13 July 2020, 13:17

Price forecast weekly from 13 to 17 of July 2020

-

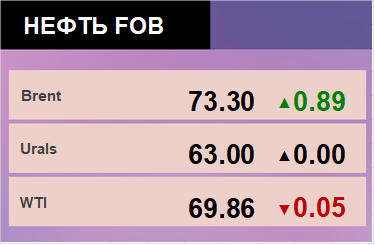

Energy market:

The pandemic continues to spread havoc in the United States. The US tries to ignore the coronavirus at the federal level and let local authorities to go their own way. Not the dollar, nor the debt, nor the stock market can withstand a second stop in the economy.

Economic problems will increase in both the member countries and non-member countries of the OPEC organization, which will sooner or later lead to a breakdown of agreements by a number of participants.

Representatives of the OPEC group say that they are being pushed to increase the production of “black gold” already in August. This is taking place against the backdrop of growing demand after the removal of a number of restrictions previously introduced against the backdrop of a pandemic. The main initiator of the increase in oil production is Saudi Arabia.

If these rumors are confirmed next week, Brent crude will roll back to 30.00.

Grain market:

The USDA report was published. The forecast for gross wheat harvest in the world is reduced by 0.53%, in the USA by 2.85%, which is significant. The market continued to grow after the release of data, which persuade us on the reality of reaching the level of 545.0 cents per bushel on the Chicago stock exchange.

Gross harvest of corn reduced by 2.13%. This is a bullish fundamental signal, but the market was expecting an even greater drop in crop volumes, therefore we saw a pullback on Friday.

Forage crop prices may suffer due to lower demand for expensive meats amid falling incomes. So far, the situation with prices for corn is not as optimistic as for wheat.

USD/RUB:

Hydrocarbon sales revenue in Russia fell by 40% between January and May. A drop in oil and gas prices threatens in the future with a 50% drop in exports to December, compared with 2019.

Of course we unwittingly pay attention to the online conversations about the denomination of the ruble. It is one thing when the exchange rate goes from 70 rubles to 140, this is a clear defeat for the government. It is another matter if, after denomination, the ruble exchange rate from 70 kopecks changes to 1 ruble 40 kopecks per dollar. Not everyone will realize that they were made twice as poor again as in 2014.

Meantime the ruble holds up well. And there are even chances to harden by 66.00, but the balance of trade in the second quarter is very alarming.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

The first sellers appeared on the market, while the buyers interest to the market began to fade. It is possible to see a turnaround. Note that the price is rising, and the balance of the open positions of speculators is shifting towards the bears.

Growth scenario: July futures, the expiration date is July 31. We see that the upward movement is fading. A break down on Thursday did not lead to success. And even if we go to the area of 45.00, it’s hard to believe in area 50.00.

Falling scenario: if there is no move to 45.00, then we can say that sellers have a significant medium-term advantage. So, no one sees the need to buy at the current prices and everyone agrees to a significant rollback.

Recommendation:

Purchase: no.

Sale: upon the appearance of the daily red candle with a close below 42.50. Stop: 43.60. Target: 32.40. Or when approaching 45.50. Stop: 47.60. Target: 32.40.

Support — 39.27. Resistance — 45.49.

WTI. CME Group

Fundamental: the number of drilling rigs in the United States fell by 4 units to 181 units.

US commercial oil inventories rose by 5.654 to 539.181 million barrels. Gasoline inventories fell -4.839 to 251.682 million barrels. Distillate stocks increased by 3.135 to 177.262 million barrels. Reserves in the Cushing storage increased by 2.206 to 47.788 million barrels.

Oil production has not changed and amounts to 11 million barrels per day. Oil imports rose by 1.425 to 7.394 million barrels per day. Oil exports fell -0.705 to 2.387 million barrels per day. Thus, net oil imports grew by 2.13 to 5.007 million barrels per day. Oil refining increased by 2 to 77.5 percent.

Demand for gasoline increased by 0.205 to 8.766 million barrels per day. Gasoline production rose 0.14 to 9.045 million barrels per day. Gasoline imports fell -0.282 to 0.729 million barrels per day. Gasoline exports grew by 0.041 to 0.524 million barrels per day.

Demand for distillates fell -0.759 to 3.019 million barrels. Distillate production increased by 0.132 to 4.756 million barrels. Distillate imports fell -0.063 to 0.072 million barrels. Distillate exports rose 0.294 to 1.36 million barrels per day.

Demand for petroleum products increased by 0.767 to 18.12 million barrels. Distillate production rose 1.032 to 21.348 million barrels. Distillate imports rose 0.3 to 2.237 million barrels. Gasoline exports grew by 0.473 to 5.217 million barrels per day.

