06 July 2020, 13:28

Price forecast weekly from 6th to 10th of July 2020

-

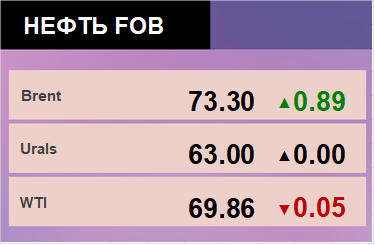

Energy market:

A story with an increase in the number of diseased people up to 50 thousand cases per day can end in repeated paralysis of the economy for at least a month. Nevertheless, the second cycle of restrictions should be easier, as there is experience, and there are already drugs, albeit experimental ones.

The inability of the US to curb the epidemic and its own citizens is bad news for the oil market. Last month, OPEC reduced production to 22.69 million barrels per day. This is the lowest figure since May 1991. Who knows, maybe this will not be enough in the coming weeks.

If the OPEC + countries want to maintain their market share, they will have to be content with a low price: $ 30 per barrel. If the price is higher, production will be supported both in the United States and in other countries outside the OPEC + deal.

Grain market:

On Friday, the 10th, we are waiting for the release of the USDA report. The market can receive powerful doping for growth in the event of a decrease in forecasts for the gross harvest of grain.

Disturbing news comes from Europe. It is expected that 27 countries of the European Union and the United Kingdom, which left the block in January, will harvest 131.3 million tons of soft wheat in 2020, according to the average forecast of analysts and traders surveyed by Reuters.

As a result, production will be closer to the dry 2018 level of 128.3 million than last year’s 147 million, according to estimates by the European Commission.

The expectation of a decrease in gross harvest may contribute to higher grain prices in the coming weeks. Judging by what we see on the charts, July can be a bull month.

USD/RUB:

The RGBI index went down. We do not see a clearly expressed fall, however, speculators can start selling Russian bonds because they feel weakness in the market. That will lead to the departure of some assets from the ruble zone.

The results of the vote on amendments to the constitution did not provoke a vigorous reaction in the West. Simply because there are enough of problems in connection with the pandemic. The fall in world GDP by the end of the year may be more than 10 percent if the second wave of infection develops, which will equal a full-fledged economic crisis.

Oil prices are at a comfortable level for the Russian budget. If there are no external shocks, then the ruble is unlikely to quickly lose ground. Moreover, preserving the energy markets in Germany and China, the Russian economy can maintain tonus in comparison with more developed countries. In this case, a move will take place to the level of 66.00 for this pair.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Against the background of Independence Day in the United States, we see a loss of speculators’ interest to new bets. It is possible that some recovery will be next week. Do not forget that the middle of summer is approaching and you need some reason for increased activity in the market.

Growth scenario: July futures, the expiration date is July 31. Movement up became exhausted. We believe in a possible move by 45.50, but not in the stronger growth. The coronavirus began to rage again.

Falling scenario: the current area is convenient for sales. A «diagonal triangle» which is likely to complete this upward movement at 45.50 will lead to a downward turn.

Recommendation:

Purchase: no.

Sale: now. Stop: 43.20. Target: 32.40. Or when approaching 45.50. Stop: 47.60. Target: 32.40.

Support — 39.27. Resistance — 45.49.

WTI. CME Group

Fundament: the number of drilling rigs in the United States fell by 3 units to 185 pieces.

US commercial oil inventories fell -7.195 to 533.527 million barrels. Gasoline inventories rose 1.199 to 256.521 million barrels. Distillate stocks fell -0.593 to 174.127 million barrels. Reserves in Cushing’s storage fell -0.263 to 45.582 million barrels.

Oil production has not changed and amounts to 11 million barrels per day. Oil imports fell -0.571 to 5.969 million barrels per day. Oil exports fell -0.065 to 3.092 million barrels per day. Thus, net oil imports fell by -0.506 to 2.877 million barrels per day. Oil refining rose 0.9 to 75.5 percent.

Demand for gasoline fell -0.047 to 8.561 million barrels per day. Gasoline production rose 0.111 to 8.905 million barrels per day. Gasoline imports rose 0.307 to 1.011 million barrels per day. Gasoline exports grew by 0.197 to 0.483 million barrels per day.

Demand for distillates increased by 0.312 to 3.778 million barrels. Distillate production increased by 0.063 to 4.624 million barrels. Distillate imports grew by 0.066 to 0.135 million barrels. Distillate exports fell -0.062 to 1.066 million barrels per day.

