05 October 2020, 11:51

PRICE FORECAST WEEKLY from 5 to 9 October 2020

-

Energy market:

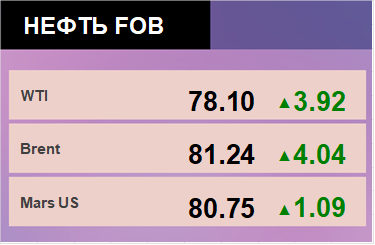

Oil production in Libya is currently 275 thousand barrels per day. A month ago it was about zero. New barrels on the market put additional pressure in circumstances where demand tends to decline.

Oil prices continue to decline and we see no reason to revise our target at 35.00 Brent. There is still plenty of time before the OPEC technical meeting on the 15th for the market to reach this level.

With oil prices falling, exploration and production are declining. As an example, the Norwegian Equinor is starting to cut staff in the exploration sector as part of a cost-cutting program.

In addition, global drilling will be down 26.6% this year to 47,099 wells, with 84% of all drilling going to the United States, Canada, Russia and China, which is likely to surpass the United States in total drilling for the first time. 2020 year.

Reading our forecasts, you could have made money on the USD/RUB pair by taking a move up from 73.10 to 78.90, and in the corn market, also taking a move up from 362.0 to 379.0.

Grain market:

The market has reached an equilibrium position and is in no hurry to get out of it. The quarterly data from the USDA on grain stocks in the US, although they turned out to be worse than expected, could not fundamentally improve the position of bulls in the market.

So, after the upward price jump in the wheat market, there was an immediate pullback downward. This tells us about a large number of sellers who are ready to sell contracts when approaching the level of 600.0 cents per bushel.

The Ministry of Agriculture of the Russian Federation has raised the forecast for grain harvest this year. The ministry expects that it will receive more than 125 million tons of grain and pulse crops, including wheat — at least 82 million tons, which is 7.5 million tons more than a year earlier. In the summer, the ministry estimated the grain harvest this year at 122.5 million tons, including 75 million tons of wheat.

USD/RUB:

Shells from Nagorno-Karabakh have not yet reached the ruble. Since no harsh statements, and most importantly actions, came from the Kremlin, it can be assumed that Russia will refrain from participating in the conflict between Armenia and Azerbaijan. The peace-loving statement of the presidents of Russia, the United States and France calling for an end to the war clearly speaks in favor of finding political ways of a settlement. This approach is perceived positively by the business.

Nevertheless, it is unlikely that the ruble will be able to maintain its current levels amid falling oil prices. We admit a correction to 76.00, but then there will be another attempt to break through to the 85.00 area.

Until Nabiullina panics and does not urgently raise the rate. This cools the hotheads of speculators who are very fond of situations when the Central Bank’s situation is getting out of control. Therefore, we will rather see well-practiced technical moves in a pair, rather than a unidirectional rally.