Demand for propane fell -0.048 to 0.647 million barrels. Propane production fell -0.041 to 2.189 million barrels. Propane imports rose 0.05 to 0.109 million barrels. Propane exports rose 0.206 to 1.333 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Sellers begin to take up the running bit by bit, building up their short positions. Meanwhile buyers began to retreat. We see a picture that suppose a turn down.

Growth scenario: August futures, the expiration date is July 21. Above 43.50 the market is not visible. The last shoot up can only form a “diagonal triangle”, but it will be difficult to go even higher. Do not buy.

Falling scenario: as a week earlier, we continue to believe that we have the right to count on a downward turn in this area. The burst up exhausted, here you can sell.

Recommendation:

Purchase: no.

Sale: from 43.30 it is obligatory to sell. Stop: 46.10. Target: 30.00. Or when a daily red candle appears with a close below 40.50. Stop: 41.20. Target: 30.00.

Support — 36.91. Resistance — 43.26.

Gas-Oil. ICE

Growth scenario: August futures, the expiration date is August 12. The move to 430.0 is possible, however, a stronger growth is not visible. Do not buy.

Falling scenario: if the level 350.0 breaks down it will be necessary to enter the short. If we go to 430.0, then we must wait until the market react. Summer is at the peak. Demand for fuel will decrease.

Recommendation:

Purchase: no. Who is in the position from 305.0 and 325.0, move the stop to 353.0. Target: 429.0.

Sale: from 429.0 it is obligatory to sell. Stop: 456.0. Target: 300.0. Or, after closing the day below 350.0, stop: 373.0. Target: 290.0.

Support — 355.75. Resistance — 429.00.

Natural Gas. CME Group

Growth scenario: August futures, the expiration date of July 29. Fundamentally, any growth is out of question. Several U.S. LNG deliveries to Europe were canceled in August, as the market was overcrowded. Consumption by air conditioners is not able to remedy the situation. However, the market is looking forward and meet problems with gas production in the required volumes in a situation of falling drilling activity. In case of growth above 1.85 you can buy.

Falling scenario: don’t sell, as the market drew a something like a break up.

Recommendation:

Purchase: after rising above 1.850. Stop: 1.72. Target: 3.00?

Sale: no.

Support — 1.739. Resistance — 1.928.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We already know about that fail of speculators who bid on the sell-off in the end of the current week. An emergency close of sellers positions led to a sharp increase in prices on Thursday and Friday. The bulls grabbed the wheat market, and are unlikely to give it away easily.

Growth scenario: September futures, the expiration date is September 14. It is good that we did not miss the jerk from 490.0. We see that the market won back the reduction in the forecast of gross harvest in the world and in the USA on Wednesday and Thursday. Someone always knows something on the market or thinks that knows.

Falling scenario: after reaching the level of 545.0 there will be a rollback to 516.0, but it’s more convenient to work on 1H intervals. Bulls can pull up the market to 590.0. Something more will hardly happen, since the proposal will be at a high level.

Recommendation:

Purchase: think when rolling back to 516.0. Who is in position from 490.0, move the stop to 514.0. Target: 544.0. You can close 20% of the position with a profit.

Sale: no.

Support — 516.6. Resistance — 545.2.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are sellers more than buyers. Both bulls and bears come to the market, the fight for levels is increasing. In the case of a unidirectional move up or down, the market will accelerate due to the closing of positions with a loss of one of the parties.

Growth scenario: September futures, the expiration date is September 14. The reduction of USDA forecast gross harvest of corn by 2.13% did not impress bulls. They expected more. The Friday red candle is frankly scary, but we will not give up the idea of a market rising to 415.0 yet. Just hold longs, buy more, the bulls have a couple more weeks.

Falling scenario: if we are in the area of 500.0 now, we would go to short with delight. But we have 300.0 cents per bushel. The price levels are historically low, therefore we will not sell.

Recommendation:

Purchase: now and up to 330.0. Stop: 320.0. Target: 415.0. Who’s in position from 345.0, keep stop at 320.0. Target: 415.0.

Sale: no.

Support — 334.2. Resistance — 354.2.

Soybeans No. 1. CME Group

Growth scenario: September futures, the expiration date is September 14. The market corrected after USDA made it clear that there would be no decline in soybean yields this year. While it’s worth keeping longs and buying in the expectation of market growth to 950.0.

Falling scenario: we will patiently wait for prices to arrive at 950.0 in order to enter the sale there.

