24 February 2025, 12:31

Price forecast from 24 to 28 February 2025

-

The whole world holds its breath. The sunrise is being realized in manual mode. Great Comrade T. is trying to turn the course of the flow of thoughts of great minds of important strategists. But the channel lies between granite shores, and to change it you have to work hard. They promise to come to the table next week. They’ll be pouring out their thoughts.

To negotiating. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

The oil market continues to remain in a balanced state. There are attempts to shake it up and get out of the range, but no one has enough energy to do it.

Russia continues to supply oil to India and China. We will have to take a look at the new sanctions packages from the UK, but it is unlikely to be something that will make Moscow feel bad. There is a multilevel game going on, the main victim of which may not be Ukraine, for example, it may be France. Americans built Disneyland in Paris for nothing. Where Disneyland is, there is America. Where there is America, there is Britain, do you think anyone has forgotten the 100-year war? There are such skeletons in closets from the Vatican to Hanover that we, with our pristine cleanliness of Veliky Novgorod or Pskov, could not even dream of.

Let’s see, preferably from a distance, what new virus has been discovered in China. Having received data on a new strain, which is transmitted from person to person, the markets began to languish. Oil was directly affected. The Chinese Communist Party, by the way, can hide its economic problems under this sauce. We, they say, are still like this, and it’s all a virus. We are forced to close factories. Buy what we have already produced. Letting people go on minimum wage for six months is still weak. It’s not allowed. Who’s going to build the pyramids?

If the virus is actually dangerous, we’ll go to 60.00 quickly.

Grain market:

So far we do not see much excitement in the grain market. IGC’s end of season forecast for 24/25 is out. It’s all good. There will be a little more wheat, a little less corn. Demand will slightly exceed supply. Yes, a new virus in China has the potential to pull the market up, making food expensive due to a disruption in supply to the foreign market. This could happen if the ports close for quarantine. So far, the China virus story has just started to rock, but there are not enough pictures of a man standing here, a man lying there. Meanwhile, somewhere there in the laboratory, some botanists…, it’s not serious. But it’s possible that the theme will continue.

The prospect of an end to the conflict in the Black Sea region should bring some softness to trade, but we have some stresses ending and others beginning. “It’s a very bad regime, very,” is roughly what Trump would say.

Europe will realize, if not today, then tomorrow, that it is alone. And this will make Europeans tougher when negotiating with other countries. The struggle for resources will become more fierce. Including over fertilizer, over soil, over water. There may be more visits to former colonies. “Let’s be friends for your resources.” That sort of thing.

Continued price growth at FOB Novorossiysk for wheat cannot be ruled out.

USD/RUB:

The Russian ruble and stock market are in a good mood amid reports of possible negotiations on Ukraine. Trump is pumping up optimism. Moscow is making scathing comments. It should be noted that three years of SWO required substantial efforts from Russia and further continuation may have an extremely negative impact on the situation in the economy, especially against the background of a possible decline in the manufacturing sector in China. Many commodity items, the same electric cars, electric scooters, electric… whatever, there is simply no one to sell them to. So they will buy fewer resources from us.

The ruble is able to feel the strength of 85.00 on the interbank and 88000 on the futures, but it will be extremely difficult to go below, for example, to 80.00. However, if the war machine stands up, it will be received extremely optimistically with strengthening at the moment up to 76.00.

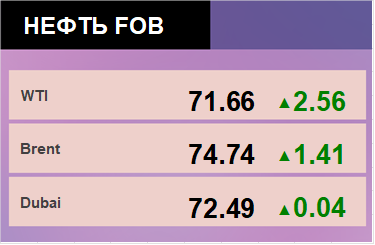

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 24 thousand contracts. Buyers were leaving, sellers were profiting in the same volumes. Bulls are controlling the situation.

Growth scenario: we switched to March futures, expiration date March 31. We keep longing. We do not open new positions.

Downside scenario: we see Friday’s long candle. Possible reset. Sell.

Recommendations for the Brent oil market:

Buy: no. Those who are in the position from 74.34 (taking into account the transition to a new contract), move the stop to 73.20. Target: 90.00.

Sell: now (74.05). Stop: 76.10. Target: 60.00. Count the risks!

Support — 73.57. Resistance — 76.78.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 7 units to 488.

U.S. commercial oil inventories rose by 4.633 to 432.493 million barrels, against a forecast of +3.2 million barrels. Gasoline inventories fell -0.151 to 247.902 million barrels. Distillate stocks fell -2.051 to 116.564 million barrels. Cushing storage stocks rose by 1.472 to 23.291 million barrels.

