Price forecast from 6 to 10 of March 2023

-

Energy market:

Europe stoked stoves with dung and survived the winter. Gas prices have dropped. Now we need to survive the summer, when air conditioners will devour energy. Gas prices will start to rise again. And so in a circle, then up, then down, for many, many years.

Add heat, open windows. May spring come to us soon. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Washington began the hunt for tankers that carry Russian oil. So far, this is expressed in pressure on companies providing transport and insurance services, but who knows what will happen next. They blew up the Nord Stream pipe, which means that mentally nothing prevents you from blowing up something else. But what about ecology? A torpedoed oil tanker is a disaster. Yes, so what. This is America!

The United Arab Emirates is considering withdrawing from the OPEC+ deal. Most likely, this is just a stuffing in order to test the waters, but what we previously only assumed is now taking shape: a struggle begins for falling volumes of Russian oil. If Russia reduces supplies by 0.5 million barrels per day in March, then someone can increase them without harm to the system. But in order to be able to bring as much as possible to the market, without discussing the issue of quotas and shares with other participants, this very agreement must be withdrawn. If the deal to cut production falls apart, it could lead to a drop in prices. However, in practice, we do not see a downward reversal. Most are waiting for the Chinese dragon to wake up in the spring and start consuming a lot of fuel.

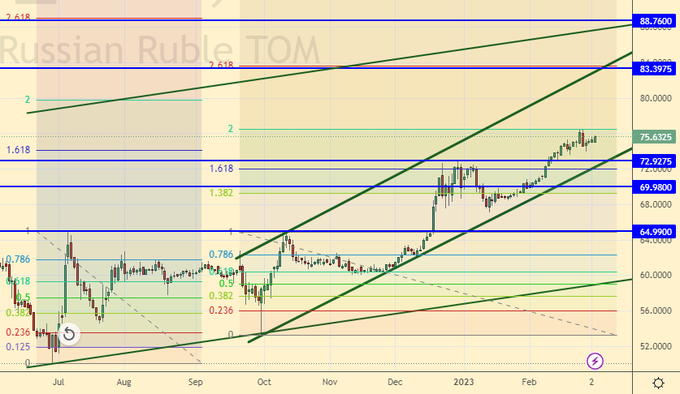

Reading our forecasts, you could make money on the dollar / ruble pair by taking a move up from 71.50 to 75.80 rubles per dollar.

Grain market:

Lavrov said at the G20 summit bluntly: «The extension of the grain deal is possible only taking into account the interests of Russia.» In practice, Moscow is unlikely to block Ukrainian grain exports. The markets are of the same opinion. Grain prices, having shown local lows, did not rebound upwards, which suggests a further decline.

The Ministry of Agriculture may increase grain purchases for the intervention fund. In fact, this should be done not only to maintain prices, which are at low levels, but also to improve food security. In the current situation, it would not hurt us to have reserves that will provide all the needs of the country for a period of 1 year, this is about 40 million tons, and not modest reserves that cover only 4 months of human consumption, in the amount of about 3.5 million tons. You give more strategic reserves!

USD/RUB:

Against the backdrop of speculation that the US Fed’s rate hike cycle is not over yet, demand for US debt increased, while the stock and gold markets remained under pressure. Most likely dollar positions will be strong for several more weeks. It is possible that the dominance of the US currency will last until mid-summer.

The ruble will be vulnerable to the US dollar if oil prices do not rise. With tax collections falling, the Kremlin needs to find funds for the military-industrial complex, as well as for the implementation of social programs. It is easy to predict that against the backdrop of a growing budget deficit, the tax burden will become tougher, and the national currency will devalue. We recall Iran, where 20% inflation per year is quite a normal story.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 15.5 thousand contracts. Sellers chose to leave, with a small group of buyers entering the market. The spread between long and short positions widened. Bulls are in control.

Growth scenario: we consider the March futures, the expiration date is March 31. The market held above the 80.00 level. We hold longs.

