28 August 2023, 12:28

Price forecast from 28 August to 1 of September 2023

-

Energy market:

European official Mr. Borrell announced victory over Russia in the trade war. Like, we reduced deliveries by 50%, and from Russia they began to buy goods by 70% less. One gets the impression that the more “winner” politicians there are in the West, the harder it is for the common people.

It’s time to start to figure out who exactly owns the «victory»: Berlin or Paris, or maybe London. And then everything is safe and somehow quiet there. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Let’s not hide from you, our entire office began to worry Iran very much. The guys are increasing oil supplies to the foreign market, while they are not too concerned about the fact that KSA and Russia have reduced shipments. In addition to Iran, there is also Venezuela, there is Iraq, Libya and Nigeria. All of these countries are projected to increase production by 0.9 million barrels per day in 23rd year and the same in 24th. And everything would be fine if the demand for oil really grew. In the meantime, exporters wishful thinking. No matter how the KSA and the Russian Federation had to cut production again.

China has never been able to wake up from the pandemic. They will draw China + 3% of GDP at the end of the year against the backdrop of deflation (read overstocking) and that’s it. China has already reduced its purchases of oil in July, and most likely will not return to the consumption of energy resources at the level of the first half of the year. All sorts of incentives will not give anything. It is possible that growth in China will stop in the 24th year, even their party bureau will have to admit this.

Despite the reduction in the intensity of drilling, oil production in the United States continues to grow. We have already reached the level of 12.8 million barrels per week. Americans really need to itch harder if they don’t want to one day see that the country’s oil reserves are running out.

Grain market:

Erdogan is maneuvering in the dark waters of the Black Sea in an attempt to get Russia back into the grain deal. What to play up, it is necessary to force the West to fulfill its conditions. And they don’t need to hurt. The harvest in Europe is good, if something is not enough, then they will bring it by rail from Ukraine. That is, they will not comply with Moscow’s demands in Brussels, since they are not in danger of starvation, which means there will be no deal. Now cheap Ukrainian grain, if it gets to Turkey, then through a slightly more expensive route. It should be noted that for Russia, the grain deal brought nothing but a loss of market share and a drop in export prices for wheat.

Egypt will increase the purchase of Russian wheat and its re-export to neighboring countries if Moscow creates a distribution center in the Suez Canal zone. This is an interesting topic, which may allow Russia to sell additional million tons of grain per year. Let it be.

Sellers have very little time left to set a new low for wheat, it is necessary to go below 608 cents per bushel in December futures. If it doesn’t happen by September 10th, we probably won’t see it this year. After the first ten days of September, the bulls will return to the market.

USD/RUB:

We see that trade with countries for reserve currencies is declining. This leads to a “decrease in the quality of foreign exchange earnings”, that is, for its resources, Russia receives more and more second-class currency, in fact. At this day and hour, this is not such a big problem, but it will get worse, especially since neither India nor China wants their currencies to be sold by Russia against the dollar. Take tea and cockroach crayons from us for oil supplies. And it’s not funny anymore. Sooner or later, the parties will start a tough bargain on this issue.

After raising the rate to 12%, the ruble is in no hurry to strengthen against the US dollar. In fairness, we note that the fall in the rate last week has a corrective character and may be limited to growth to the level of 96.00 rubles per dollar. A higher rise would lead to talk of a move towards 115.00 again. If the market fails to consolidate above 96.00, then there is a possibility of a move to 87.00 in September.

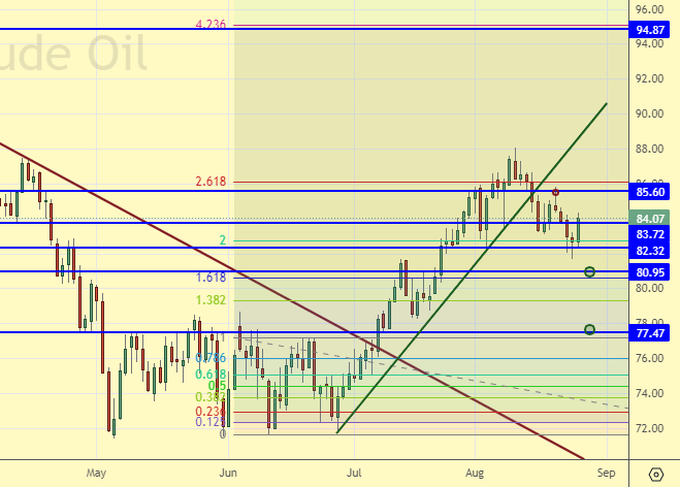

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers decreased by 12.4 thousand contracts. Sellers entered the market, buyers left in approximately equal volumes. The spread between long and short positions has narrowed, the bulls continue to control the situation.

