04 March 2024, 10:24

Price forecast from 4 to 9 March 2024

-

Energy market:

In response to the sanctions, our entire submarine fleet will go to sea to ensure security and will determine the cost of tanker passage through all the straits in exchange for guarantees of non-aggression by some Hussites. The superpowers cannot yet do anything about them.

They won’t do it anymore. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

OPEC’s efforts to curb supply will continue this year. The sheikhs like oil at 80 dollars, but at this level, production will grow in countries outside the cartel. And in case of growth to 120, offshore projects will make sense again. It will be enough to sell three-year or even farther futures at these levels and a new platform can be ordered. Therefore, anything above 80.00 is no longer good for the cartel.

We now determine for ourselves how much oil costs in dollars, if only to calculate the taxable base in January. 65 dollars, so 65 dollars for Urals. And we ourselves determine the discount from Brent, in this case it is 15 dollars.

The current rise in oil prices does not look obligatory, but we have to believe our gases. If things work out well for the bulls, Brent will be able to approach the 96.00 level.

Grain market:

Ukraine and Poland still cannot resolve the issue of grain transit. The transportation collapse on the border continues. At the same time, there are discussions about banning any commodity exchange at all. It will be painful for both sides, but apparently Polish farmers have skillfully grabbed Donald Tusk for something and now he has to fulfill his main role as a politician — to give people the opportunity to live and earn.

It is very likely that wheat exports from Russia in February will amount to 3.8 mln tons, which will be a record for this month. We see that the problems with shipments in January are gradually leveling off. Most likely, exports will continue in maximum possible volumes. Demand for grain remains at a high level, but prices are not particularly happy, remaining around $225 per ton FOB. The total volume of wheat exports from Russia in the season 23/24 is estimated at 51 million tons.

On the Chicago exchange, wheat and corn prices continue to remain in a downward trend, although it should be noted that there are hints of a reversal. The medium-term problem for bulls is that the forecast in May for gross grain harvest is likely to be favorable, which will mean abundance already in August. Only strong political or natural disasters can raise the price of grain on the exchange.

USD/RUB:

The 16% rate is rumored to really piss off the heads of manufacturing companies who are not willing to borrow at 20%. This may lead to Nabiullina’s ouster, but such a move will not change anything. And the new Central Bank chair will have to fight inflation, and that can only be done by raising the interest rate. As long as the SWO is going on, it will be very difficult to stop the ruble devaluation.

I have to write here that in case of continuation of the protracted form of the conflict in Ukraine, taking into account the possible extension of the zone of hostilities to Transnistria, the Russian currency will remain under pressure. Any strengthening of the ruble against the dollar at the moment will be artificial. The level of 90.00 seems to be optimal now.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 22.4 th. contracts. There was a small inflow of sellers and a small outflow of buyers. The bulls retain the advantage.

Growth scenario: we consider March futures, expiration date March 28. It’s a difficult situation. You can buy, but the stop is far from the entry point. Consider the risks.

Downside scenario: the bulls still managed to show something that made the sellers turn around and run away. Do not sell. At the same time, we note a large number of resistance levels.

Recommendations for the Brent oil market:

Buy: now (83.55). Stop: 81.40. Target: 90.45.

Sale: no.

Support — 81.49. Resistance — 86.84.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 3 units to 506.

U.S. commercial oil inventories rose by 4.199 to 447.163 million barrels, against a forecast of +3.1 million barrels. Gasoline inventories fell -2.832 to 244.205 million barrels. Distillate stocks fell -0.51 to 121.141 million barrels. Cushing storage stocks rose by 1.458 to 30.97 million barrels.

Oil production is unchanged at 13.3 million barrels per day. Oil imports fell by -0.269 to 6.385 million barrels per day. Oil exports fell by -0.237 to 4.728 million barrels per day. Thus, net oil imports fell by -0.032 to 1.657 million barrels per day. Oil refining rose by 0.9 to 81.5 percent.

Gasoline demand increased by 0.267 to 8.467 mln barrels per day. Gasoline production rose 0.39 to 9.419 million barrels per day. Gasoline imports fell -0.35 to 0.384 million barrels per day. Gasoline exports fell -0.156 to 0.752 million barrels per day.