Oil production increased by 0.003 to 13.497 million barrels per day. Oil imports fell by -0.489 to 5.82 million barrels per day. Oil exports rose by 0.472 to 4.381 million barrels per day. Thus, net oil imports fell -0.961 to 1.439 million barrels per day. Oil refining fell by -0.1 to 84.9 percent.

Gasoline demand fell -0.337 to 8.239 million barrels per day. Gasoline production fell -0.156 to 9.19 million barrels per day. Gasoline imports rose -0.027 to 0.346 million barrels per day. Gasoline exports fell -0.072 to 0.898 million barrels per day.

Distillate demand increased by 0.679 to 4.364 million barrels. Distillate production increased by 0.18 to 4.723 million barrels. Distillate imports rose 0.022 to 0.267 million barrels. Distillate exports fell -0.166 to 0.918 million barrels per day.

Demand for petroleum products increased by 0.029 million barrels to 19.653 million barrels. Production of petroleum products increased by 0.01 to 20.515 million barrels. Petroleum product imports rose 0.232 to 1.692 million barrels. Exports of refined products increased by 0.553 to 6.996 million barrels per day.

Propane demand fell -0.178 to 1.322 million barrels. Propane production rose 0.056 to 2.665 million barrels. Propane imports fell -0.05 to 0.132 million barrels. Propane exports rose 0.329 to 1.988 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 24.4 th. contracts. Buyers fled. Sellers arrived in insignificant volumes. The bulls are maintaining control.

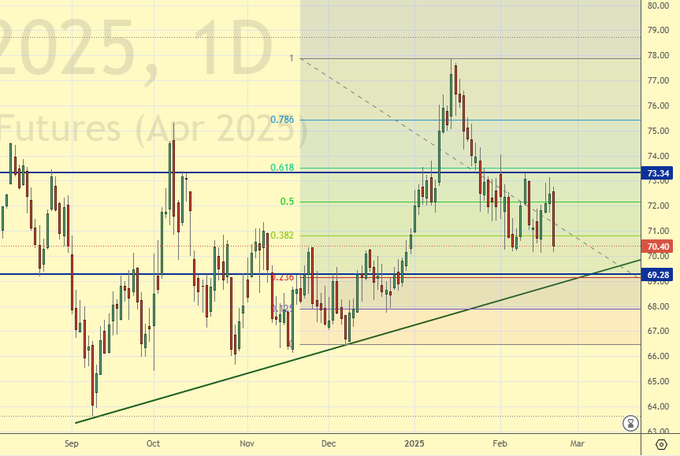

Growth scenario: we consider April futures, expiration date March 20. Here you can buy.

Downside scenario: there is no sense to sell yet.

Recommendations for WTI crude oil:

Buy: no. Who is in position from 70.50 and 72.33, keep stop at 68.80. Target: 90.00.

Sale: no.

Support — 69.28. Resistance — 73.34.

Gas-Oil. ICE

Growth scenario: we consider March futures, expiration date March 12. Those who have longs, hold them. Do not open new positions.

Downside scenario: don’t sell yet.

Gasoil Recommendations:

Buy: no. Who is in position from 701.75, keep stop at 670.0. Target: 900.0.

Sale: no.

Support — 685.00. Resistance — 761.00

Natural Gas. CME Group

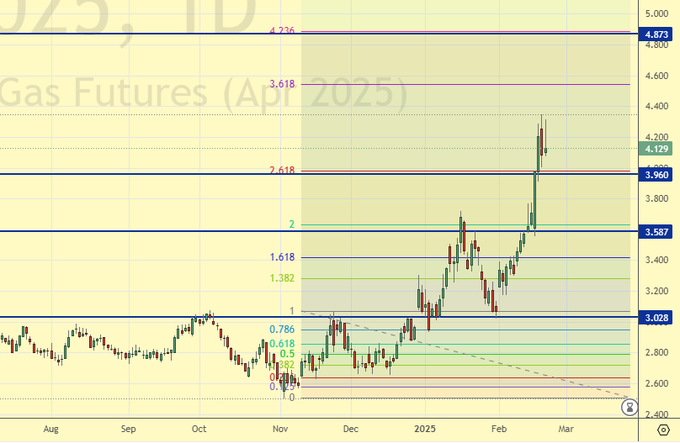

Growth scenario: we consider April futures, expiration date March 27. It is possible to hold positions. Cold weather in the US leads to an increase in gas demand.

