28 December 2020, 12:21

PRICE FORECAST from 28 December 2020 to 1 January 2021. Happy New Year!

-

Energy market:

The viral year 2020 is coming to the end.

The coalition of oil exporters, by restoring order in the discordant, expressional and hot ranks, managed to stabilize prices despite lockdowns introduced by one country or another. OPEC + has nowhere to go. The maneuvers of high ministers and deputy ministers, and princes and kings will continue in golden offices. We’ll hear: «market share», «production growth», «production decline» and all sorts of «Saudi Aramco» and «Rosneft», and the names are different, starting with Novak and ending with Barkindo. Middle Eastern and Northern macho men will saw through the ever-shrinking portion of the pie, stepping on each other’s throats with patent leather shoes. There will be screams. And so be it. We, ordinary traders, only need to understand: long or short, long or short, so shout louder, gentlemen!

Democrats in the United States managed to outrage the energetic liberal part of society, and they chose Biden as their leader, despite his age and periodic mental blocks in his gray head. Probably so that no one bothers them to have fun, hold parades and all that.

It’s interesting for us here, on the Eurasian continent, you can continue. We are waiting for the inauguration on the 21st. It is a pity that our holidays will be over, but 10th January would be the most convenient time. If there is so much talk in Washington about Russia, why not check our calendar.

Grain market:

Despite a record harvest, grain prices are going up. Either because of the fear of staying hungry during the quarantine period, or because the dollar is losing its purchasing power. Or perhaps because those in power having no ideas how to bleed the eight billion living mass white, amid the debt burden of proletarians and small bourgeois, went on the attack where you can still get something. It is very difficult for people to deny themselves food, especially basic ones.

If in 2021 the mutating virus cannot be curbed, then we may see a strong social explosion in Europe and vivid manifestations of dissolved democracy in the United States. Everything will be calm in Russia. The main thing is that the snow falls. Snow is moisture in the fields, and moisture is good winter crops, and winter crops are not 75, which is predicted now, but still 80 million tons of wheat next season.

USD/RUB:

Will the ruble hold up in 2021? Will it fall to the $100 mark?

Fundamentally, there are no such reasons. In order for such a scenario to materialize, firstly: United States and Europe must be released, they are clearly not up to Russia now. Sitting in quarantines is great entertainment, which so far is paid for by inflating debt. However, one fine day, one large bank will break down and then burst. At this moment, a certain minister, whose name will be cast in lead next to the name of Gavrila Princip, will refuse to pour trillions of newly created, that is, no-man’s dollars or euros, into it, after which a local end of the world will come, much worse than in 2008 …

Secondly, Russia can still borrow on the markets no worse than other participants, and oil prices are at the acceptable levels to the budget, so we will definitely survive 2021. If the evil grandfather Biden covers us with sanctions, then the «ruble» will shudder, of course, but it is possible that Russia does not need to rush to answer. If the West behaves as it does now, occupying 20% of GDP per year, then on the horizon of three or five years, maybe there will be no one to answer. If you look at the dynamics of bitcoin, then not only the author of these lines believes in such a scenario.

In the New Year, wise decisions for all of us and bright achievements!

Happy New Year!

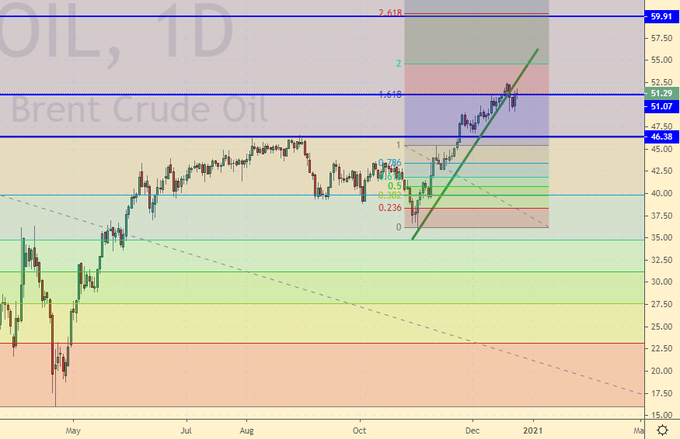

Growth scenario: December futures, expiration date December 31. To enter the long, we need a descent to 46.60. We perceive the current levels as too high.

Falling scenario: It makes sense to look for sales opportunities here. As long as the market is below 53.00, it is possible to win back the negative coming from Britain.

Recommendation:

Purchase: no.

