14 September 2020, 12:56

Price forecast weekly from 14 to 18 of September 2020

-

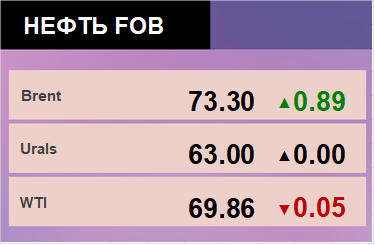

Energy market:

Austrian Chancellor Sebastian Kurz announced the beginning of the second wave of the coronavirus epidemic in the country. Unfortunately, Europe has every chance of plunging into another economic collapse in a month, if not sooner. This is a serious hit for the oil market. It’s hard to say how it will end. In the worst case scenario, we can see negative prices again.

OPEC is due out tomorrow. The forecast for oil consumption in 2021 is of interest. Based on reality, it should be reduced to 95 million barrels per day from the current 97.63. If no reduction is spelled out, then this will only indicate that the cartel is publicly not ready to acknowledge the narrowing of the market in the near future. But it will inevitably happen in a pandemic.

Grain market:

The USDA report was released on Friday.

What we see: the gross yield of wheat increased by 0.58% to 770.49 million tons, which is a bit unexpected, if we proceed from the messages that we received during August. If they harvest just that much, it will be a world record. For Russia, the forecast remains the same: 78 million tons.

The forecast for the gross corn harvest has been reduced to 1162.38 million tons. Despite the decline in the forecast, the numbers continue to be record highs for humanity. For the USA, the forecast was immediately reduced by 10 million tons, which was expected, but nevertheless, in fact, became an unpleasant surprise for the market.

USD/RUB:

It is very difficult to find positive for the ruble. Protests in Belarus do not subside, and the story with Navalny threatens to turn into new sanctions.

The Nord Stream issue is hanging in the air. It would be surprising if the pipe-laying work is not going on in three shifts now. While European officials are deciding what to do the project could be completed. It will be both funny and bitter if they do not allow one meter of pipe to be laid.

The fall in oil prices may accelerate as the pandemic develops, leading to a deficit in the balance of payments. From January to August of this year, the surplus is only $ 20 billion, and in August the surplus became negative. We are facing a currency deficit.

Based on the above, we recommend to hold the dollar against the ruble.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

We see a sharp change in the mood of speculators. About 40 thousand contracts ceased to exist in purchase, about the same number were opened in the opposite direction. Sellers will not give up this market quickly now. It’s only the beginning.

Growth scenario: September futures, the expiration date is September 30. We will continue to refrain from shopping. The second wave of the pandemic may force us not to buy even at $ 32.00 per barrel.

Falling scenario: just stand in shorts. Those who missed entering the short can expect a pullback to 42.00, hardly higher. Selling at current prices is no longer advisable.

Recommendation:

Purchase: no.

Sale: by touching 42.00. Stop: 44.60. Target: 32.10. Those who are in the position from 43.95, move the stop to 44.60. Target: 32.10 (25.00 ?!).

Support — 32.05. Resistance — 44.24.

WTI. CME Group

Fundamental USA: the number of oil drilling rigs in the US dropped by 1 unit to 180 units.

Commercial oil reserves rose by 2.033 to 500.434 million barrels. Gasoline inventories fell -2.954 to 231.905 million barrels. Distillate stocks fell -1.675 to 175.845 million barrels. Cushing’s stocks rose 1.838 to 54.351 million barrels.

Oil production rose 0.3 to 10 million barrels per day. Oil imports increased by 0.523 to 5.423 million barrels per day. Oil exports fell by -0.058 to 2.944 million barrels per day. Thus, net oil imports rose by 0.581 to 2.479 million barrels per day. Refining fell -4.9 to 71.8 percent.

Gasoline demand fell by -0.396 to 8.39 million barrels per day. Gasoline production fell by -0.604 to 8.93 million barrels per day. Gasoline imports fell by -0.003 to 0.574 million barrels per day. Gasoline exports rose 0.14 to 0.709 million barrels per day.

Distillate demand fell by -0.205 to 3.713 million barrels. Distillate production fell -0.381 to 4.398 million barrels. Distillate imports fell by -0.006 to 0.16 million barrels. Distillate exports fell by -0.182 to 1.084 million barrels per day.

