24 March 2025, 13:08

Price forecast from 24 to 28 March 2025

-

A week has passed, and the question of Trump’s internship with the Gypsies remains. They even gave him a portrait, it turns out, handwritten, and in return we are waiting for a black-and-white Xerox with the locations where he will now extract our oil in our Alaska. This is America.

Fabulous times outside the window. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

Iran has been given two months to embrace Catholicism…no, sorry, the nuclear deal. I’d rather everyone there embrace Christianity than sign a deal, honestly. But in general, it would be possible to embrace Orthodoxy. Why not? You don’t have to be clairvoyant to realize that the oil market will gravitate downward, against the backdrop of bad economic sentiment, Buffett has been sitting in cash for a long time, and politicians will periodically pull him up. What do we get? We get a wide channel down with a possible target… 50.00. Why? It’s a round number. But that’s closer to August, more likely. Demand for oil traditionally grows by the end of the year, and the market will have to correct there.

China has started refusing to buy Russian oil amid sanctions. However, everything may be much more prosaic. Our Arab “friends” simply gave a big pearl to the Chinese treasury, and with it they offered very soft prices for the long term. Why for the long term, and not strictly according to the market, because, firstly, they are the market themselves, and secondly, a long contract is a predictable future, otherwise you can wake up one day and start selling at a negative price.

No one has much doubt that we have reached peak and saturation in the economy. Overproduction under capitalism is a normal story. We will just have to live through it. This issue will last a couple of years, then people will have holes in their sofas from lying down, and it will be necessary to replace them, and with them other durable goods. Demand will appear again.

Grain market:

The outcome of negotiations on cessation of hostilities (on safety of navigation) in the Black Sea will directly affect grain prices. If there is no fear of logistical problems, grain prices may drop. It should be noted that even without this factor, wheat and corn look heavy and are able to go down by 10%. As the Russian side notes, the negotiations will not be simple.

Since March 19, the Turks have allowed duty-free imports of grain for flour production for export. Just business, so that flour mills would not be idle. Prices reacted to this decision with a rise, but then the whole bullish story deflated.

In FY25, Turkey purchased 2.3 million tons of wheat from Russia in January and February, almost twice less than in the same period a year earlier. If the sanctions pressure on Russia does not ease, and there are no such prerequisites before the completion of the SWO, a number of countries may buy food from Russia on a residual basis. Of course, they will mostly do it taking into account market interests, asking us for discounts, but sometimes without taking them into account. Simply because it is better to overpay the “right country” and not to quarrel with the EU or the USA.

USD/RUB:

The Central Bank of Russia left the rate at 21%. The US Fed also left the rate at the same level. However, the USD/RUB rate will not be affected by the US rate decisions in the coming months. The pair will be more influenced by Russian indicators: inflation, export and import volumes, and, last but not least, the mood of market participants.

The pair is able to strengthen to 80.00, but lower marks are unlikely to be reasonable, as further strengthening would make food at Pyaterochka more expensive than in the EU. You can evaluate: Lidl chain in Germany. Oil of the German brand Milbona (250 g.) — 1.99 euros. Yes, statistics are sometimes ruthless.

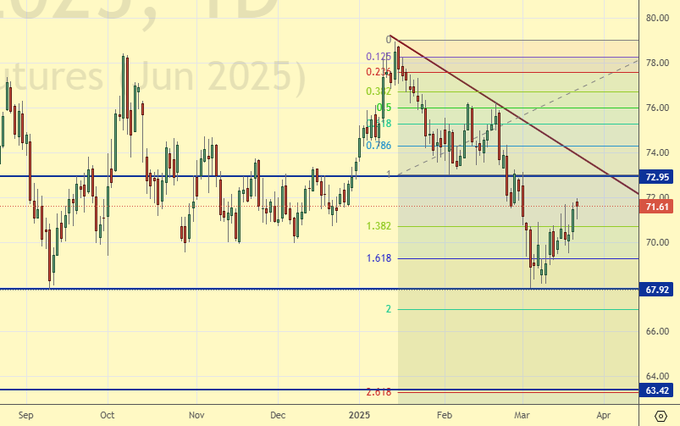

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 48.3 th. contracts. Bulls were actively entering the market. Bears were fleeing. Bulls control the situation.

