05 December 2022, 12:05

Price forecast from 5 to 9 of December 2022

-

Energy market:

And they burned candles and suffered under them. And they moaned freezing. And they called to each other in the midnight darkness. And finally they identified it. The price of oil! And be at level 60.

It will be very disappointing if the Kremlin does nothing in response to the European medieval Sabbat. At least it is necessary to transfer some calming pills with a diplomatic courier to Brussels.

We all have long summers. And we have warm winters. Hello!

It is possible that the next week will be nervous, as Russia may respond to the introduction of the maximum price for Russian oil from the West. For example, Moscow may not wait for February 5, when the embargo on the supply of petroleum products to Europe will come into force and stop deliveries earlier. In a fight, hair is not spared. Two months of deliveries of oil products to the EU, namely: December and January, will not help Russia in any way, but such a move may shock opponents.

The OPEC+ monitoring committee recommended keeping the deal to cut production by 2 million barrels of oil. At the same time, harsh verbal interventions by exporters on Monday and Tuesday cannot be ruled out. If you swallow restrictions on the price of oil for Russia, then it will soon be possible to obtain a price restriction for the states that are members of the cartel. And then this practice will spread to all raw materials mined in the world.

Next week +2 in Berlin, +5 in London. While Europe is lucky, there are no negative temperatures. But who knows what will happen to the weather for the New Year.

Grain market:

Limiting the price of oil and other sanctions against Russia will support prices. Tension in the hydrocarbon market will only increase. This factor will directly affect the cost of fuel for farmers, who will have to either get new subsidies or raise selling prices.

The gross grain harvest in Russia amounted to 155 million tons. This is a huge crop that is unlikely to be sold within the next six months, even if exported at a super-fast pace of 1 million tons of grain per week. Understanding this, a number of farms will switch to alternative crops in the spring, if possible. The grain market inside Russia will remain at low price levels for a long time.

Winter crops in the south of the country are in excellent condition. There is enough moisture in the fields. Due to the successful autumn sowing campaign on an area of 17 million hectares, it can already be said that the wheat harvest in Russia in 2023 could reach 90 million tons. Great news for the country at this difficult time.

USD/RUB:

Anticipating the pre-New Year’s consumer boom, importers increase the supply of goods to the country, which negatively affects the ruble exchange rate, as the demand for foreign currency on their part is growing. The December tourists, who need to take at least $200 for souvenirs, add fuel to the fire.

The ruble will be under pressure for the next few days, as the market will win back the imposition of an oil embargo by the EU. It is possible that before the New Year we will visit the area of 65 rubles per dollar, a stronger move up on this day and hour looks unlikely.

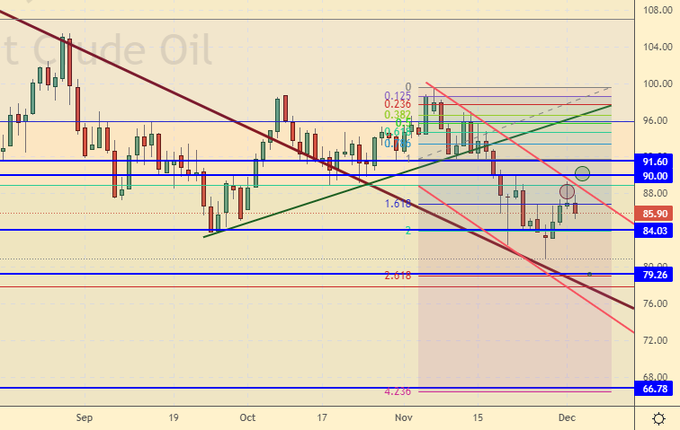

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers has decreased by 34 thousand contracts. The change is significant. The bulls left the market en masse, the sellers actively entered. The spread between long and short positions has narrowed significantly, the bulls may lose control of the market.

Growth scenario: consider the December futures, the expiration date is December 30th. We continue to refuse purchases. We are waiting for the market to fall to the level of 67.00.

Fall scenario: you can go short here. We failed to rise above 90.00, and this fact is enough for the sellers to have the advantage.

Recommendations for the Brent oil market:

Purchase: on touch 67.00. Stop: 63.20. Target: 90.00.

Sale: now. Stop: 91.30. Target: 67.00. Who is in position from 90.00, move the stop to 91.30. Target: $67.00 per barrel. Upon reaching the level of 80.00, close 25% of the position.

Support — 84.03. Resistance is 90.00.

WTI. CME Group

Fundamental US data: the number of active drilling rigs has not changed and is 627 units.

Commercial oil reserves in the US fell by -12.581 to 419.084 million barrels, while the forecast was -2.758 million barrels. Inventories of gasoline rose by 2.77 to 213.768 million barrels. Distillate inventories rose by 3.547 to 112.648 million barrels. Inventories at Cushing fell -0.415 to 24.315 million barrels.

