27 November 2023, 12:33

Price forecast from 27 November to 1 December 2023

-

Energy market:

In Holland, the parliamentary party of Eurosceptic Geert Wilders, who is ready to withdraw the Netherlands from the EU, won. People are searching. Typically, such searches end with the fires of the Inquisition beginning to burn in Europe, and then they begin to seriously talk about national identity with all that it entails. We wish them success in this direction.

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

OPEC is looking for a compromise. And, of course, before the 30th, to which the meeting was rescheduled, they will find him. They haven’t gone completely crazy there. At the same time, if additional cuts are not announced, then we will have an attempt to break below 75.00 for Brent. If the harmony of the ranks is demonstrated to the world, then we can count on the fact that we will remain around 80.00.

There was information that as a result of US pressure on oil carriers, the price of Urals began to fall and approached $60.00. Greek companies refuse to provide ships to Russia. Denmark will inspect ships to determine their technical condition. India has banned the unloading of tankers off its coast that are more than 25 years old. You will have to transfer oil into the sea from old to new, which is expensive.

Apparently, Russia will be content only with those transactions that will be at the level of $60.00 per barrel for Urals, and their volume will only cover the emerging risk of fuel shortage in any particular region. This is an extremely unpleasant trend.

Grain market:

In Russia, wheat has been harvested from 98% of the total sown area. 95 million tons threshed. The average yield is 32.5 c/ha instead of last year’s 35.9 c/ha. These results will allow about 65 million tons of wheat to be exported. In total, 142 million tons of grain will be harvested, which will be the second highest figure in history.

Ukraine continues to supply grain to the foreign market. The supply volumes would be greater, but Eastern European countries do not want to see foreign grain on their territory, as this devalues the work of local farmers. 2.7 million tons for October is a good figure, but due to the fact that in previous months exports fell by more than half compared to last year, a grain overhang remains over the market. This puts pressure on prices.

Prospects for a recovery in prices on the stock market remain, but it will probably happen a little later.

USD/RUB:

The ruble continues to aim for a descent to 80.00. At the same time, if suspicions grow that foreign currency receipts into the country will begin to decline, then we will face a new round of growth in the dollar exchange rate. The share of the dollar and euro in foreign exchange earnings fell from 97 to 17% in September, which should increase the cost of converting and obtaining these currencies from the yuan and rupee.

Imports are likely to decline, causing prices in rubles to rise, which will put additional pressure on inflation rates. So far we have no prerequisites that the rate will be reduced in the near future, but even at this rate, government bonds are in demand among banks, and the profitability of the debt securities themselves is falling.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 11.3 thousand contracts. Sellers entered the market in small numbers, buyers left the market. The bulls continue to control the situation.

Growth scenario: we are considering December futures, expiration date is December 29. The OPEC meeting has been postponed. The market will continue to remain sluggish. If you try to break down 75.00 you can buy.

Fall scenario: we don’t know the result of the OPEC meeting. We don’t sell.

Recommendations for the Brent oil market:

Purchase: when approaching 75.00. Stop: 73.00. Goal: 150.00.

Sale: no.

Support – 76.27. Resistance – 83.94.

WTI. CME Group

US fundamentals: the number of active drilling rigs has remained unchanged at 500.

Commercial oil reserves in the United States increased by 8.7 to 448.054 million barrels, with a forecast of +1.16 million barrels. Gasoline inventories increased by 0.75 to 216.42 million barrels. Distillate inventories fell by -1.018 to 105.561 million barrels. Inventories at the Cushing storage facility rose by 0.858 to 25.868 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports increased by 0.156 to 6.529 million barrels per day. Oil exports fell by -0.103 to 4.786 million barrels per day. Thus, net oil imports increased by 0.259 to 1.743 million barrels per day. Oil refining increased by 0.9 to 87 percent.

Gasoline demand fell by -0.469 to 8.48 million barrels per day. Gasoline production fell by -0.043 to 9.372 million barrels per day. Gasoline imports increased by 0.079 to 0.593 million barrels per day. Gasoline exports fell by -0.037 to 0.896 million barrels per day.