Downside scenario: we don’t think about sales yet.

Natural Gas Recommendations:

Buy: no. Who is in position from 3.069, move the stop to 3.940. Target: 4.870

Sale: no.

Support — 3.960. Resistance — 4.873.

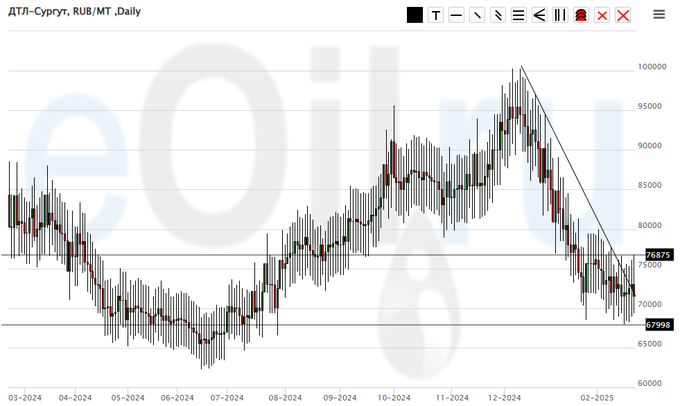

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we should buy here. Technically, the situation is favorable.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: Now (71000). Stop: 67000. Target: 110000.

Sale: no.

Support — 67998. Resistance — 76875.

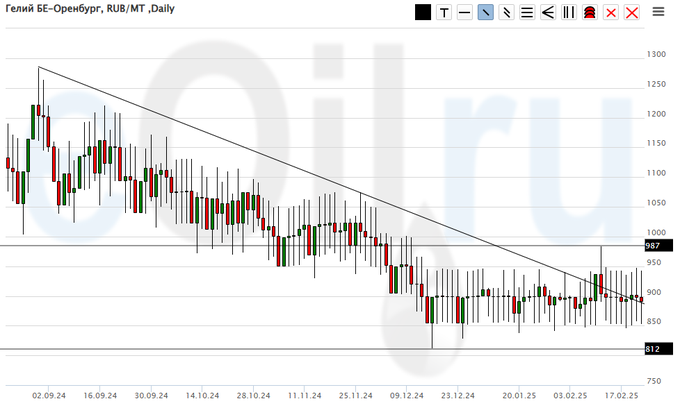

Helium (Orenburg), ETP eOil.ru

Growth scenario: it makes sense to buy here. It is unlikely that the company will release helium cheaper. This is most likely the bottom.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: possible. Those who are in position from 900, keep stop at 770. Target: 2000.

Sale: no.

Support — 812. Resistance is 987.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 26.3 th. contracts. Buyers and sellers were leaving the market. Sellers did it more actively. Bears may lose control in the long run.

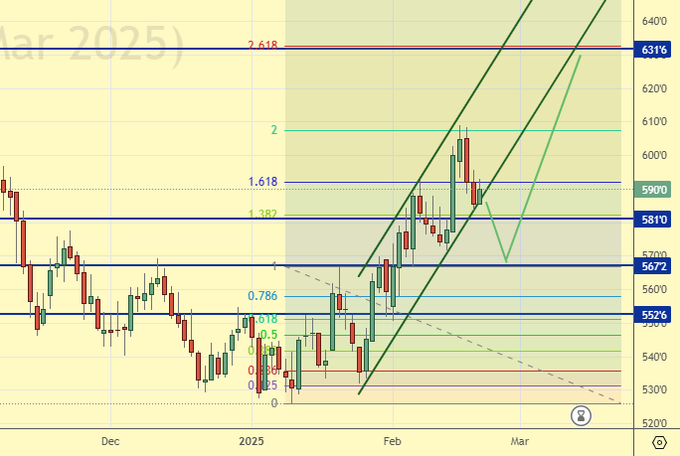

Growth scenario: we consider the March contract, expiration date is March 14. We will keep longing. We are going to 630.0, further is not clear.

Downside scenario: don’t sell yet.

Recommendations for the wheat market:

Buy: no. Who is in position from 533.0, keep stop at 564.0. Target: 631.0.

Sale: no.

Support — 581.0. Resistance — 631.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 33.5 th. contracts. Buyers have entered the market. No new bears appeared on the market. Bulls strengthened their control.

