Price forecast from from 4 to 8 December 2023

-

Energy market:

Already, and at the same time so far, every hundredth Chinese cannot pay their loans. The situation could get worse, dragging everything down. That’s all. It’s not for nothing that foreigners have been fleeing the Middle Kingdom for the 5th month in a row. Oh, someone would forgive us for our credit pranks… oh, what is this China, porcelain and gunpowder.

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

So, the exporting team decided to reduce supply by 2.2. million barrels per day from the new year. Saudi Arabia managed to persuade other states to officially join the production reduction program. What we see: the market has rolled back for now, and it is possible that it will try to break below 75.00 on Brent, but this is unlikely to succeed, since the harmony of ranks in a number of “custodians” has been preserved.

At the moment, according to various publications, there is a global deficit of 2 — 2.5 million barrels per day. That is, now stocks in storage facilities should fall. At the same time, we see that supply will be regulated. This should lead to prices moving upward. Moreover, this growth should be significant (above 100.00). Otherwise, we have all been given fundamental noodles on our ears.

For Russia, the situation is not easy in November. The West has taken up all the companies that provide their oil transportation services. In the end, you will have to create your own fleet, insure everything yourself, and so on. There will be costs, but it will also create jobs. However, with one year on the horizon, the blow to Russian exports could be painful.

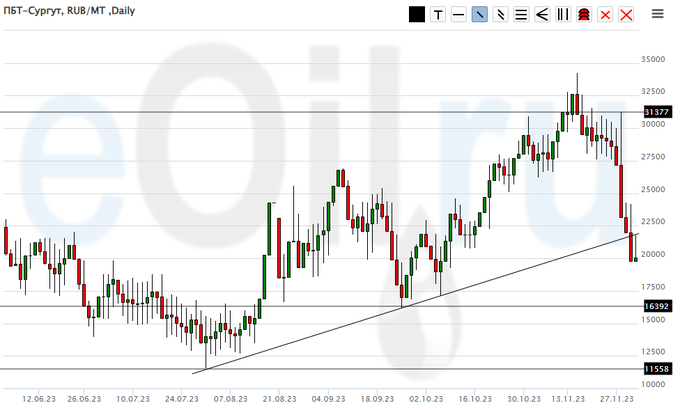

Reading our forecasts, you could take a move down on the PBT market, the basis of Surgut, from 30000 to 23300. You could also take a move up on the EUR/USD pair from 1.0700 to 1.0840. In addition, it was possible to take a downward move on the USD/RUB pair from 91.80 to 89.20.

Grain market:

The market situation remains generally calm. There are some worrying signs about winter crops in Europe. It’s raining, which prevents equipment from going out into the fields. But, there is still spring and spring sowing. And if it doesn’t work out there, lift the sanctions and exchange it for gold from Russia.

Actually, we congratulate everyone on the fact that we are with grain. The second largest harvest in history in the amount of 151 million tons (153.83 — 2022), of which 99 million tons of wheat took place. It will be possible to export 65 million tons of wheat without any problems. It is still possible to help poor countries in Africa, by almost 1 million tons. Or they could change it. At least for coffee. Well, what… Or all sorts of “cocoa” there.

The current situation is such that only the development of exchange trading within the country can preserve the characteristics of a classical market in the agricultural sector, as well as in other raw materials areas. Otherwise, farmers will be constantly kept in a “black body”, preventing them from receiving the real price for the goods. Even if it is below a certain “desired threshold” on the stock exchange, it is still better than dictates from large traders, since everyone will see that at the moment the situation is exactly this and there is no other. There will be no offense or complaints. Everyone will see the same picture.

USD/RUB:

But we didn’t go to 80.00. Even expectations of a rate increase from the Central Bank of the Russian Federation do not help. Elvira Sakhipzadovna will very likely show us 17% per annum on Friday the 15th, which will cool the stock market and attract investors. But our inflation will not decrease. Why? Because money is being issued to cover defense expenses.

Now you should think very hard about selling the dollar against the ruble when approaching 96.00, and now we have gone exactly there. The 24th year may be troubling.