Distillate demand fell by -0.404 to 3.536 million barrels. Distillate production rose by 0.118 to 4.289 million barrels. Distillate imports fell -0.133 to 0.112 million barrels. Distillate exports fell -0.112 to 0.937 million barrels per day.

Demand for petroleum products increased by 0.611 to 19.529 mln barrels. Petroleum products production rose by 0.733 to 20.94 million barrels. Petroleum product imports fell -0.888 to 1.367 million barrels. Exports of refined products fell -0.95 to 6.012 million barrels per day.

Propane demand increased by 0.406 to 1.436 mln barrels. Propane production rose 0.014 to 2.482 million barrels. Propane imports fell -0.022 to 0.125 million barrels. Propane exports rose -0.126 to 0.286 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 43.1 thousand contracts. Buyers sharply increased volume, sellers fled. The bulls stepped up their control.

Growth scenario: we consider April futures, expiration date March 20. This is an extremely uncomfortable situation for buying, but we cannot afford to miss the move to 95.00. Let’s enter long.

Downside scenario: we have to give up on sales. Take a break.

Recommendations for WTI crude oil:

Buy: now (79.97) and on a pullback to 77.00. Stop: 76.30. Target: 90.00. Count the risks!

Sale: no.

Support — 75.50. Resistance — 84.69.

Gas-Oil. ICE

Growth scenario: we consider the March futures, expiration date March 12. The situation for buyers is not too pleasant. Out of the market.

Downside scenario: you can sell. Stop near.

Gasoil Recommendations:

Buy: no.

Sell: Now (852.0). Stop: 867.0. Target: 760.0.

Support — 788.50. Resistance — 891.50.

Natural Gas. CME Group

Growth scenario: we switched to April futures, expiration date March 26. We continue to be in the falling channel. Out of the market.

Downside scenario: we took part of the move down earlier. Out of the market for now.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.591. Resistance — 2.099.

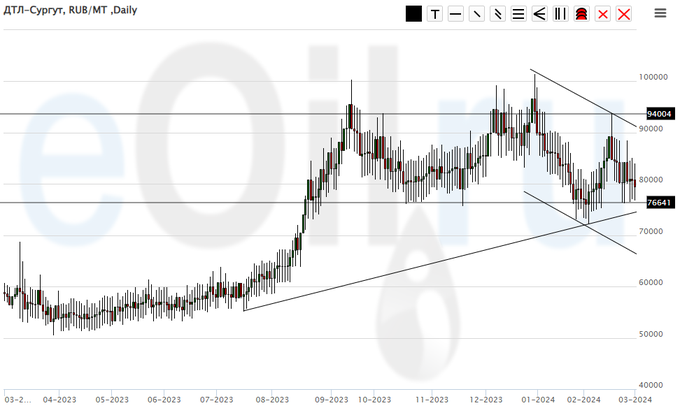

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Downside scenario: uncomfortable situation for speculation. Even if we fall below 70000, it is unlikely that this fall will continue, for example to 60000. Diesel is needed now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 76641. Resistance — 94004.

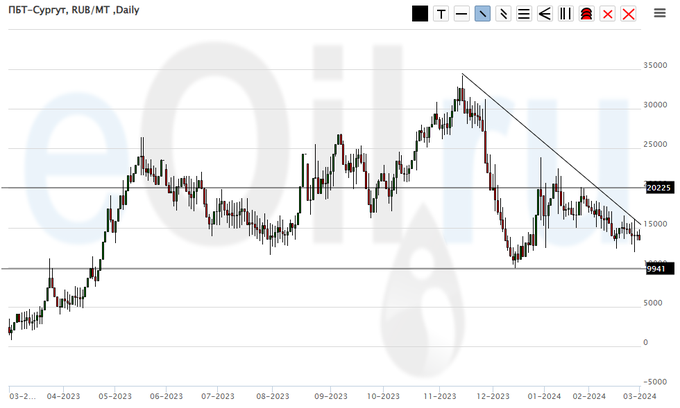

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to hold longing. Those who wish can buy at current levels. The market cannot break below 10000 for a couple of weeks, which is positive for the bulls.

