30 May 2022, 12:23

Price forecast from 30 May to 3 of June 2022

-

Energy market:

If everyone consumed like Americans, then we would already need five planets like Earth. It’s good that not everyone on the planet is a US citizen.

Hello!

European attempts to ban imports of Russian oil cannot yet take full shape, but work is underway, and this scares the market, which is already looking at the level of $150.00 per barrel.

Russia is clearly having difficulty selling oil, which means that the deficit in the international market is growing and now it can be estimated at one million barrels per day. The Americans began to put pressure on the Arabs behind the scenes, and they are forced to make comments in the spirit of: «Yes, of course, we’ll see what we can do.»

The impudent representatives of the «golden billion» will not leave the exporters alone, because no one wants to switch to bicycles from multi-ton pickups. Meanwhile, a cyclist covers a distance of 160 kilometers in four hours, and this, mind you, is in the mountains, somewhere in Italy. So there are no physiological barriers to cycling to work. This will make a lot of people slimmer.

Reading our forecasts, you could make money on the euro / dollar pair by taking a move up from 1.0430 to 1.0730.

Grain market:

Drought events in Europe can lead to a drop in grain crops. Evidently, by the autumn the negotiability of the EU states will grow strongly. Rumor has it that in the West, many prepare to eat only twice a day.

The voluntary withdrawal of 4.6 million tons of fertilizer from Russia, which were shipped to Europe in one year, has already done German farmers a disservice. Yields in a number of regions may go below 40 centners per hectare, from the current 60, which will be not only an economic but also an image blow.

The May forecasts of both the USDA and IGC can be regarded as optimistic, as no one sees any reason why the gross harvest could fall below 750 million tons. And he can. Just because of the violation of the technology of cultivation of grain crops. It is possible that the June reports will be quite good, and in July and August there may be surprises.

USD/RUB:

Elvira Sakhipzadovna at an extraordinary meeting of the Bank of Russia lowered the rate by 3% to 11% per annum. At the same time, the ruble began to rapidly decline against the dollar, but we are unlikely to see the pair rise above the level of 71.00.

As long as Russia’s balance of payments is positive, and currently the surplus is estimated at $100 billion by the end of the year, the fall of the ruble is out of the question.

Even if the EU countries impose an embargo on the purchase of Russian oil, the Central Bank will be able to easily control the ruble exchange rate for several more months, since we now have an ocean of dollars.

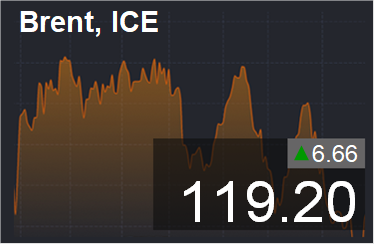

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 14,000 contracts. The number of bulls is gradually increasing. They are in complete control of the situation.

Growth scenario: we consider the June futures, the expiration date is June 30. Let’s continue to hold longs. In the case of a move above 125.00, a jerk to the 150.00 area may follow.

Falling scenario: we are not thinking about the fall yet. The market looks up aggressively. Recommendation:

Purchase: no. Who is in position from 112.00, move the stop to 111.00. Target: 125.00 (150.00).

Sale: not yet.

Support — 115.58. Resistance is 123.54.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 2 units to 574 units.

US commercial oil inventories fell by -1.019 to 419.801 million barrels, while the forecast was -0.737 million barrels. Inventories of gasoline fell -0.482 to 219.707 million barrels. Distillate inventories rose by 1.657 to 106.921 million barrels. Inventories at Cushing fell -1.061 to 24.778 million barrels.

Oil production has not changed and stands at 11.9 million barrels per day. Oil imports fell by -0.082 to 6.486 million barrels per day. Oil exports rose by 0.821 to 4.341 million barrels per day. Thus, net oil imports fell by -0.903 to 2.145 million barrels per day. Oil refining increased by 1.4 to 93.2 percent.

Gasoline demand fell by -0.229 to 8.798 million bpd. Gasoline production fell by -0.151 to 9.423 million barrels per day. Gasoline imports fell -0.029 to 0.847 million bpd. Gasoline exports fell -0.183 to 0.774 million bpd.

Demand for distillates rose by 0.051 to 3.867 million barrels. Distillate production increased by 0.267 to 5.147 million barrels. Distillate imports fell -0.034 to 0.08 million barrels. Exports of distillates rose by 0.122 to 1.124 million barrels per day.

Demand for petroleum products increased by 0.023 to 19.684 million barrels. Production of petroleum products increased by 0.396 to 21.346 million barrels. Imports of petroleum products increased by 0.009 to 2.004 million barrels. The export of oil products increased by 0.191 to 6.235 million barrels per day.

Propane demand fell -0.428 to 0.633 million barrels. Propane production increased by 0.123 to 2.452 million barrels. Propane imports fell -0.006 to 0.081 million barrels. Propane exports rose by 0.328 to 1.641 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 6.2 thousand contracts. In fact, we see that the sellers made a mistake, and this led to the closing of shorts and a price surge upwards.

Growth scenario: we are considering the July futures, the expiration date is June 21. We will keep longs open two weeks ago. We look up with optimism.

Falling scenario: we will continue to refrain from selling. Unless we go short from 150.00. Recommendation:

Purchase: no. Who is in position from 109.00, move the stop to 106.00. Target: 150.00.

Sale: not yet.

Support — 103.34. Resistance is 116.33.

Gas-Oil. ICE

Growth scenario: we consider the June futures, the expiration date is June 10. Oil may drag the market above 1250. The current levels for long entry are too high. Out of the market.