Growth scenario: we are considering the September futures, the expiration date is September 29th. We continue to stay out of the market. Buying from 81.00 and 77.50 make sense.

Fall scenario: keep short from 84.96. A price branch down to 81.00 is possible.

Recommendations for the Brent oil market:

Purchase: when approaching 81.00. Stop: 79.40. Target: 94.80.

Sale: no. Who is in position from 84.96, move the stop to 85.90. Target: 77.70.

Support — 82.32. Resistance is 85.60.

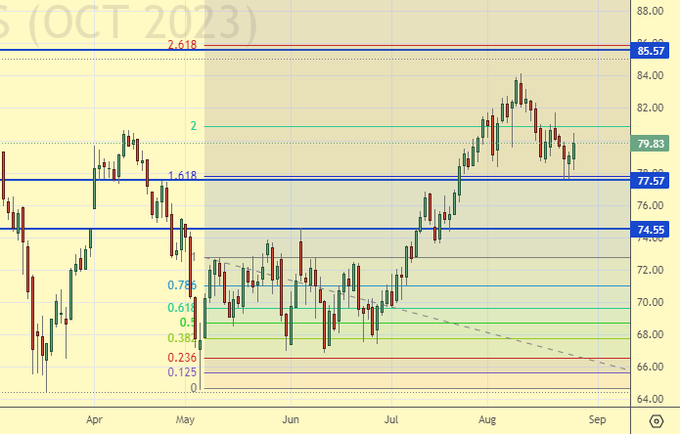

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 8 units and now stands at 512 units.

US commercial oil inventories fell by -6.134 to 433.528 million barrels. Inventories of gasoline rose by 1.468 to 217.626 million barrels. Distillate inventories rose 0.945 to 116.688 million barrels. Inventories at Cushing fell -3.133 to 30.669 million barrels.

Oil production increased by 0.1 to 12.8 million barrels per day. Oil imports fell by -0.225 to 6.933 million bpd. Oil exports fell by -0.341 to 4.258 million barrels per day. Thus, net oil imports increased by 0.116 to 2.675 million barrels per day. Oil refining fell by -0.2 to 94.5 percent.

Gasoline demand rose by 0.059 to 8.91 million barrels per day. Gasoline production increased by 0.13 to 9.715 million barrels per day. Gasoline imports rose by 0.307 to 0.893 million barrels per day. Gasoline exports fell by -0.051 to 0.83 million bpd.

Demand for distillates rose by 0.188 to 3.836 million barrels. Distillate production increased by 0.337 to 5.066 million barrels. Distillate imports fell -0.041 to 0.088 million barrels. Distillate exports fell -0.058 to 0.119 million barrels per day.

Demand for oil products fell by -0.498 to 21.165 million barrels. Oil products production fell by -0.09 to 23.089 million barrels. Imports of petroleum products increased by 0.575 to 2.108 million barrels. The export of oil products increased by 0.43 to 6.286 million barrels per day.

Propane demand fell by -0.27 to 0.974 million barrels. Propane production fell -0.046 to 2.608 million barrels. Propane imports fell -0.019 to 0.064 million barrels. Propane exports rose by 0.07 to 0.176 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers decreased by 29.6 thousand contracts. The bulls are running for the second week in a row. The volumes are significant. However, the advantage in the market remains with the bulls.

Growth scenario: we are considering the October futures, the expiration date is September 20. Buying at current levels is not convenient. Out of the market.

Fall scenario: in case of growth to 85.50 — sell. The current levels are too low.

Recommendations for WTI oil:

Purchase: not yet.

Sale: in case of growth to 85.50. Stop: 86.30. Target: 75.20.

Support — 77.57. Resistance — 85.57.

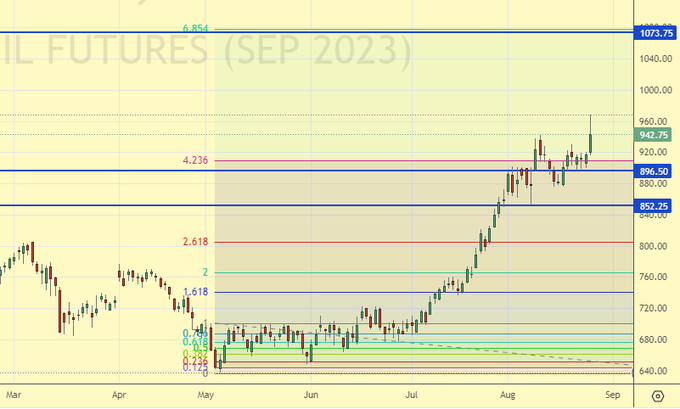

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. There is no point in shopping. Out of the market.

Fall scenario: short is possible after the close of the day below 900.0 or from 1070.0.

Gasoil recommendations:

Purchase: no.