Fall scenario: most likely we will see growth in the market around 91.50, so we are not selling yet.

Recommendations for the Brent oil market:

Purchase: no. Who is in position from 82.50, move the stop to 82.40. Target: 110.0.

Sale: no. Close all shorts.

Support — 82.39. Resistance — 89.08.

WTI. CME Group

Fundamental US data: the number of active drilling rigs decreased by 8 units and amounts to 592 units.

Commercial oil reserves in the US increased by 1.166 to 480.207 million barrels, with the forecast of +0.457 million barrels. Inventories of gasoline fell -0.874 to 239.192 million barrels. Distillate inventories rose by 0.179 to 122.114 million barrels. Inventories at Cushing rose by 0.307 to 40.718 million barrels.

Oil production has not changed and stands at 12.3 million barrels per day. Oil imports fell by -0.118 to 6.208 million barrels per day. Oil exports rose by 1.032 to 5.629 million barrels per day. Thus, net oil imports fell by -1.15 to 0.579 million barrels per day. Oil refining fell by -0.1 to 85.8 percent.

Gasoline demand rose by 0.202 to 9.112 million barrels per day. Gasoline production increased by 0.302 to 9.73 million barrels per day. Gasoline imports rose by 0.196 to 0.672 million barrels per day. Gasoline exports fell -0.117 to 0.651 million bpd.

Demand for distillates rose by 0.064 to 3.835 million barrels. Distillate production fell -0.091 to 4.609 million barrels. Distillate imports fell -0.217 to 0.197 million barrels. Distillate exports fell -0.013 to 0.945 million barrels per day.

Demand for oil products rose by 0.195 to 20.413 million barrels. Production of petroleum products fell by -0.141 to 21.242 million barrels. Imports of petroleum products fell by -0.211 to 1.854 million barrels. Exports of petroleum products fell by -0.493 to 5.499 million barrels per day.

Propane demand rose by 0.027 to 1.343 million barrels. Propane production fell by -0.022 to 2.382 million barrels. Propane imports fell by -0.025 to 0.14 million barrels. Propane exports fell -0.104 to 1.571 million barrels per day.

Growth scenario: we are considering the April futures, the expiration date is March 21. If prices rise above 81.50, open long. Until this moment, we remain outside the market.

Fall scenario: we will continue to hold the shorts. The chances of continuing the fall are small, but as long as we are inside the falling channel, we will stand down.

Recommendations for WTI oil:

Purchase: after rising above 81.50. Stop: 80.40. Target: 110.00.

Sale: no. Those in positions between 82.00 and 80.50 keep the stop at 80.80. Target: 66.00 (55.00) dollars per barrel.

Support — 75.84. Resistance — 80.78.

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. We hold the purchase from 800.0. In case of growth above 920.0, you can add to the longs.

Fall scenario: we will not close the shorts. If the market hits the stop at 870.0, then so be it.

Gasoil recommendations:

Purchase: no. Who is in position from 800.0 move the stop to 810.0. Target: 1100.0.

Sale: no. Who is in position from 900.0, keep the stop at 870.0. Target: 670.0.

Support — 821.50. Resistance is 948.50.

Natural Gas. CME Group

Growth scenario: we are considering the April futures, the expiration date is March 29. Let’s continue to keep the previously opened long. The move to the 3.500 area looks natural after a long fall.

Fall scenario: if the market rises to the level of 4.100, then it will be possible to talk about sales.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.200 move the stop to 2.330. Target: 3.480.

Sale: think when approaching 4.100.

Support — 2.741. Resistance — 4.115.

