Price forecast weekly from 23 to 27 of November 2020

-

Energy market:

The community of traders and investors is positive about the prospects for a recovery in oil demand in connection with the start of mass production of vaccines against coronavirus. Bright hopes are pushing oil prices up.

If we rely on the end of trading on Friday, when we closed above 45.00, we can talk about a very likely move to 50.00 in the next two weeks, should be in time just in time for the annual OPEC meeting, which is scheduled for December 1st.

What can prevent oil from climbing above 50.00? Only Biden’s harsh verbal comments. The new president, and apparently, it will be Biden since all Trump’s appeals ended in nothing, is able to put the United States in strict quarantine for two or even three weeks immediately after taking office on January 20th.

Grain market:

The grain market is strong. Wheat is below the 600.0 level, while corn is growing moderately with no plans to visit 435.0 cents a bushel.

Increased demand for feed from China and Europe, coupled with a sharp drop in the actual corn harvest in Ukraine by a serious 8 million tons, which is 22%, forced grain prices to remain at high levels.

Reports of positive testing for a number of vaccines led bidders to be positively charged. There are no prerequisites for a drop in demand now, but there are prerequisites for a poor harvest in 2021. Particularly, due to the La Niña effect, which will dry up the entire south of the United States next summer. This could lead to a stronger rise in prices next year.

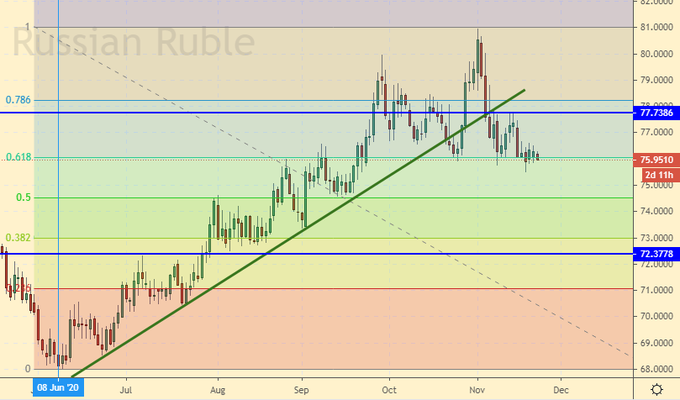

USD/RUB:

The government exceeded its borrowing plan for the 4th quarter by 10%, raising 2.2 trillion rubles, and sharply dropped the volume of OFZ sales, from 300 to 60 billion rubles per week. It is possible that borrowing will continue with an eye to 2021, since problems in the economy remain.

At most, Russia will be saved with oil at 80.00, but when and whether it will be. In other cases, you will have to borrow.

The talks about granting a residence permit in exchange for 10 million rubles of investments in the economy can be viewed positively. This at least suggests that there is an understanding of the need to improve the investment attractiveness of the country.

The ruble is still in the area from which it would be comfortable to strengthen to the level of 73.00. The reversal of the pair from the current levels upwards will look ugly.

It is likely that Biden will come to power, the electoral vote is scheduled for December 14th. The Democratic candidate has said more than once that he will increase the stimulation of the economy, that is, the distribution of money, and this will lead to a weakening of the dollar. In this case, the ruble will be able to strengthen somewhat.