Growth scenario: we switched to April futures, expiration date April 30. So far we can’t turn upwards. It is worth buying from 63.50, but we need to get there first.

Downside scenario: we will continue to recommend selling. Against the backdrop of expectations of a decline in the EU and US economies, oil prices are unlikely to rise.

Recommendations for the Brent oil market:

Buy: when approaching 63.50. Stop: 62.00. Target: 72.00.

Sell: now (71.61). Stop: 74.70. Target: 63.50. Count the risks! Add when approaching 73.00.

Support — 67.92. Resistance — 72.95.

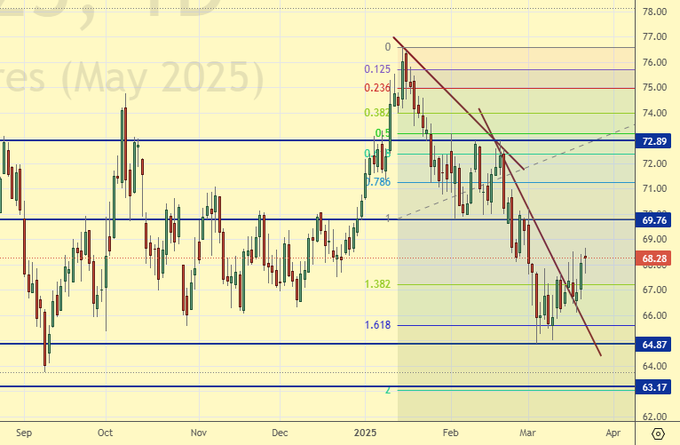

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 1 unit to 486.

US commercial oil inventories rose by 1.745 to 436.968 million barrels, with +0.8 million barrels forecast. Gasoline inventories fell -0.527 to 240.574 million barrels. Distillate stocks fell -2.812 to 114.783 million barrels. Cushing storage stocks fell -1.009 to 23.46 million barrels.

Oil production fell by -0.002 to 13.573 million barrels per day. Oil imports fell by -0.085 to 5.385 million barrels per day. Oil exports rose by 1.354 to 4.644 million barrels per day. Thus, net oil imports fell by -1.439 to 0.741 million barrels per day. Oil refining rose by 0.4 to 86.9 percent.

Gasoline demand fell by -0.365 to 8.817 million barrels per day. Gasoline production rose 0.067 to 9.623 million barrels per day. Gasoline imports rose 0.079 to 0.657 million barrels per day. Gasoline exports increased by 0.054 to 0.894 million barrels per day.

Distillate demand increased by 0.112 to 4.01 million barrels. Distillate production increased by 0.151 to 4.613 million barrels. Distillate imports rose 0.008 to 0.257 million barrels. Distillate exports increased by 0.225 to 1.261 million barrels per day.

Demand for petroleum products fell by -2.183 to 19.417 million barrels. Petroleum products production fell by -1.021 to 20.458 million barrels. Imports of refined petroleum products fell -0.286 to 1.68 million barrels. Exports of refined products rose by 0.732 to 6.96 million barrels per day.

Propane demand fell by -0.678 to 0.931 million barrels. Propane production rose by 0.018 to 2.715 million barrels. Propane imports fell -0.007 to 0.138 million barrels. Propane exports rose 0.476 to 2.194 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 15.5 th. contracts. Buyers and sellers entered the market, but sellers were more numerous. Bulls keep control.

Growth scenario: we consider May futures, expiration date April 22. We are waiting for more interesting points for water in long. So far out of the market.

Downside scenario: you can see that the Arabs are shaken. They will offer discounts. It makes sense to keep shorts.

Recommendations for WTI crude oil:

Buy: at 59.05. Stop: 58.05. Target: 68.00.

Sell: now (68.28). Stop: 72.30. Target: 59.05. Consider the risks! Add when approaching 70.00.

Support — 64.87. Resistance — 69.76.