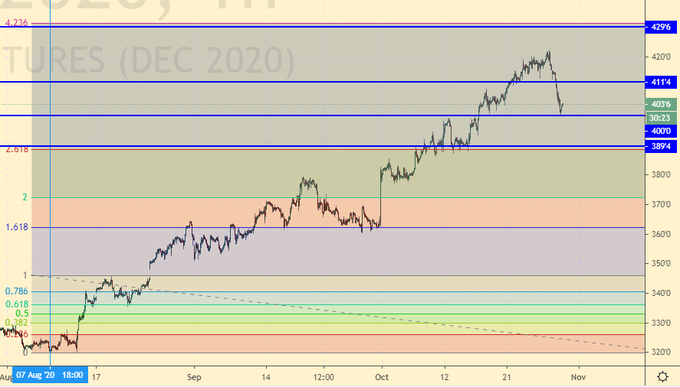

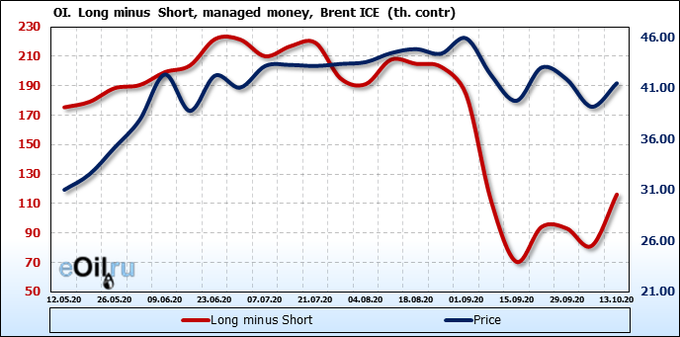

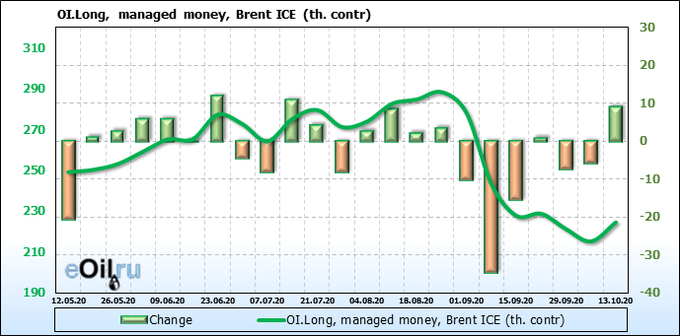

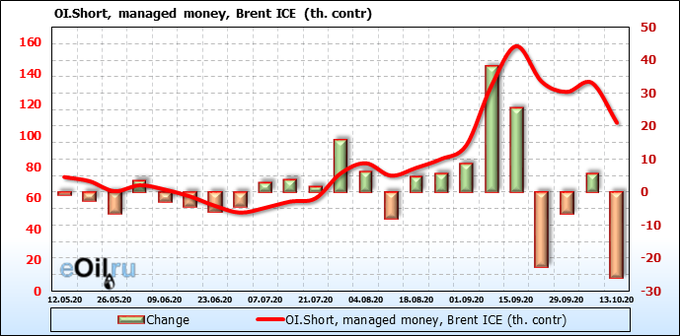

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Both buyers and sellers are leaving the market. The fall in investments in the market tells us about the uncertainty of some of the participants, and makes the situation more subtle than it was a week ago.

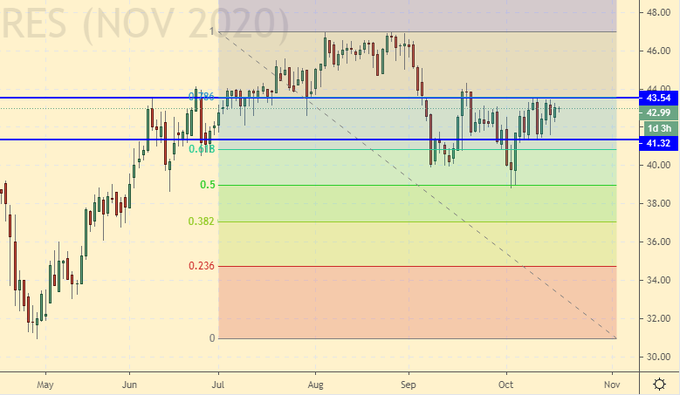

Growth scenario: October futures, the expiration date is October 30. We continue to refrain from shopping. When we approach 35.00 we will definitely buy. The rest of the levels are of no interest.

Falling scenario: we continue to stand in shorts. On Friday, they showed a new minimum that give the free hands of sellers. On Monday, we expect the bearish pressure to increase.

Recommendation:

Purchase: when approaching 35.00. Stop: 34.80. Target: 39.00.

Sale: no. Those who are in positions from 43.95, 42.90 and 42.00, move the stop to 42.70. Target: 35.10 (32.10; 27.00 ?!).

Support — 34.94. Resistance — 40.92.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 6 units to 189 units.

US commercial oil reserves fell -1.98 to 492.426 million barrels. Gasoline inventories increased by 0.683 to 228.182 million barrels. Distillate stocks fell by -3.184 to 172.758 million barrels. Cushing’s stocks rose 1.785 to 56.066 million barrels.

Oil production has not changed at 10.7 million barrels per day. Oil imports fell by -0.046 to 5.122 million barrels per day. Oil exports rose by 0.49 to 3.512 million barrels per day. Thus, net oil imports fell by -0.536 to 1.61 million barrels per day. Oil refining rose 1 percent to 75.8 percent.

Gasoline demand rose 0.014 to 8.529 million barrels per day. Gasoline production fell by -0.423 to 8.892 million barrels per day. Gasoline imports rose 0.258 to 0.732 million barrels per day. Gasoline exports fell by -0.078 to 0.668 million barrels per day.

Distillate demand fell by -0.304 to 3.655 million barrels. Distillate production fell by -0.112 to 4.358 million barrels. Distillate imports rose 0.005 to 0.141 million barrels. Distillate exports rose 0.171 to 1.299 million barrels per day.