Demand for petroleum products fell by -0.995 to 17.353 million barrels. Distillate production fell by -0.767 to 20.316 million barrels. Distillate imports fell -0.259 to 1.937 million barrels. Gasoline exports rose 0.115 to 4.744 million barrels per day.

Demand for propane fell -0.006 to 0.695 million barrels. Propane production increased by 0.076 to 2.23 million barrels. Propane imports fell -0.004 to 0.059 million barrels. Propane exports fell -0.052 to 1.127 million barrels per day.

Due to the Independence Day in the USA, we do not have new data on open interest on the CME Group exchange.

Growth scenario: August futures, the expiration date is July 21. Prices are still high. We need a pullback to enter the long, preferably in the region of 30.00.

Falling scenario: still believe that we have the right to count on a reversal down in this area. Impulse up is exhausted, you can sell here.

Recommendation:

Purchase: no.

Sale: from 43.30 it is obligatory to sell. Stop: 46.10. Target: 30.00. Or now, stop 40.70. Target: 30.00.

Support — 36.91. Resistance — 43.26.

Gas-Oil. ICE

Growth scenario: July futures, the expiration date is July 10. Prices continue to remain in a growing price channel. We can assume that if it falls below the level of 350.0, the market will quickly roll back to the area of 300.0. We move up the stop orders.

Falling scenario: a burst to 430.0 remains possible. Therefore, we will sell either by touching this level, or after falling below 350.0. The market usually closes gaps, so the move to 430.0 is seen as the most likely event.

Recommendation:

Purchase: no. Who is in the positions of 305.0 and 325.0, transfer the stop to 343.0. Target: 430.0.

Sale: from 430.0 it is obligatory to sell. Stop: 456.0. Target: 300.0.

Support — 288.00. Resistance — 378.00.

Natural Gas. CME Group

Growth scenario: August futures, the expiration date is July 29. We see a recovery that can be associated with a decrease in well head gas production due to a reduction in oil production by hydraulic fracturing. However, we will not rush with shopping. Let’s look at the development of the situation from the outside.

Falling scenario: good levels for tactical sales, which are best worked out at 1H intervals.

Recommendation:

Purchase: not yet.

Sale: no.

Support — 1.604. Resistance — 1.819.

Wheat No. 2 Soft Red. CME Group

Due to the Independence Day in the USA, we do not have new data on open interest on the CME Group exchange.

Growth scenario: September futures, the expiration date is September 14. A splash in prices of last week could lead to a move up to 545.0. If you work out this scenario, then the current levels are very attractive for purchases. If there is a fall to 480.0 – be ready to buy.

Falling scenario: the market did not give us the 440.0 mark and rolled back up. While we are under 500.0, a struggle for a new stage of decline is possible, however, we propose not to take part in this struggle.

Recommendation:

Purchase: now. Stop: 470.0. Target: 544.0.

Sale: no. They took the move from 518.0 to 491.0.

Support — 481.2. Resistance — 500.4.

Due to the Independence Day in the USA, we do not have new data on open interest on the CME Group exchange.

Growth scenario: September futures, the expiration date is September 14. Bulls attacked before Independence Day in the United States, there is some kind of «romantic» in this. In fact, a report came out on a reduction in actual US corn production from 97 to 92 million acres. Judging by the Fibonacci levels, the market can grow to the level of 415.0. If the USDA report shows a decline in production, then in July we will have time to reach the area of 400.0.

Falling scenario: this is no deal with the sales. We do not make new attempts to enter the short, take a break.

Recommendation:

Purchase: now and up to 330.0. Stop: 320.0. Target: 415.0.

Sale: no.

Support — 330.6. Resistance — 353.6.

Soybeans No. 1. CME Group

Growth scenario: September futures, the expiration date is September 14. The growing demand for feed in Europe and the recovery in demand for soy in China after the African swine fever are pushing the market up. In the area of 900.0, the market will be met by sellers, but most likely we will go to 950.0 before the end of the month.

Falling scenario: prices rise aggressively. We will refrain from sales.

Recommendation:

Purchase: no. Who is in position from 840.0, move the stop to 867.0. Target: 950.0. At 900.0, you can close 20% of the position.

Sale: no.

