22 April 2024, 12:11

Price forecast from 22 to 26 April 2024

-

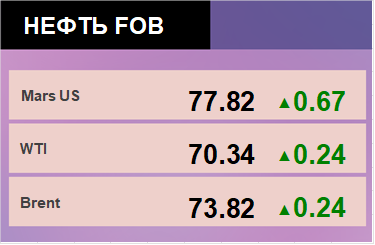

Energy market:

Apparently, there was little doubt, but there was hope Russia would be robbed of its money. That is, like gypsies, during the «let me guess» trick. And put here another 100 billion, and another 200 billion, and another 300 billion. Phew, — blows his fist! No money. Why are you yelling, I’m standing here pregnant in front of you. It’s gone. Go home.

I’d like to go to some island so I don’t have to see or know all this. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

The mighty Jews responded to the Persian bombardment. Why, yes, they did. The oil market will now depend largely on whether this story can be put to rest. And who believes it will? Nobody does. There is no one around, not a single person who believes that all this is over and will never happen again.

This conflict would have erupted long ago. And the West would have been its own arsonist, but they cannot, they cannot create such stocks that would allow them in their own countries to extinguish the sharp rise in fuel prices that will inevitably occur in the event of an invasion of Iran. Consumers will start stockpiling.

Oil deliveries from Russia to China grew by 13% in the first quarter compared to the same period of the 23rd year. The main thing is that they don’t fall now. Because we’ve got a lot of plans here.

Grain market:

According to the IGC report, weather conditions have deteriorated slightly, leading to lower estimates for the 24/25 season for gross cereal harvest. However, the reduction is small and amounts to only 10 million tons of the 2,322 million tons of gross harvest of all cereals. The main negative impact comes from corn, which will be harvested 7 million tons less.

The situation in the Middle East worries the grain market less than the oil market, but the possible cutting of trade routes bugs grain traders whenever one side sends the other a package from a bunch of missiles.

In general, in the forecasts we note optimism for wheat — 798 million tons, optimism for soybean — 413 million tons, which in case of implementation of these forecasts will keep price growth within 10% of current values.

Because the world has not become less stressed since the pandemic, consumption of tobacco, marijuana, sugar, coffee, cocoa and ethanol in all forms will increase. After reporting on the bombings, do you know if you want a candy bar. Or a drink.

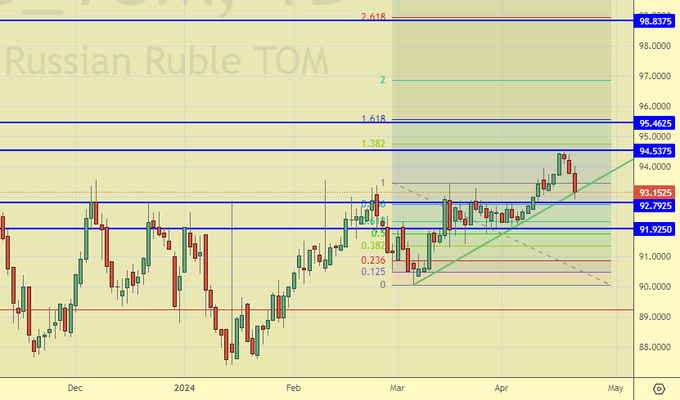

USD/RUB:

Next week we will be waiting for the Central Bank meeting on Friday the 26th. Expectations on the rate are neutral. No one expects a sharp increase or a sharp decrease. The official inflation figures are at 7.5%, which gives the Central Bank a chance to start to turn off the valve gently, but the 4% target has not been reached yet. Therefore, Nabiullina is likely to wait. And this tactic on the part of the Central Bank head is justified, as the amount of new injections may turn out to be much higher than initially planned and the entire excess money supply will have to be sterilized in the accounts at an attractive rate.

And then… then all that money will run to find merchandise on store shelves.

