Price forecast weekly from 26 to 30 October 2020

-

Energy market:

The OPEC ministerial meeting was as neutral as possible. The whole attention shifted to the next meeting on November 16-17. There were no statements related to a possible reduction in production. It was stated that the current level of production is less than consumption by 1 million barrels per day, so nothing needs to be done except to force the violators of the discipline of the past months to hold on to production.

Europe continues to plunge into the abyss of a new stage of the pandemic. On the one hand, hospitals cannot cope, on the other hand, the authorities are in no hurry to introduce strong isolation measures to save the economy from recession. While greed wins, let’s see what happens next. Note that if humanism wins, and serious restrictive measures up to curfew are adopted in Europe, then oil prices will go to an intensive fall.

Grain market:

Panic buying of grain from the new harvest is doing its job. Exchange prices for wheat in Chicago have not yet rolled back and are claiming to reach the level of 670 cents per bushel, which is comparable to FOB prices around $ 260 per ton.

The World Bank has estimated the rise in food commodity prices in July-September 2020. On average, prices rose 6% — with growth seen in almost all categories.

In October, growth continued in almost all agricultural crops and processed products. Only coffee is allocated, the cost of which decreased in October.

Rising food costs will hit the poor, keeping governments in suspense in many countries as discontent rises.

The situation could become even more dramatic next year due to the autumn drought in the Black Sea region and the Volga region this fall, as well as due to the drought in the southern United States next year due to the La Niña effect in the Pacific Ocean.

USD/RUB:

The RF Central Bank left the rate at 4.25%. The press release was somewhat surprised by the fact that it directly indicated the bank’s desire to lower the rate in the future when appropriate conditions appear, that is, when inflation falls below 4%.

It is not clear how this inflation will be drawn with the soaring prices for grain and sunflower oil this fall. You also need to take into account the increase in import prices due to the fall in the ruble exchange rate from 61.20 to 76.15 rubles per dollar, so the fall was 24.4% since the beginning of the year.

So far, the ruble has headed for strengthening. It is unlikely that the couple will vigorously go down, as concerns about the introduction of strict quarantine in the country remain. Nevertheless, oil is above 40.00 and good OFZ sales on Wednesdays make the picture quite optimistic for the next couple of months.