Sale: if the day closes below 900.0. Stop: 923.0. Target: 742.0. Or when approaching 1070.0. Stop: 1130.0. Target: 930.0.

Support — 896.50. Resistance is 1073.75.

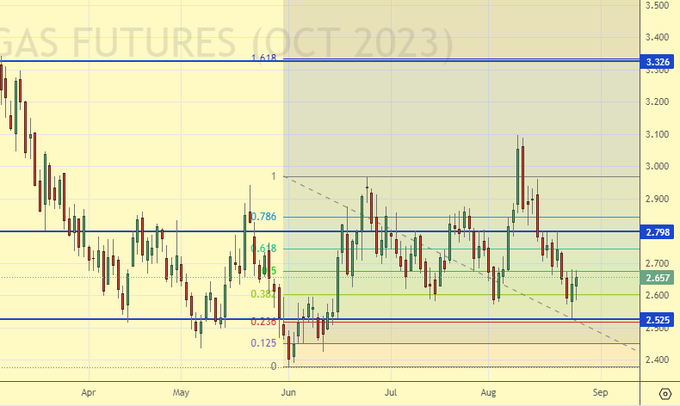

Natural Gas. CME Group

Growth scenario: consider the October futures, the expiration date is September 27th. We keep long. Looking forward to growth. Nobody knows what winter will be like. But she will.

Fall scenario: don’t sell levels too low.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep the stop at 2.320. Target: 3.900.

Sale: no.

Support — 2.525. Resistance is 2.798.

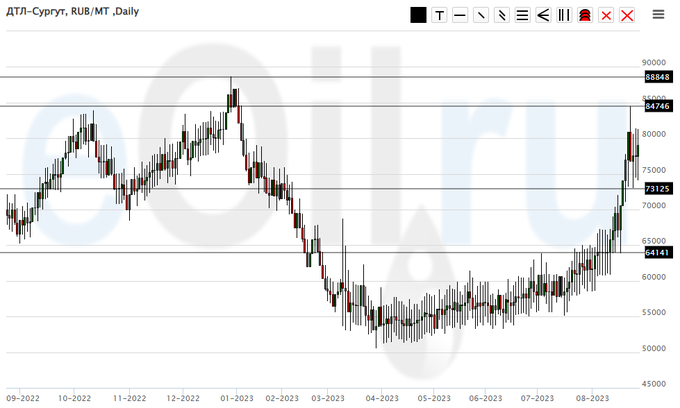

Diesel arctic fuel, ETP eOil.ru

Growth scenario: Significant growth. The market may take a break for a couple of weeks. Nevertheless, we continue to keep long, gradually fixing profits as we grow.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, move the stop to 68000. Target: 100000 (revised). You can close another 10% of the position at current prices.

Sale: no.

Support — 73125. Resistance — 84746.

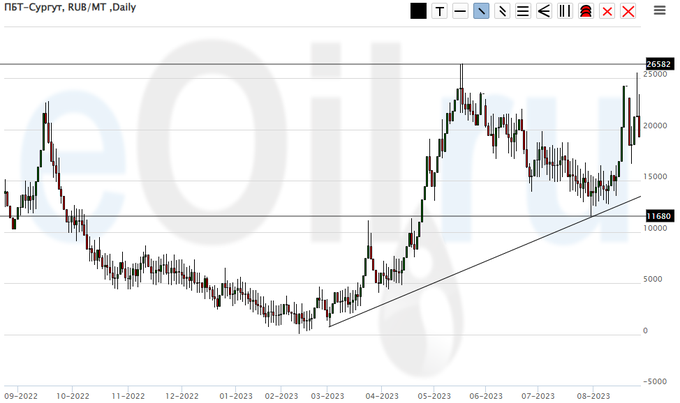

Propane butane (Surgut), ETP eOil.ru

Growth scenario: very ragged trades. Refrain from new deals.

Fall scenario: we do not make sales.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support — 11680. Resistance — 26582.

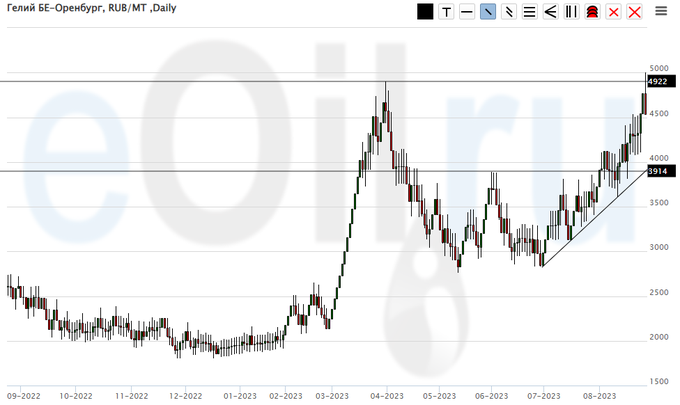

Helium (Orenburg), ETP eOil.ru

Growth scenario: again, as a week earlier, set a new maximum. We keep long.