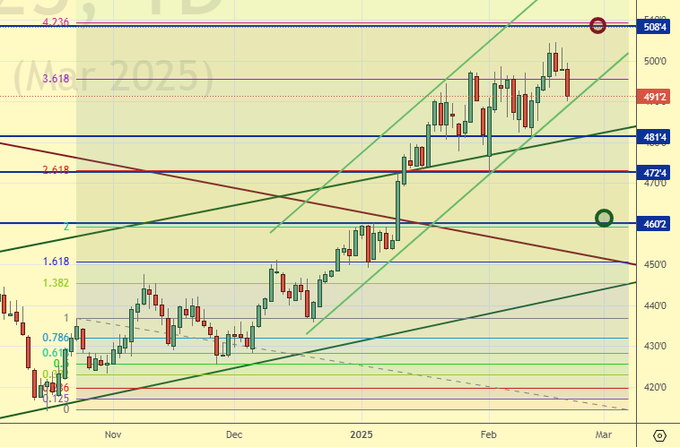

Growth scenario: we consider the March contract, expiration date March 14. Nothing new. Out of the market. If we go to 460.0, we will think about buying.

Downside scenario: shorting from 509.0 remains the main idea.

Recommendations for the corn market:

Buy: no.

Sell: on approach to 509.0. Stop: 511.0. Target: 440.0.

Support — 481.4. Resistance — 508.4.

Soybeans No. 1. CME Group

Growth scenario: we consider March futures, expiration date March 14. We may reach 1125. We keep the log, but we will wait for the stop order.

Downside scenario: refuse to sell for now.

Recommendations for the soybean market:

Buy: No. Who is in position from 1036, move the stop to 1026.0. Target: 1125.0.

Sell: on approach to 1125. Stop: 1135. Target: 830.0.

Support — 1024.2. Resistance — 1080.2.

Growth scenario: we consider February futures, expiration date February 26. To continue buying we need a pullback at least to 2760.

Downside scenario: we need to visit 3020 for order. And from this level go down.

Gold Market Recommendations:

Buy: think when approaching 2760.

Sell: when approaching 3020. Stop: 3040. Target: 2120.

Support — 2885. Resistance — 2972.

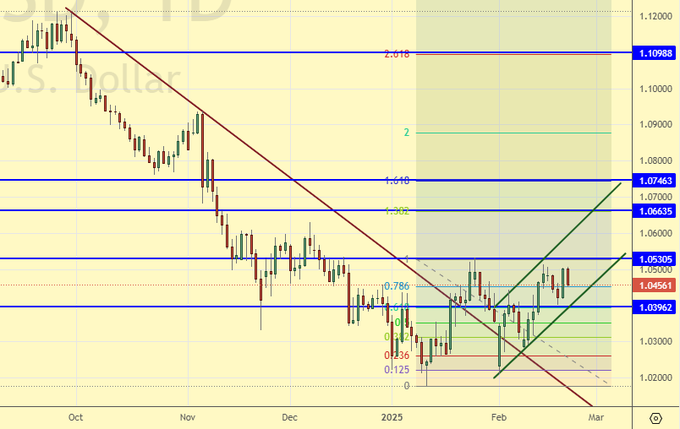

EUR/USD

Growth scenario: bulls need to go above 1.0530. If this does not happen next week it will be difficult to maintain the bullish sentiment.

Downside scenario: we refrain from selling for now. It is desirable to go below 1.0330 then we can sell.

Recommendations on euro/dollar pair:

Buy: Those in positions from 1.0325 and 1.0356, move your stop to 1.0370. Target: 1.1000 (1.2000).

Sale: no.

Support — 1.0396. Resistance — 1.0530.

USD/RUB

Growth scenario: we consider March futures, expiration date is March 20. The bulls have to be patient for now. And their problem is that the fall on the background of waiting for negotiations may be deeper.

Downside scenario: the market is strongly oversold. There is no sense to test the fate, we should aggressively press stop orders and take profits. A gap down on Monday on Trump’s positive statements is not excluded.

Recommendations on dollar/ruble pair:

Buy: when approaching 81000. Stop: 79000. Target: 115000?!!!

Sell: no. Who is in position from 100100, move stop to 90300. Target: 80700 (revised).

Support — 87975. Resistance — 93404.

RTSI. MOEX

Growth scenario: we consider March futures, expiration date March 20. We continue to refuse from purchases because of impossibility to enter at acceptable levels.

Downside scenario: where to? We could, in deep theory, go to 138,000. That’s wild. But that’s life. Out of the market.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 105500. Resistance — 120110.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.