08 June 2020, 16:02

Price forecast weekly from 8th to 12th of June 2020

-

Energy market:

OPEC+ countries have agreed to extend the current deal with the same terms for another month. The decline of production by 9.7 mn bpd will last until the end of July. Those members who did not fully fulfilled their responsibilities in the first months of the deal will compensate it in July and September.

The airlines will start active passenger traffic from mid-summer, which will increase demand for jet fuel. The demand for motor fuel will also grow, as travel by private transport is still the part of the quarantine.

The number of drilling rigs in the United States continues to decline. There is a possibility of surprise in the market – demand can increase edgily as U.S. own production shrinks after the start of active human vaccination.

USD/RUB:

As expected, The CB of Russia will announce a 1% rate cut on the 19th of June. Even after the CBR rate is 4.5% per annum, ruble bonds will remain attractive, as oil prices are rising. Current oil prices are generally at the levels budgeted for this year.

Under the current conditions, the government can borrow funds in the market on good terms to solve problems related to coronavirus. Demand for debt securities constantly exceeds supply at the auctions held on Wednesdays. The volume of the placements in recent weeks is over 100 billion rubles.

Grain market:

The United Nations has been detecting a drop in the food price index for the fourth consecutive month. At the end of May, it fell by 1.9% to 162.5 points. This is the lowest level since December 2018.

The grain market is under pressure, as the crisis will increase the number of households that will switch from more expensive varieties of meat (beef) to the cheaper ones (pork), which will reduce demand for feed. In addition, meat consumption will also decrease in absolute value.

We are waiting for the USDA report this week on the 11th. We haven’t seen a bad influence of the weather on plant vegetation. Therefore, we can confidently say that the record figures announced in the previous forecast will be confirmed. This could put additional pressure on the market.

Demand from companies producing disinfectant liquids for alcohol, as well as rising fuel prices support the corn market, as there are prospects for increased production of bioethanol.

Furthermore, in response to President Donald Trump’s criticism of the security law in Hong Kong, China instructed state companies to cancel purchases of soy and pork from the US.

Brent. ICE

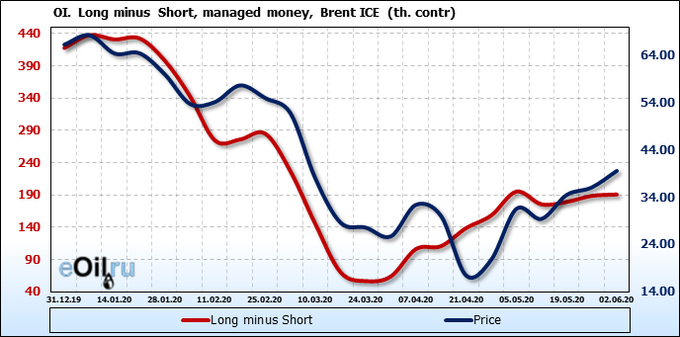

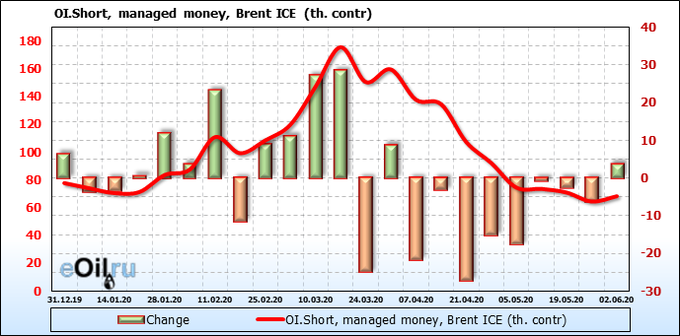

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Please note, that sellers have appeared on the market. We assume that the closer market to the level of 45.00 is, the more speculators will enter the shorts.