Brent. ICE

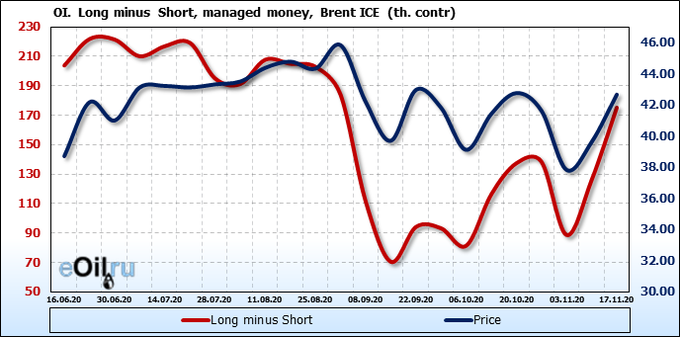

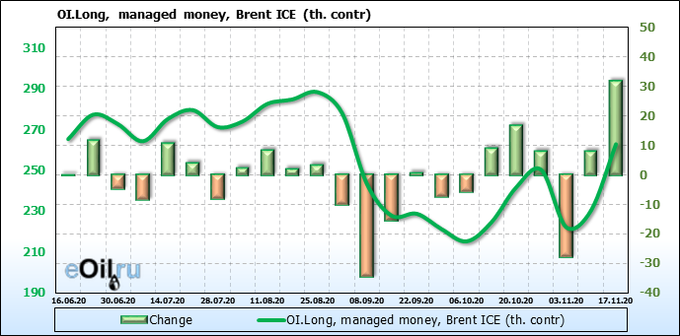

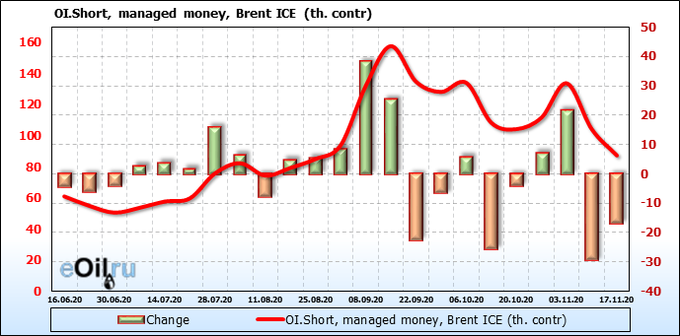

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

For the second week in a row, buyers continue to increase their activity, while sellers, on the contrary, are losing their positions. This has already led to a rise in prices in the market, and there are assumptions that the end of the growth is still far away.

Growth scenario: November futures, expiration date November 30. It is necessary to keep the longs opened earlier. Can be added after rising above 45.00, with an eye on the area of 50.00.

Falling scenario: looking at the optimism prevailing in the market over the past week, do not buy.

Recommendation:

Purchase: no. Those who are in the position from 42.00, move the stop to 41.20.

Target: 49.60. Sale: no.

Support — 42.61. Resistance — 45.33.

Fundamental US data: the number of active drilling rigs fell by 5 units to 231 units.

Commercial oil reserves in the US increased by 0.769 to 489.475 million barrels. Gasoline inventories rose by 2.611 to 227.967 million barrels. Distillate stocks fell by -5.216 to 144.073 million barrels. Cushing’s stocks rose 1.2 to 61.613 million barrels.

Oil production rose by 0.4 to 10.9 million barrels per day. Oil imports fell by -0.245 to 5.254 million barrels per day. Oil exports fell by -0.017 to 2.748 million barrels per day. Thus, net oil imports fell by -0.228 to 2.506 million barrels per day. Refining increased by 2.9 to 77.4 percent.

Gasoline demand fell by -0.504 to 8.258 million barrels per day. Gasoline production fell by -0.255 to 9.064 million barrels per day. Gasoline imports rose 0.08 to 0.53 million barrels per day. Gasoline exports fell by -0.02 to 0.69 million barrels per day.

Distillate demand rose by 0.171 to 4.225 million barrels. Distillate production rose 0.038 to 4.275 million barrels. Distillate imports rose by 0.154 to 0.285 million barrels. Distillate exports rose 0.001 to 1.08 million barrels per day.

The demand for petroleum products fell by -0.616 to 19.564 million barrels. Production of petroleum products fell by -0.266 to 20.302086 million barrels. Imports of petroleum products fell by -0.063 to 1.824 million barrels. Exports of petroleum products rose 0.269 to 5.07 million barrels per day.

Propane demand rose 0.173 to 1.47 million barrels. Propane production rose 0.054 to 2.28 million barrels. Propane imports fell by -0.002 to 0.128 million barrels. Propane exports rose 0.031 to 1.224 million barrels per day.