The demand for petroleum products fell by -0.992 to 17.447 million barrels. Distillate production fell 0.77 to 20.008 million barrels. Distillate imports fell by -0.084 to 1.951 million barrels. Gasoline exports rose 0.167 to 5.14 million barrels per day.

Propane demand fell by -0.434 to 0.615 million barrels. Propane production increased by 0.123 to 2.351 million barrels. Propane imports rose by 0.051 to 0.161 million barrels. Propane exports rose 0.276 to 1.315 million barrels per day.

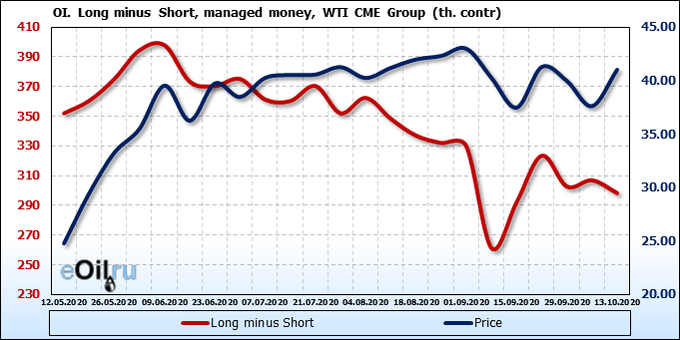

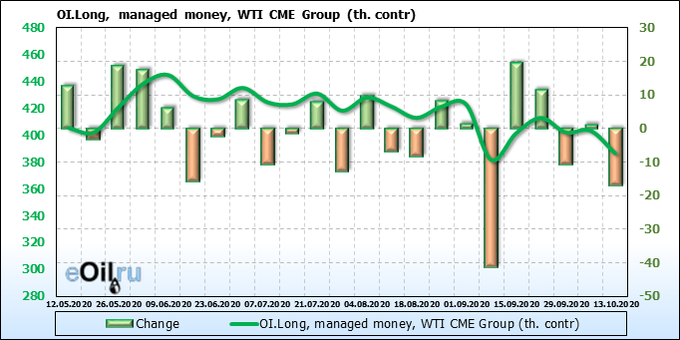

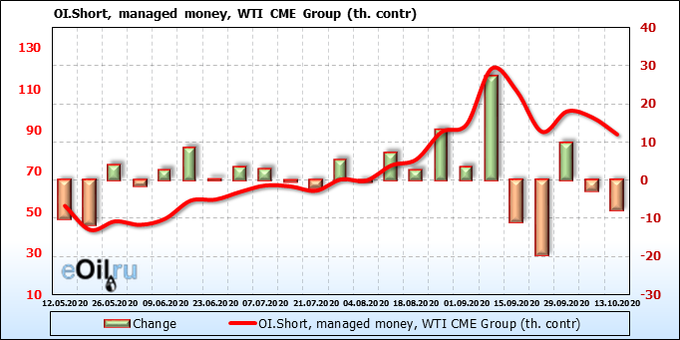

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Buyers flee, sellers, on the contrary, come to the market. We see an increase in negative moods. WTI was unable to set a new low on Friday, however, the market is unlikely to postpone this achievement on the back burner. The long red candle on Friday cut buyers claws.

Growth scenario: November futures, the expiration date is October 20. If we fall to 32.00, then it is worth looking for opportunities to enter the long. It is unlikely that sellers will be able to pass this level before the meeting of the OPEC technical committee on the 15th.

Falling scenario: hold the shorts. So far, everything is going well. The market behaves as we saw it back in early September. The target at 32.00 is quite realistic. After a pause, a deeper dive is not excluded.

Recommendation:

Purchase: think, look for reversal signals when approaching 32.00.

Sale: no. Those who are in the position between 40.30 and 39.80, move the stop to 40.70. Target: 32.20 (30.00?).

Support — 36.53 (32.16). Resistance — 42.54.

Gas-Oil. ICE

Growth scenario: October futures, the expiration date is October 12. It is worth thinking hard about buying when approaching 300.0. The level is extremely interesting for buyers. However, if the oil market drops in a recoilless mode, it is not worth buying.

Falling scenario: continue to wait for the move to 300.0. Given the situation, I would like to hold the shorts even after reaching the designated level. It is possible that we will go to 270.0. But to work out this theory, only 30% of the initial volume of the open short will be enough.

