05 August 2024, 12:03

Price forecast from 5 to 9 August 2024

-

Energy market:

After an Algerian man beat an Italian woman’s face in the ring, and they fought not for food but just for fun, we can safely assume that other competitions will soon appear. For example, someone who identifies himself as a hound will participate in a dog race for a mechanical hare. With a number on board (on the side), with tongue on the shoulder, on the whistle, everything as it should be. Unlikely to win, but the broadcast will attract attention.

For equal chances and objective judging. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

«Well, no…», said the sellers. We have gone below 80.00 in oil, which may entail verbal interventions from OPEC representatives (one would hope). That would be the logical thing to assume. But these wise men held a technical committee on August 2nd and gave birth to the idea that they might revise production quotas in October. And what was wrong with oil at 80.00?! And it did not grow much against the background of the deficit of 1.6 million barrels per day, which you mentioned. We have squeezed the cash flow, not our necks. We don’t need to go to the circus.

On Friday, the data on new jobs in the US was released, which the country started to create noticeably less, which brought the market down and here we are at 76.00 on Brent. China started sneezing in the background. Yes, it can lead to a fall. And it will be, if the esteemed Prince Salman will not be distracted from important matters and will not pay attention to what is happening.

Grain market:

The forecast for the grain harvest in Russia has been maintained at 132 million tons. At the beginning of August, 64 million tons have been harvested, 40% of the area has been threshed. At the same time, fears about the weather so far, on a national scale, are unfounded. Given the interest in Russian wheat, it should be expected that it will be offered for sale both for foreign currency and rubles, in cases where sales for foreign currency will be impossible due to sanctions pressure.

Rains in China forced local farmers to abandon grain storage. However, the government intervened and bought up the surplus to support prices. China harvested 138 million tons of wheat, which is 2.7% higher than last year. At the same time, imports did not fall, which amounted to 9.3 million tons. There are good reasons to assume that the country is expanding its strategic reserve at a record pace, and this applies not only to food, but also to raw materials, expecting harsher everyday life.

Kazakhstan has closed its borders to Russian wheat from August 1 to January 1, 2025. The Kazakhs plan to harvest as much as 25 million tons of grain, compared to 16.6 million tons last year. They can take about 20 million tons of their own wheat.

USD/RUB:

The Fed meeting was held without surprises. The rate was left at the same level of 5.5%, note that after the release of statistics on Friday, the risk of a rate cut in September has increased.

The Americans shifted from August 13 to October 12 the ban on communication with the Moscow stock exchange for foreign investors, which may create preconditions for renewed interest in the Chinese yuan and reduce the rate of strengthening of the Russian ruble.

The paradox is that the beads that the Chinese send to New York to the ladies and effeminate men there are made of Russian raw materials, partially or completely. So Washington itself is not interested in an abrupt halt to trade between Moscow and Beijing.

After the ban on the publication of currency trading volumes, it is worth noting their current complete opacity, however, taking into account external factors, such a decision of the Central Bank is not something out of the ordinary. Let’s just believe the Central Bank that today the ruble-dollar exchange rate is like this. That’s all.

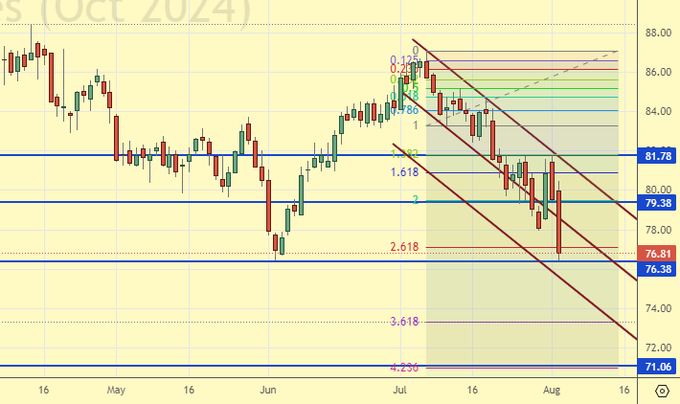

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers decreased by 73.7 thousand contracts. The change is significant. Buyers significantly reduced positions. Sellers have been entering the market. Buyers may be losing control.

Growth scenario: we consider the August futures, expiration date August 30. The data on the U.S. economy lowered the market. Do not buy.