Sale: now. Stop: 52.60. Target: 46.60. Whoever is in positions between 50.00 and 50.70, keep the stop at 52.60. Target: 46.60.

Support — 46.38. Resistance — 59.91.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 1 unit to 264 units.

US commercial oil reserves fell by -0.562 to 499.534 million barrels. Gasoline inventories fell -1.125 to 237.754 million barrels. Distillate stocks fell -2.325 to 148.934 million barrels. Stocks at the Cushing storage facility increased by 0.198 to 58.409 million barrels.

Oil production has not changed at 11 million barrels per day. Oil imports fell -1.055 to 5.424 million barrels per day. Oil exports rose by 0.472 to 3.099 million barrels per day. Thus, net oil imports fell by -0.332 to 2.465 million barrels per day. Refining fell -1.1 to 78 percent.

Gasoline demand rose 0.375 to 7.975 million barrels per day. Gasoline production rose 0.307 to 8.829 million barrels per day. Gasoline imports fell by -0.04 to 0.571 million barrels per day. Gasoline exports fell by -0.027 to 0.757 million barrels per day.

Distillate demand rose 0.613 to 4.002 million barrels. Distillate production fell by -0.014 to 4.59 million barrels. Distillate imports fell by -0.048 to 0.444 million barrels. Distillate exports rose 0.123 to 1.193 million barrels per day.

The demand for petroleum products increased by 0.801 to 19.335 million barrels. Production of petroleum increased by 0.041 to 20.129143 million barrels. Imports of petroleum products fell by -0.31 to 1.933 million barrels. Exports of petroleum rose by 0.776 to 5.714 million barrels per day.

Propane demand fell by -0.02 to 1.671 million barrels. Propane production fell by -0.01 to 2.312 million barrels. Propane imports fell by -0.027 to 0.148 million barrels. Propane exports rose by 0.145 to 1.501 million barrels per day.

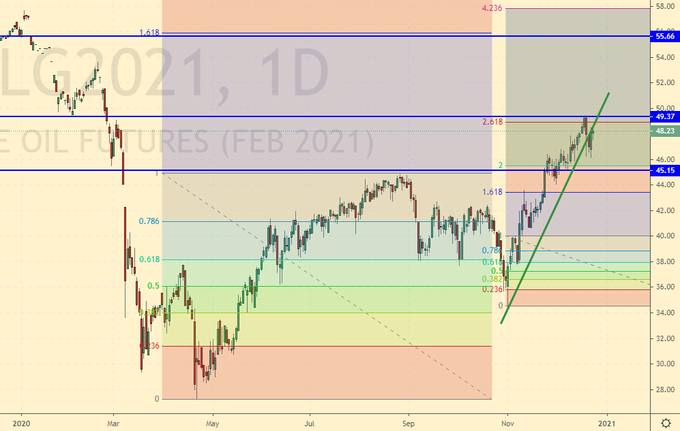

Falling scenario: the market could not go above 50.00. Here you can sell, especially since OPEC is inclined to increase oil production by 0.5 million barrels of oil in January.

Recommendation:

Purchase: no.

Sale: now. Stop: 50.80. Target: 44.10. Whoever is in the position between 48.30 and 49.30, keep the stop at 50.80. Target: 44.10.

Support — 45.15. Resistance — 49.37 (55.66)

Gas-Oil. ICE

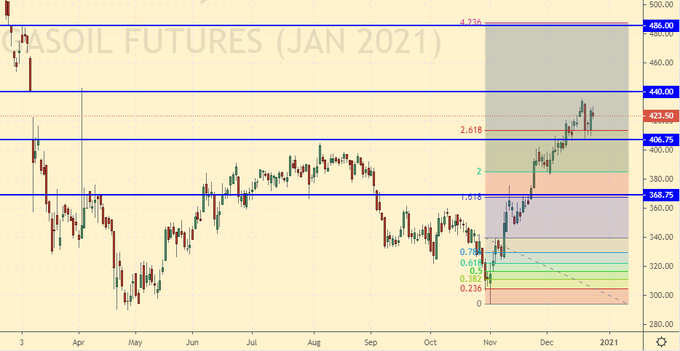

Growth scenario: January futures, expiration date January 12. We will not buy here. Prices are too high.

Falling scenario: good situation for a short. We put and do not think about anything.

Recommendation:

Purchase: no.

Sale: now. Stop: 443.00. Target: 390.0.

Support — 406.75. Resistance — 440.00 (486.00).

Natural Gas. CME Group

Growth scenario: February futures, expiration date January 27. We will buy, counting on the intensification of cold weather in Europe.