Oil production has not changed and is 12.1 million barrels per day. Oil imports fell by -1.026 to 6.037 million barrels per day. Oil exports rose by 0.706 to 4.948 million barrels per day. Thus, net oil imports fell by -1.732 to 1.089 million barrels per day. Oil refining increased by 1.3 to 95.2 percent.

Gasoline demand fell by -0.01 to 8.317 million barrels per day. Gasoline production increased by 0.196 to 9.36 million barrels per day. Gasoline imports fell by -0.05 to 0.535 million barrels per day. Gasoline exports rose by 0.24 to 1.138 million barrels per day.

Demand for distillates fell by -0.19 to 3.656 million barrels. Distillate production increased by 0.2 to 5.311 million barrels. Distillate imports rose by 0.03 to 0.152 million barrels. Distillate exports rose by 0.158 to 1.3 million barrels per day.

Demand for petroleum products fell by -0.161 to 19.717 million barrels. Production of petroleum products increased by 0.113 to 22.252 million barrels. Imports of petroleum products increased by 0.303 to 1.91 million barrels. Exports of petroleum products rose by 1.143 to 6.828 million barrels per day.

Propane demand rose by 0.036 to 0.91 million barrels. Propane production increased by 0.097 to 2.553 million barrels. Propane imports rose by 0.075 to 0.173 million barrels. Propane exports rose by 0.079 to 1.586 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 7.4 thousand contracts. Both buyers and sellers left the market, but buyers did so more actively. The spread between long and short positions has narrowed, the bulls continue to control the situation.

Growth scenario: consider the January futures, the expiration date is December 20. The bulls failed to move above 85.00, which tells us that they are not ready to take control of the market. We do not buy from current levels, we are waiting for a fall.

Fall scenario: sellers hold control. Keep open shorts.

Recommendations for WTI oil:

Purchase: when approaching 67.00. Stop: 64.00. Target: 80.00.

Sale: no. Who is in position from 86.80, keep a stop at 85.80. Target: $67.00 per barrel.

Support — 66.21. Resistance — 83.38.

Gas-Oil. ICE

Growth scenario: consider the January futures, the expiration date is January 12. The market is in balance. It’s hard to give preference to someone. We don’t buy.

Fall scenario: from current levels, you can sell with minimal risk.

Gasoil recommendations:

Purchase: no.

Sale: now. Stop: 953.0. Target: 800.0.

Support — 866.75. Resistance is 967.00.

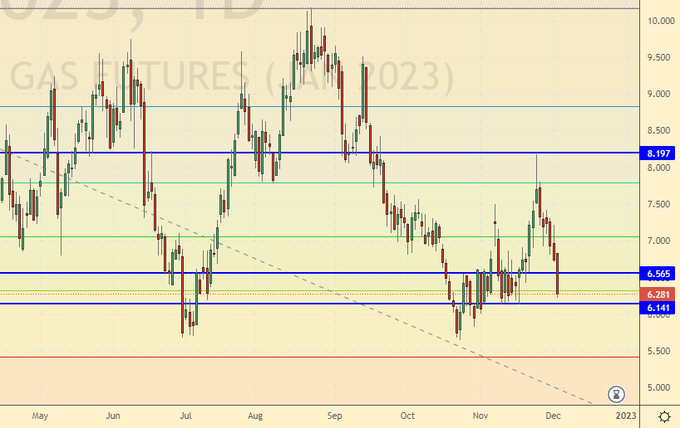

Natural Gas. CME Group

Growth scenario: consider the January futures, the expiration date is December 28. Despite the terrible last week, we will continue to stand in the longs. Moreover, here you can increase your positions.

Fall scenario: we will not sell. It’s winter outside. And it is not yet clear how severe it can be.

Recommendations for natural gas:

Purchase: now. Stop: 5.800. Target: 15.000. Who is in position between 5.320 and 5.800, keep a stop at 5.800. Target: 15.000 per 1 million BTUs.

Sale: no.

Support — 6.141. Resistance is 6.565.

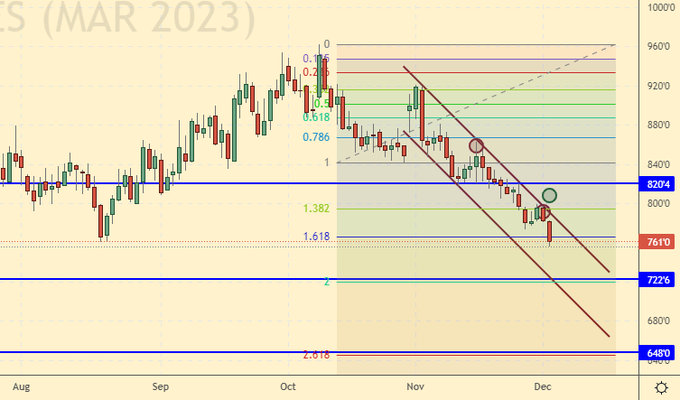

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 2.8 thousand contracts. A small number of buyers entered the market, a small number of sellers left. The spread between short and long positions has narrowed slightly, sellers retain the advantage.