Brent. ICE

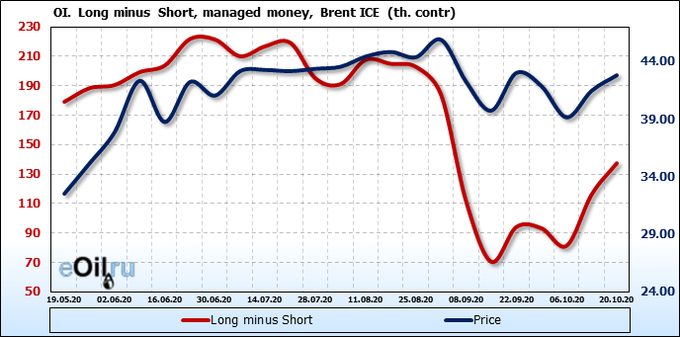

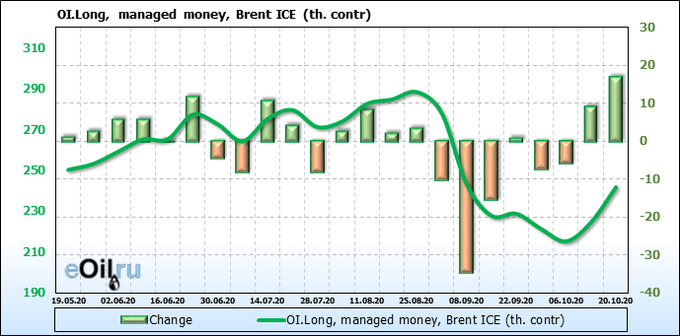

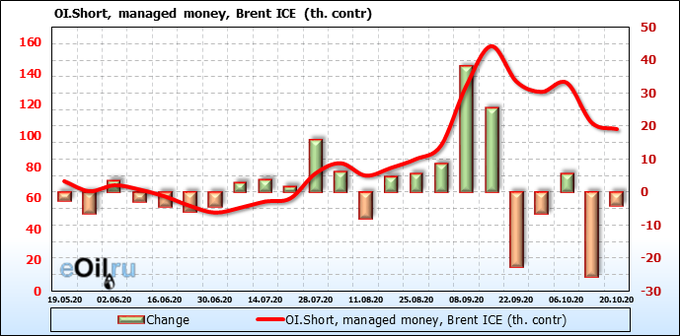

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

The buyers tried to push, but nothing came of it, at least not yet. If the market goes down next week, then speculators will have to do something with 30 thousand contracts that were probably unsuccessfully bought on the market over the past two weeks, or rather, they will have to be sold, which may increase the fall in prices.

Growth scenario: October futures, the expiration date October 30. Since the OPEC + meeting was held without loud statements, the market was left on its own for another month. A pandemic will have a big impact. The fewer the consequences for the economy, the better for oil. So far, we see no reasons for the rise in prices.

Falling scenario: those who did not enter short, wait prices to fall below 41.00. The situation is mainly balanced at the moment. Need some kind of driver. Perhaps they will be the results of the US elections, and until November 3 the market will be dozy.

Recommendation:

Purchase: think after rising above 44.00.

Sale: think after falling below 41.00.

Support — 41.33. Resistance — 43.61.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 6 units to 211 units.

Commercial oil reserves in the US fell -1.002 to 488.107 million barrels. Gasoline inventories increased by 1.895 to 227.016 million barrels. Distillate stocks fell by -3.832 to 160.719 million barrels. Inventories at Cushing’s storage facility rose 0.975 to 60.417 million barrels.

Oil production fell by -0.6 to 9.9 million barrels per day. Oil imports fell by -0.168 to 5.118 million barrels per day. Oil exports rose 0.901 to 3.036 million barrels per day. Thus, net oil imports fell by -1.069 to 2.082 million barrels per day. Refining fell by -2.2 to 72.9 percent.

Gasoline demand fell by -0.287 to 8.289 million barrels per day. Gasoline production fell by -0.307 to 8.933 million barrels per day. Gasoline imports rose 0.111 to 0.509 million barrels per day. Gasoline exports fell by -0.026 to 0.699 million barrels per day.

Distillate demand fell by -0.587 to 3.588 million barrels. Distillate production fell by -0.138 to 4.131 million barrels. Distillate imports fell by -0.008 to 0.152 million barrels. Distillate exports fell by -0.046 to 1.243 million barrels per day.

The demand for petroleum products fell by -1.363 to 18.112 million barrels. Distillate production fell by -0.871 to 19.867 million barrels. Distillate imports fell by -0.186 to 1.85 million barrels. Gasoline exports fell by -0.398 to 4.992 million barrels per day.

Propane demand rose 0.335 to 1.473 million barrels. Propane production rose 0.005 to 2.157 million barrels. Propane imports rose 0.02 to 0.119 million barrels. Propane exports fell by -0.364 to 1.027 million barrels per day.