Downside scenario: a move below 78.00 is a surprise, which is not clear yet how to interpret. Out of the market.

Recommendations for the Brent oil market:

Buy: no.

Sale: no.

Support — 76.38. Resistance — 79.38.

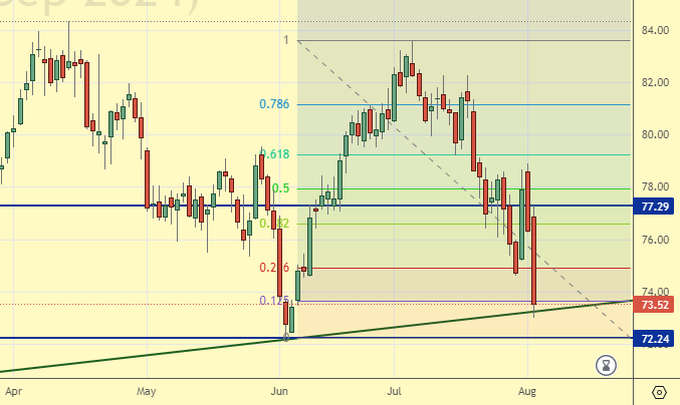

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 482.

U.S. commercial oil inventories fell by -3.436 to 433.049 million barrels, with -1.6 million barrels forecast. Gasoline inventories fell by -3.665 to 223.757 million barrels. Distillate stocks rose 1.534 to 126.847 million barrels. Cushing storage stocks fell by -1.106 to 29.85 million barrels.

Oil production remained unchanged at 13.3 million barrels per day. Oil imports increased by 0.082 to 6.953 million barrels per day. Oil exports rose by 0.733 to 4.919 million barrels per day. Thus, net oil imports fell by -0.651 to 2.034 million barrels per day. Oil refining fell -1.5 to 90.1 percent.

Gasoline demand fell -0.206 to 9.25 million barrels per day. Gasoline production fell -0.205 to 10.008 million barrels per day. Gasoline imports rose 0.139 to 0.917 million barrels per day. Gasoline exports rose 0.092 to 1.007 million barrels per day.

Distillate demand fell by -0.136 to 3.725 million barrels. Distillate production rose by 0.043 to 4.98 million barrels. Distillate imports rose 0.028 to 0.14 million barrels. Distillate exports fell -0.406 to 1.175 million barrels per day.

Demand for petroleum products fell by -0.309 to 20.724 million barrels. Petroleum products production increased by 0.313 to 22.654 million barrels. Petroleum product imports rose 0.255 to 2.231 million barrels. Exports of refined products increased by 0.148 to 6.585 million barrels per day.

Propane demand fell by -0.302 to 0.716 million barrels. Propane production rose 0.039 to 2.668 million barrels. Propane imports rose 0.024 to 0.108 million barrels. Propane exports rose 0.21 to 1.641 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 25.8 th. contracts. Buyers were fleeing. There were no sellers. The bulls are maintaining control.

Growth scenario: we consider September futures, expiration date August 20. Unexpected development. We keep falling. Out of the market.

Downside scenario: took only half of what we could have, but it would have been a mistake not to move the stop up last week.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 72.24. Resistance — 77.29.

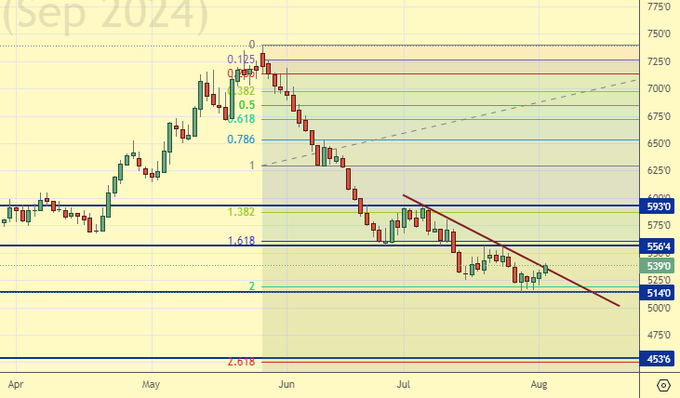

Gas-Oil. ICE

Growth scenario: we consider the August futures, expiration date August 12. Given the current aggression, we refuse to buy.