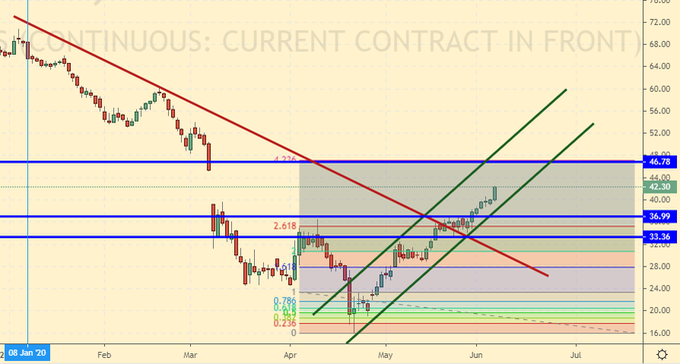

rowth scenario: June futures, the expiration date is 30 June. The market growth will end at the level of 47.00. It is more comfortable to make new purchases on an 1H intervals.

Falling scenario: when approaching the level of 45.00, you can start selling at the appearance of downside reversal signals with small timeframes. From 46.50 it is possible to sell aggressively.

Recommendations:

Buy: no. Whoever is in position from 31.50, move the stop on 35.80. Target: 45.90.

Sale: by touching 45.90. Stop: 47.90. Target: 35.60.

Support — 36.99. Resistance – 46.78.

WTI. CME Group

Fundament: the number of oil drilling rigs in US dropped by 16 to 206.

Commercial oil reserves in the USA fell by -2,077 to 532,345 mn barrels. Gasoline reserves increased by 2.795 mln barrels to 257.795 mln barrels. Distillate inventories increased by 9,934 mln barrels to 174,261 mln barrels. The Cushing storage capacity dropped by -1,739 mn barrels to 51,723 mn barrels.

Oil production fell by -0.2 mn barrels to 11.2 mn barrels per day. Oil import fell by -1.021 mn barrels to 6.179 mn barrels per day. Crude oil exports dropped by -0.382 to 2.794 mn barrels per day. Thus, net oil imports fell by -0.639 mn barrels to 3.385 mn barrels per day. Oil processing grew by 0.5 to 71.8%.

Gasoline demand increased by 0.296 to 7.549 mn barrels per day. Gasoline production increased by 0.608 to 7.779 mln barrels per day. Gasoline imports increased by 0.49 mn barrels per day to 0.782 mn barrels per day. Gasoline exports increased by 0.053 mn barrels per day to 0.263 mn barrels per day.

Demand for distillates fell by -0.548 mn barrels to 2.718 mn barrels. Distillate production fell by -0.066 mn barrels to 4.714 mn barrels. Imports of distillates rose by -0.008 mn barrels to 0.163 mn barrels. Distillate exports fell by -0.145 to 0.74 mln barrels per day.

Demand for petroleum products dropped by -0.892 to 15.066 mln barrels. Distillate production increased by 0.528 mn barrels to 18.92 mn barrels. Imports of distillates rose by 0.279 bbl to 1.834 mln barrels. Gasoline exports increased by 0.079 to 4.426 mln barrels per day.

Propane demand fell by -0.19 mn barrels to 0.589 mn barrels. Production of propane fell by -0.025 to 1.989 mln barrels. Imports of propane dropped by -0.039 to 0.068 mln barrels. Export of propane fell by -0.095 to 1.027 mln barrels per day.