Falling scenario: this is an exchange bluff. We do not sell. We don’t believe, don’t even look down.

Recommendation:

Purchase: now. Stop: 2.440. Target: 3.400.

Sale: no.

Support — 2.489. Resistance — 2.771.

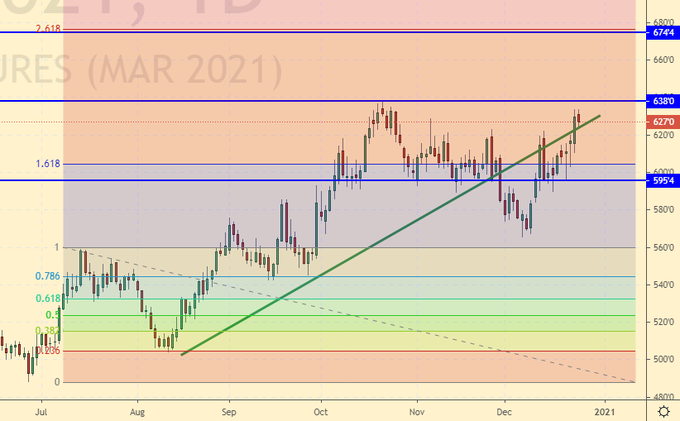

Wheat No. 2 Soft Red. CME Group

Growth scenario: March futures, expiration date March 12. The bulls don’t want to give up. Last week you should have been pulled into a purchase from 625.0. Not a very effective entry, but what to do, I don’t want to miss the move to 674.

Falling scenario: until the market falls below 600.0, we will not sell.

Recommendation:

Purchase: no. Those who are in position, from 625.0, move the stop to 607.0. Target: 674.0

Sale: no.

Support — 595.4. Resistance — 638.0.

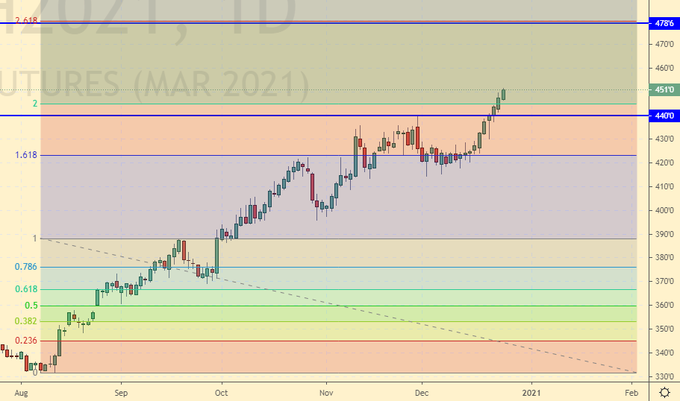

Growth scenario: March futures, expiration date March 12. It’s a pity, but we didn’t believe in recoilless growth. The goal is clear — it’s 478.0. Practice it on a «1H». On «1D» outside the market.

Falling scenario: waiting for the approach to 478.0 and sell.

Recommendation:

Purchase: no.

Sale: no.

Support — 440.0. Resistance — 478.6.

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, expiration date January 14. Sitting and waiting for a rollback. Buying at current levels is scary.

Falling scenario: the market is clearly overheated. Sell here counting on a fall to 1180.0.

Recommendation:

Purchase: no.

Sale: now. Stop: 1287.0. Target: 1180.0.

Support — 1142.2. Resistance — 1277.0.

Sugar 11 white, ICE

Growth scenario: March futures, expiration date February 26. We entered the long last week, although there were doubts. Now we’re waiting for how big the coconut will grow.

Falling scenario: we were thrown out of the short. Sorry. Let’s be persistent and enter again. Somehow we went down from 15.00 spectacularly. Recommendation:

Purchase: no. Those who are in the position from 14.40, move the stop to 14.37. Target: 16.00.

Sale: now. Stop: 15.03. Target: 12.60.

Support — 13.88. Resistance — 15.07.

Сoffee С, ICE

Growth scenario: March futures, expiration date March 19. Kept long with a stop at 118.00. We move the stop slightly up and stand.

Falling scenario: let’s wait for the situation to be clarified. We keep old sales, don’t open new ones. Supposing all instruments in the agricultural market did not grow by 10% by the end of January. Recommendation:

Purchase: no. Anyone in a position from 110.0, move the stop to 122.0. Target: 140.0.

Sale: no. Those who are in the position from 124.00, move the stop to 128.10. Target: 108.00.

Support — 116.35. Resistance — 128.65.