Demand for distillates increased by 0.001 to 4.11 million barrels. Distillate production increased by 0.185 to 4.938 million barrels. Imports of distillates fell by -0.077 to 0.075 million barrels. Exports of distillates increased by 0.048 to 1.048 million barrels per day.

Demand for petroleum products fell by -0.038 to 20.042 million barrels. Production of petroleum products increased by 0.862 to 21.961 million barrels. Imports of petroleum products increased by 0.049 to 1.694 million barrels. Exports of petroleum products increased by 0.161 to 6.151 million barrels per day.

Demand for propane increased by 0.128 to 0.982 million barrels. Propane production fell by -0.032 to 2.597 million barrels. Propane imports increased by 0.036 to 0.105 million barrels. Propane exports fell -0.012 to 0.095 million barrels per day.

Growth scenario: we are considering January futures, expiration date is December 19. We will remain long with a stop at 71.00. If the position survives, it may have a good future.

Fall scenario: refrain from selling. Suddenly there will be a tough statement from OPEC to reduce production.

Recommendations for WTI oil:

Purchase: no. Anyone in position from 73.50, keep a stop at 71.00. Target: 83.00.

Sale: no.

Support – 71.57. Resistance – 78.93.

Gas-Oil. ICE

Growth scenario: we are considering December futures, expiration date is December 12. The idea is the same: we’ll take it when we approach 700.00, if the market gives such an opportunity. We do nothing at current prices.

Fall scenario: stabilized. If we rise to 860.0, we can sell.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sell: when approaching 860.0. Stop: 880.00. Goal: 700.00.

Support – 800.25. Resistance – 843.25.

Natural Gas. CME Group

Growth scenario: we are considering January futures, expiration date is December 27. We continue to refuse purchases. There’s a lot of gas. The market is saturated. We don’t buy.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 2.101. Resistance – 3.464.

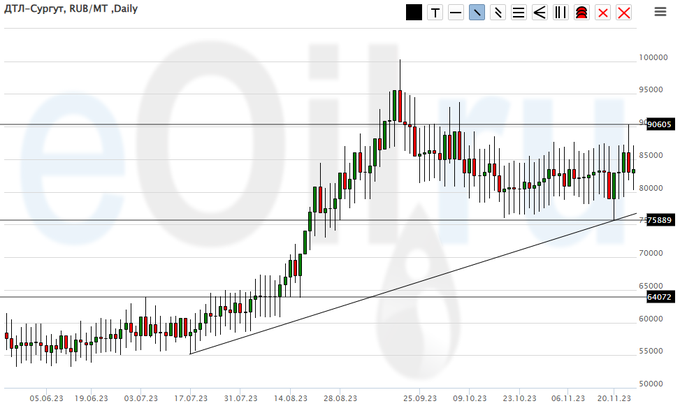

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 65,000. It will be possible to buy there.

Fall scenario: also no change. Let’s continue to stay short. We see an attempt to go above 90,000, which was unsuccessful. While we are below 90,000, sellers have a chance.

Recommendations for the diesel market:

Purchase: when approaching 65,000. Stop: 58,000. Target: 85,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 66000.

Support – 75889. Resistance – 90605.

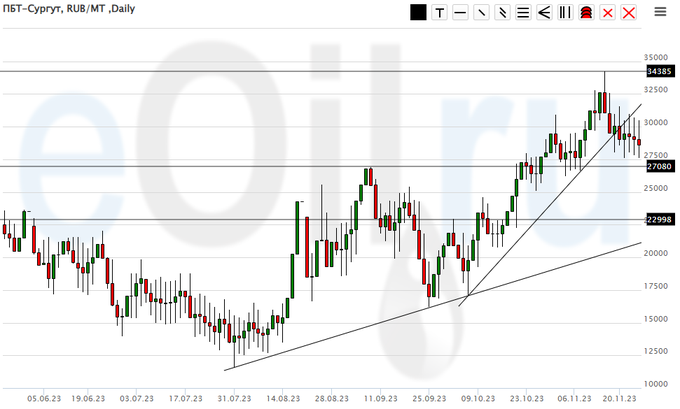

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we see that growth has stopped. We need a stronger dive to enter a new long position.

Fall scenario: we will continue to hold shorts in anticipation of the market cooling to 23300.

Recommendations for the PBT market:

Purchase: no.