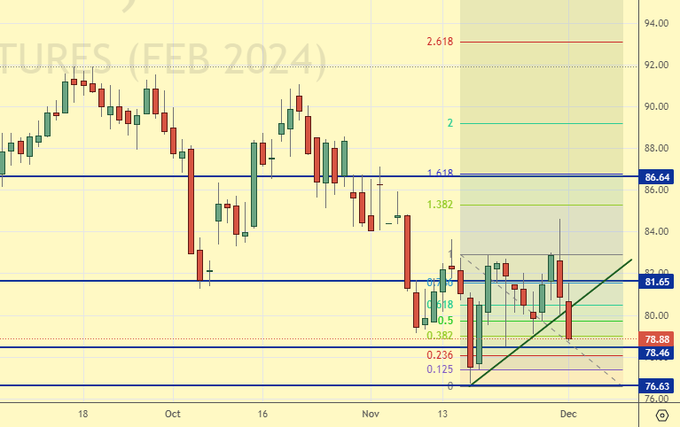

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 4.1 thousand contracts. Sellers left the market more actively than buyers, while the volumes of closing positions were insignificant. The bulls continue to control the situation.

Growth scenario: we are considering December futures, expiration date is December 29. We see a fairly violent reaction to the outcome of the OPEC+ meeting. There will be reductions, but they have not made much of an impression on the market. We will buy from 75.00 in anticipation of a market reversal upward.

Fall scenario: we will not sell, counting on a move, for example, by 60.00. The current levels for entering shorts are too low, and we are unlikely to go down to 60.00.

Recommendations for the Brent oil market:

Purchase: when approaching 75.00. Stop: 73.00. Goal: 150.00.

Sale: no.

Support – 78.46. Resistance – 81.65.

WTI. CME Group

US Fundamental Data: The number of active drilling rigs increased by 5 to 505.

Commercial oil reserves in the United States increased by 1.61 to 449.664 million barrels, with a forecast of -0.933 million barrels. Gasoline inventories increased by 1.764 to 218.184 million barrels. Distillate inventories increased by 5.217 to 110.778 million barrels. Inventories at the Cushing storage facility increased by 1.854 to 27.722 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports fell by -0.696 to 5.833 million barrels per day. Oil exports fell by -0.031 to 4.755 million barrels per day. Thus, net oil imports fell by -0.665 to 1.078 million barrels per day. Oil refining increased by 2.8 to 89.8 percent.

Gasoline demand fell by -0.274 to 8.206 million barrels per day. Gasoline production fell by -0.035 to 9.337 million barrels per day. Gasoline imports fell by -0.13 to 0.463 million barrels per day. Gasoline exports increased by 0.279 to 1.175 million barrels per day.

Demand for distillates fell by -1.096 to 3.014 million barrels. Distillate production increased by 0.06 to 4.998 million barrels. Imports of distillates increased by 0.02 to 0.095 million barrels. Exports of distillates increased by 0.286 to 1.334 million barrels per day.

Demand for petroleum products fell by -1.125 to 18.917 million barrels. Production of petroleum products fell by -0.331 to 21.63 million barrels. Imports of petroleum products fell by -0.512 to 1.182 million barrels. Exports of petroleum products increased by 0.559 to 6.71 million barrels per day.

Demand for propane increased by 0.233 to 1.215 million barrels. Propane production increased by 0.048 to 2.645 million barrels. Propane imports fell -0.017 to 0.088 million barrels. Propane exports increased by 0.045 to 0.14 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 6.6 thousand contracts. Sellers entered the market in small numbers, buyers also came, but in microscopic quantities. The bulls continue to control the situation.

Growth scenario: we are considering January futures, expiration date is December 19. Let’s continue to stay long with a stop at 71.00. If the position survives, it may have a good future.

Fall scenario: refrain from selling. Perhaps in a week, we will get a much more interesting situation for entering shorts.

Recommendations for WTI oil:

Purchase: no. Anyone in position from 73.50, keep a stop at 71.00. Target: 83.00.

Sale: no.

Support – 72.46. Resistance – 79.68.

Gas-Oil. ICE

Growth scenario: we are considering December futures, expiration date is December 12. The idea is the same: we’ll take it when we approach 700.00, if the market gives such an opportunity. We do nothing at current prices.

Fall scenario: we roll back from new sales, as OPEC+ countries showed their teeth. Those who entered when approaching 860.0, keep short.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: no. Those who sold from 850.00, move the stop to 840.00. Goal: 700.00.