Falling scenario: a rollback is technically possible. When a red daily candle appears with a close below 1120.0, sell.

Recommendation:

Purchase: no.

Sale: when a red daily candle appears with a close below 1120.0, sell. Stop: 1170.0. Target: 800.0.

Support — 1123.50. Resistance is 1224.00.

Natural Gas. CME Group

Growth scenario: we are considering the July futures, the expiration date is June 28. We continue to refrain from shopping. Despite the rise in prices to the area of 9.500, we do not rush after the market. Waiting for cooling.

Falling scenario: we continue to believe that it would be interesting to enter short from 10.200. Sales from current levels are possible.

Recommendation:

Purchase: no.

Sale: when approaching 10.200. Stop: 11.200. Target: 7.500. Or now. Stop: 9.700. Target: 7.000.

Support — 7.627. Resistance is 9.440.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers has decreased by 6.7 thousand contracts. However, the bulls continue to control the market.

Growth scenario: we consider the July futures, the expiration date is July 14. We are in an ascending channel. We hold longs. You can go long from current levels.

Falling scenario: technically the chances of a correction are good, but the fundamentals are almost all bullish. From 1250.0 short is possible.

Recommendation:

Purchase: now. Stop: 1060.0. Target: 1400.0. Who is in position from 1060.0, keep the stop at 1080.0. Target: 1400.0.

Sale: when approaching 1250.0. Stop: 1280.0. Target: 850.0.

Support — 1114.2. Resistance is 1282.0.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers decreased by 44.9 thousand contracts. The bulls were frightened by the export of corn from Ukraine and partially lost ground.

Growth scenario: we consider the July futures, the expiration date is July 14. We continue to wait for prices to fall. We don’t buy.

Falling scenario: the short continues to be interesting. Selling pressure is intensifying. After falling below 750.0, you can add to previously opened positions.

Recommendation:

Purchase: not yet.

Sale: now. Stop: 806.0. Target: 700.0. Who is in position from 810.0, move the stop to 806.0. Target: 700.0 (600.0!).

Support — 753.0. Resistance — 809.6.

Soybeans No. 1. CME Group

Growth scenario: we consider the July futures, the expiration date is July 14. We’re going to 1800. Levels are high. Out of the market.

Falling scenario: if we get to 1800.0, then shorting is a must. We do not open shorts from current levels.

Recommendation:

Purchase: no.

Sale: when approaching 1800.0. Stop: 1830.0. Target: 1350.0.

Support — 1577.2. Resistance — 1802.2.

Sugar 11 white, ICE

Growth scenario: we are considering the July futures, the expiration date is June 30. We continue to draw price branches that should lead us to 21.60. Stronger growth is not visible yet. We hold longs.

Falling scenario: we continue to believe that shorts from 21.60 are possible. Selling from current levels looks premature.

Recommendation:

Purchase: no. Who is in position from 19.80, keep the stop at 19.00. Target: 21.60.

Sale: think when approaching 21.60.

Support — 19.27. Resistance is 20.50.

Сoffee С, ICE

Growth scenario: we are considering the July futures, the expiration date is July 19. Our perseverance is bearing fruit. We’re going up. Target 248.00. We hold longs.

Falling scenario: do not sell. When approaching the 250.0 area, you can go short.

Recommendation:

Purchase: no. Those in positions between 211.0 and 217.0, move the stop to 218.00. Target: 248.00.

Sale: no.

Support — 211.05. Resistance is 231.00.

Gold. CME Group

Growth scenario: another downward blow cannot be ruled out. We don’t buy.

Falling scenario: holding shorts. If there will be a blow up in 1890 it can be sold.

Recommendations:

Purchase: when approaching 1740. Stop: 1720. Target: 2300!

Sale: now. Stop: 1870. Target: 1730. Or when approaching 1890. Stop: 1920. Target: 1730.

Support — 1786. Resistance — 1869 (1894).

EUR/USD

Growth scenario: it makes sense to close longs at current prices. Growth to 1.1000 is possible, but it is unlikely to take place before the meetings of the ECB and the Fed (June 9 and 15, respectively).

Falling scenario: we will sell when we return in the region of 1.1000.

Recommendations:

Purchase: no. Close all positions.

Sale: think when approaching 1.1000.

Support — 1.0641. Resistance is 1.0801.

USD/RUB

Growth scenario: The market has risen above 65.00. According to our recommendations, you should have been drawn into the purchase. We hold longs.

Growth above 71.00 looks optional, but it will be possible in the event of an embargo from the EU on the purchase of Russian oil.

Falling scenario: we will not talk about shorts yet. Let’s see how the situation develops.

Recommendations:

Purchase: no. Who is in position from 65.00, keep the stop at 63.40. Target: 100.00!

Sale: no.

Support — 55.68. Resistance — 71.03.

RTSI

Growth scenario: Gazprom will pay a maximum dividend of 52.53 rubles per share, which will give a yield of about 20% per annum to shareholders. However, there is no other positive on the market. Sberbank feels bad, steelworkers feel bad, and oilmen are sick of their own fuel oil. We are waiting for the RTS index to fall to the level of 100,000. Further, it is not clear yet.

Falling scenario: the bulls did not reach the target at 130,000, it will be worse for them from this. Failure to meet the target buyers will give more confidence to the bears. Those who wish can build up shorts if they roll back up to 120000.

Recommendations:

Purchase: no. Close all positions.

Sale: when approaching 120000. Stop: 127000. Target: 80000 (50000). Who is in position from 126000, keep stop at 127000. Target: 100000 (80000).

Support — 97360. Resistance — 130520.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.