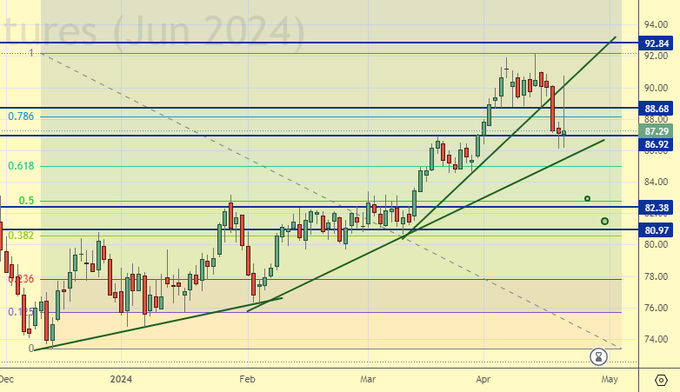

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 20.7 th. contracts. Bulls entered the market. Sellers are not running yet. Buyers control the situation.

Growth scenario: we consider April futures, expiration date April 30. We do not buy. We are waiting for a pullback to 82.40 and 81.00.

Downside scenario: we will keep shorting from 90.10, which was not obvious a week ago. It is possible that we may manage to go down to 80.00.

Recommendations for the Brent oil market:

Buy: when approaching 82.40 and 81.00. Stop: 79.00. Target: 110.00.

Sell: no. Those who are in the position from 90.13, move the stop to 90.15. Target: 81.00 (revised).

Support — 82.38. Resistance — 88.68.

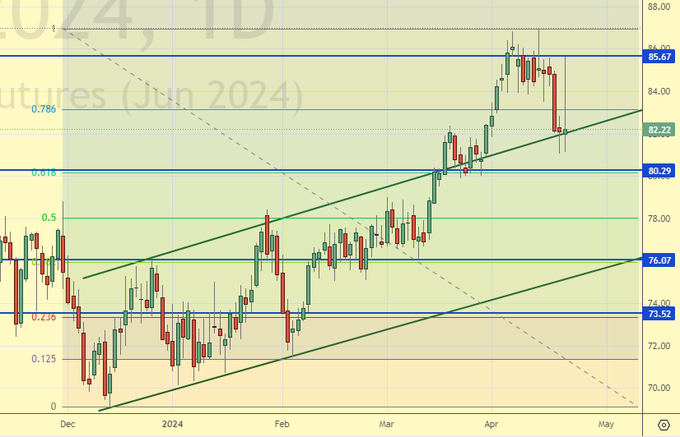

WTI. CME Group

US fundamentals: the number of active rigs rose by 5 to 511.

US commercial oil inventories rose by 2.735 to 459.993 million barrels, with +1.6 million barrels forecast. Gasoline inventories fell -1.154 to 227.377 million barrels. Distillate stocks fell -2.76 to 114.968 million barrels. Cushing storage stocks rose by 0.033 to 33.026 million barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports increased by 0.027 to 6.461 million barrels per day. Oil exports rose by 2.018 to 4.726 million barrels per day. Thus, net oil imports fell by -1.991 to 1.735 million barrels per day. Oil refining fell by -0.2 to 88.1 percent.

Gasoline demand rose 0.05 to 8.662 million barrels per day. Gasoline production fell -0.025 to 9.417 million barrels per day. Gasoline imports fell -0.021 to 0.709 million barrels per day. Gasoline exports fell -0.152 to 0.826 million barrels per day.

Distillate demand rose by 0.681 to 3.666 million barrels. Distillate production fell by -0.038 to 4.601 million barrels. Distillate imports fell -0.014 to 0.149 million barrels. Distillate exports fell -0.102 to 1.478 million barrels per day.

Demand for petroleum products fell by -0.016 to 19.22 million barrels. Petroleum products production rose by 0.153 to 21.085 million barrels. Petroleum product imports fell -0.514 to 1.853 million barrels. Exports of refined products fell -0.48 to 6.373 million barrels per day.

Propane demand fell -0.63 to 0.675 million barrels. Propane production rose 0.062 to 2.735 million barrels. Propane imports fell -0.023 to 0.085 million barrels. Propane exports rose 0.084 to 1.575 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 36.3 thousand contracts. Sellers appeared unexpectedly numerous. Buyers were retreating. Bulls keep control.

Growth scenario: we consider June futures, expiration date May 21. The market is high. A correction is needed for new purchases. We are waiting for the market at 76.00.

Downside scenario: we will keep the short we opened earlier. The market is capable of pulling back. Especially if it becomes clear that Israel is quiet. At least for a while.

Recommendations for WTI crude oil:

Buy: ideal on a pullback to 76.20. Stop: 75.20. Target: 100.00.

