Price forecast from 5 to 9 of April 2021

-

Energy market:

The OPEC meeting was very pragmatic. It was announced that production in May and June will increase by 350 thousand barrels, and production in July will increase by 450 thousand barrels per day.

Considering that production in the United States is growing by 100 thousand barrels per week, and drilling activity is only going up, it can be assumed that OPEC at the end of April at its next meeting may revise its own plans towards tightening.

Business in Europe does not want to improve because of the coronavirus. France went into strict quarantine for a month. Germany is also under attack, to the extent that Merkel has to repent publicly. There is a serious risk that we will get the same scenario in the oil market as a year ago, albeit with a slight shift forward by a couple of months, since the demand for fuel will remain under pressure.

If in the current conditions oil quotes continue to rise, it will be difficult to explain. Yes, in the United States, the situation on the labor market has improved, unemployment has dropped from 6.2 to 6.0 percent, but the American fuse may not be enough for everyone.

Grain market:

«And I shouldn’t have done that because I wanted to give in to my vice president, who’s smarter than me,» incumbent US President Joe Biden during a business trip. I would like to add that we still grow a lot of corn. And in general, everything is cool, since the country is in good hands thanks to the brain of Kamala Harris. Will he complete this year, that is the question.

The acreage in the United States for wheat and corn, albeit insignificantly, in the region of 1 percent, but still increased this year. Against the background of the release of this information, speculators tried to organize the breakdown of stop orders, pushing the quotes up, and in part they succeeded. The next day we saw a deep retracement, and then the crowd went to rest as Good Friday arrived.

Today is Catholic Easter, congratulations!

The grain market is likely to lose 8-10% by early May, but hardly more, as the virus continues to put actual and psychological pressure on governments. Let’s take the same Turkey, one of the largest importers of agricultural products. Quarantine measures have been reinforced there again and there is no end in sight to this struggle. In conditions of uncertainty, importers will buy grains and oilseeds at any price.

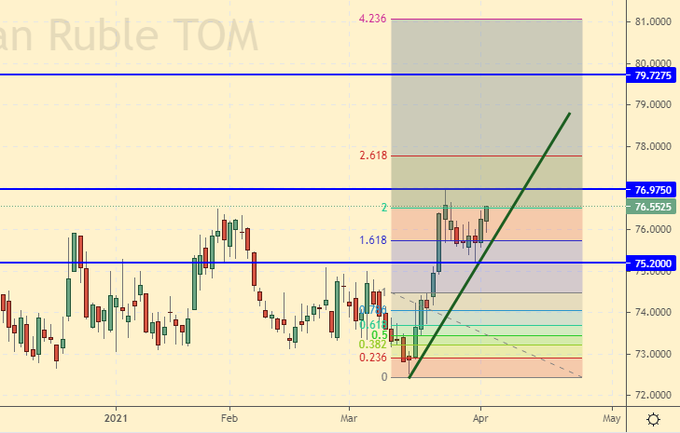

USD/RUB:

The ruble will have a hard time next week. It is unlikely that any breakthrough is possible in the current negotiations on Donbass, and if so, then the parties will enter the next summer in a state of uncertainty. In case of aggravation of the situation on the contact line, the Russian currency will go to 80.00.

Falling oil may also become negative for the Russian currency, but there are options here, since the drop does not look obvious at the moment, although it remains a more likely option than growth.

We will wait for April GDP statistics for the first quarter with some concern. If the numbers are close to zero, the ruble will fall.

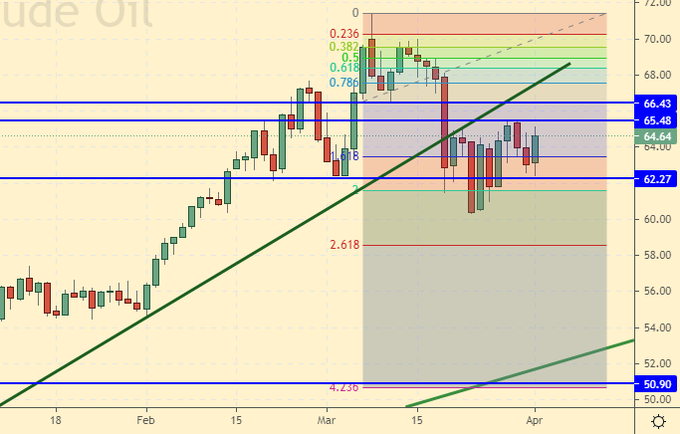

Growth scenario: April futures, expiration date April 30. For now, we continue to believe that a fall is the most likely scenario. We do not buy.