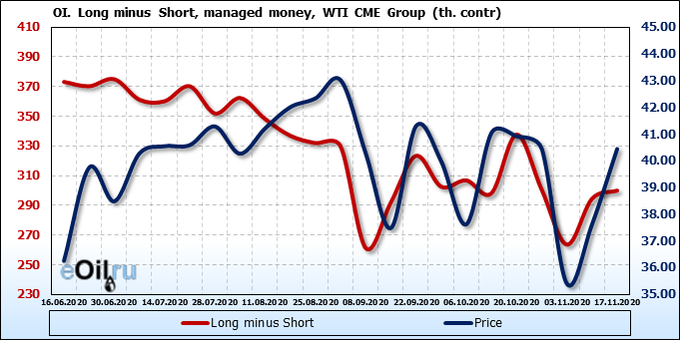

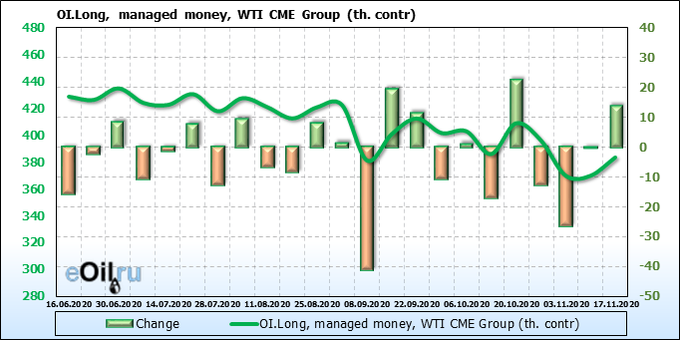

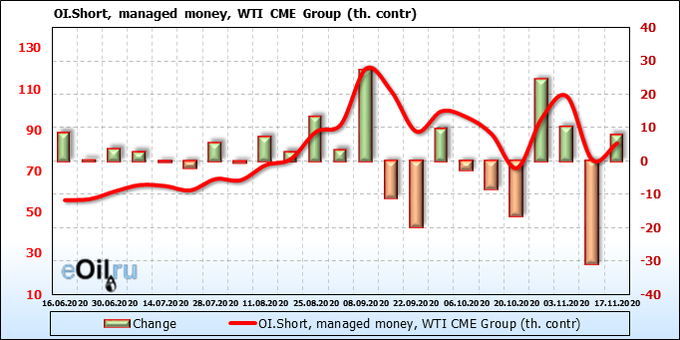

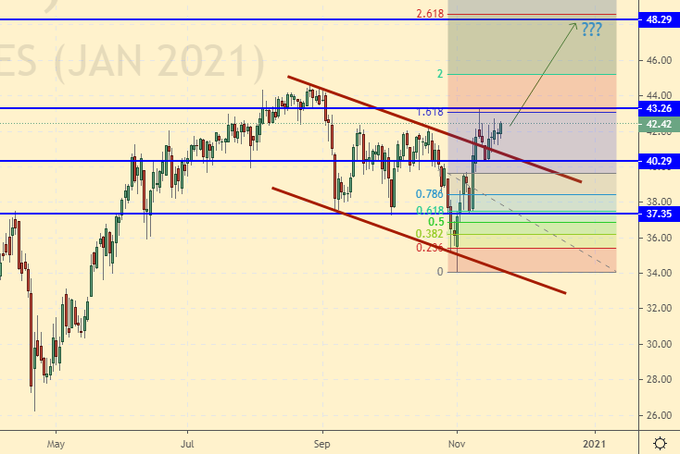

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Against the backdrop of the emergence of vaccines, people believed in a bright tomorrow. The activity of speculators in the market is growing, which makes the current rise in prices more reliable and confirmed.

Growth scenario: January futures, expiration date December 21. Despite the fact that the OPEC meeting was inert, the participants believe in growth. We will keep longs. In case of a pass above 43.50, you can add.

Falling scenario: if the market reaches 48.00, then we will think about selling. A small short with a tight stop is possible from the current levels.