Sale: no. If you are in a position from 30000, keep your stop at 32600. Target: 23300.

Support – 27080. Resistance – 34385

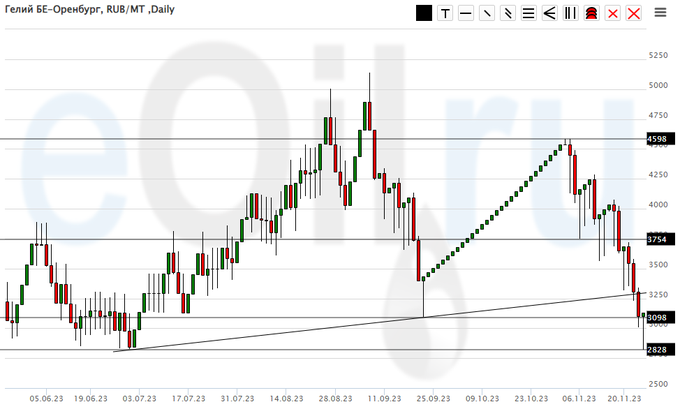

Helium (Orenburg), ETP eOil.ru

Growth scenario: good levels for purchases remain. We enter long.

Fall scenario: we continue to remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: Now. Stop: 2700. Target: 5000.

Sale: no.

Support – 2828. Resistance – 3754.

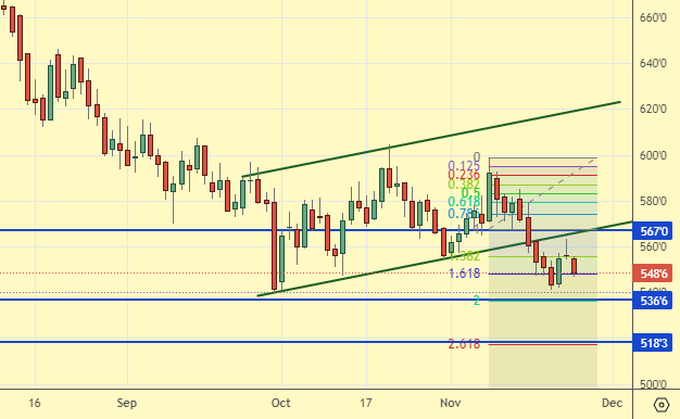

Wheat No. 2 Soft Red. CME Group

Growth scenario: we are considering December futures, expiration date is December 14. We continue to wait for the market to fall to 500.0. Buying from 520.0 is also possible, but less attractive.

Fall scenario: as before, we refuse to sell. It is better to work out a possible move to 500.0 on the clock.

Recommendations for the wheat market:

Purchase: when approaching 500.0. Stop: 480.0. Target: 647.0 (710.0).

Sale: no.

Support – 536.6. Resistance – 567.0.

Corn No. 2 Yellow. CME Group

Growth scenario: we are considering December futures, expiration date is December 14. We continue to expect the market to fall. It will be interesting to buy from 425.0.

Fall scenario: keep shorts with targets at 425.0.

Recommendations for the corn market:

Purchase: no.

Sale: no. Anyone in position from 474.0, move the stop to 481.0. Target: 425.0 (revised).

Support – 457.4. Resistance – 481.3.

Soybeans No. 1. CME Group

Growth scenario: we are considering January futures, expiration date is January 12. We continue to refuse purchases. Lots of soy. The weather has improved in Argentina.

Fall scenario: we will think about selling if it falls below 1320. Out of the market for now.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support – 1328.4. Resistance – 1389.2.

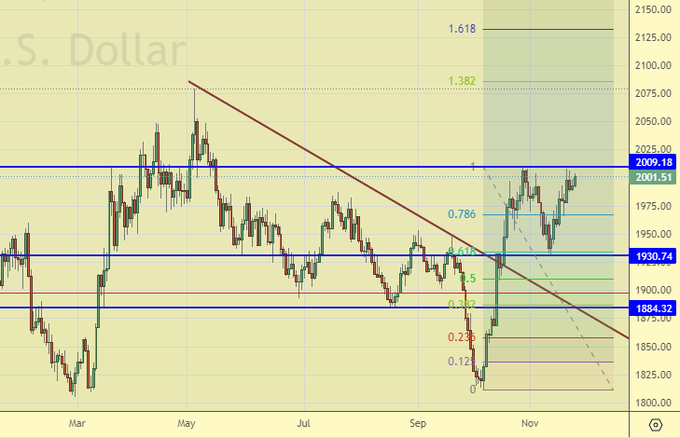

Growth scenario: growth in gold may continue. In case of growth above 2010, you can add.

