Price forecast weekly from 16 to 20 of November 2020

-

Energy market:

There are no countries left in the world that have not been affected by the pandemic. There are more and more sick people, this is especially true for the Eurozone. The situation has also worsened in the United States. German scientists say straight that there is no proven vaccine yet, and that 2021 will be held in the fight against the virus.

How will oil prices rise in such conditions? All exporting countries need currency like air. However, buyers are becoming less and less, countries operate in a limited mode. Tourism and the service sector will not be able to count on normal conditions for at least two more years. People are cutting back on travel and minimizing contact.

In this regard, the reaction of the OPEC + countries to what is happening at the next meeting on the 16th — 17th is interesting. If there is even a hint that production will increase from January, the market will refuse to understand this approach and will fall.

In addition to the not too disciplined Iran and Iraq, Libya has been added to the number of problem countries, which does not want to discuss anything until oil production in the country rises to 1.7 million barrels per day. There was something like a truce and an active growth in production began immediately, which is understandable. But OPEC will have to cut something down somewhere.

Among other things, the number of active drilling rigs has been growing in the US for a month now. In the future, this also does not bode well for the market.

Acting in concert, the OPEC + countries can bring the market to 50.00 for some time, but it will be extremely difficult to keep quotes at this level.

Reading our forecasts, you could make money on the soybean market by taking a move up from 1050.0 to 1150.0.

Grain market:

The grain market corrected after a phase of active growth. The main question for the next week or two is whether the correction is over or not.

Fundamental reasons for price increases can only emerge if producers begin to experience logistical problems in supplying crops to their own ports for export. So far, nothing is known about such problems.

At the moment, the market is perceived to be quite balanced, given the harvest volumes of the current season. In the future, the emphasis will shift to the accumulation of moisture in the fields during the winter months. There may be surprises that can support the quotes.

Wheat and corn prices are likely to rise by 10-12% by the end of the year, but we are unlikely to see stronger growth.

USD/RUB:

The ruble continues to look better than the expectations of that part of the crowd, which with some fanaticism is waiting for 100 rubles per dollar. Russian debt securities continue to be in demand due to reasonable oil prices, which are supporting the ruble.

The Russian currency saves face thanks to the American mess with elections and the European desire in a number of countries, for example, in Austria, to tie everyone to bunks for two weeks.

Note that with the West losing interest in life, China will also begin to suffocate. Exports will inevitably fall. Beijing’s signature on November 15 under the new free trade area with ASEAN countries confirms that our neighbor is looking for new ways of development. Australia, South Korea and Japan also participate in the agreement. There are no Americas and Europe there.

Brent. ICE

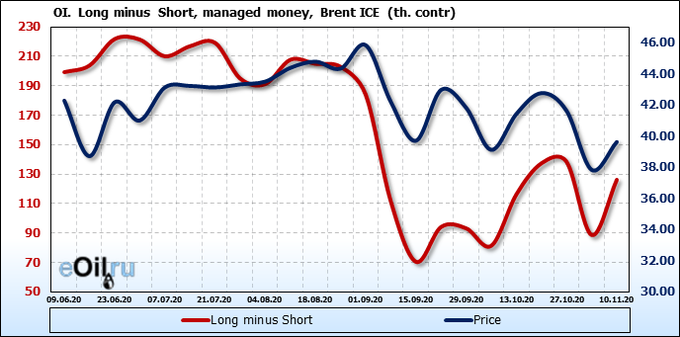

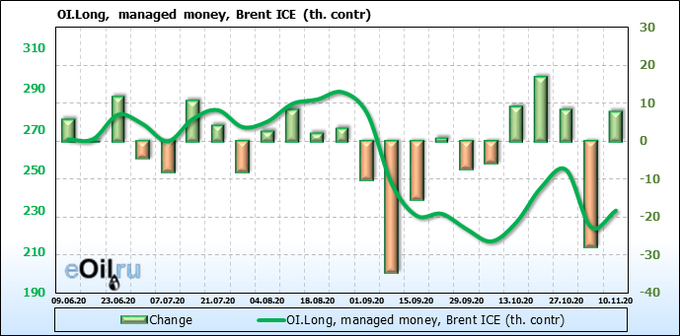

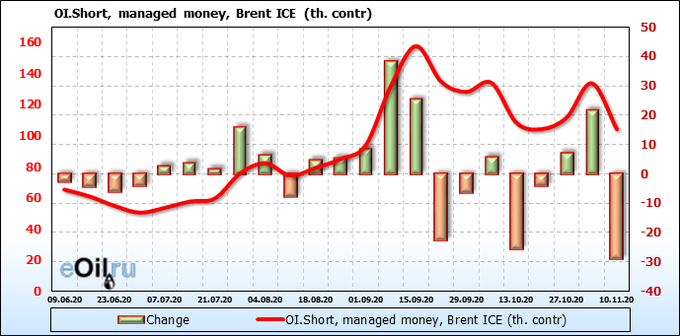

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

We see some growth in interest from the bulls. The current levels look attractive, so we expect the buyers’ activity to continue growing next week.