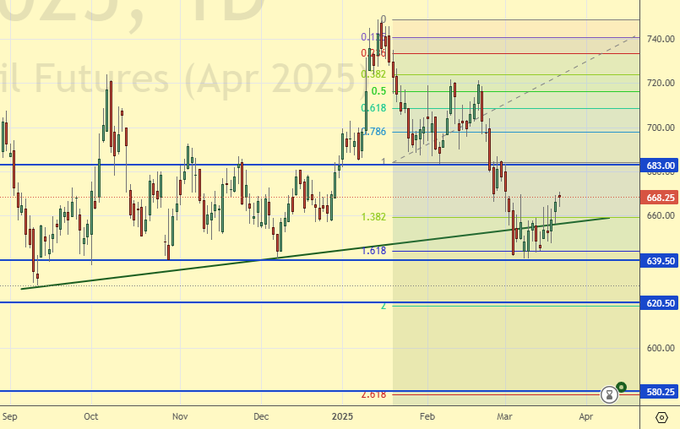

Gas-Oil. ICE

Growth scenario: we consider April futures, expiration date is April 9. We continue to believe that we should wait for the downward momentum to fully work out, which will probably happen at 580.0.

Downside scenario: if there is a rise, it can be used to enter short.

Gasoil Recommendations:

Buy: when approaching 580.0. Stop: 570.0. Target: 680.0.

Sell: on approach to 680.0. Stop: 730.0. Target: 580.00. Add when approaching 700.0.

Support — 639.50. Resistance — 683.00

Natural Gas. CME Group

Growth scenario: we consider May futures, expiration date April 28. Rolled back, but we would like to get 3.200 for a new long.

Downside scenario: prices are likely to fall further, but this fall is better worked out on hourly intervals.

Natural Gas Recommendations:

Buy: when approaching 3.200. Stop: 2.800. Target: 3.900.

Sale: no.

Support — 3.791. Resistance — 4.423.

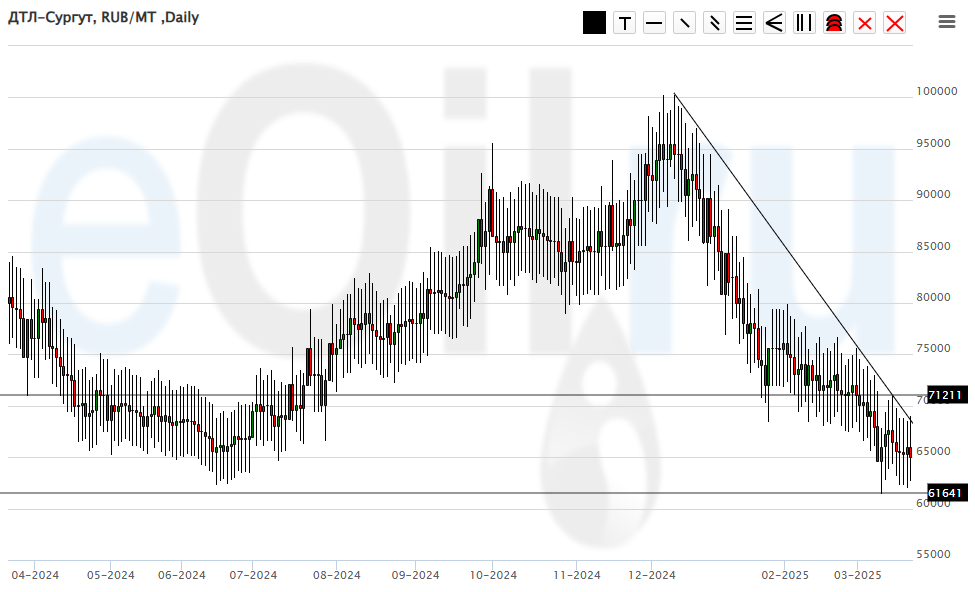

Diesel arctic fuel, ETP eOil.ru

Growth scenario: knocked out of buying. We take a pause.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 61641. Resistance — 71211.