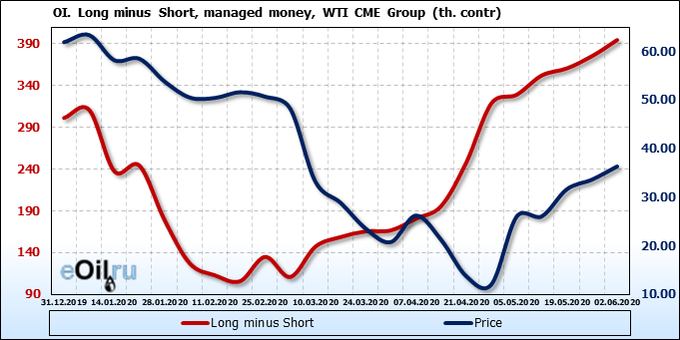

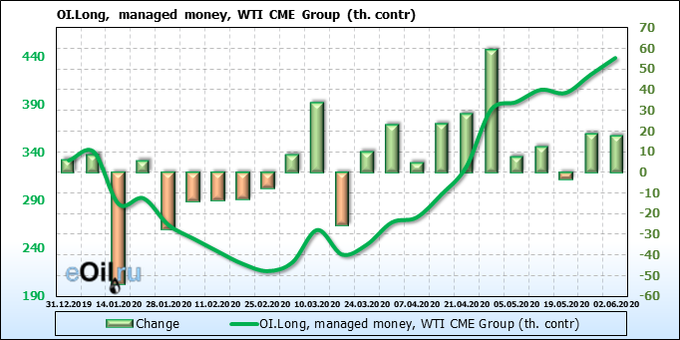

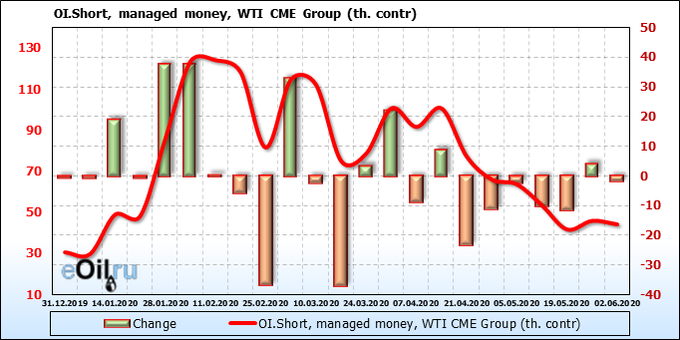

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group exchange.

Bulls are still pushing. But the market is overbought, this could lead to a sharp turn down. Bulls lifted the market 10 out of 11 weeks. We’re waiting for a rollback from 45.00 area.

Growth scenario: July futures, expiration date is June 22. The market is high for purchases. Better buy when prices return to 29.00.

Falling scenario: we can try to find the entry points to the shorts at the 40.00 area. More active sales will be made by touching 45.00.

Recommendation:

Buy: no.

Sale: sell from 45.00 is obligatory. Stop: 47.30. Target: 31.60. If now, stop: 40.60. Target: 29.00.

Support — 35.13. Resistance — 45.33.

Gas-Oil. ICE

Growth scenario: July futures, expiration date July 10. Growth to 430.0 is possible. Therefore, keep longs even if at 350.0 sellers will meet the market.

Falling scenario: sales at 350 can be taken into account in case of downside reversal signals on small timeframes. Place the stop-order close to the entry point.

Recommendation:

Buy: no. Whoever is in position from 305.0, move the stop order to 290.0. Target: 430.0.

Sell: sell from 430.0 is obligatory. Stop: 446.0. Target: 312.0. Or, by touching 356.0. Stop: 363.0. Target: 280.0.

Support – 308.25. Resistance – 353.50.

Natural Gas. CME Group

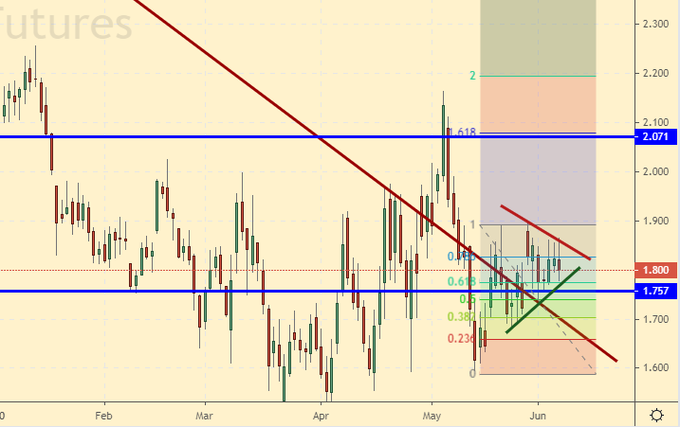

Growth scenario: July futures, expiration date June 26. The current consolidation has great chances to end in growth. We keep the longs opened earlier. Those who wish to buy – do it.

Growth scenario: we continue to ignore sales. Oil is rising, which supports gas prices as well. Move to 2.00, and then to 2.37, seems obvious. The stronger growth is still in question.