Recommendation:

Purchase: no. Those who are in positions between 40.00 and 40.30, move the stop to 40.20. Target: 48.30.

Sale: now. Stop: 42.70. Target: 39.00.

Support — 40.29. Resistance — 43.26

Gas-Oil. ICE

Growth scenario: December futures, expiration date December 10. Oil pulls fuel prices with it. We will keep longs and expect to reach the 410.0 area. In case of growth above 375.0, longs can be increased.

Falling scenario: you can sell from current levels. There aren’t many chances, but the reward / risk ratio is good. Recommendation:

Purchase: no. Those who are in the position from 340.0, move the stop to 334.0. Target: 410.0.

Sale: now. Stop: 371.0. Target: 330.0.

Support — 342.50. Resistance — 372.25.

Natural Gas. CME Group

Growth scenario: January futures, expiration date December 29. The gas went deep underground. The fall from 3.500 was rapid. Some recovery is possible from current levels. We will buy, but we will not give the market much freedom.

Falling scenario: selling is not at all interesting. There are very few profit prospects. We do not enter the short. Recommendation:

Purchase: now. Stop: 2.610. Target: 3.030.

Sale: no.

Support — 2.422. Resistance — 3.205.

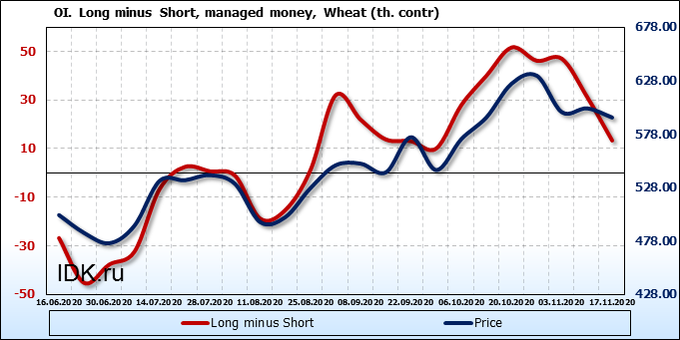

Wheat No. 2 Soft Red. CME Group

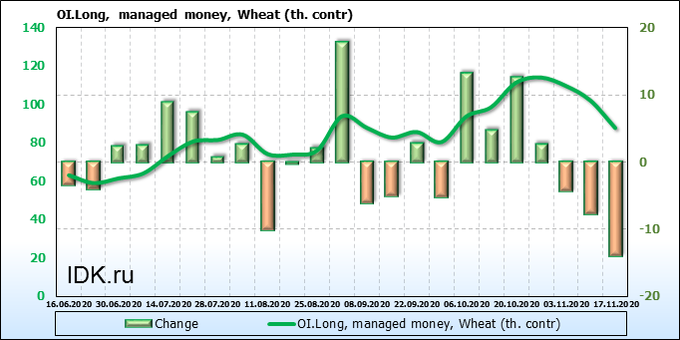

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Bulls-speculators have been cutting their investments in wheat for three weeks in a row. Most likely, next week this will lead to the exit of prices from the growing channel downward, and then a quick rollback to 560.0 will follow.

Growth scenario: December futures, expiration date December 14. For now, we tend to believe that a breakdown will take place. Only after the prices go down to 560.0 it will be possible to buy.

Falling scenario: if prices touch 585.0, then you can go short. Entering on a breakout is not a good thing, but in this situation you can afford it, especially if you don’t put your stop far.

Recommendation:

Purchase: on touch 560.0. Stop: 540.0. Target: 670.0.

Sale: on touch 585.0. Stop: 601.0. Target: 560.0.

Support — 588.2. Resistance — 604.2.

