09 September 2024, 10:07

Price forecast from 9 to 13 September 2024

-

Energy market:

If we look for wise men on Earth, we should certainly not look for them in OPEC+. It would be bad enough if the people who had the luck of 32 teeth, the ones who discovered oil, stopped thinking altogether. No. They can think! Amid falling oil prices has shifted talk of ramping up production by two months.

Here’s to foresight, may it be much better than OPEC+! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

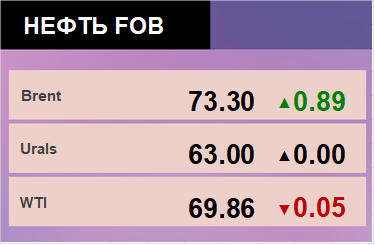

We see that oil went to 71.00, which is worse than our expectations for this market. The burying of China’s economy in the press continues, which keeps the bulls on their toes. OPEC+ should think not about stopping talks about increasing production, but about how to reduce it by another 1 million barrels per day. Otherwise, we are waiting for an unpleasant stage in the market for the RF budget, namely, a fall to the level of 60.00 dollars per barrel for Brent. Yes, it is very low, but bears’ appetite comes at mealtime. It’s time for the princes to stop eating halva and come out with statements that it is necessary to restore balance in the market.

Over the past 2.5 years, Russia’s export history has survived all sorts of Western attempts to restrict oil exports at market price. There is harm, but it is overcome by giving discounts to those who want to work with Russia, not to those who do not want to work with it. Russian oil exports by sea to Europe have been stopped since August. To other countries, 3.16 million bpd were shipped by sea in August, down 9% from April this year. The sanctions are in place, and it is worth noting that if the price drop continues, it is unlikely that it will be possible to return to the European market even by roundabout ways.

Grain market:

We are waiting for the USDA report on September 12. Most likely, the heat wave did cause some damage to the crop in Europe and the US, which is reflected in the price behavior on the stock exchange over the last week. However, the UN raised this season’s wheat harvest to 791 million tons compared to 789 million tons a month earlier, which tells us that hot August was not everywhere on the planet. The USDA report will be decisive for the next couple months. Unless the gross harvest forecast is down 3 percent or more from last month, the market will move off the current local highs down to 540 cents a bushel for wheat, after which the gains will likely continue. If the forecast is the same as in July, the market could fall to 500 cents per bushel (minus 10 percent) and then rise.

FOB prices at Novorossiysk remain low. 212 dollars per ton for milling wheat (12.5% protein) is not the level sellers would like to see. Will there be an increase in the next two months? More likely yes than no. Based on seasonality, we are at, or will be at, the lows of the year by the 15th, after which we will see a recovery. However, it will be weak. It is unlikely that we will be able to go above $240 per ton for Russian wheat before winter. We do not expect a significant increase in demand for wheat, it will grow year-on-year, but at a very low rate and will not be able to significantly raise prices on the back of a good harvest.

USD/RUB:

On Friday the 13th the Central Bank of the Russian Federation will meet. It is possible that the rate will be left at 18%, while we cannot believe in a slowdown in inflation either at the current rate or at a higher rate. The halt in inflation over the last week, which many have cheered, is a consequence of cheap tomatoes and potatoes. That’s just the harvest. The most unpleasant thing: society is getting used to living with constant price increases. Everyone is whining, everyone understands everything, but it doesn’t scare anyone anymore. Note that a rate hike will not stop the printing press. As long as the SWO is going on, the costs of which cannot be calculated and described, we cannot expect a slowdown in inflation. The dollar/ruble exchange rate will gravitate to a gradual weakening to 95.00 by mid-autumn.