Downside scenario: no interesting ideas for sales. Out of the market.

PBT Market Recommendations:

Buy: No. Who is in position from now 13000, keep stop at 11000. Target: 25000.

Sale: no.

Support — 9941. Resistance — 20255.

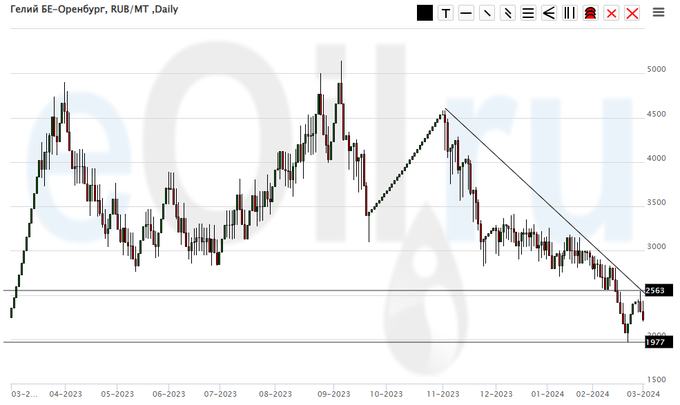

Helium (Orenburg), ETP eOil.ru

Growth scenario: we continue to wait patiently for growth. Our stop at 1900 is intact. It should be noted that in case prices continue to fall, we can increase aggression in purchases.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no. Who is in position from 2200 and 2100, keep stop at 1900. Target: 5000.

Sale: no.

Support is 1977. Resistance is 2563.

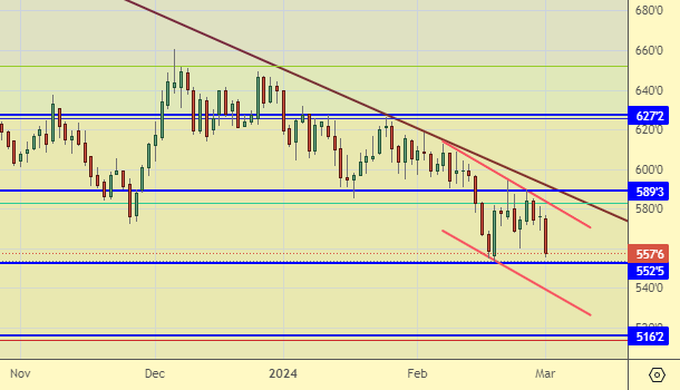

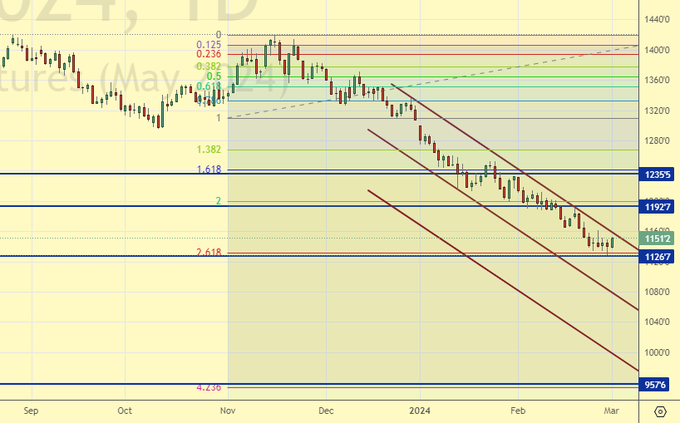

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 15.4 th. contracts. Sellers retreated, buyers entered the market. Bears are maintaining control.

Growth scenario: we consider the May futures, expiration date May 14. The bulls failed to show us anything. Most likely, new lows are waiting for us.

Downside scenario: the market continues to look down. The target at 516.0 looks natural.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sale: no.

Support — 552.5. Resistance — 589.3.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 40.8 th. contracts. Sellers fled in substantial volumes, buyers entered the market. Bears are maintaining control.

Growth scenario: we consider the May futures, expiration date May 14. The growth of quotations last week is a bit alarming, as we are waiting for lower levels. We will start buying from 370.0, if we are allowed to do it.