Downside scenario: keep shorting. A move below 700.0 cannot be ruled out.

Gasoil Recommendations:

Buy: no.

Sell: No. Those in position from 807.50, move your stop to 760.00. Target: 650.00! We can close 10% of the position.

Support — 701.75. Resistance — 754.00.

Natural Gas. CME Group

Growth scenario: we consider September futures, expiration date August 28. We continue to refuse to buy. The US is producing more oil, which means more gas is coming.

Downside scenario: refrain from selling.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.500. Resistance — 2.054.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no. Who is in position from 65000, keep stop at 64000. Target: 100000!

Sale: no.

Support — 66523. Resistance — 80098.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: reached the target at 35000. We fixed the profit. For new purchases we need a pullback to 20000.

Downside scenario: despite reaching the level of 35000 we will not sell.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 19297. Resistance — 38516.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — 1516.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 3.2 th. contracts. Buyers and sellers entered the market in small volumes. Bears keep control.

Growth scenario: we consider the September futures, expiration date September 13. We want the mark of 455.0 for purchases. The current upside is unlikely to lead to a market reversal. Until September 10, sellers will keep pushing.

Downside scenario: shorting from 523.0 after a week looks very silly. The falling dollar and the crisis in the Middle East may support prices. Nevertheless, we remain in sales.

Recommendations for the wheat market:

Buy: at 455.0. Stop: 425.0. Target: 650.0!

Sell: no. Those in position from 523.4, keep stop at 557.0. Target: 455.0.

Support — 514.0. Resistance — 556.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 33.6 th. contracts. There were no buyers. Sellers were leaving the market. Bears retain control.

Growth scenario: we consider the September futures, expiration date September 13. The market continues to look heavy. We expect the decline to continue.

Downside scenario: we will keep shorting. If the market stays under 390.0 next week, it will create strong preconditions for a move to the 335.0 area.

Recommendations for the corn market:

Buy: when approaching 335.0. Stop: 315.0. Target: 440.0.

Sell: no. Those in position from 394.4, keep stop at 412.0. Target: 335.0.

Support — 369.4. Resistance — 390.4.

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. Given the market situation, we’ll buy. But the stop is close by. We note that the market is able to go deeper on the background of the new harvest.

Downside scenario: you can keep shorts.

Recommendations for the soybean market:

Buy: now (1018.0). Stop: 994.0. Target: 1150.0. Or at touching 880.0. Stop: 850.0. Target: 1090.0.

Sell: no. Those in position from 1042.0, move your stop to 1082.0. Target: 880.0!

Support — 876.0. Resistance — 1031.0.

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2180 will be interesting.

Downside scenario: it may not be the best decision to enter the same river three times in a row, but we will sell again if the market falls below 2440 or if it approaches 2500.

Gold Market Recommendations:

Buy: when approaching 2180. Stop: 2140. Target: 3000?!

Sell: after a move below 2440. Stop: 2475. Target: 2180. Consider the risks! Or when approaching 2500. Stop: 2530. Target: 2180 (1955).

Support — 2396. Resistance — 2522.

EUR/USD

Growth scenario: we cannot miss this growth. Buy.

Downside scenario: bad data on the labor market provoked the euro growth. We do not open new positions down, we keep the old ones. It is possible that this outburst will turn out to be false. Things are not better in Europe.

Recommendations on euro/dollar pair:

Buy: now (1.0908), also when approaching 1.0840. Stop: 1.0770. Count the risks!

Sell: no. Who is in position from 1.0854, keep your stop at 1.0957. Target: 1.0000.

Support — 1.0874. Resistance — 1.1080.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. Taking into account the shift on sanctions against Moscow Exchange to October 12, it is possible to buy. Demand for yuan may grow a bit. Then, the tax period is over.

Downside scenario: we are sliding down, no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: Now (85976). Stop: 84900. Target: 100000.

Sale: no.

Support — 84156. Resistance — 87586.

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: we will keep shorts. The ruble may weaken due to the shift of sanctions to the Moscow Exchange in October, while the downside potential of Russian securities is not exhausted.

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in the position from 115200, move the stop to 111600. Target: 98000.

Support — 107570. Resistance — 111380.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.