Falling scenario: short from current levels is very interesting. However, it is worth waiting for the US market to open on Monday evening.

Recommendation:

Purchase: no.

Sale: now. Stop: 66.20. Target: 51.00. Those who are in positions between 64.00 and 63.00, move the stop to 66.20. Target: 51.00.

Support — 62.27. Resistance — 65.48.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 13 units to 337 units.

US commercial oil reserves fell by -0.876 to 501.835 million barrels. Gasoline inventories fell -1.735 to 230.544 million barrels. Distillate stocks rose by 2,542 to 144,095 million barrels. Inventories at the Cushing storage facility rose 0.782 to 47.057 million barrels.

Oil production increased by 0.1 to 11.1 million barrels per day. Oil imports rose 0.523 to 6.145 million barrels per day. Oil exports rose 0.693 to 3.174 million barrels per day. Thus, net oil imports fell by -0.17 to 2.971 million barrels per day. Refining increased by 2.3 to 83.9 percent.

Gasoline demand rose 0.275 to 8.891 million barrels per day. Gasoline production rose 0.762 to 9.339 million barrels per day. Gasoline imports fell by -0.32 to 0.619 million barrels per day. Gasoline exports rose 0.108 to 0.541 million barrels per day.

Distillate demand rose 0.521 to 4.113 million barrels. Distillate production rose 0.137 to 4.738 million barrels. Distillate imports fell by -0.223 to 0.441 million barrels. Distillate exports fell by -0.426 to 0.703 million barrels per day.

The demand for petroleum products increased by 1.611 to 20.313 million barrels. Production of petroleum products increased by 1.064 to 20.738146 million barrels. Imports of petroleum products fell by -0.465 to 2.361 million barrels. Exports of petroleum products fell by -0.968 to 4.254 million barrels per day.

Propane demand rose by 0.491 to 1.676 million barrels. Propane production rose 0.061 to 2.369 million barrels. Propane imports fell by -0.08 to 0.148 million barrels. Propane exports fell by -0.187 to 1.13 million barrels per day.

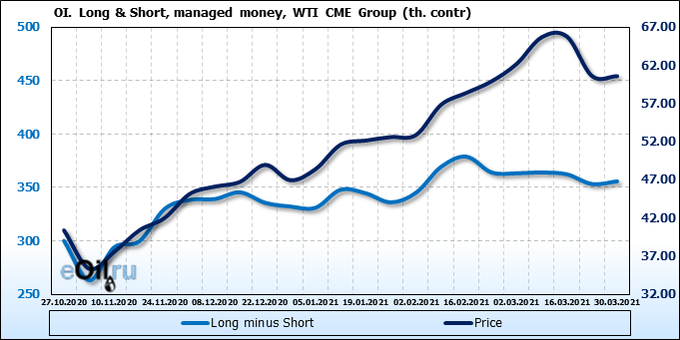

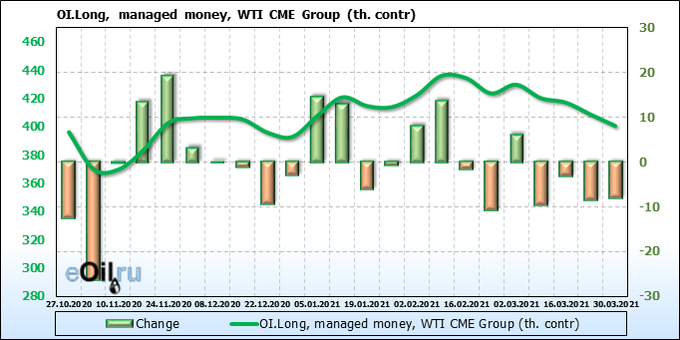

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We see an outflow of money from speculators before the OPEC meeting. However, the most interesting thing is that after the meeting there was no clarification on the market.