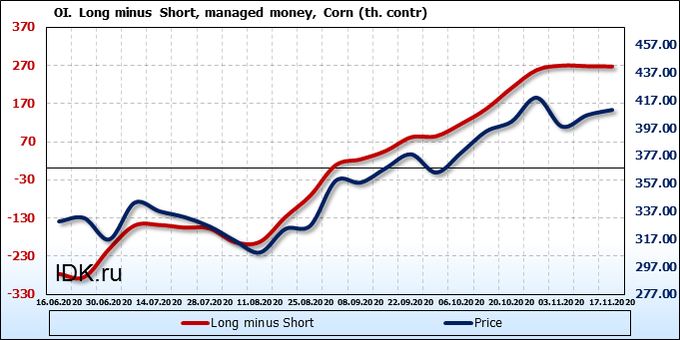

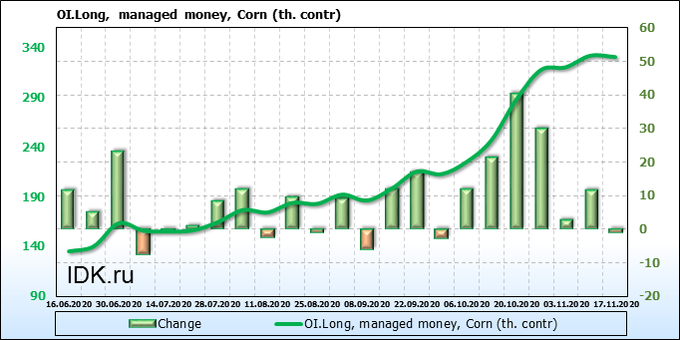

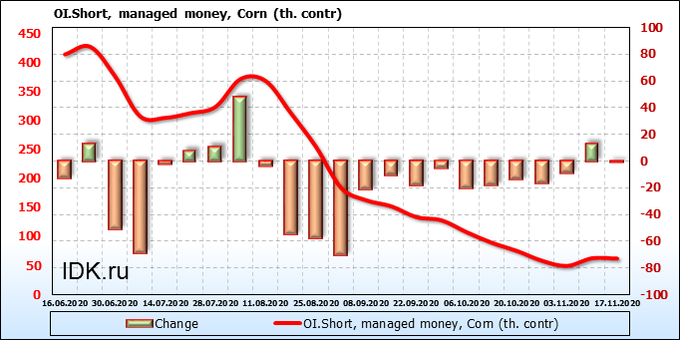

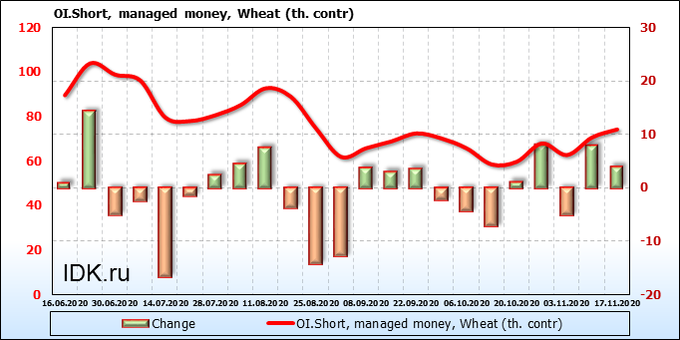

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Customer enthusiasm is dying. The growth of recent days is not supported by the flow of money. The market should start turning down soon.

Growth scenario: December futures, expiration date December 14. If the market hits 430.0 without prior deep correction, it will be a surprise. We do not open new purchases. We believe that we are in the area from which there should be a pullback downward.

Falling scenario: keep your shorts here. Selling at current levels is possible. We believe in a corrective move.

Recommendation:

Purchase: no. Whoever remained in the position from 395.0, keep the stop at 402.0. Target: 430.0 (480.0 ?!).

Sale: now. Stop: 439.0. Target: 376.0. Those who are in the position from 425.0, move the stop to 439.0. Target: 376.0.

Support — 403.2. Resistance — 433.2.