Downside scenario: lower than 408.0 cannot be ruled out. The level of 370.0 and even 350.0 still fit in the current development of events.

Recommendations for the corn market:

Buy: when approaching 370.0, add at 350.0 aggressively. Stop: 320.0. Target: 500.0. Consider the risks!!!

Sale: no.

Support — 408.6. Resistance — 432.2.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. We will continue to hold longs. We are unlikely to see a strong growth, but a slight rise to 1230 is possible.

Downside scenario: if we grow to 1230, it makes sense to look for selling opportunities. We are not selling yet.

Recommendations for the soybean market:

Buy: no. Who is in position from 1141.6, keep stop at 1110.0. Target: 1230.0.

Sale: not yet.

Support — 1126.7. Resistance — 1192.7.

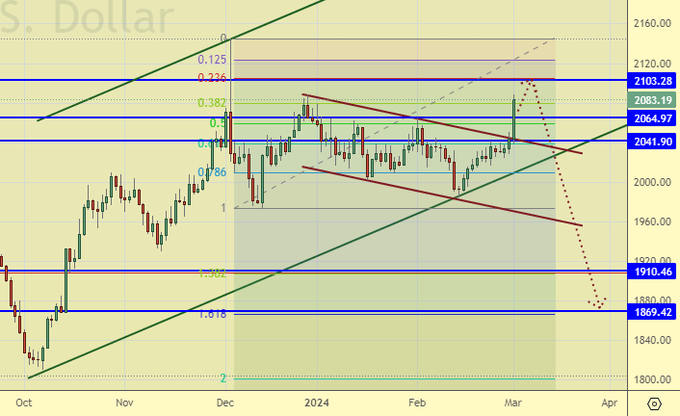

Growth scenario: and gold went up… A rise above 2100 will open the way to 2400 we will take this into account further.

Downside scenario: shorting from 2100, this is the last opportunity for sellers to prove something to the world. There are no other ideas.

Gold Market Recommendations:

Purchase: no.

Sell: on approach to 2100. Stop: 2140. Target: 1870?!

Support — 2041. Resistance — 2103.

EUR/USD

Growth scenario: keep longs. It looks very similar (wave theory) that we will continue to grow to 1.0925. Further is not clear yet.

Downside scenario: there are chances for a decline, but as long as we are above 1.0780 it is better not to look down.

Recommendations on euro/dollar pair:

Buy: no. Who is in position from 1.0722, keep stop at 1.0730. Target: 1.2000.

Sale: no.

Support — 1.0785. Resistance — 1.0925.

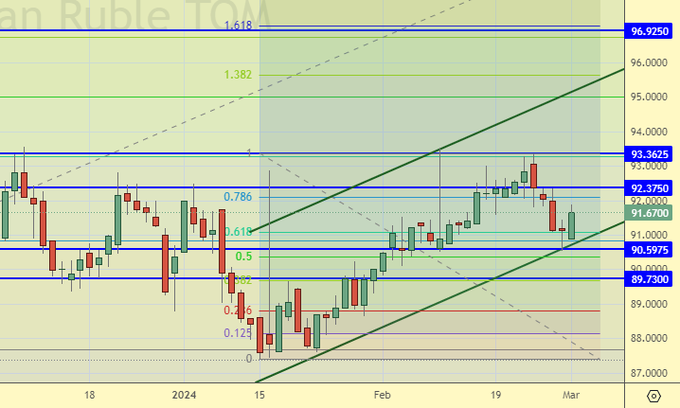

USD/RUB

Growth scenario: in case of growth above 93.00 we will resume buying. Out of the market for now.

Downside scenario: we would be happy to go short on the dollar if the domestic economic situation was softer. Out of the market for now.

Recommendations on dollar/ruble pair:

Buy: no.

Sale: no.

Support — 90.59. Resistance — 92.37.

RTSI

Growth scenario: we consider the March futures, expiration date March 21. We flew not only to 111000, but also to 113000. Further growth looks unnecessary. We need to cool down a bit after such feats.

Downside scenario: and we wanted 100,000 so badly, but no one is giving us that level yet. Outside the market. On hourly intervals you can look for selling opportunities from the current area.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 110810. Resistance — 113310.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.