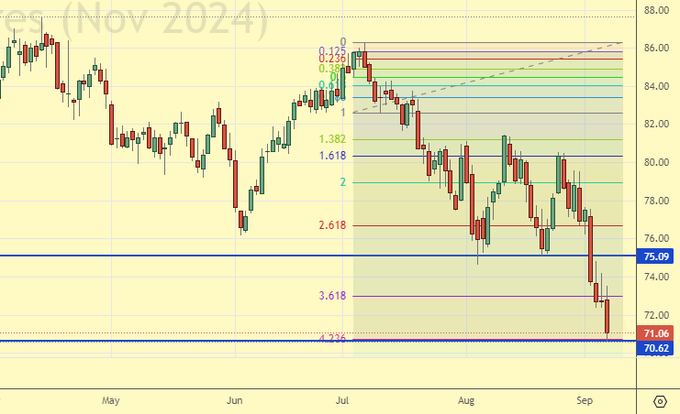

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 44.9 thousand contracts. The change is significant. Buyers were leaving. Sellers were actively entering the market in large volumes. Buyers may lose control over the market.

Growth scenario: we consider November futures, expiration date September 30. We can buy. The market is oversold. A rise to 74.90 looks natural, especially as commercial oil inventories in the US continue to fall. Stronger growth is still questionable.

Downside scenario: rise to 74.90 can be used for selling. But we will not explicitly recommend this trade.

Recommendations for the Brent oil market:

Buy: now (71.06). Stop: 70.00. Target: 100.00.

Sell: think in case of growth to 74.90.

Support — 70.62. Resistance — 75.09.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 483.

U.S. commercial oil inventories fell by -6.873 to 418.31 million barrels, with a forecast of -0.6 million barrels. Gasoline inventories rose 0.848 to 219.242 million barrels. Distillate stocks fell -0.371 to 122.715 million barrels. Cushing storage stocks fell by -1.142 to 26.394 million barrels.

Oil production is unchanged at 13.3 million barrels per day. Oil imports fell by -0.768 to 5.792 million barrels per day. Oil exports rose by 0.085 to 3.756 million barrels per day. Thus, net oil imports fell -0.853 to 2.036 million barrels per day. Oil refining remained unchanged at 93.3 percent.

Gasoline demand fell -0.369 to 8.938 million barrels per day. Gasoline production rose by 0.136 to 9.748 million barrels per day. Gasoline imports fell -0.212 to 0.655 million barrels per day. Gasoline exports rose -0.048 to 0.865 million barrels per day.

Distillate demand increased by 0.175 to 3.997 mln barrels. Distillate production rose by 0.167 to 5.169 million barrels. Distillate imports fell -0.038 to 0.182 million barrels. Distillate exports rose -0.046 to 1.407 million barrels per day.

Demand for petroleum products fell by -1.051 to 20.541 million barrels. Petroleum products production fell by -0.386 to 22.320 million barrels. Imports of refined petroleum products fell -0.149 to 1.811 million barrels. Exports of refined products rose by 0.763 to 7.33 million barrels per day.

Propane demand fell -0.298 to 0.729 million barrels. Propane production fell -0.012 to 2.689 million barrels. Propane imports fell -0.008 to 0.079 million barrels. Propane exports rose 0.045 to 1.664 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers decreased by 64.7 thousand contracts. The change is huge. Buyers were leaving the market. Sellers were entering in comparable volumes. Bulls are still keeping control.

Growth scenario: we consider October futures, expiration date is September 20. The market has gone below the Fibonacci support. Don’t buy.

Downside scenario: a move to 60.00 cannot be ruled out. However, there are no interesting levels for selling. We are out of the market for now. Only a rise to 74.00 can make us think about shorts.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 60.63. Resistance — 68.89.

Gas-Oil. ICE

Growth scenario: switched to October futures, expiration date October 10. The market is oversold. An upward reversal is possible. However, a collapse cannot be ruled out. Do not buy.

Downside scenario: nothing of interest to sellers here.

Gasoil Recommendations:

Buy: no.

Sale: no.

Support — 683.50. Resistance — 708.25.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. A move to 2.835 is not excluded. We hold longs.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: no. Those in position from 2.127, keep your stop at 1.980. Target: 5,000?!

Sale: no.

Support — 1.987. Resistance — 2.419.