Recommendation:

Buy: now. Stop: 1.69. Target: 2.37. Whoever’s in position from 1.83, hold the stop at 1.69. Target: 2.37.

Sale: No.

Support – 1.757. Resistance – 2.071.

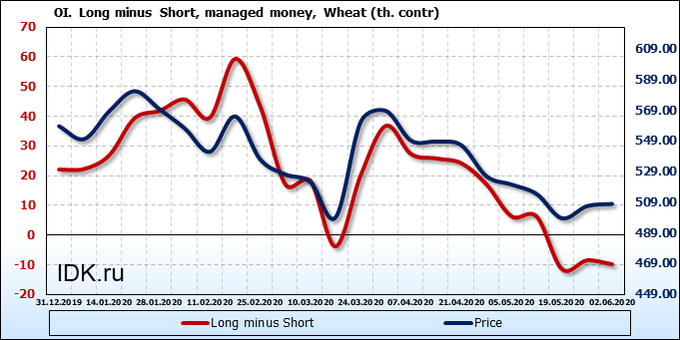

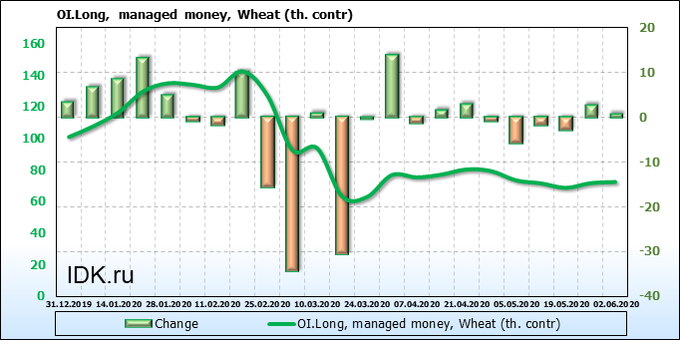

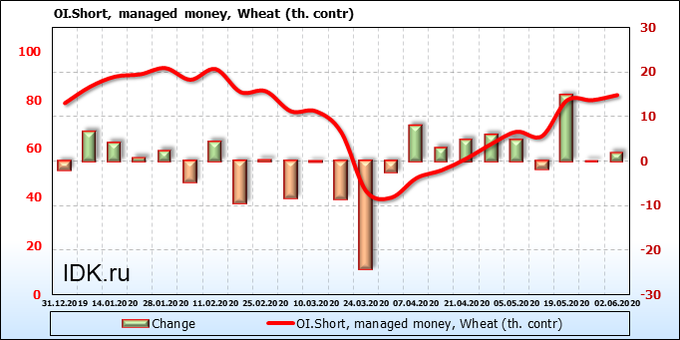

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group exchange.

There are no ideas on the market. Everyone is waiting for the USDA report. If it is extremely optimistic, prices may fall, this behavior will be unnatural for June.

Growth scenario: July futures, expiration date is July 14. We maintain to hold purchases because prices still remain in a rising price channel. We do not add to current positions, also don’t open new purchases.

Falling scenario: Friday closed below the middle of the previous long candle. Short is possible.

Recommendation:

Buy: no. Who is in position from 501.0, move the stop to 503.0. Target: 570.0.

Sale: now. Stop: 529.0. Target: 450.0.

Support – 506.2. Resistance – 529.4.