The demand for oil products rose by 1.699 to 18.678 million barrels. Distillate production rose 0.249 to 20.352 million barrels. Distillate imports rose by 0.572 to 2.192 million barrels. Gasoline exports fell -0.827 to 4.242 million barrels per day.

Propane demand rose by 0.473 to 1.096 million barrels. Propane production fell by -0.042 to 2.125 million barrels. Propane imports fell by -0.016 to 0.083 million barrels. Propane exports fell by -0.212 to 0.804 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The sellers have been building up the pressure for 4 weeks. At the fifth, the market collapsed. At the end of August, there was one week when customers reminded of themselves, but that was all. It is possible that sellers will loosen their grip a little, but only in order to sell higher again.

Growth scenario: October futures, the expiration date is September 22. We will not buy anything yet. The market retains the potential for deeper diving.

Falling scenario: it is worth to hold the positions. There is a possibility of a pullback to 40.00 next week. If it happens, then you can build up shorts. There are no prerequisites for a market turn up.

Recommendation:

Purchase: no.

Sale: when rolled back to 40.00. Stop: 41.70. Target: 30.00. Those who are in the position from 39.80, move the stop to 41.70.

Support — 35.18. Resistance — 41.38.

Gas-Oil. ICE

Growth scenario: October futures, the expiration date is October 12. A rollback up to 350.0 is possible, but it is better to work it out on 1H intervals. Fear over the coronavirus will keep prices from rising in the coming weeks.

Falling scenario: the market has come to the first target at 315.0. We do not blame them who get the profit. The rest are offered to wait for the move to 300.0.

Recommendation:

Purchase: think when approaching 300.0.

Sale: by touching 345.0. Stop: 366.0. Target: 300.0. Those who are in positions between 370.0 and 375.0, move the stop to 366.0. Target: 300.0.

Support — 315.00. Resistance — 364.00.

Natural Gas. CME Group

Growth scenario: October futures, the expiration date is September 28. We are close to comfortable buying levels. Gas was somewhat oversold in the last year, therefore, even if the fall in the oil market continues, it is not a fact that gas will drop below 2.00.

Falling scenario: you can take profit on sales at 2.73. Those interested can leave 20% of the position to see how the market deals with 2.10.

Recommendation:

Purchase: now and up to 2.100. Stop: 2.060. Target: 3.536.

Sale: no. Anyone in the position from 2.730, move the stop to 2.560. Target: 2.120.

Support — 2.102. Resistance — 2.730.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Different speculative jactations can lead to the market falling, since in order to grow against the background of a record harvest, will is needed, well, and money, of course. Note that fears of a pandemic could help the market, provided that importers start to panic slightly due to the coming uncertainty.

Growth scenario: December futures, the expiration date is December 14. We continue to wait for a rollback to 530.0 and continued growth. If the market grows to 600.0 by the end of October under current conditions, this can be considered a victory for exporters.

Falling scenario: just like a week earlier, we continue to believe that it is better to refrain from selling until prices rise to 600.0. We do not sell.

Recommendation:

Purchase: on a rollback to 530.0. Stop: 510.0. Target: 600.0. Whoever is in positions between 492.0 and 499.0, keep the stop at 510.0. Target: 600.0.

Sale: think when approaching 600.0.

Support — 539.4. Resistance — 556.2.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Money leaves the market. The number of both long and short positions is decreasing. This tells us that the current upside potential is limited.

Growth scenario: December futures, the expiration date is December 14.Corn harvest will be ocean-wide. It makes no sense to buy at the current levels. Let’s continue to wait for a rollback.

Falling scenario: from 387.0 you can sell. American traders may slightly accelerate the market amid a decline in the US harvest, but they are unlikely to be able to drive quotes above 390.0.

Recommendation:

Purchase: by touching 351.0. Stop: 338.0. Target: 387.0.

Sale: by touching 387.0. Stop: 397.0. Target: 350.0.

Support — 362.2. Resistance — 371.6.

Soybeans No. 1. CME Group

Growth scenario: November futures, the expiration date is November 13. The forecast for the gross yield of soybeans in the US is reduced by 3.1 million tons, to 117.3 million tons, which supported the market on Friday. There is a potential for a move to 1042, after which a pullback will follow.