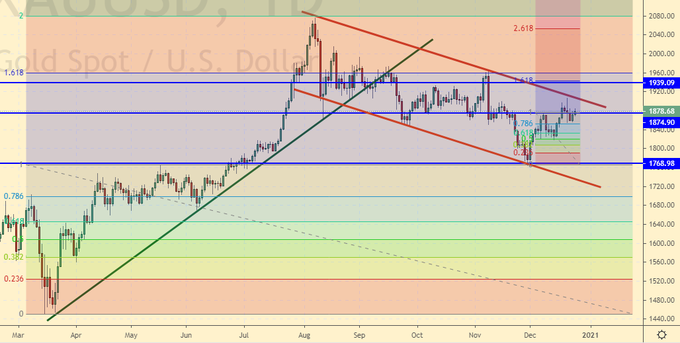

Gold. CME Group

Growth scenario: due to the sequential growth of the lows, the bulls have a local advantage. It makes sense to keep holding longs.

Falling scenario: yes, it is possible, but somehow restless. The Americans are sailing to Iran, Israel has joined them. Probably to spread democracy. We do not sell.

Recommendation:

Purchase: no. Anyone in the position between 1765 and 1900, move the stop to 1835. Target: 2260.

Sale: no.

Support — 1768. Resistance — 1939.

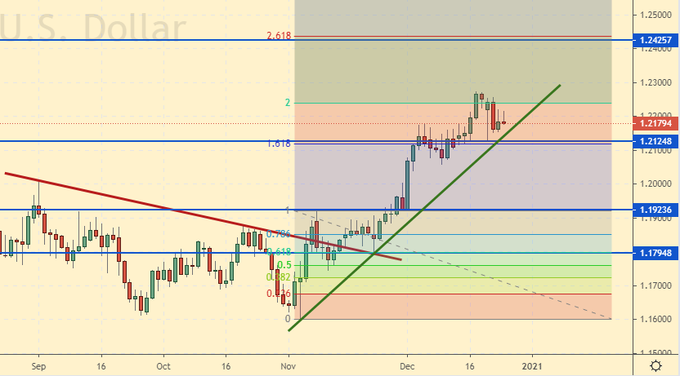

EUR/USD

Growth scenario: the pair endured the emergence of a new virus strain in Britain and several European countries quite calmly. Here you can open up or build up longs.

Falling scenario: we continue to believe that sales may be interesting from 1.2400, not earlier. Recommendation:

Purchase: now. Stop: 1.2090. Target: 1.2400 (1.2900). Whoever is in positions between 1.1840 and 1.1820, keep the stop at 1.2090. Target: 1.2400 (1.2900).

Sale: think when approaching 1.2400.

Support — 1.2124. Resistance — 1.2425.

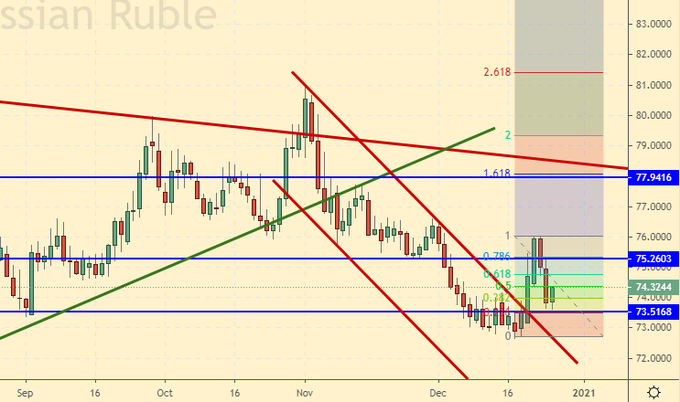

USD/RUB

Growth scenario: the situation is such that nothing but the long can be recommended here. We buy.

Falling scenario: don’t sell yet. But if the market falls below 73.00, then it will be possible to speculate about it.

Purchase: now. Stop: 72.30. Target: 80.00. Who entered from 74.30, 74.00 and 73.00, keep the stop at 72.30. Target: 80.00.

Sale: no.

Support — 73.51. Resistance — 75.26.

RTSI

Growth scenario: with such a disposition, we will only think about buying after a rollback to 126,000.

Falling scenario: continue to recommend shorts. The market is so frozen that nothing but a sale come to the head. This, of course, bad, but you have to believe your eyes, at least once.

Recommendation:

Purchase: no.

Sale: now. Stop: 142200. Target: 126000. Who is in position from 139700, move the stop to 142200. Target: 126000.

Support — 125650. Resistance — 138420.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.