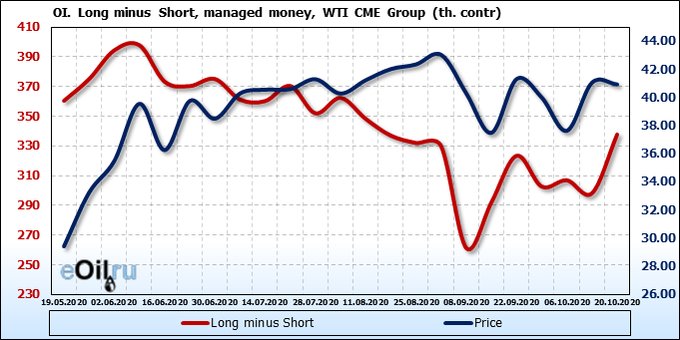

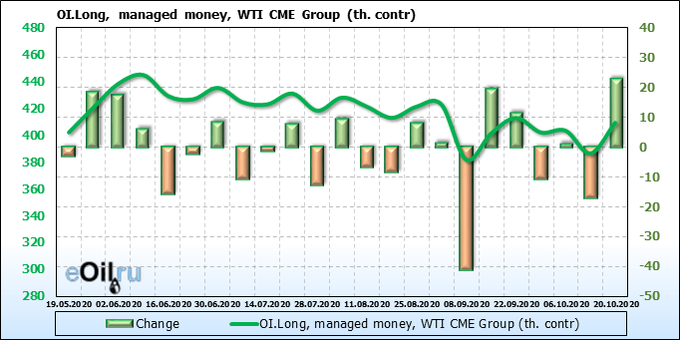

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The bulls tried to attack, but nothing came of it. “We talked and went our separate ways” — this is not the result that buyers expected from the OPEC + meeting. The bulls’ hopes were trampled upon by very spatial speculations about vaccines, supply-demand balances, and discipline breakers. Nothing specific. And I would like to hear that in the event of a strict quarantine in the United States, for example, OPEC + will automatically reduce production by 1 million barrels, or something like that.

Growth scenario: December futures, the expiration date November 20. We continue to believe that there is no point in speculating about purchases until we have risen above 42.00. Market is in balance.

Falling scenario: prices are slowly beginning to probe support at 39.00, if it is broken, then you can sell.

Recommendation:

Purchase: think after rising above 42.00.

Sale: think after the market falls below 39.00.

Support — 39.34. Resistance — 41.75

Gas-Oil. ICE

Growth scenario: November futures, the expiration date November 12. Everything is pretty neutral. Neither side has an advantage. Until we open positions below 355.0.

Falling scenario: sell here. The move down is not obvious, but a weak-willed Friday could be the beginning of a fall to 280.00.

Recommendation:

Purchase: think after rising above 355.00.

Sale: think when approaching 370.00. Second option: now. Stop: 347.00. Target: 280.00. Anyone in the position from 335.00, move the stop to 347.00. Target: 280.00.

Support — 312.25. Resistance — 353.25.

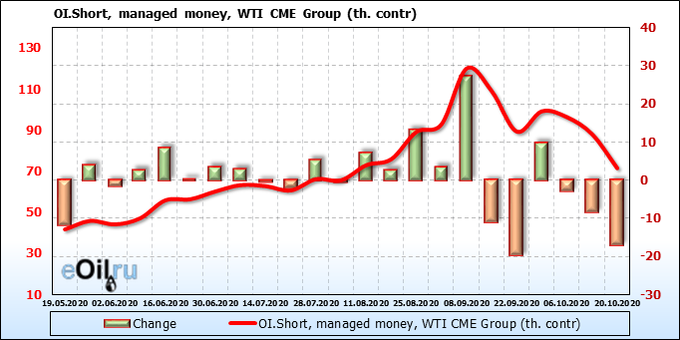

Natural Gas. CME Group

Growth scenario: December futures, the expiration date November 25. We switched to December futures. Here you can buy with the target at 3.500. In a pandemic, countries create the maximum reserves they can afford.

Falling scenario: there is no point in shorts yet. We need a rise to 3.500. And when it happens, you still have to look at the news background before deciding to sell.

Recommendation:

Purchase: no. Those who are in position from 2.450, move the stop to 2.920. Target: 3.500.

Sale: not yet.

Support — 3.081. Resistance — 3.530.