Corn No. 2 Yellow. CME Group

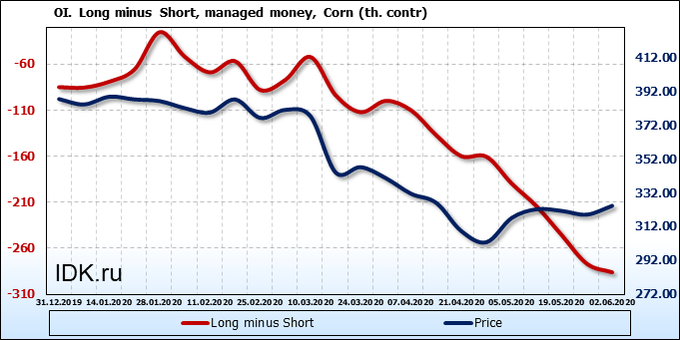

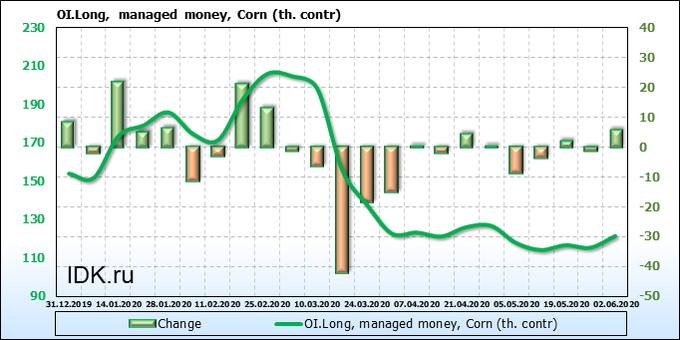

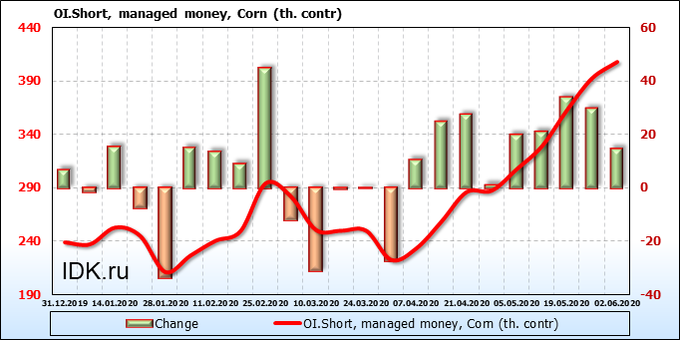

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group exchange.

A small group of customers came. However, the pressure from the sellers still persists. If the prices go above 338.0, we can see the price shoot up, because sellers will have to exit from their short positions and buy.

Growth scenario: July futures, expiration date is July 14. We believe that we should keep the longs opened earlier from 315.0 and 325.0. It makes no sense to open new buy positions. Shift the stop order by trend.

Falling scenario: until there is a long red candle down, we will not sell. It is entirely possible that sellers who accumulate their positions for three months will be trapped.

Recommendation:

Buy: no. If you are in position 315.0 and 325.0, move the stop to 317.0. Target: 400.0?!

Sell: is possible by touching 317.0. Stop: 327.0. Target: 250.0.

Support – 321.2. Resistance – 338.2.

Soybeans No. 1. CME Group

Growth scenario: July futures, expiration date July 14. In this situation, you can buy with a correction to 853.0. If it is not, you should not buy. Prices are high.

Falling scenario: you can sell from the current levels if desired. There is a confrontation between the USA and China on the market. Pay attention to the weak candle of Friday.

Recommendation:

Buy: no. If you are in position from 840.0, move the stop to 843.0. Target: 1000.0?!

Sale: now. Stop: 882.0. Target: 750.0.

Support – 852.4. Resistance – 895.2.

Sugar 11 white, ICE

Growth scenario: July futures, expiration date is June 30. We have reached the target at 12.00, congrats! Now we are waiting for the rebound by 11.07 and then buy again. We can leave 20% of the position, in case the growth will continue without a pullback.

Falling scenario: You can sell now. A pullback by 11.07 is very possible. We do not consider a deeper fall yet.

Buy: with a rollback to 11.07. Stop: 10.40. Target: 13.80. Congrats with a profit.

Sale: now. Stop: 12.26. Target: 11.07.

Support — 10.51. Resistance — 12.05 (13.82).

Сoffee С, ICE

Growth scenario: July futures, expiration date July 21. This is a 1W timeframe! We can see that the market is close to its minimums. If the market rises above 100.0 again, we will buy.

Falling scenario: we keep standing in shorts. Once again we move the stop order in trend, we believe in the coffee apocalypse and price of 75.00!

Recommendation:

Buy: by touching 76.00. Stop: 72.00. Target: 99.00. Or after growing above 100.0. Stop: 97.00. Target: 120.0?