Growth scenario: November futures, expiration date November 30. Broke through 42.00 and went down. Not a bad situation to enter long. We do not deny the possibility of falling to 40.50, but prices are unlikely to go lower.

Falling scenario: falling requires lack of consensus in the ranks of OPEC. Let’s hope nothing extraordinary happens.

Recommendation:

Purchase: now and until 41.00. Stop: 40.20. Target: 49.66. Those who are in the position from 42.00, move the stop to 40.20. Consider the risks carefully.

Sale: no.

Support — 42.01. Resistance — 45.33.

Fundamental US data: the number of active drilling rigs increased by 10 units to 236 units.

Commercial oil reserves in the US increased by 4.277 to 488.706 million barrels. Gasoline inventories fell -2.309 to 225.356 million barrels. Distillate stocks fell -5.355 to 149.289 million barrels. Stocks at the Cushing storage facility fell -0.518 to 60.413 million barrels.

Oil production has not changed at 10.5 million barrels per day. Oil imports rose 0.47 to 5.499 million barrels per day. Oil exports rose by 0.5 to 2.765 million barrels per day. Thus, net oil imports fell by -0.03 to 2.734 million barrels per day. Refining fell by -0.8 to 74.5 percent.

Gasoline demand rose by 0.426 to 8.762 million barrels per day. Gasoline production rose 0.247 to 9.319 million barrels per day. Gasoline imports fell by -0.18 to 0.45 million barrels per day. Gasoline exports fell by -0.006 to 0.71 million barrels per day.

Distillate demand rose 0.292 to 4.054 million barrels. Distillate production fell by -0.038 to 4.237 million barrels. Distillate imports fell by -0.201 to 0.131 million barrels. Distillate exports rose 0.008 to 1.079 million barrels per day.

The demand for petroleum products rose by 1.818 to 20.18 million barrels. Production of petroleum products fell by -0.089 to 20.568035 million barrels. Imports of petroleum products rose by 0.149 to 1.887 million barrels. Exports of petroleum products fell by -0.502 to 4.801 million barrels per day.

Propane demand rose 0.049 to 1.297 million barrels. Propane production rose 0.022 to 2.226 million barrels. Propane imports rose 0.027 to 0.13 million barrels. Propane exports fell by -0.232 to 1.193 million barrels per day.

rowth scenario: December futures, expiration date November 20. We see a breakout and pullback. We buy. If OPEC pays more attention to Libya and encourages it to dialogue, it will support the market.

Falling scenario: move up looks aggressive. We will not sell.

Recommendation:

Purchase: now. Stop: 37.80. Target: 48.35. Anyone in the position from 40.00, move the stop to 37.80. Target: 48.35.

Sale: no.

Support — 39.68. Resistance — 43.13

Gas-Oil. ICE

Growth scenario: December futures, expiration date December 10. It should be admitted that this exit to the top was unexpected. Now we have the prerequisites for the formation of an upward impulse. You have to buy.

Falling scenario: too bad the shorts didn’t work out. We take a break. We are not selling yet. Recommendation:

Purchase: now. Stop: 317.0. Target: 410.0. Those who are in the position from 340.0, move the stop to 317.0. Target: 410.0.

Sale: no.

Support — 336.50. Resistance — 372.25.

Natural Gas. CME Group

Growth scenario: December futures, expiration date November 25. It is difficult for the market to grow amid warm weather in Europe. We see that sellers meet the market when they approach 3.100. Only if we go above this level will it be possible to buy.

Falling scenario: short from current levels does not have a lot of potential for taking profit, we do not sell.

Recommendation:

Purchase: think after rising above 3.100. Sale: no.

Support — 2.807. Resistance — 3.081.

Wheat No. 2 Soft Red. CME Group

Growth scenario: December futures, expiration date December 14. We found support at the lower border of the growing channel. It is not clear yet whether the market can continue to grow. The scenario of the descent to 560.0 remains in my head. It will be possible to buy on the breakout only after rising above 615.0. Consider the risks.

Falling scenario: we fail to enter short. Who does not want to miss a possible drop to 560.0 please be patient. We will sell only on a pullback up to 608.0.

Recommendation:

Purchase: on touch 560.0. Stop: 540.0. Target: 670.0.

Sale: on touch 608.0. Stop: 615.0. Target: 560.0.

Support — 579.2. Resistance — 613.4 (626.2).

Growth scenario: December futures, expiration date December 14. It was possible to close longs, or at least some of them last week when approaching 430.0. If you have not done this, hold positions, there is a scenario in which the market will grow to 480.0.

Falling scenario: the market approached 427.0 for two days in a row, you should have been short in one way or another last week. If you haven’t done so, then wait for the rise to 418.0 and sell.

Recommendation:

Purchase: no. Whoever remained in the position from 395.0, move the stop to 402.0. Target: 430.0.