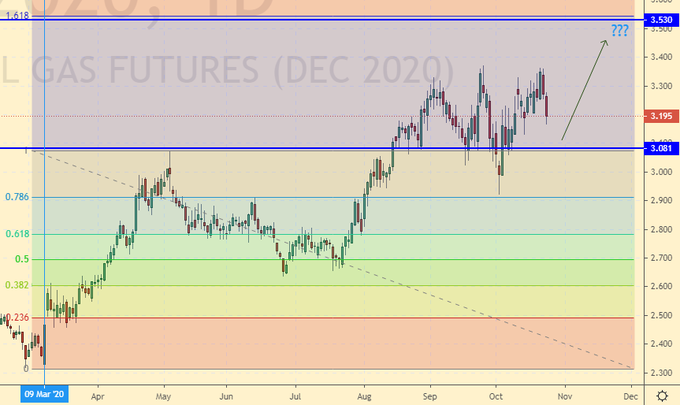

Wheat No. 2 Soft Red. CME Group

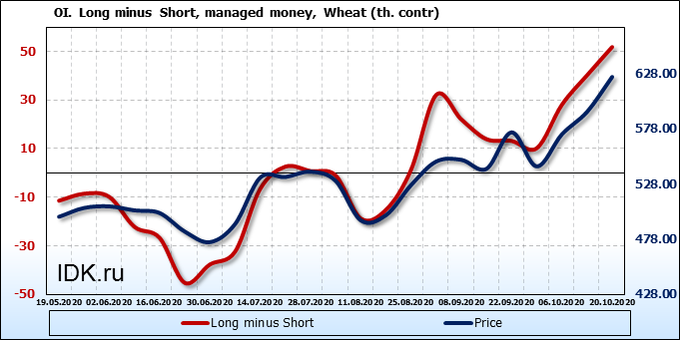

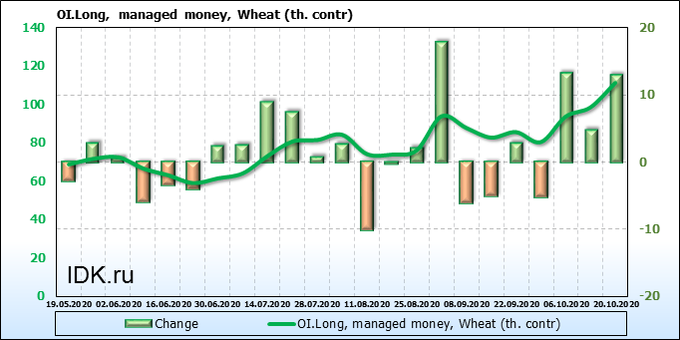

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The bulls are tearing apart the market for three weeks in a row. The first sellers have appeared, but there are still very few of them. Prices have a growth potential of about six to seven percent, after which there should be much more sellers.

Growth scenario: December futures, the expiration date December 14. The market does not roll back against our expectations. The current levels are high for speculative buying. We are out of the market.

Falling scenario: it makes sense to sell only when approaching 675.0. The bulls are in full control of the situation for now.

Recommendation:

Purchase: no.

Sale: when approaching 675.0. Stop: 687.0. Target: 610.0.

Support — 616.6. Resistance — 676.2.