Recommendation:

Purchase: who closed a 20% position at 900.0, you can look for a place to build up longs, maybe you can re-enter from 876.0. Who’s in position from 840.0, keep stop at 867.0. Target: 950.0.

Sale: no.

Support — 874.4. Resistance — 905.4.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. If the market goes below 11.50, then there will be a threat of moving below 110.0, and this can already lead to a descent to 10.00. In respect that, we will buy here with a short stop order.

Falling scenario: continue to hold open positions for sale. If prices exit a growing channel, there is a chance that the decline will continue.

Recommendation:

Purchase: now. Stop: 11.40. Target: 14.00.

Sale: no. Who entered from 11.96, hold the stop at 12.30 (the maximum was at 12.29). Target: 10.00 ?!

Support — 11.28. Resistance — 12.40.

Сoffee С, ICE

Growth scenario: September futures, the expiration date is September 18. We see the pullback that was predicted in the previous forecast. You can buy here. The risk is small.

Falling scenario: the one-way move up, which was nine days ago, still dominating. If the market returns at 94.00, it will be unpleasant. However, we do not sell. Prices are low.

Recommendation:

Purchase: now. Stop: 94.00. Target: 125.00. Who is in position from 100.0 and 96.00, keep stop at 94.00. Target: 125.0.

Sale: no.

Support — 94.20. Resistance — 98.85.

Gold. CME Group

Growth scenario: if the Fed will buy up bad debts in the market, preventing the situation from getting worse, and there will be constant support to the stock market through liquidity injections, then reevaluation will go through gold and other precious metals. Hold longs.

Falling scenario: we continue to believe that we don’t need to sell above 1750 so far. Let’s not be rush with sales.

Recommendations:

Purchase: no. Who is in position from 1750, keep stopping at 1747. Target: 2200.

Sale: after closing the day below 1750. Stop: 1777. Target: 1650 (1400).

Support — 1789. Resistance — 1922.

EUR/USD

Growth scenario: the main idea is still alive, continue to wait the rising. Whether the Fed will lower the rate to zero on the 29th, that’s the question. If so, then the pair will quickly be at 1.2000 and will head for 1.4000.

Falling scenario: there is no doubt that Berlin, despite the epidemic and economic problems, will urge the south of Europe to ask for less debt and work more. On the other hand, we have been observing the demarches of the southerners for a long time, but things haven’t come to a divorce and are unlikely to come. For Spain and Italy, this is not the time to destroy current economic relations definitely.

Recommendations:

Purchase: in case of growth above 1.1350. Stop: 1.1230. Target: 1.1960. Who is in the position of 1.0800, move the stop to 1.1170. Target: 1.1960. Who is in the position of 1.1350, keep stopping at 1.1230. Target: 1.1960.

Sale: after falling below 1.1150. Stop: 1.1260. Target: 1.0000.

Support is 1.1185. Resistance — 1.1450.

USD/RUB

Growth scenario: the RGBI is still in a good shape. We are waiting for the trade balance data in the second quarter next week. The release of this data may lead to strong movements in the market. We will take into account that in the current economic situation the Government of the Russian Federation hardly needs a strong ruble.

As long as the pair is above the level of 70.00 the bulls will have an advantage.

Falling scenario: sellers need to return the market below 69.70 so that a large number of market participants believe in the moving scenario to 66.00.

Inflation in June 2020 was 0.2% after 0.3% in May. In the 1st half of the year, prices rose by 2.6%. Annual inflation in June of this year accelerated to 3.2% after 3.0% in May.

We see that the chance for a further rate cut by the Bank of Russia become lesser. We can assume that the current rate of 4.5% is unlikely to be reduced from current levels, which will provide support to the ruble.

Recommendations:

Purchase: no. Who is in position, from 68.00 and 69.70, move the stop at 69.60. Target: 74.50 (78.50).

Sale: think after falling below 69.70.

Support — 69.77. Resistance — 72.57.

RTSI

Growth scenario: the market is in the range. There are no sellers, and the growth scenario by 1450 is becoming more and more real, especially since the SP500 index is preparing to set a new historic maximum in the US. The current levels for purchases are slightly overstated, but this should not prevent us from making a test long with a stop order at 1190.

Falling scenario: we continue to believe that a move to 1100 is possible. Our stop is at 1286. Current levels are attractive for sales. If the ruble weakens next week after the release of data about the trade balance, the way to 1100 on the RTSI will be open.

Recommendation:

Purchase: think when rolling back to 1100. Or now. Stop: 1190. Target: 1450.

Sale: now. Stop: 1286. Target: 1100 (600?). Who is in position, hold stop at 1286. Target: 1100 (600?).

Support is 1182. Resistance is 1314.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.