scenario: May futures, expiration date May 14. Can buy. Somewhat uncomfortable from high levels, but the situation is binding.

Falling scenario: there is a risk that the corn will draw one more branch up to 605.0 and only after that the upward impulse will end. We will not make new sales. We keep the old ones.

Recommendation:

Purchase: now. Stop: 539.0. Target: 604.0.

Sale: on touch 604.0. Stop: 616.0. Target: 532.0. Whoever is in positions between 570.0 and 540.0, keep the stop at 562.0. Target: 496.0 (456.0).

Support — 528.6. Resistance — 571.2.

Soybeans No. 1. CME Group

Growth scenario: May futures, expiration date May 14. Will we go to 1700 that is the question. As consumption patterns change from animal fats to vegetable fats, growth in the soybean market is likely to continue, but whether this will happen immediately tomorrow is a question. Nevertheless, we try and buy.

Falling scenario: we will remain in shorts, although the position is unpleasant. In case of growth above 1420, those who wish can run away. Recommendation:

Purchase: now. Stop: 1384.0. Target: 1700. Who is in positions between 1452.0 and 1425.0, keep the stop at 1384.0. Target: 1700.0.

Sale: no. Whoever is in the position from 1425.0, keep the stop at 1446.0. Target: 1180.0. You can cut the position after the market rises above 1420.0.

Support — 1390.4. Resistance — 1459.4.

Sugar 11 white, ICE

Growth scenario: May futures, the expiration date is April 30. While we stand in longs. A bit scary, but we hope that the threat of a deficit will force prices to rise.

Falling scenario: the short from 18.20 continues to be the main idea. We are waiting for the arrival of prices to this level.

Recommendation:

Purchase: now. Stop: 15.40. Target: 18.20. Whoever is in the position between 16.50 and 16.30, keep the stop at 15.40. Target: 18.20.

Sale: when approaching the area at 18.20. Stop: 18.60. Target: 16.60.

Support — 14.58. Resistance — 16.58.

Сoffee С, ICE

Growth scenario: considering the May futures, the expiration date is May 18. We will continue to stand in longs. We do not open new positions.

Falling scenario: if the market breaks below 125.00, you can think about shorts. Out of the market.

Recommendation:

Purchase: no. Anyone in a position from 128.0 keep a stop at 125.90. Target: Target: 157.0.

Sale: not yet.

Support — 126.45. Resistance — 140.40.

Gold. CME Group

Growth scenario: after the day closes above 1750, we will buy. Not earlier.

Falling scenario: Sell here. Stop order is near. If we stay inside the channel we can slide down to 1600.

Recommendations:

Purchase: after the day’s close above 1750. Stop: 1724. Target: 1850.

Sale: now. Stop: 1757. Target: 1600.

Support — 1698. Resistance — 1755.

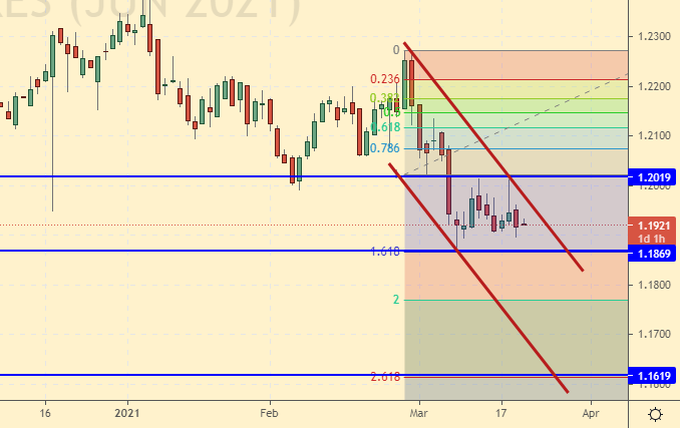

EUR/USD

Growth scenario: waiting for the arrival of prices at 1.1600, do not buy.

Falling scenario: keep holding the shorts. The situation in Europe due to the coronavirus is bad. The outlook for the euro is bleak.

Recommendations:

Purchase: no.

Sale: no. Whoever is in positions between 1.2050 and 1.1950, keep the stop at 1.2110. Target: 1.1630.

Support — 1.1869. Resistance — 1.2019.

USD/RUB

Growth scenario: while the market has not taken 75.10, there is no point in buying. The situation for the ruble is getting unpleasant, but the dollar is not showing any success either. We are waiting for action from the market. Note that an exit from the range is ripe.

Falling scenario: now it will be difficult for the ruble to return under 73.00. We do not open new sell positions, we keep the old ones.

Purchase: after rising above 75.10. Stop: 74.10. Target: 80.00.

Sale: no. Whoever is in the position from 74.60, keep the stop at 75.10. Target: 70.00 (68.00).

Support — 72.45. Resistance — 75.06.

RTSI

Growth scenario: looking at the graph gives the impression that the index is choking when it tries to climb. No enthusiasm is visible. You can be very careful about shopping. What if Biden will apologize to the President of the Russian Federation. Then we will definitely see 200,000. Sorry, this is just a fantasy.

Falling scenario: if we fall below 140,000, we must sell. The downside potential is not clear. Russian stocks may be of interest to investors against the backdrop of economic problems in Europe, as well as against the backdrop of our upcoming embrace with the Chinese dragon. The main thing is that Lavrov is not strangled in the arms of March 22 and 23 in the Celestial Empire and we are together with him.

Recommendation:

Purchase: now. Stop: 143000. Target: 1677000.

Sale: after falling below 140,000. Stop: 146,000. Target: 100,000. Consider the risks!

Support — 143360. Resistance — 153740.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.