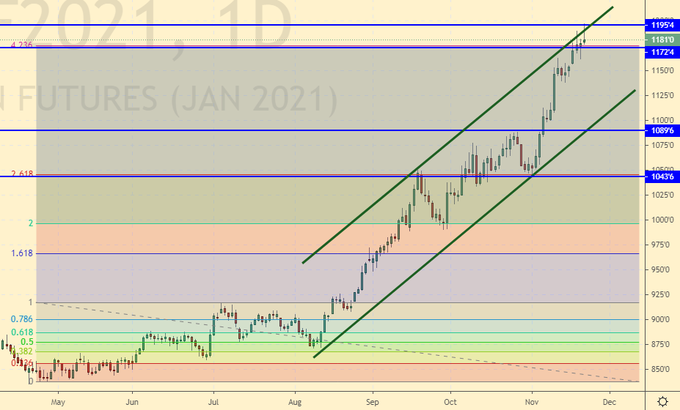

Soybeans No. 1. CME Group

Growth scenario: January futures, expiration date January 14. Soy has accelerated and cannot stop. The growth above 1175.0 came as an unpleasant surprise. We want to see a rollback, but there is none. We do not buy. We need to understand what’s going on.

Falling scenario: we will sell again thanks to the long shadow and small body of the Friday candlestick. We are high, the market is overbought. The rollback will benefit everyone.

Recommendation:

Purchase: no.

Sale: now. Stop: 1197.0. Target: 1050.0.

Support — 1172.4. Resistance — 1195.4.

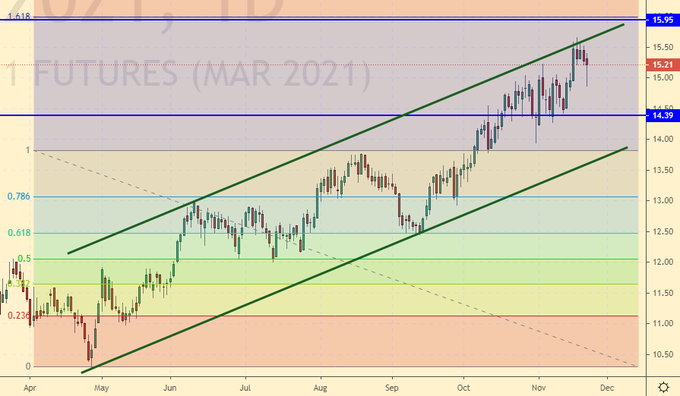

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date February 26. We go to the area 16.00. Let’s not interfere with the market and be patient.

Falling scenario: the idea is the same, we will sell when we approach the 16.00 area. The current reset is already unnerving, but let’s hope we climb a little higher. Recommendation:

Purchase: no. Those who are in the position from 14.10, move the stop to 14.34. Target: 15.90.

Sale: when approaching 16.00. Stop: 16.17. Target: 14.10.

Support — 14.39. Resistance — 15.95.

Сoffee С, ICE

Growth scenario: December futures, expiration date December 18. We quickly went above 110.0 and rolled back. The current situation is quite favorable for increasing longs with targets around 140.0. The emergence of vaccines should, in the long term, increase demand from food service outlets.

Falling scenario: we will not sell despite the fact that Friday’s candle looks threatening. The sales situation is awkward. It will be another matter if we return to the 120.0 level in the future.

Recommendation:

Purchase: now. Stop: 106.0. Target: 140.0. Those who are in the position from 110.0, move the stop to 106.0. Target: 140.0.

Sale: when approaching 120.0. Stop: 123.0. Target: 80.00 ?!

Support — 108.45. Resistance — 121.15.

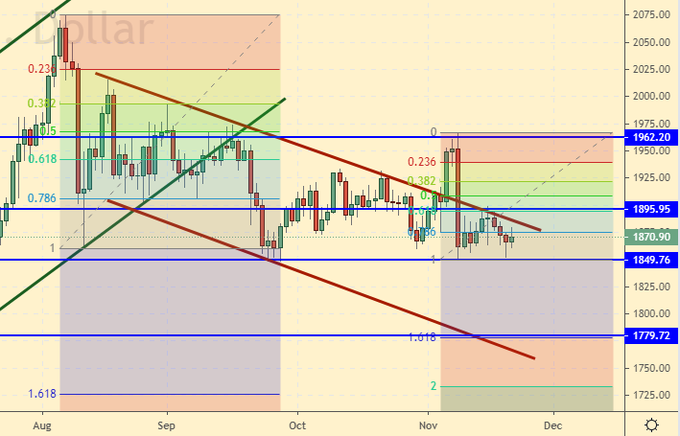

Gold. CME Group

Growth scenario: while we are below 1900 we will not buy. The prospect of a normalization of the situation in the world with the advent of vaccines will put pressure on prices. Growth in the future will be possible when the market focuses on the dollar’s problems.