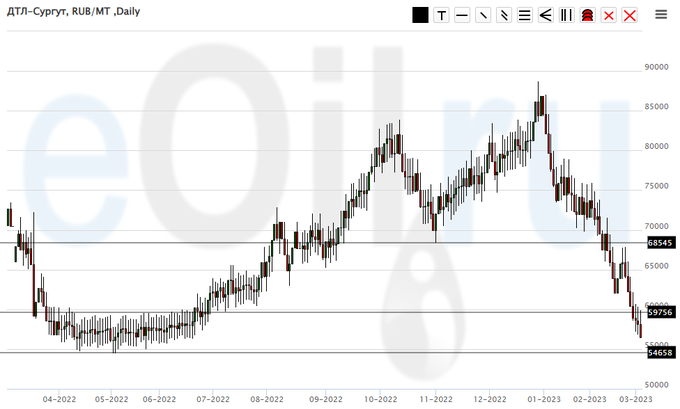

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: we are down to 56000. A rapid decline suggests a strong rebound. The current area will be interesting to enter long after the appearance of one long daily green candle.

Fall scenario: we will continue to recommend unloading your sell positions. Here you can leave only 20% of the total previously opened volume. Don’t be greedy, take profits.

Diesel market recommendations:

Purchase: now. Stop: 53000. Target: 67000.

Sale: no. Those who are in positions between 84000 and 74000, move the stop to 59000. Target: 55000 rubles per ton. At current levels, you can close another 20% of the position. Thus, only 20% of the original sales should remain.

Support — 54658. Resistance — 59756.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we could not go above 5000. Let’s take a pause in trading for this week, after which we may resume buying.

Fall scenario: we will continue to refuse sales. Prices are extremely low.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support — 78. Resistance — 4805.

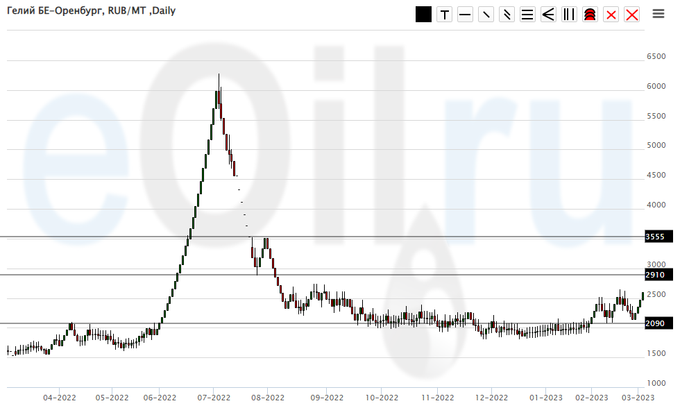

Helium (Orenburg), ETP eOil.ru

Growth scenario: The market has once again confirmed that the 2000 level is a strong support. We will continue to hold longs for a move to the level of 3000.

Fall scenario: nothing has changed for sellers in a week. When approaching the level of 3000, you can sell if a red daily candle appears.

Recommendations for the helium market:

Purchase: no. Those who are in positions from 1800, 1900 and 2000, keep the stop at 1900. Target: 2750 (3000) rubles per cubic meter.

Sale: when approaching 3000. Stop: 3200. Target: 2100.

Support — 2090. Resistance — 2910.

Wheat No. 2 Soft Red. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We will buy when approaching the level of 670.0. It is unlikely that the market will bounce up from it very high, but we have the right to count on a move from 670.0 to 770.0.

Fall scenario: sales are possible if prices return to the 770.0 area. Moreover, a return upwards should occur before touching the level of 670.0, only under this condition it makes sense to sell.

Recommendations for the wheat market:

Purchase: on touch 670.0. Stop: 650.0. Target: 770.0.

Sale: on the rise to 770.0. Stop: 790.0. Target: 670.0 cents per bushel.

Support — 670.2. Resistance is 721.0.

Growth scenario: consider the May futures, the expiration date is May 12. It is possible that next week the bulls will try to lift the market, but they are unlikely to be able to go above the 665.0 area. In our opinion, corn remains very expensive at the moment.

Fall scenario: continue to hold shorts. As long as the market is below 680.0, sellers have nothing to fear.