Fall scenario: you can go short from current levels. The target for 1880 is realistic.

Recommendations for the gold market:

Purchase: when approaching 1880. Stop: 1860. Target: 2400. Whoever is in a position from 1840, keep the stop at 1940. Target: 2400.

Sale: now. Stop: 2010. Target: 1880. Those in position from 1975, keep the stop at 2010. Target: 1880.

Support – 1930. Resistance – 2009.

EUR/USD

Growth scenario: we continue to hold longs. If we immediately take the level of 1.1000, then the level of 1.1200 will open.

Fall scenario: we will not sell. For now, people are largely betting that the cycle of increasing interest rates in the US has come to an end.

Recommendations for the euro/dollar pair:

Purchase: no. If you are in a position from 1.0700, move your stop to 1.0840. Target: 1.2000.

Sale: no.

Support – 1.0886. Resistance – 1.1270.

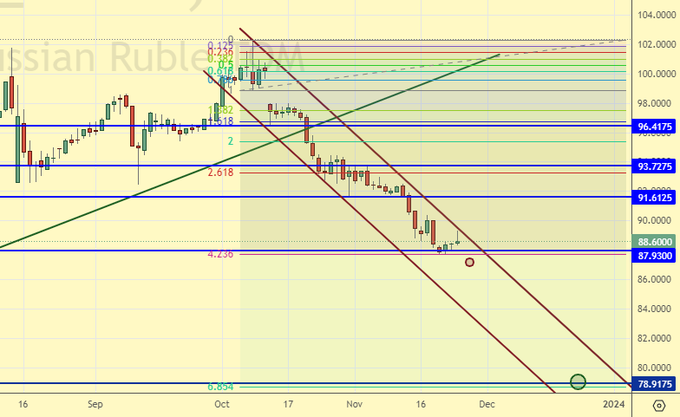

USD/RUB

Growth scenario: entered a purchase when it touched 88.00, it makes sense to stand and wait. If there is a descent to 87.00, then you will have to leave the deal.

Fall scenario: maniacally want to buy from 96.00. Current levels for entering shorts are too low. However, if it falls below 87.00, we will sell with targets at 79.00.

Recommendations for the dollar/ruble pair:

Purchase: no. If you are in a position from 88.00, move your stop to 87.00. Goal: 100.00.

Sale: no. Anyone in position from 91.80, move the stop to 89.20. Goal: 79.00.

Support – 87.93. Resistance – 91.61.

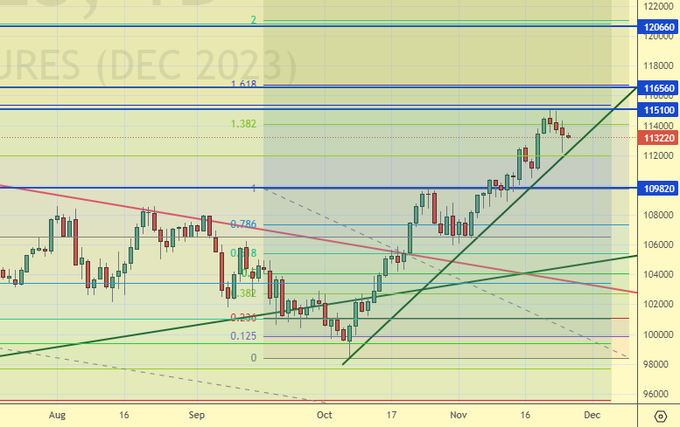

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. At current levels, purchases are not interesting. Off the market.

Fall scenario: got into shorts from 115,000. It makes sense to hold. It is unlikely that we will be able to move above 117600 without a correction.

Recommendations for the RTS Index:

Purchase: no.

Sale: no. Who is in a position from 115000, keep a stop at 117600. Target: 50000?!

Support – 109820. Resistance – 115100.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.