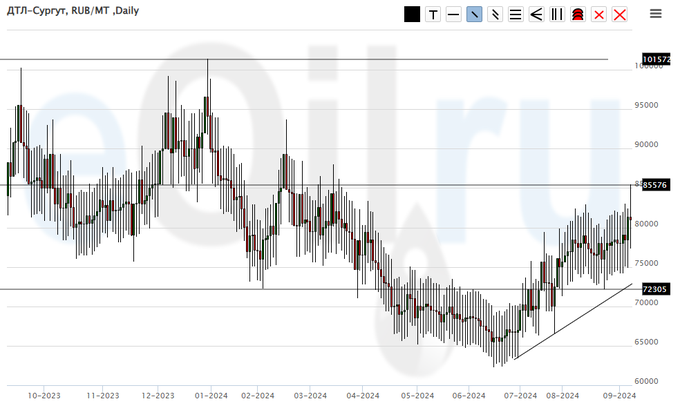

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 70,000. Target: 100000!

Sale: no.

Support — 72305. Resistance — 85576.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21016. Resistance — 35313.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — 1525.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 11 thousand contracts. Sellers and buyers reduced their positions in small volumes. Bears are maintaining control.

Growth scenario: we consider December futures, expiration date December 13. On pullbacks downward, it is possible to buy. Note that the current upward pullback did not break the bears. The risk of prices falling to 500.0 remains.

Downside scenario: the market did not go down amid the heat wave in the US and Europe. Not selling.

Recommendations for the wheat market:

Buy: when approaching 540.0. Stop: 530.0. Goal: 650.0. Or when approaching 500.0. Stop: 490.0. Target: 650.0.

Sale: no.

Support — 544.4. Resistance — 589.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 60.7 thousand contracts. The change is significant. Buyers entered the market. Sellers were fleeing. Bears are in control for now.

Growth scenario: we consider December futures, expiration date December 13. The current upward flight is premature. We are waiting for a pullback, or even a new low. We can look for entry points to buy.

Downside scenario: our time for selling is running out. There is no sense to enter shorting, as prices have gone down as much as they could on the background of the new harvest and further fall is under great question.

Recommendations for the corn market:

Buy: when approaching 395.0. Stop: 385.0. Target: 450.0. Or when approaching 360.0. Stop: 340.0. Target: 450.0.

Sale: no.

Support — 395.0. Resistance — 416.0.

Soybeans No. 1. CME Group

Growth scenario: we consider November futures, expiration date November 14. An upside flight before the USDA report looks premature. It is possible that we will see lower levels. Forecasts for soybeans remain excellent. Expect prices to continue to fall.

Downside scenario: sell again despite last week’s setback. Oilseeds are plentiful. We should continue to fall.

Recommendations for the soybean market:

Buy: when approaching 850.0. Stop: 830.0. Target: 1100.0.

Sell: now (1005.0). Stop: 1025.0. Target: 850.0.

Support — 986.4. Resistance — 1031.6.

Growth scenario: we consider December futures, expiration date December 27. Nothing new. The bulls cannot convince us of their power yet. We don’t buy, but we are watching carefully.

Downside scenario: we keep shorting. We want the level of 2120, but we will agree with 2400 for the beginning.

Gold Market Recommendations:

Buy: no.

Sell: no. Who is in position from 2527, keep stop at 2572.0. Target: 2120.

Support — 2502. Resistance — 2570.

EUR/USD

Growth Scenario: We may continue a slow downward pullback. The latest report on the US labor market is in favor of the dollar. If there will be a rate cut, it will be very slow. Nevertheless, the bulls will rule as long as we are above 1.0900.

Downside scenario: could the dollar surprise with its strengthening? It could. And if we fall under 1.0900, we will have to look for short entry opportunities.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.0900. Stop: 1.0870. Target: 1.2000.

Sale: no.

Support — 1.1026. Resistance — 1.1223.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. Nothing new. The market is able to go higher. Let’s hold the long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those who are in the position from 85976, keep your stop at 85900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 87601. Resistance — 90446.

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We have consolidated under 97600. We continue not to believe in the growth of the Russian market in dollars. Yes, longing from 87000 area is possible, but we should weigh everything very well for such a step. We will not give an explicit recommendation for this purchase yet.

Downside scenario: nothing new. We’ll keep shorting. It should go to the area of 87000. Note that falling below 87000 may cause panic and total dumping of securities.

Recommendations on the RTS index:

Buy: no.

Sell: no. Those who are in position from 115200, move the stop to 96300. Target: 87400.

Support — 90510. Resistance — 97170.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.