Growth scenario: May futures, the expiration date is April 20. We continue to believe that the risk of a failure to 46.00 remains. Only after the growth above 65.00 will we reconsider our approaches.

Falling scenario: sell here. We can try to go above 63.00, but this is unlikely to succeed. We look down.

Recommendation:

Purchase: no.

Sale: now and on the way to 63.00. Stop: 66.60. Target: 46.00. Anyone in the position from 61.00, move the stop to 66.60. Target: 46.00.

Support — 55.89. Resistance — 63.23.

Gas-Oil. ICE

Growth scenario: we consider the April futures, the expiration date is April 12th. Let’s continue to wait for the market to fall. We do not buy.

Falling scenario: the current levels are not bad for entering a short. We can get to 530.0, but we’re unlikely to go higher.

Recommendation:

Purchase: no.

Sale: now and up to 536.0. Stop: 543.0. Target: 410.0. Whoever is in positions between 520.0 and 515.0, keep the stop at 543.0. Target: 410.0.

Support — 470.25. Resistance — 530.00.

Natural Gas. CME Group

Growth scenario: May futures, expiration date April 28. We will buy. Against the background of increased drilling activity in the United States, we are unlikely to face a gas shortage, but fear after the last winter will support demand, primarily in Europe.

Falling scenario: do not sell. The prices are low.

Recommendation:

Purchase: now. Stop: 2.480. Target: 3.615. Whoever is in positions between 2.52 and 2.60, keep the stop at 2.48. Target: 3.615.

Sale: no.

Support — 2.520. Resistance — 2.685.

Wheat No. 2 Soft Red. CME Group

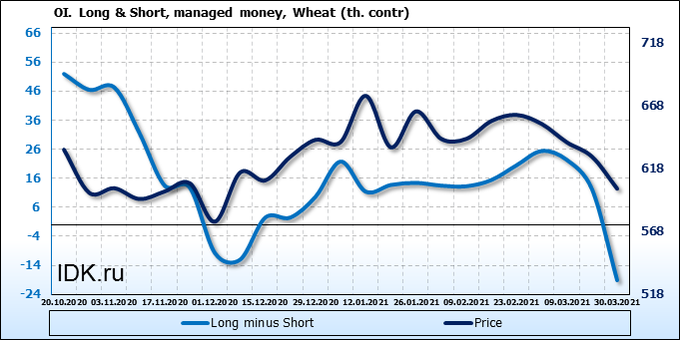

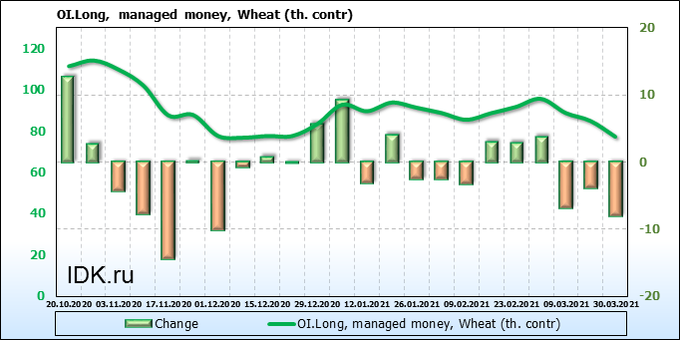

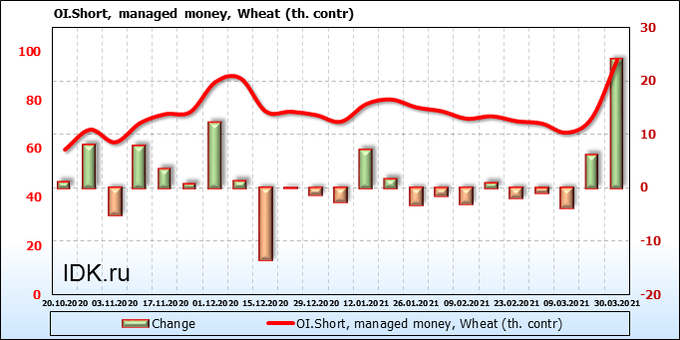

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Sellers have come to the market. The upward blow on Wednesday was most likely aimed at knocking out some of the bears from the position, but it seems to have succeeded far from 100%. The market continues to look down.