Sale: no. Who’s in position, from 112.0 and 100.0, move the stop to 106.0. Target: 76.0?!

Support – 91.60. Resistance – 103.25.

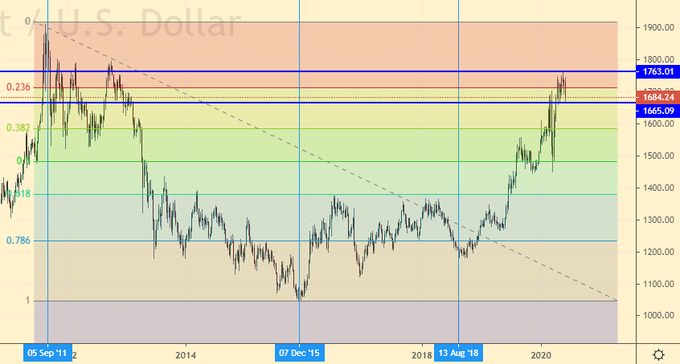

Gold. CME Group

Growth scenario: it’s a 1W timeframe! The 1750 area is extremely important for future developments. If we fail to pass above 1765, the market has all chances to make a correction move to 1400. We do not purchase while.

It is possible that the comment from Chairman Powell will affect the market after the 10th of June FRS meeting.

Falling scenario: who entered last week, hold your positions. The probability of a move to 1400 is increasing as concerns about the coronavirus are reduced. Sales from current levels are also possible.

Recommendation:

Buy: no.

Sell: now. Stop: 1723. Target: 1400. Whoever is in position from 1730, hold the stop at 1747. Target: 1400?!

Support – 1665. Resistance: – 1763.

EUR/USD

Growth scenario: it is unlikely that the FRS Chairman Powell will publicly repent in front of the people and talk about problems on the 10th FRS meeting. Just because statistics on job creation outside the agricultural sector brought a surprise on Friday. Instead of an expected decline of 8 million, there was shown an increase of 2.5 million. At least we’re waiting for a correction to 1.1150, possibly to 1.1000.

Falling scenario: sales are possible now. In case the market falls below 1.1150 and 1.1000, it will be possible to add to the open positions.

Recommendation:

Buy: no. If you are in position from 1.0800, move the stop to 1.0970. Target: 1.1480 (1.2000). It is possible to close 20% of the position volume.

Sell: Now. Stop: 1.1410. Target: 1.000 (0.7500?!!).

Support – 1.1155. Resistance – 1.1457.

USD/RUB

Growth scenario: we will buy a lot from the area 67.00, its obligatory. The Russian government hasn’t interest to strong ruble. The current levels are already attractive for long-term purchases.

Falling scenario: we continue to believe that we need to be patient here and reach our goal at 66.70. Do not open new sell positions because prices are low.

Recommendation:

Buy: now and up to 65.70. Stop: 64.70. Target: 72.00.

Sale: no. Who is in position from 72.80, move the stop to 70.37. Target: 66.70.

Support – 66.04. Resistance – 70.52.

RTSI

Growth scenario: sellers will meet the market in 1330 area. Considering that the potential for oil growth and ruble appreciation is close to their end, we recommend to close at least half of the volume of your positions at 1350. The move to 1450 is possible provided that SP500 will forget about the real world and goes to 4000, we have technical prerequisites for that.

Falling scenario: we will sell at 1330. If the market goes higher, we will increase our sales volume from 1450.

In addiction both the volume of sales of hydrocarbons in the foreign market and the foreign currency proceeds to the country have decreased. Gazprom will be more active in domestic gasification, expanding gas sales on the local market. Exporting companies will be under the strict administrative control because of the inflow of foreign currency in Russia will limited.

The market movement above 1450 is not visible.

Recommendation:

Buy: no. Who is in position from 1170, move the stop to 1230. Target: 1330 (1450).

Sale: by touching 1330. Stop: 1360. Target: 600?! Or by touching 1445. Stop: 1510. Target: 1,000.

Support – 1169. Resistance – 1331.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.