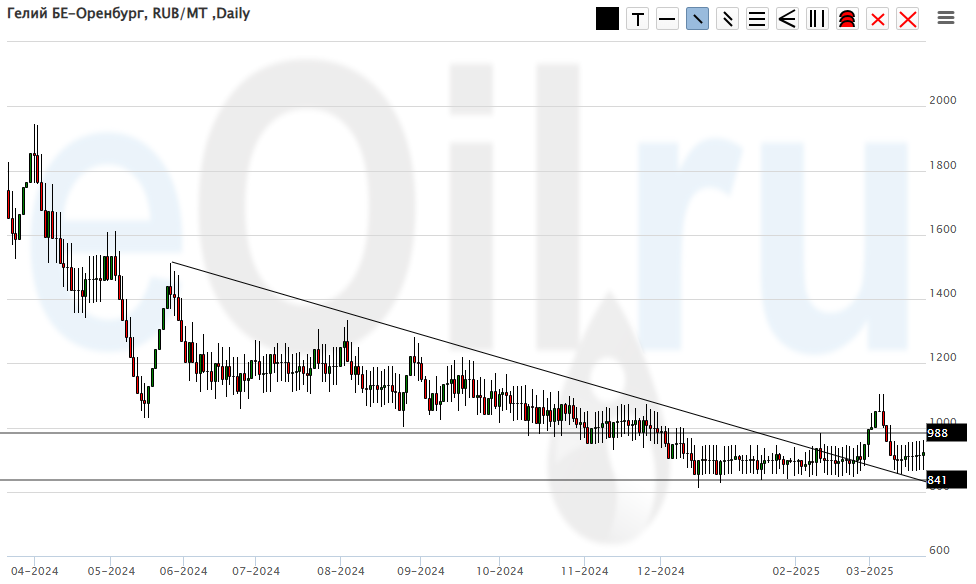

Helium (Orenburg), ETP eOil.ru

Growth scenario: it makes sense to keep longing. At a certain point, prices will start to rise for everything. And helium, too.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: No. Who is in position from 900, keep stop at 850. Target: 2000.

Sale: no.

Support — 841. Resistance — 988.

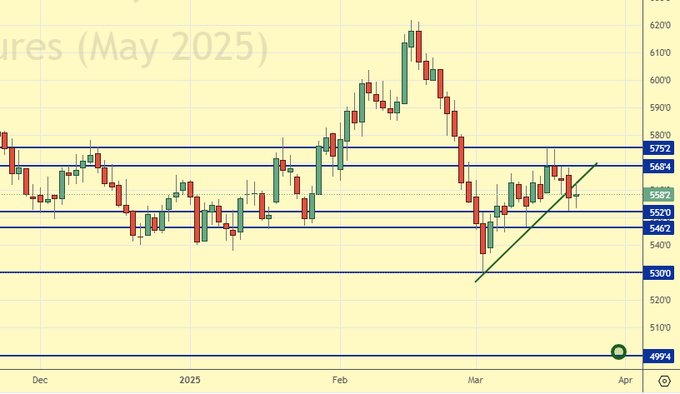

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 2.3 thousand contracts. There was practically no activity on the market. Bears control the situation.

Growth scenario: we consider the May contract, expiration date May 14. Intrigue remains. We want 500.0. We do not buy at current levels.

Downside scenario: looking heavy. Let’s fall.

Recommendations for the wheat market:

Buy: obligatory when approaching 500.0. Stop: 400.0. Target: 700.0.

Sell: Now (558.2). Stop: 677.0. Target: 500.0. Count the risks!

Support — 552.0. Resistance — 568.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 28 th. contracts. Buyers continued to leave the market in small volumes. Sellers arrived for the third week in a row. Bulls may lose control in the near future.

Growth scenario: we consider the May contract, expiration date May 14. We should keep longing. If it does not survive, we will buy from deeper levels.

Downside scenario: approached 472.0. It was possible to get into shorts. We want 380.0.

Recommendations for the corn market:

Buy: no. Who is in position from 444.0, keep stop at 445.0. Target: 510.0.

Sell: not. Who is in position from 470.0, move the stop to 477.0. Target: 380.0?!!!!

Support — 455.2. Resistance — 470.2.