Growth scenario: May futures, expiration date May 14. We will refrain from shopping. You can get lower levels to enter long.

Falling scenario: stop at 633.0 survived. And good. You can build up the short counting on the continuation of the fall.

Recommendation:

Purchase: not yet.

Sale: no. Whoever is in the position from 660.0, keep the stop at 633.0. Target: 580.0 (560.0).

Support — 579.2. Resistance — 630.6.

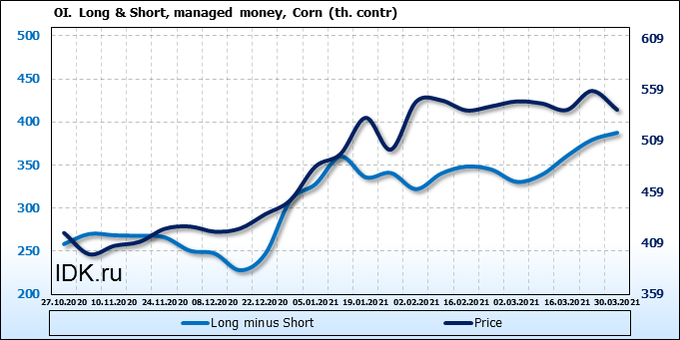

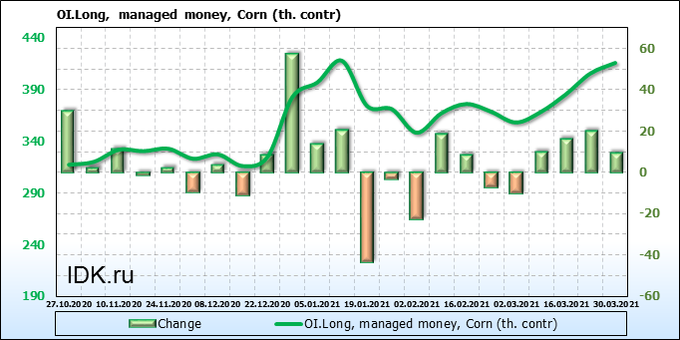

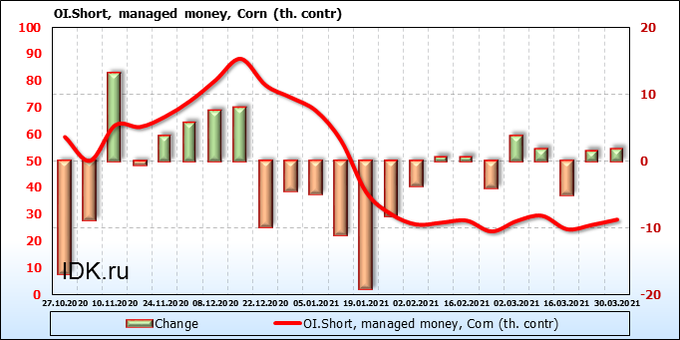

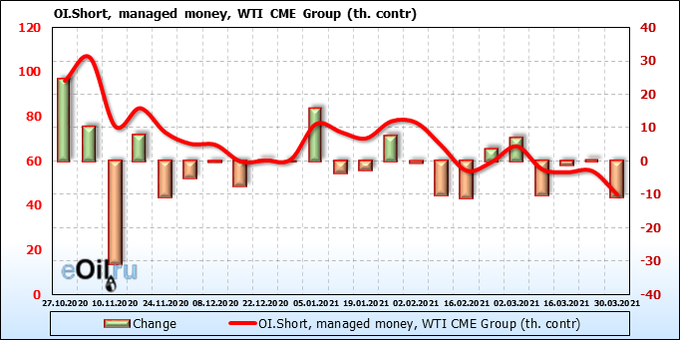

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

A small number of buyers and sellers entered the market at the same time. There is a feeling of heaviness in the minds of the bulls. Indeed, prices are high and there is no point in buying at current levels.