Support — 872.2. Resistance — 899.2.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. Going above 12.40 will not be easy. However, the growth rate suggests that we still go above this level and go to 14.00. In case of growth above 12.50 — buy.

Falling scenario: while you can hold shorts, as there is little chance of a continuation of the fall. There is no point in changing anything, since our stop is at 12.30, which is extremely close to the current levels.

Recommendation:

Purchase: in case of growth above 12.50. Stop: 11.90. Target: 14.00.

Sale: no. Who entered from 11.96, hold the stop at 12.30. Target: 10.60.

Support — 11.28. Resistance — 12.40.

Сoffee С, ICE

Growth scenario: September futures, the expiration date is September 18. We see a vibrant breakdown of the resistance line. We are waiting a rollback after such hitch, which will make it possible to increase positions or simply to do purchases.

Falling scenario: if the bears pass 106.0, then the upward movement will continue. We see that this level has been support for a long time, now it can become resistance. Note that there is concern about coffee harvest this and next year due to coronavirus. The situation with the coronavirus in Brazil is extremely bad.

Recommendation:

Purchase: by touching 100.10. Stop: 94.00. Target: 125.00. Who is in the position of 96.00, move the stop at 94.00. Target: 125.0.

Sale: no. The move from 112.0 to 103.0 was taken.

Support — 98.85. Resistance — 105.20.

Gold. CME Group

Growth scenario: bulls continue to control the situation. The story with 83 tons of fake gold in China unwittingly supports the market. However, we are at the lower boundary of the growing price channel, and if prices go below the level of 1750, prices may start a downward movement.

Falling scenario: we will not sell above 1750. Almost all countries will either have to run into debt or print money. This creates negative market expectations. And here, gold as a protective asset will continue to be in demand.

Recommendations:

Purchase: now. Stop: 1740. Goal: 2270. Who is in position, move the stop to 1747. Goal: 2200.

Sale: after falling below 1740. Stop: 1770. Target: 1650 (1400).

Support – 1757. Resistance – 1789.

EUR/USD

Growth scenario: we see consolidation, which is very likely to end with a breakthrough up and we will go to 1.1960. From here, buy or add to your positions in case of growth above 1.1350.

Falling scenario: if Europeans can prettily, without fighting, through the issuance of bonds, get out of this crisis, then Europe (the euro zone) will become stronger. The extremely aggressive struggle between Democrats and Republicans, in particular the story with BLM, harms the reputation of United States. In addition, there is a danger that several regions of the country will be shut due to coronavirus. Fundamentally, it is not yet visible due to what the dollar may be stronger than the euro. Yes, the Fed rate is in the positive zone, but that’s only for now.

Recommendations:

Purchase: in case of growth above 1.1350. Stop: 1.1230. Target: 1.1960. Who is in the position from 1.0800, move the stop at 1.1070. Target: 1.1960.

Sale: after falling below 1.1150. Stop: 1.1260. Target: 1.0000. Who is in the position of 1.1230, move the stop to 1.1320. Target: 1.0000.

Support is 1.1185. Resistance — 1.1304.

USD/RUB

Growth scenario: the ruble continues to weaken. For three weeks, we recommended buying a pair, now it’s too late to do it. So far, we have a move scenario at 66.00 below 72.60, but for this we need a strong fundamental, but there will be problems with this in the second quarter. We keep the long in the pair.

Falling scenario: the bulls tore sellers up last week. We will see some struggle around 72.00, but it is unlikely that sellers will be able to regain control of the market. Unless the dollar index moves to an active fall.

Recommendations:

Purchase: no. Who is in position, from 68.00 and 69.70, move the stop at 68.60. Target: 74.50 (78.50).

Sale: no.

Support — 69.77. Resistance — 72.57.

RTSI

Growth scenario: the week ended against buyers. Traders were careful, as the week was incomplete both in Russia and in the USA. However, while the SP500 claims to resume growth, buyers have chances for a bright future. Another thing is that above 1450 the market is not visible under any circumstances.

Falling scenario: we continue to expect a fall to 1100. We understand that even if there is a move to the 1400 area, a downward turn is inevitable, since in a falling economy, the stock market cannot grow for a long time.

Recommendations:

Purchase: think when rolling back to 1100.

Sale: now. Stop: 1286. Target: 1100 (600?).

Support is 1182. Resistance is 1314.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.