21 September 2020, 13:26

PRICE FORECAST WEEKLY from 21 to 25 of September 2020

-

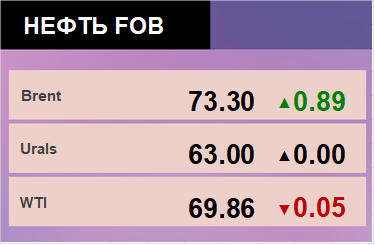

Energy market:

The comrades from the cartel have closed the ranks.

The past meeting of the OPEC + energy ministers showed that the need to regulate production still remains. And this is the only way against the background of falling consumption. The market greeted with warmth and glee the determination of the exporting countries to keep the balance, which resulted in a 10% increase from the previously reached lows.

But, ahead of the cartel is a difficult autumn. We are waiting for the next restrictions on travel, because the number of infected is growing again, no matter what politicians say. There is no vaccine. The Russian vaccine is neither here nor there. The correct vaccine can only be made in the United States.

Reading our predictions, you could have made money on gas futures by taking a move from 2.730 to 2.120.

Falling prices in this situation is only a matter of time. We are waiting.

Grain market:

The results of wheat supply tenders to Egypt and Turkey can be considered as lopsided game. Prices rose by 14% in a month, from $ 206 to $ 235 per ton, and this is against the backdrop of a huge harvest. What can push prices up, other than collusion among competitors?

First and obvious staff: coronavirus and an increase in the number of infections. Who knows whether quarantine will be introduced in ports in late autumn or winter, as it was already in the spring of 2020, because of which it will not be possible to replenish grain stocks. So, we need to buy now, while everything is calm.

The second and unobvious: since 2011, the La Niña effect in the Pacific Ocean was remembered only in passing. However, on September 10, the US Climate Prediction Center stated that the phenomenon can be considered formed.

La Niña usually brings above average rainfall to Australia and Southeast Asia, which can lead to flooding. May dry out southern United States in winter. Arable land in Argentina may become drier and drought is possible in parts of Brazil.

Aware, one can understand the concern of grain importers who are ready to succumb in such circumstances to blackmailing sellers.

USD/RUB:

The CBR did not cut the rate last week, pointing out the remaining high expectations of the population on inflation. Why are people so negative? Oh, yes, the dollar rate has grown by 10 percent since June.

If the weakening of the national currency continues, then inflationary expectations will rise even more. Thus, the weakening of the ruble as part of an attempt to replenish the budget as much as possible with revenues from hydrocarbon exports will lead to inflation.

At the same time, the Central Bank should continue to keep the rate at the low level so active economic agents can service their own debts in softer conditions.

Experience suggests that the government will choose the path of weakening the ruble and solving immediate problems. The main thing is that by the end of the year everything will be, if not beautiful, it will not be so because of an obvious deficit, but acceptable.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Sellers continue to push, albeit with less intensity. We see growth in the market, but due to the data on open interest, we will doubt it for now.

Growth scenario: September futures, the expiration date is September 30. Growth against the background of the OPEC meeting looks interesting. However, while we are below 45.00 we will not buy.

Falling scenario: we continue to stand in shorts. The bounce last week raises concerns, but prices have not yet been able to disrupt our stop orders. The current levels are good for sales from a technical point of view.

Recommendation:

Purchase: no.

Sale: now. Stop: 44.80. Target: 32.10. Those who are in positions between 43.95 and 42.00, move the stop to 44.80. Target: 32.10 (25.00 ?!).

Support — 39.06. Resistance — 44.24.

WTI. CME Group

Fundamental US data: the number of oil drilling rigs fell by 1 unit to 179 units.

Commercial oil reserves fell by -4.389 to 496.045 million barrels. Gasoline inventories fell by -0.381 to 231.524 million barrels. Distillate stocks rose by 3.461 to 179.306 million barrels. Cushing’s stocks fell -0.074 to 54.277 million barrels.

Oil production rose 0.9 to 10.9 million barrels per day. Oil imports fell by -0.415 to 5.008 million barrels per day. Oil exports fell by -0.349 to 2.595 million barrels per day. Thus, net oil imports fell by -0.066 to 2.413 million barrels per day. Oil refining rose 4 percent to 75.8 percent.