Support – 775.75. Resistance – 843.25.

Natural Gas. CME Group

Growth scenario: we are considering January futures, expiration date is December 27. The market is absolutely not interesting for speculation. Off the market.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 2.101. Resistance – 3.464.

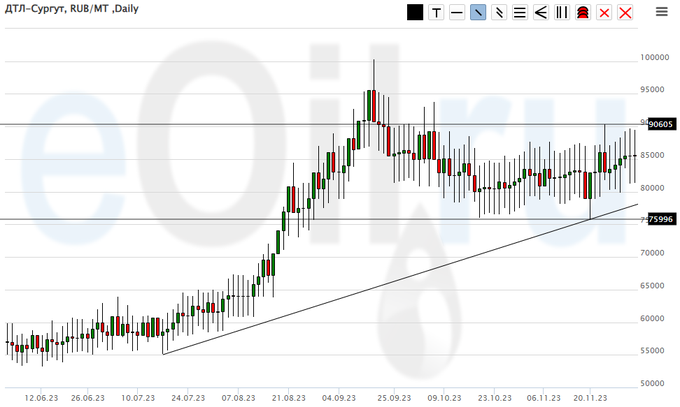

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 65,000. It will be possible to buy there.

Fall scenario: also no change. Let’s continue to stay short. We see an attempt to go above 90,000, which was unsuccessful. While we are below 90,000, sellers have a chance.

Recommendations for the diesel market:

Purchase: when approaching 65,000. Stop: 58,000. Target: 85,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 66000.

Support – 75996. Resistance – 90605.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: here we are at 20,000. This is interesting. But the long from 16500 is much more interesting.

Fall scenario: we took a move from 30,000 to 23,300. Now out of the market.

Recommendations for the PBT market:

Purchase: when approaching 16500. Stop: 14500. Target: 28000.

Sale: no.

Support – 16392. Resistance – 31377

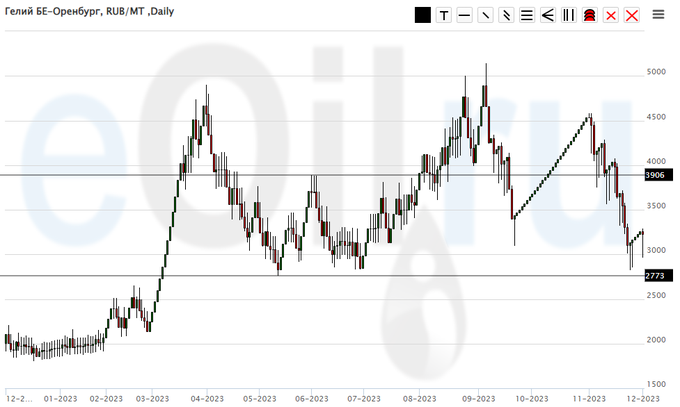

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. It is unlikely that the market will go below 2700 in the near future.

Fall scenario: we continue to remain outside the market, prices are low.

Helium market recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2773. Resistance – 3906.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 6.6 thousand contracts. Sellers entered the market in small numbers, buyers left the market. The bulls continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. We went from 550.0 to the top. Not on the market yet. But with a rollback to 570.0 it will be possible to buy.

Fall scenario: as before, we refuse to sell. The 600.0 region is not bad, but it’s better to work it out on the clock.

Recommendations for the wheat market:

Purchase: on a rollback to 570.0. Stop: 548.0. Goal: 700.0.

Sale: no.

Support – 583.2. Resistance – 611.3.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 10.2 thousand contracts. Sellers entered the market in small numbers, buyers left the market. The bulls continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. We continue to expect the market to fall. It will be interesting to buy from 425.0.

Fall scenario: we took 10 cents on the December contract, move to the March one with targets at 425.0.

Recommendations for the corn market:

Purchase: no.

Sale: now. Stop: 492.0. Target: 425.0.

Support – 482.3. Resistance – 496.3.

Soybeans No. 1. CME Group

Growth scenario: we are considering January futures, expiration date is January 12. Yes, the market is weakening. We don’t buy. Everything will be fine with soybeans (that is, there will be a lot of it).

Fall scenario: we will think about selling if it falls below 1320. Out of the market for now.