Growth scenario: May futures, expiration date May 14. Let’s leave the purchases of the last week, we won’t open new positions.

Falling scenario: when approaching 605.0, it is obligatory to sell. Corn will complete the fifth wave of impulse and turn down.

Recommendation:

Purchase: no.

Sale: on touch 604.0. Stop: 616.0. Target: 532.0.

Support — 534.4. Resistance — 585.0.

Soybeans No. 1. CME Group

Growth scenario: May futures, expiration date May 14. Let’s get back to the reasoning about buying after the growth above 1470.0. There is a chance that soybeans will reach 1720.0.

Falling scenario: after sharp movements you don’t want to sell. Let’s go short only after falling below 1380.0.

Recommendation:

Purchase: think after rising above 1470.0. Target: 1720.0.

Sale: after falling below 1380.0. Stop: 1436.0. Target: 1180.0.

Support — 1390.4. Resistance — 1459.4.

Sugar 11 white, ICE

Growth scenario: May futures, the expiration date is April 30. We approached a significant support line. There will clearly be a struggle here, and we think to take part in it. Can buy.

Falling scenario: the short from 18.20 continues to be the main idea. We are waiting for the arrival of prices to this level.

Recommendation:

Purchase: now. Stop: 14.40. Target: 18.20.

Sale: only when approaching the area at 18.20. Stop: 18.60. Target: 16.60.

Support — 14.58. Resistance — 16.58.

Сoffee С, ICE

Growth scenario: May futures, the expiration date is May 18. Rested at 120.00. Let’s wait for the situation to be clarified. Be sure to buy only after falling to 115.00.

Falling scenario: if you went short on the breakout of 125.00, then move your stop to 128.00. We do not open new positions.

Recommendation:

Purchase: on touch 115.20. Stop: 113.80. Target: 157.00.

Sale: no.

Support — 120.60. Resistance — 126.30.

Gold. CME Group

Growth scenario: after the day closes above 1760, we will buy. Not earlier.

Falling scenario: we do not open new sell positions. We regard the rollback upward from 1680 as unconvincing for now.

Recommendations:

Purchase: after the day’s close above 1760. Stop: 1724. Target: 1850.

Sale: no. Anyone in the position between 1745 and 1735, keep the stop at 1752. Target: 1600.

Support — 1698. Resistance — 1757.

EUR/USD

Growth scenario: buying from 1.1610 is possible. We do not enter the market until this level.

Falling scenario: everything is fine, prices are inside the falling channel. We continue to hold the shorts. Coronavirus puts pressure on the euro. If the EU does not show GDP growth in the first quarter, then the pair will go to 1.1000 in the future. Recommendations:

Purchase: on touch 1.1610. Stop: 1.1570. Target: 1.1820.

Sale: no. Those who are in positions between 1.2050 and 1.1950, move the stop to 1.1870. Target: 1.1610 (revised).

Support — 1.1592. Resistance — 1.1839.

USD/RUB

Growth scenario: move at 74.30 is still possible, but its probability is low. If the market rises above 77.00 — add to longs.

Falling scenario: short for the ruble? Now or never. Or wait? If we go below 76.00, we can sell with a target at 74.30. However, the risk in such a trade should be taken as only 1/3 of your standard value. We will not explicitly recommend the shorts.

Purchase: on a rollback to 75.00 and below. Stop: 74.10. Target: 80.00. Whoever is in the position from 75.10, keep the stop at 74.10. Target: 80.00.

Sale: no.

Support — 75.20. Resistance — 76.97.

RTSI

Growth scenario: only growth above 147,000 will make us speculate cautiously about the possibility of moving to 160,000. We keep old longs, do not open new ones.

Falling scenario: the short from 149,000 remains the main idea. If prices come to this level, enter the sale with the prospects of a move to at least 120,000, and a maximum of 100,000. Recommendations:

Purchase: no. Who is in position from 143000, move the stop to 141000. Target: 160000.

Sale: after falling below 141000. Stop: 146000. Target: 100000. Or, when approaching 149000. Stop: 152000. Target: 120000 (100000). Consider the risks!

Support — 142840. Resistance — 146900.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.