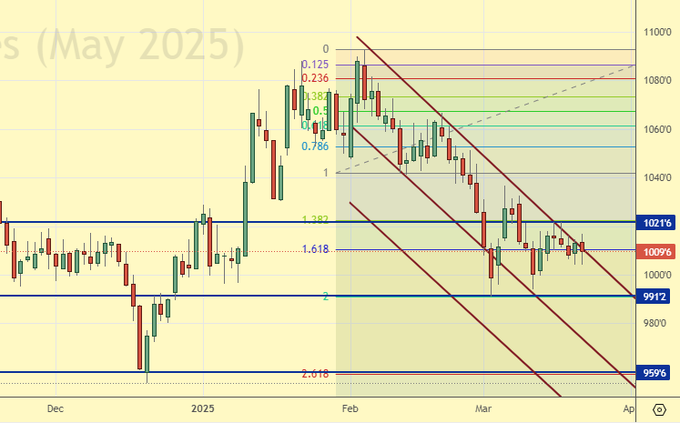

Soybeans No. 1. CME Group

Growth scenario: we consider the May contract, expiration date May 14. We continue to believe that buying is neither fundamentally nor technically interesting. Out of the market.

Downside scenario: hold shorts in expectation of a strong fall.

Recommendations for the soybean market:

Buy: no.

Sell: no. Those who are in position from 1025.6, move the stop to 1023.0. Target: 878.0.

Support — 991.2. Resistance — 1021.6.

Growth scenario: we switched to April futures, expiration date April 28. The market has fulfilled all the firkins at the top. We should rollback to 2885, better to 2770.

Downside scenario: we see the fulfillment of the Fibo target at 3020. We should now get a pullback. But how deep it will be is still a question. And then there will be another branch upwards, somewhere towards 3300.

Gold Market Recommendations:

Buy: when approaching 2770. Stop: 2730. Target: 3350.

Sale: now (3021). Stop: 3074. Target: 2120?!!!

Support — 2941. Resistance — 3066.

EUR/USD

Growth scenario: we will wait for a pullback to 1.0550. It is uncomfortable to buy from current levels.

Downside scenario: our reversal in a not very clear place. We want 1.0550. Trump may strengthen the dollar with the chaos he creates.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.0550. Stop: 1.0450. Target: 1.1090 (1.2000).

Sell: no. Who is in position from 1.0875, keep your stop at 1.0956. Target: 1.0550.

Support — 1.0751. Resistance — 1.0955.

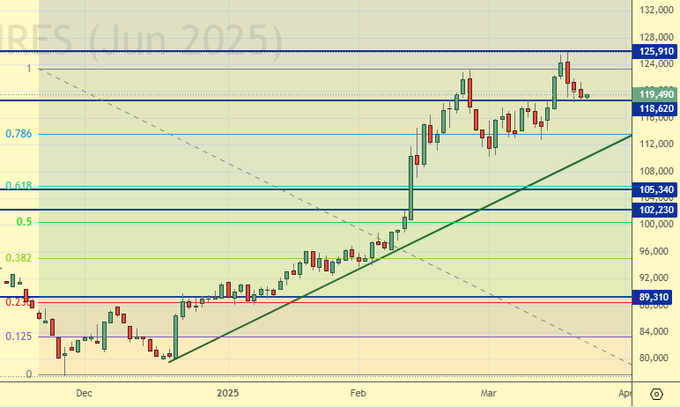

USD/RUB

Growth scenario: we consider June futures, expiration date June 19. From 82600 to buy unambiguously. A rise above 91000 will make us think about buying after the breakdown of the falling trend line.

Downside scenario: a move to 82500 is possible. Since we have pulled back up, we have created an acceptable situation to enter short. You can sell if you have not done it earlier. At current levels you can add to shorts. Don’t forget about the stop!

Recommendations on dollar/ruble pair:

Buy: when approaching 82600. Stop: 81400. Target: 115000?!!!

Sell: No. Who is in position from 92186, move your stop to 90300. Target: 82600.

Support — 82521. Resistance — 89675.

RTSI. MOEX

Growth scenario: we’re looking at the June futures, expiration date June 19. Citizens! Where are you all going?! This is not normal. We recommend you to look for other assets to buy. The RTS index is overbought.

Downside scenario: in case of falling below 117500 it makes sense to suspect something wrong and sell. Otherwise, out of the market.

Recommendations on the RTS index:

Buy: when approaching 105500. Stop: 103000. Target: 138000?!!! Also on approach to 89500. Stop: 88300. Target: 110000.

Sell: after falling below 117500. Stop: 121000. Target: 89500. Consider the risks. Extremely high volatility!

Support — 118620. Resistance — 125910.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.