Recommendation:

Purchase: think, look for reversal signals when approaching 300.0.

Sale: no. Those who are in positions between 340.0, 370.0 and 375.0, move the stop to 341.0. Target: 300.0 (270.0).

Support — 299.75. Resistance — 339.25.

Natural Gas. CME Group

Growth scenario: November futures, the expiration date is October 28. Buyers meet the market in the area of 2.300 — 2.400. This can be seen in the long shadows down. You can buy here. The risks are not big.

Falling scenario: we continue to refuse to sell. On the eve of winter, it is inexpedient to sell one of the most important energy sources.

Recommendation:

Purchase: now. Stop: 2.330. Target: 3.500.

Sale: no.

Support — 2.346. Resistance — 2.607.

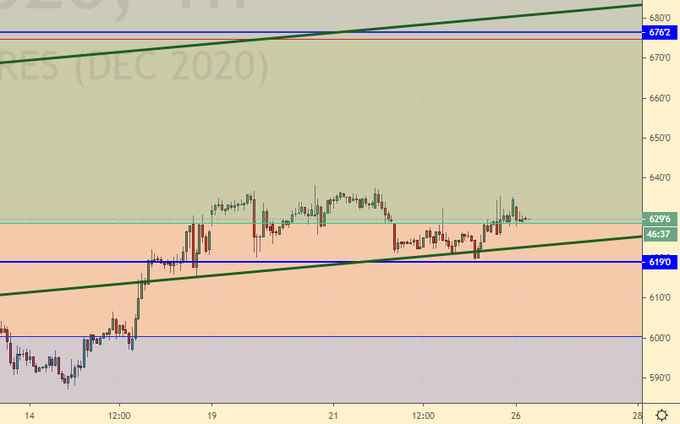

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Both sellers and buyers decreased activity somewhat, which confirms our conclusion that there is uncertainty in the market. In such a situation, it is better to refrain from active actions. There is no point in opening new positions now. Previously opened deals can be held.

Growth scenario: December futures, the expiration date December 14. On the second try, they caught a long from the 540.0 area. Despite a good leap forward on Wednesday, there are fears that we will not be able to approach 600.0. Three consecutively growing highs practically on the same line do not bode well for bulls. We pull up stop orders. We wait.

Falling scenario: if the market falls below 545.0 again, then this is an unambiguous short. There is a threat of breaking the growing impulse upward, which will lead to a depression for many months to get out of which will be extremely difficult. In addition, it makes sense to sell when approaching 600.0.

Recommendation:

Purchase: no. Those who are in positions from 492.0, 499.0 and 541.0, move the stop to 547.0. Target: 600.0 (650.0).

Sale: think, look for reversal signals when approaching 600.0.

Support — 556.0. Resistance — 600.4.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Albeit insignificant, but the simultaneous outflow of money from speculators from the market shows us that there is uncertainty with the trend. Note that the record harvest puts pressure on the minds of traders, it is not easy to buy in such circumstances. Not everyone is in a hurry to support the bulls.

Growth scenario: December futures, the expiration date is December 14. There is no sense in waiting for our target to touch at 387.0. We take profit at the current price. Whoever has already done this, our sincere congratulations.

Falling scenario: when approaching 387.0, you have to sell. There are prerequisites that the second wave of coronavirus will be softer. Nobody will close any ports, as it was in the spring. This means that there will be no logistical problems. In addition, the dollar is strengthening, which will reduce the export potential of US corn.

Recommendation:

Purchase: no. Close everything. Congratulations on your profit.

Sale: on touch 387.0. Stop: 393.0. Target: 365.0.

Support — 372.0. Resistance — 387.6.

Soybeans No. 1. CME Group

Growth scenario: November futures, the expiration date is November 13. We are objectively high so that we can talk about purchases. Out of the market.

Falling scenario: another downward price branch suggests itself. The move to 940.0 is quite possible, therefore we keep the previously opened shorts, and in addition, we sell from the current levels.

Recommendation:

Purchase: no.

Sale: now. Stop: 1042.0. Target: 966.0. Whoever is in positions between 1040.0 and 1020.0, keep the stop at 1042.0. Target: 940.0.

Support — 983.6 Resistance — 1045.0.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 26. Prices have left the growing channel, and now they tend to return to it, but this will be extremely difficult to do due to the aggressive slope of the straight lines. We can hardly go above 13.80. We are not buying yet.

Falling scenario: we continue to think that the 13.60 area is a great spot for a short. We go on sale. We expect the market to fall to the 11.70 area.