Falling scenario: waiting for prices to approach 1040 and sell. This level is extremely attractive, so you can enter with good risk and with targets for correction around 970.0.

Recommendation:

Purchase: no. If you have not closed everything at 960.0, move your stop to 964.0. Target: 1040.0.

Sale: by touching 1040.0. Stop: 1053.0. Target: 970.0.

Support — 964.0. Resistance — 1042.4

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. The market is likely to continue to fall. The current support at 12.00 does not look strong. However, we cannot ignore the two long shadows of Wednesday and Friday and put a small long.

Falling scenario: we will continue to stand in sales with targets at 10.90. So far, we do not see a single long green candlestick on the market, which means that sellers have the advantage.

Recommendation:

Purchase: by touching 10.90. Stop: 10.40. Target: 14.00. Or now, stop: 11.78. Target: 14.00.

Sale: no. Anyone in the position from 12.80, keep the stop at 12.60. Target: 10.90.

Support — 11.26. Resistance — 12.51.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 18. We switched to December futures and moving towards 140.0. Still stand in longs. We are waiting for the achievement of the goal.

Falling scenario: we will enter short when approaching 140.0. Buyers have to run out of steam to this level.

Recommendation:

Purchase: no. Whoever is in position from 110.0, keep the stop at 124.0. Target: 140.0.

Sale: by touching 140.0. Stop: 146.0. Target: 125.0.

Support — 124.30. Resistance — 140.15.

Gold. CME Group

Growth scenario: prices did not manage to gain a foothold above 1950. We suggest that the market stop tormenting traders and finally fall to 1800, where we will gladly buy.

Falling scenario: after Thursday’s long shadow, it makes sense to sell. Everything is ready for the downward correction to continue after the impressive growth.

Recommendations:

Purchase: no.

Sale: now. Stop: 1954. Target: 1780.

Support — 1857. Resistance — 1967.

EUR/USD

Growth scenario: bulls do not give up yet, although technically everything is against them. The market will wait for September 16th (the Fed meeting). If Powell does not say that he does not understand anything, and it is not clear how much more money will need to be borrowed (printed), then everything will be fine with the dollar for the next few weeks.

Falling scenario: we continue to believe that if the market falls below 1.1770, we should sell. The chances of working out the «head and shoulders» pattern remain. We really want to see a move to 1.1500.

Recommendations:

Purchase: not yet.

Sale: by touching 1.1770. Stop: 1.1860. Target: 1.1520 (1.1320).

Support — 1.1750. Resistance — 1.1925.

USD/RUB

Growth scenario: in the current political and economic circumstances, the dollar is not visible below 73.00. We can return to this level as part of a technical correction, but it would be naive to count on a trend reversal, and a move below 70.00 would be naive. We stand in longs for a dollar.

Falling scenario: even if we had confidence that the dollar would continue to lose ground against other currencies, we would not buy the ruble now. Concealment (securing) of budget revenues, so far only from oil and gas, but who knows what will happen next, this is not the background on which the currency of a state is bought especially if state began to wriggle. The currency of such a state is sold.

Purchase: when approaching 73.00. Stop: 72.90. Target: 78.70 (85.00). Anyone in the position from 73.10, keep the stop at 72.90. Target: 78.70 (85.00).

Sale: no.

Support — 73.06. Resistance — 78.59.

RTSI

Growth scenario: we found support when approaching 1170. It is technically beautiful, and immediately want to think about buying. However, we will drive these thoughts away from ourselves until the market rises above 1300. There is still not enough imagination to come up with such a background against which this rise can occur. We do not buy.

Falling scenario: if the Fed on the 16th by its strong statements makes the US stock market fall, Russian stocks will get into hot water too. If endless assistance to all those in need is announced, the dollar index will continue to lose ground, and the RTS index will have chances for a corrective rise to 1300, but it is unlikely that it will be able to go higher. Therefore, 1300 or more shorts are required.

Recommendations:

Purchase: no.

Sale: when approaching 1300. Stop: 1330. Target: 1000. Who is in position from 1228, keep the stop at 1268. Target: 1000.

Support — 1171. Resistance — 1342.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.