Recommendations for the corn market:

Purchase: no.

Sale: no. Who is in position from 688.0, move the stop to 683.0. Target: 580.0 (550.0) cents per bushel.

Support — 598.6. Resistance — 648.4.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. Most likely, sellers will continue to increase pressure on the market. We don’t buy.

Fall scenario: we see that the market is testing the previously broken support line from below. You can increase sales.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1547.0. Target: 1000.0. Who is in position from 1540.0, keep the stop at 1547.0. Target: 1000.0 cents per bushel.

Support — 1472.4. Resistance — 1549.2.

Growth scenario: we need levels 1790 and 1730 to buy. We consider the current upward reversal as false.

Fall scenario: we will continue to hold the short from 1920 with the target at 1790. It makes sense to leave part of the position to work out the fall to the level of 1730.

Recommendations for the gold market:

Purchase: think when approaching 1790.

Sale: no. Who is in position from 1920, keep the stop at 1890. Target: 1790 (1730) dollars per troy ounce.

Support — 1788. Resistance — 1910.

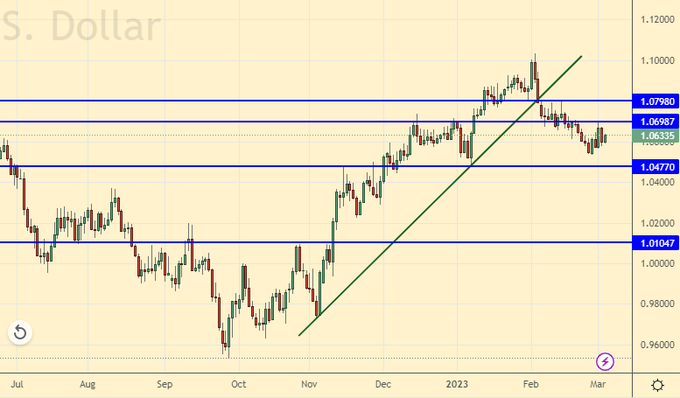

EUR/USD

Growth scenario: the euro is struggling with the dollar, but most likely nothing will come of the European. We will continue to decline. For purchases, we need a level of 1.0480, or even better, 1.0100.

Fall scenario: we continue to hold shorts in the expectation of a fall to 1.0480. The move to 1.0100 will also continue to be considered as very probable.

Recommendations for the EUR/USD pair:

Purchase: think when approaching 1.0480. From 1.0100 it is obligatory to buy.

Sale: no. Who is in position from 1.0690, keep the stop at 1.0830. Target: 1.0480 (1.0120).

Support — 1.0477. Resistance is 1.0698.

USD/RUB

Growth scenario: according to the results of trading last week, there are still chances for a fall to 72.00. Note that if we go above 76.70, the market will very quickly get to 80.00.

Fall scenario: you can sell at current levels. Last week, it was not possible to roll back by any significant amount. If there is no down move next week, then the overbought market will disappear and the market will be ready to rise again.

Recommendations for the dollar/ruble pair:

Purchase: think when approaching 72.00. Stop: 71.00 Target: 88.00.

Sale: now. Stop: 76.70. Target: 72.00 (65.50). Who is in position from 75.80, keep the stop at 76.70. Target: 72.00 (65.50).

Support — 72.92. Resistance — 83.39.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. We continue to remain in the falling channel. While we are below the level of 100,000, it makes no sense to buy. And even if we rise above this level, it is still worth thinking ten times before taking Russian securities.

Fall scenario: great selling position. We continue to assume that if the market goes below 90000, then we will have a quick fall to the level of 80000, possibly 75000. After falling below 90000, we can add to the shorts.

Recommendations for the RTS index:

Purchase: think after rising above the 100000 level.

Sale: now. Stop: 101000. Target: 80000 (50000, then 20000) points. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101000. Target: 80000 (50000, then 20000) points.

Support — 91100. Resistance — 97970.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.