Sale: on touch 418.0. Stop: 437.0. Target: 376.0. Or by touching 430.0. Stop: 437.0. Target: 376.0. Whoever is in position from 425.0, keep the stop at 437.0 Target: 376.0.

Support — 403.2. Resistance — 435.0.

Soybeans No. 1. CME Group

Growth scenario: January futures, expiration date January 14. There is nothing to think about. It is necessary to take profit. Congratulations to everyone with a successful trend from 1050.0. We do not make new purchases.

Falling scenario: this situation is comfortable for the short. We sell now. We build up with the growth of the market.

Recommendation:

Purchase: no. All with a profit.

Sale: now and as it rises to 1185. Stop: 1193.0. Target: 1050.0.

Support — 1089.6. Resistance — 1173.6.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date February 26. The target at 15.95 remains. The market is not inclined to correct downward, which creates good prospects for growth.

Falling scenario: the idea is the same, we will sell when we approach the area of 16.00, not earlier. Recommendation:

Purchase: no. Those who are in the position from 14.10, move the stop to 14.15. Target: 15.90.

Sale: when approaching 16.00. Stop: 16.17. Target: 14.10.

Support — 13.79. Resistance — 15.95.

Сoffee С, ICE

Growth scenario: December futures, expiration date December 18. The market has not yet managed to gain a foothold above 110.0. If you’re in, stop. If not, then wait for a new rise above 110.0 and buy.

Falling scenario: let’s refrain from selling for now. The market is trying to move away from the minimum levels. Let’s not bother him.

Recommendation:

Purchase: think after rising above 110.0. Those who are in the position from 110.0, move the stop to 104.0. Target: 140.0 ?!

Sale: no.

Support — 108.25. Resistance — 115.85.

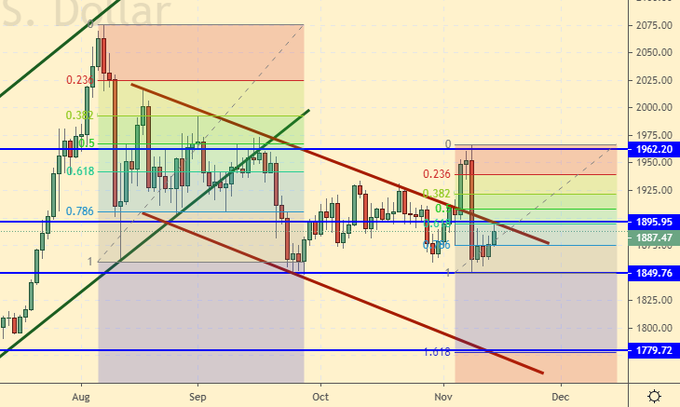

Gold. CME Group

Growth scenario: what will finish off traders faster: virus or vaccine development reports and American elections. Gold is back on the dark side thanks to Pfizer and its vaccine, we don’t buy.

Falling scenario: prices returned to the falling channel — sell. We have had a mark at 1780 for a long time. It’s time to visit her. This will make everyone feel better. So banks are writing about gold at 2600 next year. It’s time to fall. Recommendations:

Purchase: not yet. Think in case of growth above 1940.0.

Sale: now. Stop: 1907. Target: 1870.

Support — 1849. Resistance — 1895.

EUR/USD

Growth scenario: buyers tried to consolidate above 1.1900. So far this has not succeeded, but the technical picture is still for them. We buy again.

Falling scenario: let’s get back to talking about shorts only if it falls below 1.1700.

Recommendation:

Purchase: now. Stop: 1.1730. Target: 1.2800. Sale: no.

Support — 1.1737. Resistance — 1.1919.

USD/RUB

Growth scenario: we do not see long green candles upwards. The bulls have nothing to rely on yet. We are not buying yet. The Russian debt index RGBI continues to be in good shape.

Falling scenario: sorry, but the “thorn” pattern didn’t form. The market rolled back from 75.80 upwards, but the favorable situation for sellers still remains. You can try to sell the dollar against the ruble.

Purchase: think if it rises above 80.00. Sale: now. Stop: 78.30. Target: 71.17. Anyone in the position from 75.80, move the stop to 78.30. Target: 71.17.

Support — 75.85. Resistance — 78.12.

RTSI

Growth scenario: if the oil market does not let us down, then we can expect a recovery to 170,000. We will hardly go higher, but we can demonstrate something in the form of a New Year rally. But we are unlikely to show an aggressive rise under Biden, this must be borne in mind.

Falling scenario: “we are unlikely to turn down sharply next week,” we noted a week ago and were right. We do not want to fall, even to be corrected. We are not selling yet. Recommendation:

Purchase: on rollback to 120,000. Stop: 114300. Target: 170,000. Who entered from 112000 and from 120,000, move the stop to 114300. Target: 170,000 ?!

Sale: not yet.

Support — 116900. Resistance — 125500.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.