Sell: no. Those who are in the position from 85.66, move the stop to 85.76. Target: 76.20 (revised).

Support — 80.29. Resistance — 85.67.

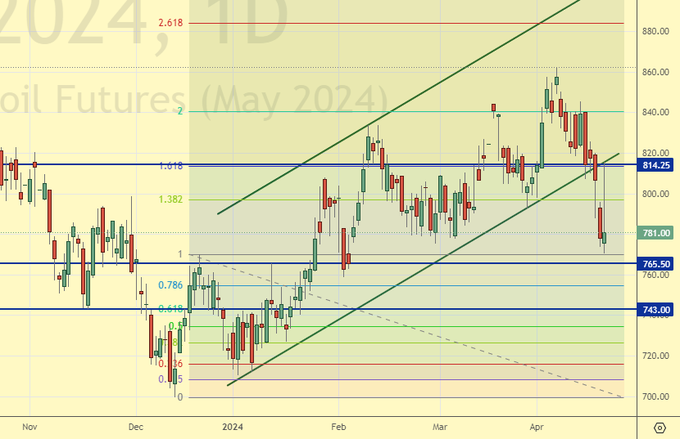

Gas-Oil. ICE

Growth scenario: we consider May futures, expiration date May 10. It is possible to buy. Long from 743.00 is certainly more interesting, but these levels can be considered as working levels for purchases.

Downside scenario: the market has not given us 880.00 yet. let’s refrain from shorts.

Gasoil Recommendations:

Buy: now (781.00) and on touching 743.00. Stop: 730.00. Target: 880.00.

Sell: on approach to 880.00. Stop: 892.50. Target: 800.00.

Support — 765.50. Resistance — 814.25.

Natural Gas. CME Group

Growth scenario: we consider June futures, expiration date May 29. Let’s go long again. It will be very hard for the market to go down.

Downside scenario: refrain from selling, market is low.

Natural Gas Recommendations:

Buy: now (1.988). Stop: 1.800. Target: 3.000?!

Sale: no.

Support — 1.905. Resistance — 2.137.

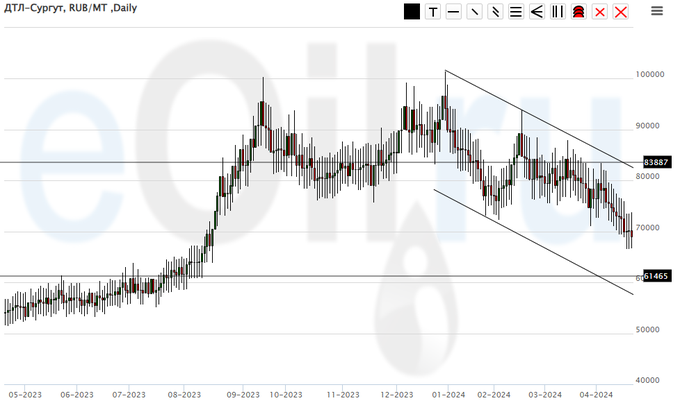

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we get above 82000, we don’t think about buying. Out of the market. On a side note: buying is possible from 63000.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 61465. Resistance — 83887.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: let’s be persistent in buying. Moreover, the situation is technically favorable for it.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: Now (10000). Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 8760. Resistance — 15527.

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market gives us a chance to take it at a low price. And we will take that chance.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: now (1450). Stop: 1300. Target: 3500. Who is in position from 1500 and 1600, keep your stop at 1300. Target: 3500.

Sale: no.

Support — 1352. Resistance — the area of 1958.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 9.8 th. contracts. Sellers entered the market, there were no buyers. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. We continue to want the market at 515.0. it is possible to buy at current levels, but the chances of survival of the position are small.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sell: no. Those who are in position from 565.0, move the stop to 569.0. Target: 450.0 (revised).

Support — 533.6. Resistance — 558.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 15.9 thousand contracts. Sellers were arriving, buyers were absent. Bears maintain control.

Growth scenario: we consider the May futures, expiration date May 14. We have very low hopes for continued growth. Prospects for corn are good despite the reduction of areas in the USA.

Downside scenario: those willing to sell can sell. The situation is ambiguous, but if there is a breakdown, it will be deep and sharp.