Recommendation:

Purchase: no.

Sale: now. Stop: 13.87. Target: 11.70. Whoever is in position from 13.55, keep the stop at 13.87. Target: 11.70.

Support — 12.44. Resistance — 13.79.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 18. Green Friday candle lures us to long. Let’s buy. The risk is small.

Falling scenario: we think about shorts only in case of growth to 125.00. The current levels are extremely low.

Recommendation:

Purchase: now. Stop: 103.00. Target: 125.00.

Sale: no.

Support — 106.20. Resistance — 114.80.

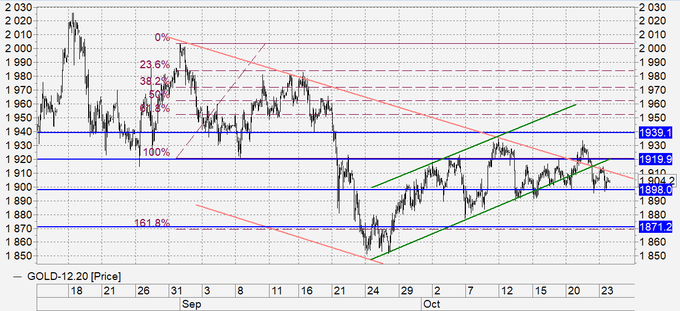

Gold. CME Group

Growth scenario: despite growth by 1920, we continue to believe that sellers still control the market. We are in a falling price channel, and until we get out of it, we should not give preference to the bulls.

Falling scenario: sell here. The move to 1780 will be the natural course of events in this situation.

Recommendations:

Purchase: think, look for reversal signals when touching 1780.

Sale: now. Stop: 1940. Target: 1780. Whoever is in position between 1950 and 1900, keep the stop at 1940. Target: 1780.

Support — 1845. Resistance — 1934.

EUR/USD

Growth scenario: for the dollar, another wave of strengthening suggests itself. Only if the market consolidates above 1.1800 will it make sense to talk about buying.

Falling scenario: here you need to sell or increase previously opened positions. The market is in a position to go to 1.1350.

Recommendations:

Purchase: think in case of growth above 1.1800.

Sale: now. Stop: 1.1870. Target: 1.1350. Whoever is in positions between 1.1850 and 1.1750, keep the stop at 1.1870. Target: 1.1350.

Support — 1.1610. Resistance — 1.1769.

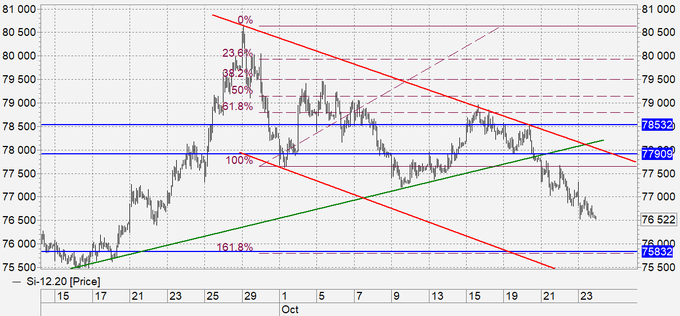

USD/RUB

Growth scenario: we have successfully met the target at 77.90. All with a profit. Now we need a pullback to 76.00 so that we can enter the purchase again. If it does not exist, and the pair continues to rise, we will prefer to stay out of the market on daily intervals.

Falling scenario: bulls were clearly overwhelmed by emotions during the week. We sharply went to 80.00, where, it is possible, the Central Bank entered the market with a lot, which cooled the ardor of buyers. Correction to 76.00 is possible, but it is better to work it out at hourly intervals.

Purchase: no. All with a profit.

Sale: no.

Support — 76.64. Resistance — 78.85.

RTSI

Growth scenario: the market has drawn a five-wave downward impulse. We are waiting for the rise to the area of 1220, after which another wave of decline should follow. If there is no upward correction, we will simply fall to 1000. Don’t buy yet.

Falling scenario: we continue to believe that if the market recovers to 1220, we need to increase the shorts. The 1000 target looks quite achievable. Strengthening tax administration by the government does not add optimism to bidders.

Recommendations:

Purchase: no.

Sale: when approaching 1220. Stop: 1268. Target: 1000. Who is in position between 1240 and 1228 keep the stop at 1268. Target: 1000.

Support — 1115. Resistance — 1262

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.