Falling scenario: we stand in sales. In case the market falls below 1850, you can add to the shorts.

Recommendation:

Purchase: not yet. Think in case of growth above 1900.0. Sale: no. Anyone in the position from 1890, keep the stop at 1907. Target: 1780.

Support — 1849. Resistance — 1895.

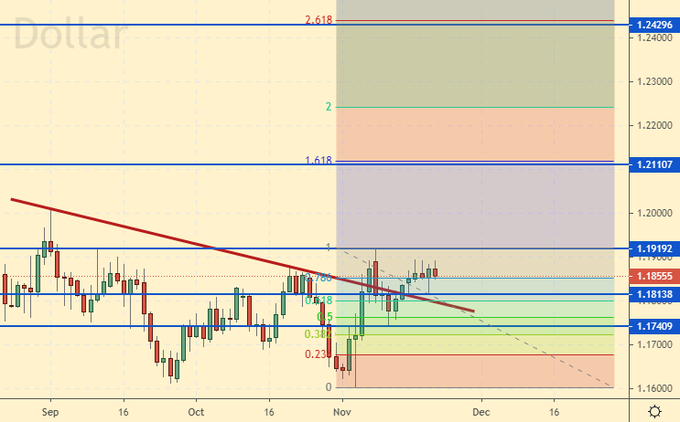

EUR/USD

Growth scenario: the market cannot take 1.1900 yet. The problems in the Eurozone due to the virus are still growing, which does not give a chance for a quick strengthening of the euro. Nevertheless, the European bureaucrats in Brussels seem preferable than violent Washington.

Falling scenario: we will refrain from sales for now. Let’s get back to talking about shorts only in case of falling below 1.1700.

Recommendation:

Purchase: now. Stop: 1.1790. Target: 1.2800. Anyone in the position from 1.1840, move the stop to 1.1790. Target: 1.2800.

Sale: no.

Support — 1.1813. Resistance — 1.1919.

USD/RUB

Growth scenario: the dollar has nothing to offer yet. There is no growth in any form. Therefore, we stay away from shopping. The weakness is projected in the US currency in the first months of Biden’s rule.

Falling scenario: ruble fans continue to press, and the deeper they plunge the quotes, the more fearful buyers become. If the market breaks down at 75.80, then stop orders will be triggered, leading to a rapid move at 75.00. The target at 73.00 looks plausible.

Purchase: think if it rises above 77.00.

Sale: no. Those who are in positions between 75.80 and 75.90, move the stop to 77.80. Target: 73.10.

Support — 72.37. Resistance — 77.73.

RTSI

Growth scenario: the market slowed down, but did not pull back. This betrays the desire of the crowd to continue to drag the market to new heights. So far, we do not see any prerequisites for any concern. We will keep the longs opened earlier and expect growth.

Falling scenario: if there is any rollback from the current levels, then it is more convenient to work it out on the clock. Against the backdrop of growing oil and the start of vaccine replication, there are no prerequisites for the market to fall. Biden’s rise to power in the United States is capable of driving investor optimism around the world to new heights. Not for long, though. The current background will be positive for two to three months. Hardly any longer.

Recommendation:

Purchase: on a pullback to 120,000. Stop: 114300. Target: 170,000. Who entered from 112000 and from 120,000, keep the stop at 114300. Target: 170,000. We want a New Year rally.

Sale: not yet.

Support — 121340. Resistance — 128310.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.