Recommendations for the corn market:

Buy: no. Who is in position from 432.0, keep stop at 423.0. Target: 500.0.

Sell: now (433.4). Stop: 444.4. Target: 360.0!!!

Support — 424.4. Resistance — 438.4.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. Last week’s purchases did not lead to anything. Out of the market.

Downside scenario: it is very difficult to decide something. Shorting will be good only at approach to 1175.0.

Recommendations for the soybean market:

Buy: think after rising above 1200.

Sell: on approach to 1175.0. Stop: 1195.0. Target: 950.00!

Support — 1130.0. Resistance — 1225.4.

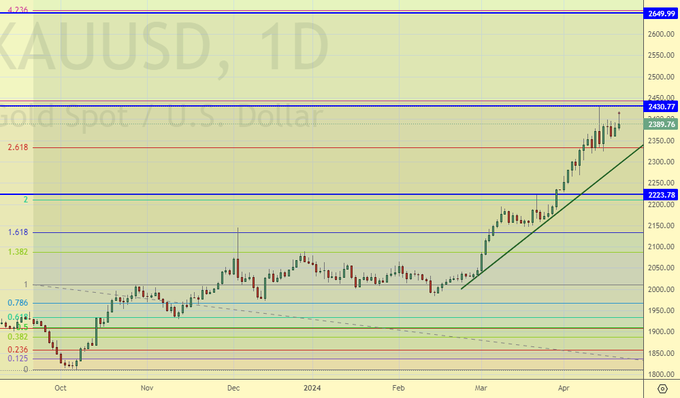

Growth scenario: we are waiting for, or rather want, a significant correction, then we can talk about buying.

Downside scenario: we have caught from the area of 2420. It is possible to keep shorts.

Gold Market Recommendations:

Buy: from 2100 would be interesting, from 2000 would be perfect.

Sell: No. Those who are in position from 2415, move the stop to 2430. Target: 2100 (2000).

Support — 2223. Resistance — 2430.

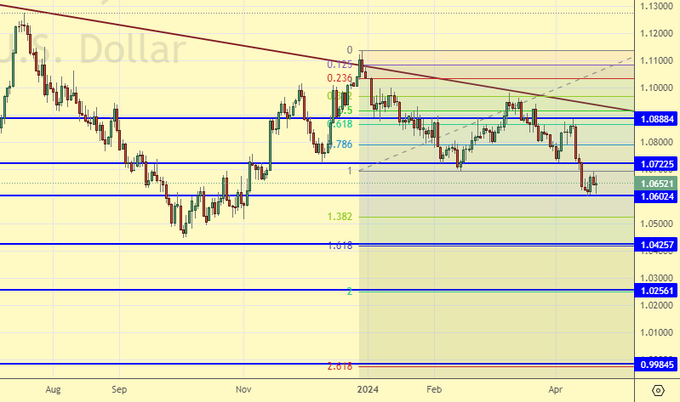

EUR/USD

Growth scenario: you should not buy now. The euro will be under pressure amid continued high interest rates in the US.

Downside scenario: we managed to cling on from the 1.0700 area. We hold shorts. At the same time, we realize that a surge to 1.0800 is possible.

Recommendations on euro/dollar pair:

Buy: no.

Sell: when approaching 1.0800. Stop: 1.0860. Target: 1.0000. Those who are in the position from 1.0690, move the stop to 1.0860. Target: 1.0000. Count the risks!

Support — 1.0602. Resistance — 1.0722.

USD/RUB

Growth scenario: yes, we can strengthen before the inauguration to 92.00 and even to 91.90, but going below will not be easy.

Downside scenario: we will not sell. None of the experts are seriously talking about the ruble strengthening.

Recommendations on dollar/ruble pair:

Buy: no. Who is in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 92.79. Resistance — 94.53.

RTSI

Growth scenario: we consider June futures, expiration date June 20. So far we haven’t taken 116000. And since that is the case, we will not buy. Those who wish can work out the move to 120000 on hourly intervals.

Downside scenario: knocked out of the short. We are not making new sales for now. Approach to 120000 is a new reason to consider opportunities to enter short.

Recommendations on the RTS index:

Buy: no.

Sale: to think when approaching 120000.

Support — 113040. Resistance — 115920 (120200).

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.