Gasoline demand rose 0.088 to 8,478 million barrels per day. Gasoline production fell by -0.111 to 8.819 million barrels per day. Gasoline imports rose 0.026 to 0.6 million barrels per day. Gasoline exports fell by -0.203 to 0.506 million barrels per day.

Distillate demand fell by -0.904 to 2.809 million barrels. Distillate production rose 0.005 to 4.403 million barrels. Distillate imports fell by -0.048 to 0.112 million barrels. Distillate exports rose 0.128 to 1.212 million barrels per day.

The demand for petroleum products fell by -1.651 to 17.027 million barrels. Distillate production fell 0.752 to 19.6 million barrels. Distillate imports fell by -0.199 to 1.993 million barrels. Gasoline exports rose 0.173 to 4.415 million barrels per day.

Propane demand rose by 0.382 to 1.478 million barrels. Propane production rose 0.038 to 2.163 million barrels. Propane imports rose 0.006 to 0.089 million barrels. Propane exports rose by 0.146 to 0.95 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

A group of speculators switched from selling to buying. So far, this has not led to a medium-term change in market sentiment, however, if the pressure continues, we risk seeing prices rise. But against the backdrop of the second wave of coronavirus, this will not be so easy to do.

Growth scenario: November futures, the expiration date is October 20. Until the market is below 44.00, we will not buy. Adherents of price growth can catch on longs in case of a correction to 39.00, but we will not recommend this.

Falling scenario: keep holding the shorts. Moreover, those who wish can build up their sell positions here. For now, we will fight for the dark future of the oil market.

Recommendation:

Purchase: no.

Sale: now. Stop: 42.70. Target: 30.00. Anyone in the position from 39.80, move the stop to 42.70. Target: 30.00.

Support — 36.53. Resistance — 42.54.

Gas-Oil. ICE

Growth scenario: October futures, the expiration date is October 12. We continue to believe that fear of the coronavirus will prevent prices from rising in the coming weeks. Last week’s growth is nothing more than a technical pullback.

Falling scenario: waiting for the move to 300.0. Now and in the wake of rising to 360.0, you can sell. The market retains the potential to fall as the summer season ends.

Recommendation:

Purchase: no.

Sale: now and as it grows to 360.0. Stop: 373.0. Target: 300.0 (270.0). Those who are in positions between 370.0 and 375.0, move the stop to 373.0. Target: 300.0 (270.0).

Support — 315.00. Resistance — 364.00.

Natural Gas. CME Group

Growth scenario: October futures, the expiration date is September 28. Despite the fact that prices went below 2.000, we recommend you to buy. Levels are good for long entry. As long as we are above 1.900 we can fight.

Falling scenario: took the move from 2.73 to 2.12. Now we forget about sales, since there will be no good levels for a week, and maybe even longer.

Recommendation:

Purchase: now and up to 1.900. Stop: 1.800. Target: 3.536.

Sale: no. All with a profit.

Support — 1.917. Resistance — 2.730.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We already see that timid attempts to sell for two weeks have led nowhere. The market is growing. This forced sellers to close their positions, as a result price increases.

Growth scenario: December futures, the expiration date is December 14. From 530.0 we were not allowed to catch on. But the positions open from 492.0 and 499.0 remain in the ranks. We should reach the 600.0 area without any problems, further growth may be suspended.

Falling scenario: nothing interesting yet. The market just showed a new maximum, let’s give it a say.

Recommendation:

Purchase: no. Those who are in positions between 492.0 and 499.0, move the stop to 515.0. Target: 610.0 (650.0).

Sale: no.

Support — 567.0 (542.4). Resistance — 611.0.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Buyers hit everything they could last week. In the future, we are unlikely to see a large inflow of speculative money, since everyone who wanted to buy had done it earlier. We have been going in one direction for more than a month. The market is overbought.

Growth scenario: December futures, the expiration date is December 14. And there is no recoil. As a result, there are no good buy levels. We continue to climb, what makes it impossible for us to earn. We’ll have to stay away. We are not buying, the market is high.

Falling scenario: we continue to believe that from 387.0 it is possible to sell. After reaching this level, we will have to adjust to at least 365.0.

Recommendation:

Purchase: no.

Sale: by touching 387.0. Stop: 397.0. Target: 365.0.

Support — 371.6. Resistance — 387.6.