Fall scenario: do not sell. Prices may continue to rise.

Recommendations for the helium market:

Purchase: no. Those in positions between 2900 and 3200, move the stop to 3900. Target: 6000.

Sale: no.

Support — 3914. Resistance — 4922.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 5.6 thousand contracts. The vendors keep coming. There are no new buyers yet. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: consider the December futures, the expiration date is December 14th. Looking forward to another week. Out of the market.

Fall scenario: sales are not interesting. There is no speculative potential here.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support — 608.4 Resistance — 646.3.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Last week, the difference between long and short positions of managers increased by 35,000 contracts. Sellers continue to enter the market in a massive way. Buyers back off. The sellers once again strengthened their superiority.

Growth scenario: consider the December futures, the expiration date is December 14th. We don’t buy. We are waiting for another week.

Fall scenario: there is no point in selling. Out of the market.

Recommendations for the corn market:

Purchase: not yet.

Sale: no.

Support — 473.2. Resistance is 494.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: short from current levels is possible, but the stop order is close.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1396.0. Target: 1000.0?

Support — 1332.2. Resistance — 1390.3.

Gold. CME Group

Growth scenario: Designated support for 1904. Buy.

Fall scenario: there are no interesting levels for sales. Out of the market.

Recommendations for the gold market:

Purchase: now. Stop: 1902. Target: 2400?!

Sale: no.

Support — 1904. Resistance — 1930.

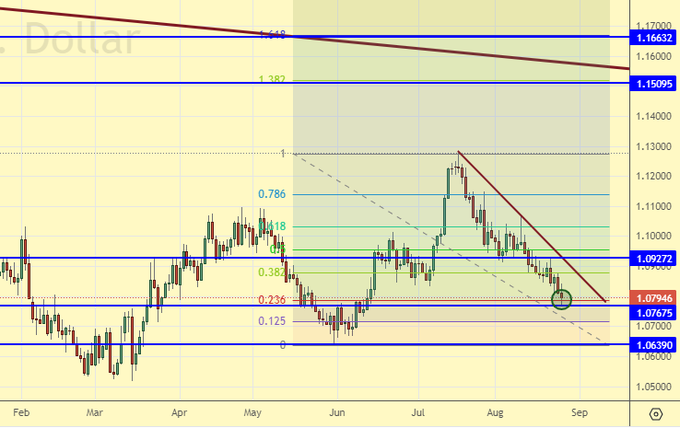

EUR/USD

Growth scenario: keep long from 1.0790. We expect a move to 1.1660.

Fall scenario: as a week earlier, there are no interesting levels for sales. We do not sell.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.0790, move the stop to 1.0760. Target: 1.1660.

Sale: no.

Support — 1.0767. Resistance is 1.0927.

USD/RUB

Growth scenario: if the market allows, then it is mandatory to buy from 87.30. If we fix next week above 96.00, we will have to think about buying on the market. And this is not very interesting, but the move to 114.00 cannot be missed.

Fall scenario: shorts from 96.00 are possible.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 87.00. Stop: 84.80. Target: 114.00.

Sale: now and when approaching 96.00. Stop: 97.00. Target: 87.30. Count the risks.

Support — 92.54. Resistance is 97.52.

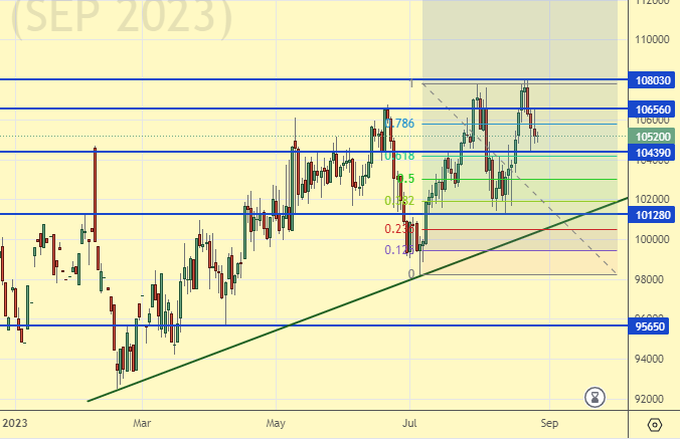

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. Growth is possible. Let’s buy.

Fall scenario: we will keep shorts from 105800. It is worth recognizing that the situation is balanced. At the same time, the market can quickly swing in either direction.

Recommendations for the RTS index:

Purchase: now. Stop: 104000. Target: 112000.

Sale: no. Who is in position from 105800, move the stop to 107200. Target: 90000 (50000; 20000?!!!).

Support — 104390. Resistance — 106560.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.