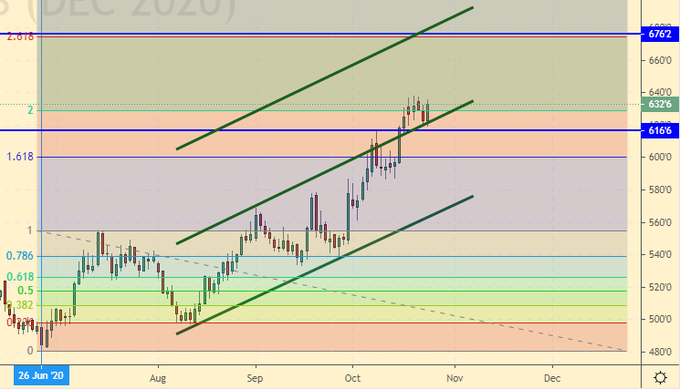

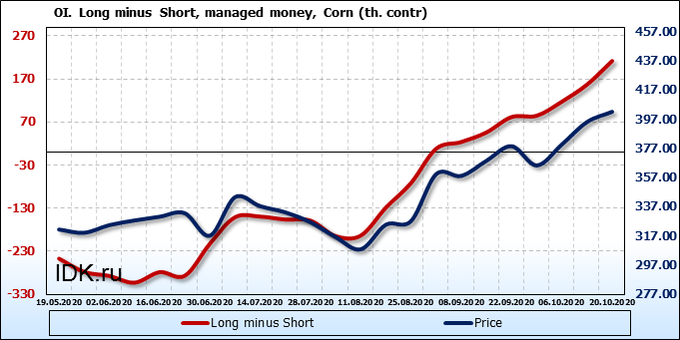

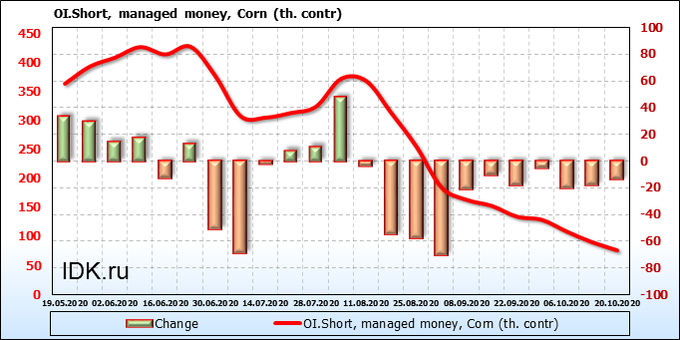

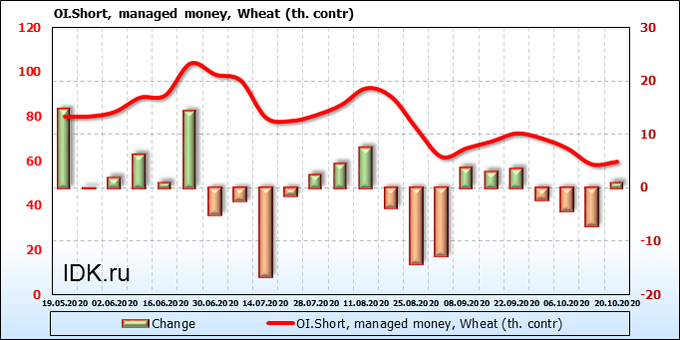

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

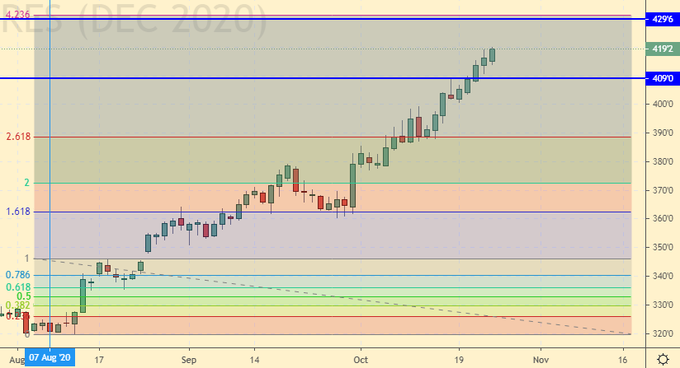

Growth rates have been rising for three consecutive weeks. There is not a single salesperson on the horizon. This will continue until we rise to 430.0 cents per bushel. Stronger growth will only be possible if the wheat does not stop and goes above 670.0.

Growth scenario: December futures, the expiration date December 14. It’s a pity, but we will not be able to capture the current growth, since the market did not roll back. In contrast, prices continue to accelerate. We are out of the market.

Falling scenario: we continue to believe that when approaching 430.0 it is necessary to sell without fail. We are gaining patience, preparing money.

Recommendation:

Purchase: no.

Sale: by touching 430.0. Stop: 437.0. Target: 396.0.

Support — 409.0. Resistance — 429.6.

Soybeans No. 1. CME Group

Growth scenario: November futures, the expiration date November 13. Market growth resumed. No doubt we are heading to 1170. At this stage, we do nothing, only hold the longs that were opened earlier.