Growth scenario: we consider the March futures, the expiration date is March 14. The bulls failed to hold the market. We showed a new low. We will now buy only from 650.0.

Fall scenario: we continue to hold shorts from 840.0. Let’s shift down the target for the current fall to the level of 650.0 cents per bushel.

Recommendations for the wheat market:

Purchase: no.

Sale: no. Who is in position from 840.0, move the stop to 822.0. Target: 650.0 cents per bushel.

Support — 722.6. Resistance — 820.4.

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 37.3 thousand contracts. The change is significant. Buyers actively entered the market, sellers left. The spread between long and short positions widened, and the bulls’ edge increased.

Growth scenario: we consider the March futures, the expiration date is March 14. Red Friday broke growth hopes. Out of the market.

Fall scenario: level 675.0 held. We keep falling. Reaching the level of 630.0 cents per bushel is very likely.

Recommendations for the corn market:

Purchase: when approaching 630.0. Stop: 605.0 Target: Target: 670.0.

Sale: no. Who is in position from 670.0, move the stop to 673.0. Target: 500.0 cents per bushel. At the level of 630.0, 25% of the position can be closed.

Support — 623.6. Resistance — 673.6.

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, the expiration date is January 13th. We will continue to hold longs from 1425.0. We are not opening new positions.

Fall scenario: knocked out of the position by a stop order. Despite this, we will sell again.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, keep the stop at 1416.0. Target: 1600.0.

Sale: now. Stop: 1467.0. Target: 1000.0 cents per bushel.

Support — 1407.2. Resistance — 1479.2.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. The market rebounded from the 19.00 area. If you have bought, hold positions.

Fall scenario: here you can sell. There are few chances for further downward movement, but they are there.

Recommendations for the sugar market:

Purchase: when approaching 19.00 and 18.50. Stop: 17.70. Target: 21.45. Who is in position from 19.05, move the stop to 18.95. Target: 21.45.

Sale: now. Stop: 20.10. Target: 18.00. Who is in position from 20.00, keep the stop at 20.10. Target: 18.00 cents per pound.

Support — 18.97. Resistance — 20.03.

Сoffee С, ICE

Growth scenario: we consider the March futures, the expiration date is March 21. Let’s be honest, buying from 160.0 has almost no chance. Move the stop closer.

Fall scenario: we remain outside the market and wait for more profitable levels to enter the shorts.

Recommendations for the coffee market:

Purchase: no. Those in positions from 160.0, 170.00 and 175.00, move the stop to 158.00. Target: 210.0 cents per pound.

Sale: no.

Support — 154.05. Resistance is 175.55.

Gold. CME Group

Growth scenario: we went up… In this situation, it was necessary to buy above 1780 (we wrote about it). Most likely we are going to 1890.

Fall scenario: sellers were kicked out of the market. We do not sell. And from 1890 we will not sell.

Recommendations for the gold market:

Purchase: no. Those in positions between 1675 and 1780 move the stop to 1740. Target: $2350 a troy ounce.

Sale: no.

Support — 1764. Resistance — 1889.

EUR/USD

Growth scenario: we went straight to 1.0700. December 8th ECB meeting. If there are no tough decisions, the pair will roll back from 1.0700 back down. We don’t buy.

Fall scenario: Selling when approaching 1.0700 is a normal idea. It is unlikely that the euro will be able to strengthen even more. There are too many problems in Europe. For example, Biden refused Macron to stop the Americans from poaching European enterprises. And Russia will soon refuse them diesel fuel. They will ride reindeer.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: when approaching 1.0700. Stop: 1.0770. Target: 0.8700?!!!

Support — 1.0397. Resistance is 1.0696.

USD/RUB

Growth scenario: for the dollar bulls, the situation began to develop in a favorable way. It is worth holding the previously opened positions. There is a possibility that our politicians will sacrifice the Russian market and the Russian currency in the confrontation with the West. Decisions that are inefficient from the point of view of developing their own economy can be made.

Fall scenario: we did not see the strengthening of the ruble, although such a possibility could not be written off. Now we are not thinking about strengthening the national currency.

Recommendations for the dollar/ruble pair:

Purchase: no. Those in positions between 60.00 and 61.60 move the stop to 60.40. Target: 74.00.

Sale: no.

Support — 61.38. Resistance — 62.47.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. The market last week showed new lows day after day. There is a threat of a pass below the 106000 level, which will lead to a fast move to 101000.

Fall scenario: bulls failed to push the market to 117000. This indicates the weakness of the buyers. Now we cannot expect any growth in the Russian market against the backdrop of the embargo on oil by the EU. Keep shorts.

Recommendations for the RTS index:

Buy: think when approaching 101000.

Sale: no. Who is in position from 107000, move the stop to 108000. Target: 80000 (50000) points.

Support — 101110. Resistance — 109540.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.