Soybeans No. 1. CME Group

Growth scenario: November futures, the expiration date is November 13. We see that the soy has fully expressed itself. A rollback is needed to continue the growth. It is unlikely that we will go to 1173.0 non-stop. We do not buy. Congratulations to everyone on the profit, who waited for the target at 1040.0.

Falling scenario: sell here. A rollback to 965.0 is a good idea. We will not talk about the departure to 920.0 for now, for this it is necessary that the entire market of agricultural products temporarily falls into a depression.

Recommendation:

Purchase: no.

Sale: now. Stop: 1053.0. Target: 965.0. Anyone in the position from 1040.0, keep the stop at 1053.0. Target: 965.0.

Support — 991.2. Resistance — 1173.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. If we rise above 13.00 just think about purchases. If there is a pullback to 12.00, it can also be used to enter a long.

Falling scenario: a classic short entry situation. We have broken through the ascending price channel and are testing it from the reverse side. The market is quite capable of giving us another wave of decline.

Recommendation:

Purchase: by touching 12.00. Stop: 11.80. Target: 15.56. Or after a rise above 13.00. Stop: 12.40, Target: 15.56.

Sale: now. Stop: 12.90. Target: 11.00.

Support — 11.72. Resistance — 13.31.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 18. Who knew…We were knocked out of a promising long. We took a move from 110.0 from 124.00, but this is not what we expected. Red candles are so big and scary that we will refrain from shopping.

Falling scenario: a sharp correction from a level we hadn’t seen left us with nothing. It’s a pity. We are out of the market.

Recommendation:

Purchase: no.

Sale: no.

Support — 106.50. Resistance — 124.30.

Gold. CME Group

Growth scenario: there is some fuss in the market after the Fed meeting. In order to confirm its strength, gold needs to break above 1970. Until this happens, we will refrain from buying.

Falling scenario: offer to sell. The situation for the short is unlikely to get any better anytime soon. There is not enough news for sellers to catch hold of in order to swing the market down.

Recommendations:

Purchase: think after growth above 1970.

Sale: now. Stop: 1980. Target: 1780.

Support — 1857. Resistance — 1967.

EUR/USD

Growth scenario: The Fed announced that it will continue to buy back active at $ 120 billion per month, but not a penny more. Powell’s press conference was neutral. Again, a few words were dropped on it about the coronavirus, but the improvement in the forecast for the fall in GDP seems to be much more interesting. Only minus 3.7%. This is significantly better than the European minus 8%. The euro is unlikely to be able to grow against such a background.

Falling scenario: we can sell here. Technically, the picture is even better than a couple of weeks ago. We go short now and add after falling below 1.1750.

Recommendations:

Purchase: no.

Sale: now and add if it falls below 1.1750. Stop: 1.1930. Target: 1.1350.

Support — 1.1750. Resistance — 1.1918.

USD/RUB

Growth scenario: we could not go below 74.50. We see that the market on Friday headed for 78.60. The RF budget deficit of 4 trillion rubles by the end of the year will keep traders on the alert. In addition, the Navalny case and the protesting Belarus remain on the agenda. We keep longs.

Falling scenario: it is possible that we will see a correction from 79.00, but it will happen only if the approach to this level is not aggressive. Otherwise, we can see a recoilless rise to 85.00.

Purchase: now. Stop: 74.40. Target: 78.60 (85.00). Anyone in the position from 73.10, move the stop to keep the stop at 74.40. Target: 78.70 (85.00).

Sale: no.

Support — 74.65. Resistance — 78.59.

RTSI

Growth scenario: The Central Bank of the Russian Federation did not cut the rate, indicating in its press release concern about inflationary expectations from population. We see the classic disappointment in the stock market from the lack of monetary policy easing. We do not buy.

Falling scenario: the US stock market saw no reason for growth after the Fed meeting, which makes the prospects for a fall in the Russian market quite tangible, since the external background is not improving.

In addition, the excitement of the Russian government to fill the treasury by increasing the fiscal burden on oil, steelworkers and fertilizer producers cannot delight investors. We must sell.

Recommendations:

Purchase: no.

Sale: when approaching 1300. Stop: 1330. Target: 1000. Or now. Stop: 1268. Target: 1000. Whoever is in position from 1228, keep the stop at 1268. Target: 1000.

Support — 1171. Resistance — 1342.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.