Recommendations for the soybean market:

Purchase: no.

Sale: if it falls below 1320. Stop: 1355. Target: 1212.

Support – 1297.5. Resistance – 1353.4.

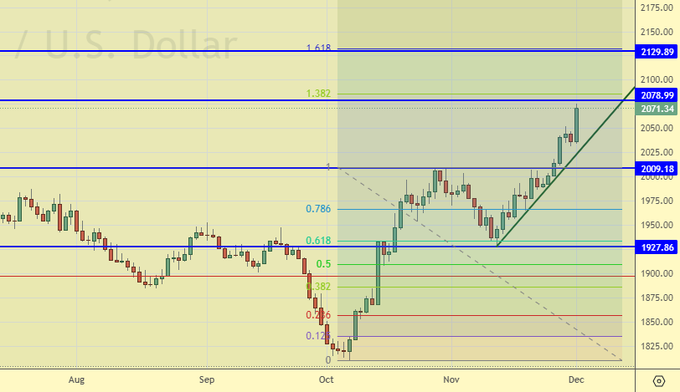

Growth scenario: hold longs. We are not afraid of anything. The situation is that we are going somewhere towards 2400.

Growth scenario: hold longs. We are not afraid of anything. The situation is that we are going somewhere towards 2400.

Fall scenario: attempts to short the stock did not lead to anything. Off the market.

Recommendations for the gold market:

Purchase: no. Anyone in position from 1840, move the stop to 1980. Target: 2400.

Sale: no.

Support – 2009. Resistance – 2078.

EUR/USD

Growth scenario: we were removed from the market with a stop at 1.0840. Let’s take a break for a week.

Fall scenario: we will not sell. We need more information from the market.

Recommendations for the euro/dollar pair:

Purchase: no.

Sale: no.

Support – 1.0757. Resistance – 1.0930.

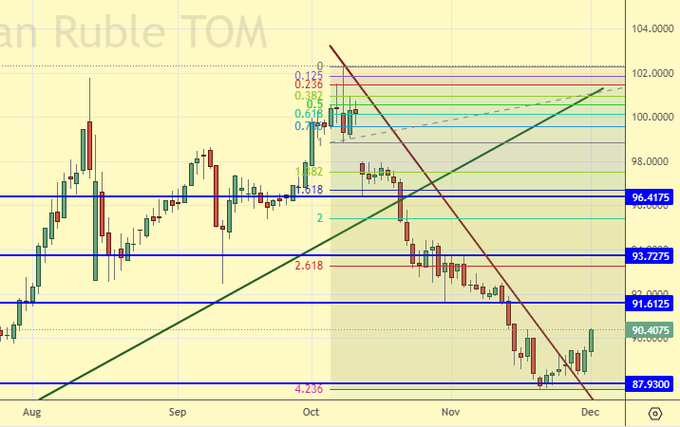

USD/RUB

Growth scenario: but we couldn’t break below 88.00. Moreover, we also closed Friday above 90.00. This could lead to a move of 96.00.

Fall scenario: somehow it’s not as perfect for the ruble as it seemed before. For now we refuse to sell. As we approach 96.00 it is strong, no, very strong, we think.

Recommendations for the dollar/ruble pair:

Purchase: no. If you are in a position from 88.00, move your stop to 88.40. Goal: 100.00 (120.00; 200.00; 1000.00).

Sale: no.

Support – 87.93. Resistance – 91.61.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. We continue to believe that purchases are not interesting at current levels. Off the market.

Fall scenario: we are short at 115,000. Somehow the ruble depreciated against expectations. This means there is the prospect of a deeper dive. A fight at 103,000 is possible, but it may be lost by the bulls.

Recommendations for the RTS Index:

Purchase: no.

Sale: no. Who is in a position from 115000, move the stop to 114000. Target: 50000?!

Support – 105920. Resistance – 111100.

https://www.oilexp.ru/oilstat/report/price-forecast-from-27-november-to-1-december-2023/307523/

Previous forecast

#Wheat, #Corn, #Soybean, #Brent, #WTI, #Gasoil, #NaturalGas,

#Gold, #EUR, #USD, #RUB, #RTSI, #IDK

https://exp.idk.ru/analytics/report/price-forecast-from-27-november-to-1-december-2023/633637/

Previous forecast