Falling scenario: we continue to wait for prices to approach the 1180 area. Given the scale of events, the correction should be quite significant there.

Recommendation:

Purchase: no. Anyone in the position from 1050.0, move the stop at 1030.0. Target: 1170.0.

Sale: when approaching 1175.0. Stop: 1192.0. Target: 1066.0.

Support — 1048.4. Resistance — 1177.0.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date February 26. We keep longs. The target at 15.95 remains. We continue to aggressively move the stop along the trend.

Falling scenario: we will sell when we approach the area of 16.00, not earlier. Apparently, people ease stress from the pandemic by eating sweeties. You cannot drink, you cannot smoke, you only have to eat pastries.

Recommendation:

Purchase: no. Those who are in the position from 14.10, move the stop to 13.90. Target: 15.90.

Sale: when approaching 16.00. Stop: 16.17. Target: 14.10.

Support — 13.79. Resistance — 15.95.

Сoffee С, ICE

Growth scenario: December futures, the expiration date December 18. “It will be very unpleasant if the market falls below 105.0,” we wrote a week earlier. And this, unfortunately, happened. The situation became incomprehensible. We are out of the market.

Falling scenario: that’s going too far. The general background in the market is bullish, and coffee is going underground. It’s strange. We will not sell. The levels are low.

Recommendation:

Purchase: no.

Sale: no.

Support — 103.05. Resistance — 107.40.

Gold. CME Group

Growth scenario: a week has passed, but the situation has not become clearer. As before, we recommend buying after the growth above 1936. It is possible that the market will remain inert until November 3, before the US elections. If a mess begins there, and with weapons in hand, the gold will burst up.

Falling scenario: technically nothing new, if prices go below 1875, then we can count on a continuation of the fall to 1770. Until this happens, sales are out of the question.

Recommendations:

Purchase: in case of growth above 1936. Stop: 1912. Target: 2260.

Sale: think after falling below 1770. Who is in the position between 1950 and 1900, hold the stop at 1940. Target: 1780.

Support — 1884. Resistance — 1936.

EUR/USD

Growth scenario: “in case of another rise in prices above 1.1800, we will buy again” — this is a quote from last week. And so they did. The move to 1.2500 is our target. We look forward to unrest in the US and the weakening of the dollar amid demonstrations and protests.

Falling scenario: the market has pulled down the stop at 1.1841. So be it. The bulls showed a new local high last week. We are not making new sales yet.

Recommendations:

Purchase: no. Those who are in the position from 1.1810, move the stop to 1.1780. Target: 1.2500.

Sale: no.

Support — 1.1685. Resistance — 1.2001.

USD/RUB

Growth scenario: the pair broke through the long-term support and headed for 74.00. There is no sense now to enter the market with purchases. The escalation of events in Belarus may do some harm, but nothing is clear there yet. We do not buy.

Falling scenario: what an unpleasant Thursday with its long shadow up. And it’s great that our stop was registered at 78.60. We can expect a drop to 74.00. We will talk about deeper levels later.

Purchase: no.

Sale: no. Those who are in positions between 77.50 and 77.90, move the stop to 78.30. Target: 74.12.

Support — 74.12. Resistance — 78.48.

RTSI

Growth scenario: the strengthening ruble helps the index to feel the ground under its feet. The prospects for making a profit for Russian companies in 2020 remain vague, but it is worth noting an increase in mortgage volumes, an increase in prices for metals, gas and coal, and stable oil prices. There is only one serious danger: strict quarantine due to the virus.

Falling scenario: stop at 1177. Let it be there. If it works, then we will not sell any more. Let’s wait for the situation to be clarified.

Recommendations:

Purchase: on touch 1075. Stop: 1069. Target: 1200. Think after rising above 1200.

Sale: no. Whoever is in positions between 1240 and 1228, keep the stop at 1177. Target: 1075 (1000).

Support — 1074. Resistance — 1179 (1221).

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.